This is an excerpt from our most recent Economic Outlook report. To access the full PDF, please click here.

Indeed is a national and worldwide aggregator -- of on-line employment website job postings.

Indeed calculates its index change in seasonally-adjusted job postings set to a 100 index level in the pre-COVID moment:

That is Feb. 1st, 2020, using a 7-day trailing average.

The St. Louis Fed FRED website wants it explicitly set to a Feb. 1st, 2020, pre-pandemic baseline.

- Indeed seasonally adjusts each series based on historical patterns in 2017, 2018, and 2019.

- Each series, including the national trend, occupational sectors, and sub-national geographies, is seasonally adjusted; separately.

- Indeed switched to this new methodology in Jan. 2021 and now reports all historical data using this new methodology.

Historical numbers have been revised and may differ significantly from originally reported values.

I used this data before on April 13, 2023, in “Lessons to Capture from Job Postings on Indeed.”

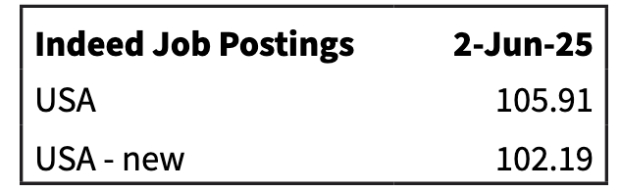

U.S.A. Indeed Job Postings

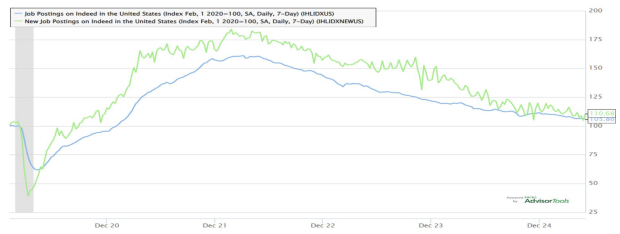

Overall U.S. job postings are shown here:

Image Source: Zacks Investment Research

The basic point? On June 2nd, 2025, the U.S. online job posting level has steadily been falling back to just +2% to +4% above the pre-pandemic Feb. 1st, 2020 level. Slow-and-steady erosion is seen.

Image Source: Zacks Investment Research

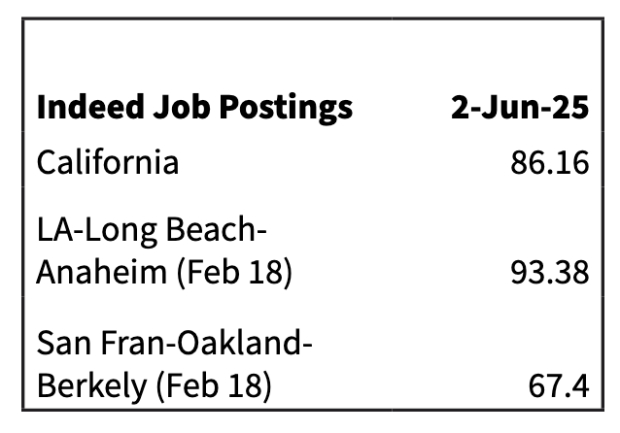

Digging further into the June 2nd, 2025 Indeed data, I pulled details from bellwether California, and two of its major metro areas.

Image Source: Zacks Investment Research

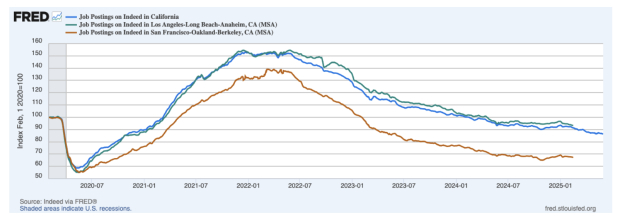

Surprising to me, California job postings are well below the pre-pandemic Feb. 1st 2020 baselines.

On June 2nd, 2025, California is -14% below its pre-pandemic level. LA metro is better, at -6.6% below. San Francisco metro area is the worst at -32.6% below.

IT data is more boom-and-bust.

Image Source: St Louis Federal Reserve

Image: Shutterstock

A Fresh Look at Indeed Job Postings

This is an excerpt from our most recent Economic Outlook report. To access the full PDF, please click here.

Indeed is a national and worldwide aggregator -- of on-line employment website job postings.

Indeed calculates its index change in seasonally-adjusted job postings set to a 100 index level in the pre-COVID moment:

That is Feb. 1st, 2020, using a 7-day trailing average.

The St. Louis Fed FRED website wants it explicitly set to a Feb. 1st, 2020, pre-pandemic baseline.

Historical numbers have been revised and may differ significantly from originally reported values.

I used this data before on April 13, 2023, in “Lessons to Capture from Job Postings on Indeed.”

U.S.A. Indeed Job Postings

Overall U.S. job postings are shown here:

Image Source: Zacks Investment Research

The basic point? On June 2nd, 2025, the U.S. online job posting level has steadily been falling back to just +2% to +4% above the pre-pandemic Feb. 1st, 2020 level. Slow-and-steady erosion is seen.

Image Source: Zacks Investment Research

Digging further into the June 2nd, 2025 Indeed data, I pulled details from bellwether California, and two of its major metro areas.

Image Source: Zacks Investment Research

Surprising to me, California job postings are well below the pre-pandemic Feb. 1st 2020 baselines.

On June 2nd, 2025, California is -14% below its pre-pandemic level. LA metro is better, at -6.6% below. San Francisco metro area is the worst at -32.6% below.

IT data is more boom-and-bust.

Image Source: St Louis Federal Reserve