We use cookies to understand how you use our site and to improve your experience.

This includes personalizing content and advertising.

By pressing "Accept All" or closing out of this banner, you consent to the use of all cookies and similar technologies and the sharing of information they collect with third parties.

You can reject marketing cookies by pressing "Deny Optional," but we still use essential, performance, and functional cookies.

In addition, whether you "Accept All," Deny Optional," click the X or otherwise continue to use the site, you accept our Privacy Policy and Terms of Service, revised from time to time.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

2 Cheap Nuclear Energy Stocks to Buy Now to Ride AI-Boosted Growth

Key Takeaways

Tech titans and the U.S. government are fully backing nuclear energy to power AI and beyond.

MIR: Why this soaring under-the-radar nuclear stock is a must buy at $20 a share.

Buy Nvidia-crushing Rolls-Royce for huge long-term upside in nuclear and more.

Tech titans and the U.S. government—two of the biggest drivers of the economy—are fully backing nuclear energy expansion to help power economic growth and the energy-hungry artificial intelligence revolution while slowly weaning off fossil fuels.

The U.S. government has launched various initiatives to support the revival of nuclear energy, aiming to triple capacity by 2050. More recently, President Trump signed a nuclear energy executive order in late May to help speed up nuclear power expansion and innovation.

The Bull Case for Nuclear Energy’s AI-Boosted Growth

Meta’s ((META - Free Report) ) nuclear energy deal with Constellation Energy, announced on June 3, highlights the increasingly interconnected relationship between AI expansion and nuclear energy growth.

The Facebook parent’s new 20-year nuclear power deal is part of Meta’s wider nuclear energy push as it aims to expand its power-hungry AI efforts while reducing its reliance on fossil fuels.

Microsoft, Amazon, and other AI hyperscalers have all made nuclear energy deals over the past year that support currently viable nuclear power growth and pursue next-generation efforts such as small modular reactors.

Big Tech companies, specifically Amazon, Microsoft, Alphabet, and Meta, are projected to spend a combined $325 billion on AI capital expenditures in 2025 alone. This backdrop is part of the reason why global investment in clean energy technologies and infrastructure is expected to hit $2.5 trillion in 2025.

Nuclear energy investments are a direct bet on a vibrant AI future, and a shifting and growing energy landscape.

The two highly-ranked stocks trading for $20 a share or less that we dive into today provide investors exposure to long-term nuclear energy industry expansion.

Buy This Under-the-Radar $20 Nuclear Stock Now?

Mirion Technologies ((MIR - Free Report) ) specializes in radiation safety, science, and medical solutions, focusing on detecting, measuring, analyzing, and monitoring ionizing radiation. Its Nuclear & Safety group provides radiation safety technologies that are critical for operational nuclear facilities, R&D, next-gen nuclear reactors, and beyond.

Image Source: Zacks Investment Research

Micron’s nuclear-focused technologies are essential throughout the entire nuclear energy lifecycle. Many of MIR’s solutions are also mandatory for customers in highly regulated industries such as nuclear energy.

On top of that, Mirion is committed to expanding its reach in the next generation of nuclear energy by working with small modular reactor developers to “solve essential nuclear measurement, safety and security challenges.”

Image Source: Zacks Investment Research

Mirion joined the Nuclear Energy Institute and the American Nuclear Society’s Trustees of Nuclear program earlier this year. This means the company will participate in discussions that shape the nuclear industry and its growth.

MIR, which went public via a SPAC in late 2021, has soared 95% in the past year and 150% in the last three. Mirion has surged off the market's April lows, hitting new all-time highs of $19.94 a share on Thursday.

Image Source: Zacks Investment Research

Nuclear power accounted for roughly 40% of its revenue in 2024. Mirion is expected to expand its sales by over 5% in 2025 to $906.5 million, following 8% growth last year and 12% in 2023.

On the earnings front, it is projected to expand its adjusted EPS by 15% in FY25 to $0.47 a share, topping its 21% growth last year. Mirion's upward earnings revisions earn it a Zacks Rank #2 (Buy), and all five of the brokerage recommendations Zacks has are “Strong Buys.”

Buy Soaring Rolls-Royce Stock and Hold For Huge Upside

Rolls-Royce ((RYCEY - Free Report) ) stock has skyrocketed over 900% in the past three years to crush Nvidia’s 640% and Constellation Energy’s ((CEG - Free Report) ) 340%.

Despite the charge, which includes a 100% run in the past 12 months, the historic engine maker trades 45% below its all-time highs and 25% under its average Zacks price target at $11.99 a share. Rolls-Royce has turned around its struggling business after former oil industry executive Tufan Erginbilgic took over as CEO in January 2023.

Image Source: Zacks Investment Research

The new boss aimed to quadruple Rolls-Royce’s profits in five years and complete other key initiatives. On top of its financial goals, Rolls-Royce is utilizing its expertise in nuclear propulsion systems to design cutting-edge small modular nuclear reactors and micro-reactor technology.

RYCEY reported blockbuster 2024 results and boosted its guidance in late February after reaching key initiatives well ahead of schedule. Rolls-Royce grew its operating profit by 55% on 16% higher sales.

Image Source: Zacks Investment Research

It reinstated shareholder dividends and announced a £1bn share buyback. Rolls-Royce also said it’s well ahead of its goal of quadrupling profits by the end of 2028.

Rolls-Royce's defense business is set to get a boost from increased British government spending. The firm is also looking to expand its reach into narrowbody aircraft, which represent a far bigger portion of the global market for civil aircraft by volume.

Image Source: Zacks Investment Research

Rolls-Royce is projected to grow its adjusted earnings by 31% in FY25 and 19% in FY26 on the back of 20% and 8%, respective revenue expansion. RYCEY's upbeat EPS revisions earn it a Zacks Rank #2 (Buy). Plus, nine of the 11 brokerage recommendations that Zacks has are “Strong Buys.”

RYCEY stock might be a bit overheated in the short run, and it could be due to test its 50-day or 200-day moving averages. But the long-term upside is firmly intact.

See More Zacks Research for These Tickers

Normally $25 each - click below to receive one report FREE:

Image: Bigstock

2 Cheap Nuclear Energy Stocks to Buy Now to Ride AI-Boosted Growth

Key Takeaways

Tech titans and the U.S. government—two of the biggest drivers of the economy—are fully backing nuclear energy expansion to help power economic growth and the energy-hungry artificial intelligence revolution while slowly weaning off fossil fuels.

The U.S. government has launched various initiatives to support the revival of nuclear energy, aiming to triple capacity by 2050. More recently, President Trump signed a nuclear energy executive order in late May to help speed up nuclear power expansion and innovation.

The Bull Case for Nuclear Energy’s AI-Boosted Growth

Meta’s ((META - Free Report) ) nuclear energy deal with Constellation Energy, announced on June 3, highlights the increasingly interconnected relationship between AI expansion and nuclear energy growth.

The Facebook parent’s new 20-year nuclear power deal is part of Meta’s wider nuclear energy push as it aims to expand its power-hungry AI efforts while reducing its reliance on fossil fuels.

Microsoft, Amazon, and other AI hyperscalers have all made nuclear energy deals over the past year that support currently viable nuclear power growth and pursue next-generation efforts such as small modular reactors.

Big Tech companies, specifically Amazon, Microsoft, Alphabet, and Meta, are projected to spend a combined $325 billion on AI capital expenditures in 2025 alone. This backdrop is part of the reason why global investment in clean energy technologies and infrastructure is expected to hit $2.5 trillion in 2025.

Nuclear energy investments are a direct bet on a vibrant AI future, and a shifting and growing energy landscape.

The two highly-ranked stocks trading for $20 a share or less that we dive into today provide investors exposure to long-term nuclear energy industry expansion.

Buy This Under-the-Radar $20 Nuclear Stock Now?

Mirion Technologies ((MIR - Free Report) ) specializes in radiation safety, science, and medical solutions, focusing on detecting, measuring, analyzing, and monitoring ionizing radiation. Its Nuclear & Safety group provides radiation safety technologies that are critical for operational nuclear facilities, R&D, next-gen nuclear reactors, and beyond.

Image Source: Zacks Investment Research

Micron’s nuclear-focused technologies are essential throughout the entire nuclear energy lifecycle. Many of MIR’s solutions are also mandatory for customers in highly regulated industries such as nuclear energy.

On top of that, Mirion is committed to expanding its reach in the next generation of nuclear energy by working with small modular reactor developers to “solve essential nuclear measurement, safety and security challenges.”

Image Source: Zacks Investment Research

Mirion joined the Nuclear Energy Institute and the American Nuclear Society’s Trustees of Nuclear program earlier this year. This means the company will participate in discussions that shape the nuclear industry and its growth.

MIR, which went public via a SPAC in late 2021, has soared 95% in the past year and 150% in the last three. Mirion has surged off the market's April lows, hitting new all-time highs of $19.94 a share on Thursday.

Image Source: Zacks Investment Research

Nuclear power accounted for roughly 40% of its revenue in 2024. Mirion is expected to expand its sales by over 5% in 2025 to $906.5 million, following 8% growth last year and 12% in 2023.

On the earnings front, it is projected to expand its adjusted EPS by 15% in FY25 to $0.47 a share, topping its 21% growth last year. Mirion's upward earnings revisions earn it a Zacks Rank #2 (Buy), and all five of the brokerage recommendations Zacks has are “Strong Buys.”

Buy Soaring Rolls-Royce Stock and Hold For Huge Upside

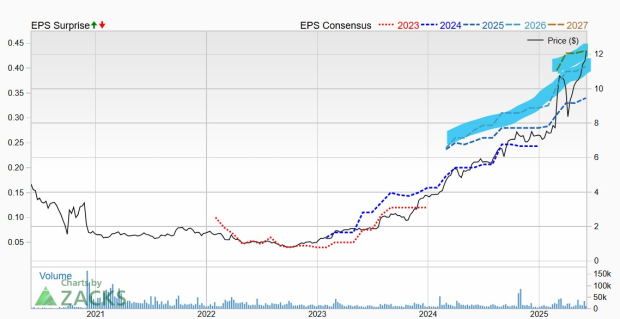

Rolls-Royce ((RYCEY - Free Report) ) stock has skyrocketed over 900% in the past three years to crush Nvidia’s 640% and Constellation Energy’s ((CEG - Free Report) ) 340%.

Despite the charge, which includes a 100% run in the past 12 months, the historic engine maker trades 45% below its all-time highs and 25% under its average Zacks price target at $11.99 a share. Rolls-Royce has turned around its struggling business after former oil industry executive Tufan Erginbilgic took over as CEO in January 2023.

Image Source: Zacks Investment Research

The new boss aimed to quadruple Rolls-Royce’s profits in five years and complete other key initiatives. On top of its financial goals, Rolls-Royce is utilizing its expertise in nuclear propulsion systems to design cutting-edge small modular nuclear reactors and micro-reactor technology.

RYCEY reported blockbuster 2024 results and boosted its guidance in late February after reaching key initiatives well ahead of schedule. Rolls-Royce grew its operating profit by 55% on 16% higher sales.

Image Source: Zacks Investment Research

It reinstated shareholder dividends and announced a £1bn share buyback. Rolls-Royce also said it’s well ahead of its goal of quadrupling profits by the end of 2028.

Rolls-Royce's defense business is set to get a boost from increased British government spending. The firm is also looking to expand its reach into narrowbody aircraft, which represent a far bigger portion of the global market for civil aircraft by volume.

Image Source: Zacks Investment Research

Rolls-Royce is projected to grow its adjusted earnings by 31% in FY25 and 19% in FY26 on the back of 20% and 8%, respective revenue expansion. RYCEY's upbeat EPS revisions earn it a Zacks Rank #2 (Buy). Plus, nine of the 11 brokerage recommendations that Zacks has are “Strong Buys.”

RYCEY stock might be a bit overheated in the short run, and it could be due to test its 50-day or 200-day moving averages. But the long-term upside is firmly intact.