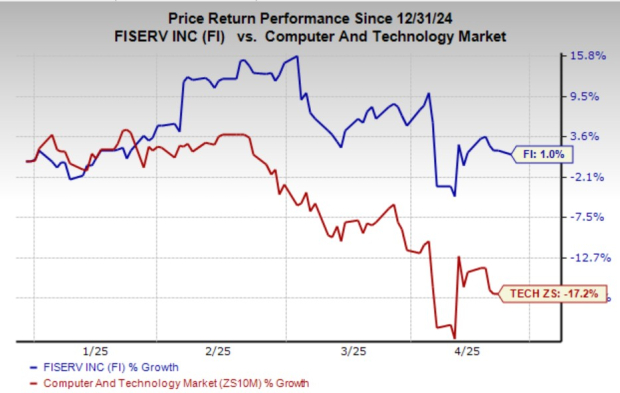

Fiserv, Inc. ) is a backend payment solutions giant that has been a safe haven amid the 2025 market turmoil.

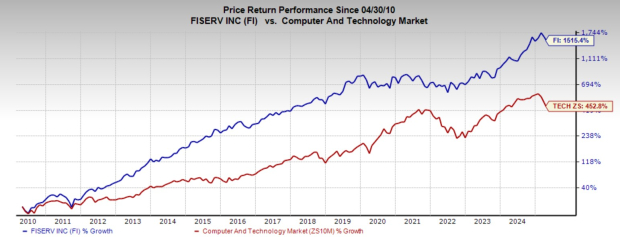

The fintech stock has moved sideways this year, while the Zacks Tech sector has dropped by over 17%. Over the past 20 years, Fiserv stock has nearly tripled the Zacks Tech sector.

Fiserv’s growing portfolio spans digital banking solutions, payments, card issuer processing, account processing, network services, cloud-based point-of-sale systems, and more.

The payments and financial services giant trades roughly 14% below its all-time highs heading into its first-quarter earnings release on Thursday, April 24.

Investors might consider buying Fiserv stock now for potential shelter from the tariff storm and long-term upside.

Image Source: Zacks Investment Research

Why This Fintech Stock Is a Buy-and-Hold Investment

Fiserv is a behind-the-scenes fintech company operating backend payment processing and money transfer technology used by large financial institutions, banks, credit unions, fintech firms, merchants, and more.

Fiserv operates two core segments: Financial Solutions and Merchant Solutions. Its growth and importance stem from its ability to support the digital transformation of financial services, meeting the growing demand for efficient, scalable, and innovative fintech solutions.

Image Source: Zacks Investment Research

Fiserv is expanding due to the increasing adoption of digital payments, the growth of its Clover POS platform, and strategic acquisitions.

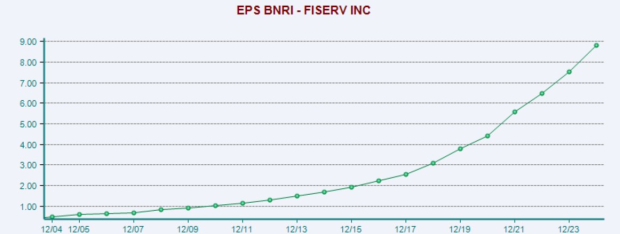

Clover is its primary growth engine, with segment revenues up 29% in Q4. “Fiserv’s track record of growth and consistency continued through 2024—our fourth consecutive year of double-digit organic revenue growth and 39th consecutive year of double-digit adjusted earnings per share growth,” CEO Frank Bisignano said in Q4 remarks.

Image Source: Zacks Investment Research

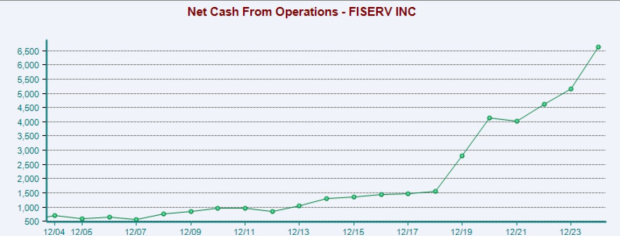

“The strength and sustainability of Fiserv’s performance is a testament to our unparalleled business model, which generates high recurring revenue, strong incremental margins, and healthy free cash flow.”

Why This Tech Stock Might Be a Safe Haven

Fiserv’s revenue streams are stable because demand for payment processing and digital banking is not directly impacted by tariff and trade policies—only by broader economic cycles that hit the entire economy.

Its recurring revenue model, driven by long-term contracts with financial institutions, provides predictable cash flows. Fiserv’s ability to grow through secular trends (digital payments, fintech innovation) rather than trade-dependent markets reduces its exposure to tariff risks.

Image Source: Zacks Investment Research

Fiserv averaged 8% revenue growth over the past four years. It is expected to follow that up with 9% sales growth in 2025 and 2026, reaching nearly $23 billion in the process.

Fiserv is projected to grow its adjusted earnings by 17% in 2025 and 2026, matching its impressive and steady bottom-line expansion over the past several years. While FI’s EPS revisions have stalled recently, they stand out from the broader S&P 500, which has seen its earnings outlook fade.

Fiserv closed last year with an operating cash flow of $6.63 billion, up 29% year-over-year. FI’s growing cash position enabled it to repurchase $5.5 billion worth of stock in 2024. Its consistent growth and financial stability help explain why 28 of the 36 brokerage recommendations tracked by Zacks are “Strong Buys.”

Is Now the Time to Buy FI Stock on the Dip?

Fiserv shares have soared 1,800% over the past 20 years, compared to the S&P 500’s 380% and the Tech sector’s 640%.

FI’s outperformance of the Tech sector remains intact over the past 10 and five years. More recently, the fintech stock has climbed 38% in the last 12 months, while the Tech sector has edged up just 3%.

Image Source: Zacks Investment Research

Wall Street has stuck with FI during the 2025 selloff because its growth is not based on artificial intelligence hype. Plus, its core digital payment business is poised to remain as insulated from the tariff fray as possible for a major technology company.

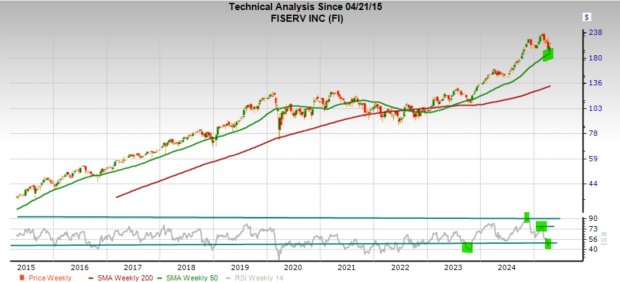

Still, Fiserv trades 14% below its March highs and 20% below its average Zacks price target. Fiserv is trading between its 200-day and 50-day moving averages, having found buyers at its 200-day and 50-week levels earlier this month.

Image Source: Zacks Investment Research

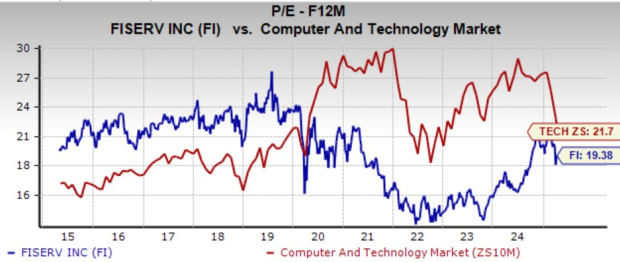

The tech stock dropped from its most overbought RSI levels in the past decade in late 2024 to neutral. On the valuation front, Fiserv trades just below its 10-year median, at a 30% discount to its highs and 10% below the Tech sector at 19.4x forward earnings.

Image: Bigstock

Buy This Market-Crushing Tech Stock for Tariff Safety and Long-Term Growth

Fiserv, Inc. ) is a backend payment solutions giant that has been a safe haven amid the 2025 market turmoil.

The fintech stock has moved sideways this year, while the Zacks Tech sector has dropped by over 17%. Over the past 20 years, Fiserv stock has nearly tripled the Zacks Tech sector.

Fiserv’s growing portfolio spans digital banking solutions, payments, card issuer processing, account processing, network services, cloud-based point-of-sale systems, and more.

The payments and financial services giant trades roughly 14% below its all-time highs heading into its first-quarter earnings release on Thursday, April 24.

Investors might consider buying Fiserv stock now for potential shelter from the tariff storm and long-term upside.

Image Source: Zacks Investment Research

Why This Fintech Stock Is a Buy-and-Hold Investment

Fiserv is a behind-the-scenes fintech company operating backend payment processing and money transfer technology used by large financial institutions, banks, credit unions, fintech firms, merchants, and more.

Fiserv operates two core segments: Financial Solutions and Merchant Solutions. Its growth and importance stem from its ability to support the digital transformation of financial services, meeting the growing demand for efficient, scalable, and innovative fintech solutions.

Image Source: Zacks Investment Research

Fiserv is expanding due to the increasing adoption of digital payments, the growth of its Clover POS platform, and strategic acquisitions.

Clover is its primary growth engine, with segment revenues up 29% in Q4. “Fiserv’s track record of growth and consistency continued through 2024—our fourth consecutive year of double-digit organic revenue growth and 39th consecutive year of double-digit adjusted earnings per share growth,” CEO Frank Bisignano said in Q4 remarks.

Image Source: Zacks Investment Research

“The strength and sustainability of Fiserv’s performance is a testament to our unparalleled business model, which generates high recurring revenue, strong incremental margins, and healthy free cash flow.”

Why This Tech Stock Might Be a Safe Haven

Fiserv’s revenue streams are stable because demand for payment processing and digital banking is not directly impacted by tariff and trade policies—only by broader economic cycles that hit the entire economy.

Its recurring revenue model, driven by long-term contracts with financial institutions, provides predictable cash flows. Fiserv’s ability to grow through secular trends (digital payments, fintech innovation) rather than trade-dependent markets reduces its exposure to tariff risks.

Image Source: Zacks Investment Research

Fiserv averaged 8% revenue growth over the past four years. It is expected to follow that up with 9% sales growth in 2025 and 2026, reaching nearly $23 billion in the process.

Fiserv is projected to grow its adjusted earnings by 17% in 2025 and 2026, matching its impressive and steady bottom-line expansion over the past several years. While FI’s EPS revisions have stalled recently, they stand out from the broader S&P 500, which has seen its earnings outlook fade.

Fiserv closed last year with an operating cash flow of $6.63 billion, up 29% year-over-year. FI’s growing cash position enabled it to repurchase $5.5 billion worth of stock in 2024. Its consistent growth and financial stability help explain why 28 of the 36 brokerage recommendations tracked by Zacks are “Strong Buys.”

Is Now the Time to Buy FI Stock on the Dip?

Fiserv shares have soared 1,800% over the past 20 years, compared to the S&P 500’s 380% and the Tech sector’s 640%.

FI’s outperformance of the Tech sector remains intact over the past 10 and five years. More recently, the fintech stock has climbed 38% in the last 12 months, while the Tech sector has edged up just 3%.

Image Source: Zacks Investment Research

Wall Street has stuck with FI during the 2025 selloff because its growth is not based on artificial intelligence hype. Plus, its core digital payment business is poised to remain as insulated from the tariff fray as possible for a major technology company.

Still, Fiserv trades 14% below its March highs and 20% below its average Zacks price target. Fiserv is trading between its 200-day and 50-day moving averages, having found buyers at its 200-day and 50-week levels earlier this month.

Image Source: Zacks Investment Research

The tech stock dropped from its most overbought RSI levels in the past decade in late 2024 to neutral. On the valuation front, Fiserv trades just below its 10-year median, at a 30% discount to its highs and 10% below the Tech sector at 19.4x forward earnings.