This is an excerpt from our most recent Economic Outlook report. To access the full PDF, please click here.

The worst parts of the U.S. unemployment situation in the fall of 2025 include:

- The rise in long-term unemployment

- A stalling job market with slowing hiring, and

- Disproportionate impacts, on specific demographics and industries

While the headline U.S. unemployment rate remains low, these underlying trends signal a weakening U.S. economy, and increasing struggles for many U.S. job seekers.

The Rise in Long-term U.S. Unemployment

A key concern is the growing number of people who have been jobless for over six months, a trend that is uncharacteristic outside of a recession.

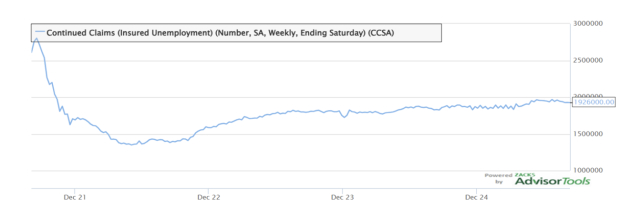

Consult the rise in the Continuing Claims for Insured Unemployment chart below:

Image Source: Zacks Investment Research

Highest share in years: In August 2025, the share of unemployed people who were long-term unemployed (27 weeks or longer) climbed to 25.7%, the highest percentage since February 2022.

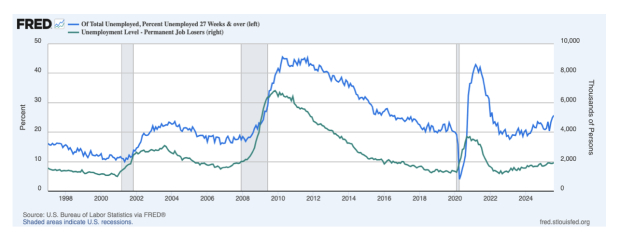

Consult the rise in the Number of Total Unemployed, for 27 Weeks & Over, chart below:

Image Source: Zacks Investment Research

The Slowdown in U.S. Job Growth

Challenges for the jobless: Long-term unemployment can create a cycle of hardship, as a long gap in employment can erode skills, deplete savings, and make job seekers appear less attractive to employers.

Impact on college graduates: The trend of long-term unemployment has also affected college-educated workers more than in the past, with the fraction of long-term unemployed holding a college degree growing significantly.

The overall hiring rate has cooled significantly, making it harder for unemployed individuals to find new opportunities.

Consult the stunning 10.8% New Entrants stall, as a Percent of Total Unemployed, chart below:

Image Source: Zacks Investment Research

Stalled hiring: The economy added a meager 22,000 jobs in August 2025, falling well short of analyst expectations and continuing a trend of weak hiring since April.

First net job loss since 2020: Revised data from the Bureau of Labor Statistics (BLS) shows the economy lost 13,000 jobs in June 2025—the first monthly decline since December 2020.

Low-fire, low-hire market: According to the Federal Reserve, the labor market is in a "low-hiring, low-firing" environment.

This means that while mass layoffs are not widespread, new job openings are scarce, leaving job seekers with fewer options and making the market feel stagnant.

The Worst Parts of U.S. 2025 Joblessness

This is an excerpt from our most recent Economic Outlook report. To access the full PDF, please click here.

The worst parts of the U.S. unemployment situation in the fall of 2025 include:

While the headline U.S. unemployment rate remains low, these underlying trends signal a weakening U.S. economy, and increasing struggles for many U.S. job seekers.

The Rise in Long-term U.S. Unemployment

A key concern is the growing number of people who have been jobless for over six months, a trend that is uncharacteristic outside of a recession.

Consult the rise in the Continuing Claims for Insured Unemployment chart below:

Image Source: Zacks Investment Research

Highest share in years: In August 2025, the share of unemployed people who were long-term unemployed (27 weeks or longer) climbed to 25.7%, the highest percentage since February 2022.

Consult the rise in the Number of Total Unemployed, for 27 Weeks & Over, chart below:

Image Source: Zacks Investment Research

The Slowdown in U.S. Job Growth

Challenges for the jobless: Long-term unemployment can create a cycle of hardship, as a long gap in employment can erode skills, deplete savings, and make job seekers appear less attractive to employers.

Impact on college graduates: The trend of long-term unemployment has also affected college-educated workers more than in the past, with the fraction of long-term unemployed holding a college degree growing significantly.

The overall hiring rate has cooled significantly, making it harder for unemployed individuals to find new opportunities.

Consult the stunning 10.8% New Entrants stall, as a Percent of Total Unemployed, chart below:

Image Source: Zacks Investment Research

Stalled hiring: The economy added a meager 22,000 jobs in August 2025, falling well short of analyst expectations and continuing a trend of weak hiring since April.

First net job loss since 2020: Revised data from the Bureau of Labor Statistics (BLS) shows the economy lost 13,000 jobs in June 2025—the first monthly decline since December 2020.

Low-fire, low-hire market: According to the Federal Reserve, the labor market is in a "low-hiring, low-firing" environment.

This means that while mass layoffs are not widespread, new job openings are scarce, leaving job seekers with fewer options and making the market feel stagnant.