We use cookies to understand how you use our site and to improve your experience.

This includes personalizing content and advertising.

By pressing "Accept All" or closing out of this banner, you consent to the use of all cookies and similar technologies and the sharing of information they collect with third parties.

You can reject marketing cookies by pressing "Deny Optional," but we still use essential, performance, and functional cookies.

In addition, whether you "Accept All," Deny Optional," click the X or otherwise continue to use the site, you accept our Privacy Policy and Terms of Service, revised from time to time.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

3 Domestic Auto Stocks to Consider Amid Upbeat Demand Outlook

Read MoreHide Full Article

The Zacks Domestic Auto industry is set for renewed momentum as affordable EVs and proposed tax incentives encourage buyers despite economic uncertainty and rising tariffs. More budget-friendly EVs are expected to expand adoption, while tariffs may limit foreign rivals, supporting domestic manufacturers. The Trump administration’s proposed tax deduction of up to $10,000 on interest for U.S.-assembled vehicles could further boost demand, with 2025 sales projected to reach 16.1-16.2 million units.Domestic automakers like General Motors Company (GM - Free Report) , Polaris Inc. (PII - Free Report) and Blue Bird Corporation (BLBD - Free Report) are likely to gain from acquired momentum.

Industry Overview

The Zacks Domestic Auto industry includes companies that are engaged in designing, manufacturing and retailing vehicles across the globe. These include passenger cars, crossover vehicles, sport utility vehicles, trucks, vans, motorcycles and electric vehicles. The industry, which is highly consumer cyclic and provides employment to a large number of people, is at the forefront of innovation, courtesy of its nature and the transformation that it is going through. The widespread use of technology and rapid digitization are resulting in a fundamental restructuring of the automotive market. Several companies in the industry have engine and transmission plants, and conduct research and development, and testing of electric and autonomous vehicles.

Factors Shaping the Industry's Prospects

Affordable EVs to Attract Buyers:Even with higher tariffs and economic uncertainty clouding the outlook for the auto sector, the growing availability of lower-priced electric vehicles is expected to draw in more buyers. Until now, most EVs sold in the United States have been positioned at premium price points, putting them beyond the reach of many shoppers. That is starting to change as carmakers shift their attention to more economical models, with multiple EVs priced at $35,000 or below slated to launch in the next few years. Additionally, stricter tariffs are likely to limit foreign automakers, especially dominant Chinese players, from entering the domestic market, potentially boosting the share of American manufacturers.

Tax Incentives Aimed at Boosting Vehicle Demand:Per Forbes, the Trump administration’s proposed “One Big Beautiful Bill Act” would allow eligible buyers of newly purchased, U.S.-assembled vehicles to deduct up to $10,000 in interest paid on auto loans. The benefit excludes leases and commercial vehicles and begins phasing out for individuals earning more than $100,000 or couples making above $200,000. With the average new car priced at $48,000 and loan rates near 8.64%, someone paying $2,000 in annual interest could save roughly $400 each year or about $2,000 across a five-year loan. These savings could help counteract price increases linked to Trump’s import tariffs. The measure is expected to stimulate demand for new vehicles. Per S&P Global, U.S. auto sales in 2025 will climb to 16.1-16.2 million units, up from 15.98 million in 2024.

Losing Ground in European & Chinese Markets: Chinese automakers boosted their collective share of Europe’s total vehicle sales to around 5.1% in the first half of 2025, nearly double their share from a year earlier, per data from JATO Dynamics. In China, domestic EV companies have also tightened their hold on the market, with their share jumping from 65% in the first half of 2020 to nearly 90% in the first half of 2025, per Counterpoint. Against this backdrop, American automakers are finding it increasingly difficult to defend their global market positions, which is constraining their sales growth outside the domestic market. The global share loss limits U.S. automakers’ scale, margins, and investment capacity, ultimately influencing pricing and competitiveness in their home market as well.

Zacks Industry Rank Indicates Bright Near-Term Prospects

The Zacks Automotive – Domestic industry is part of the broader Zacks Auto-Tires-Trucks sector. The industry currently carries a Zacks Industry Rank #65, which places it in the top 27% of 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates bright near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the top 50% of the Zacks-ranked industries is a result of a positive earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are optimistic about this group’s earnings growth potential.

Amid an upbeat industry outlook, we will present a few stocks that you might consider adding to your watchlist. Before that, let us discuss the industry’s recent stock market performance and valuation picture.

Industry Lags Sector And S&P 500

The Domestic Auto industry has underperformed the auto sector and the Zacks S&P 500 composite over the past year. The industry has returned 6.3% compared with the sector and S&P 500’s growth of 7.1% and 14.5%, respectively.

One-Year Price Performance

Image Source: Zacks Investment Research

Industry's Current Valuation

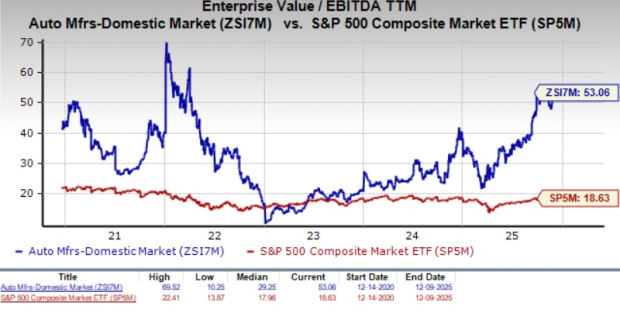

Since automotive companies are debt-laden, it makes sense to value them based on the EV/EBITDA (Enterprise Value/Earnings before Interest Tax Depreciation and Amortization) ratio. On the basis of the trailing 12-month enterprise value to EBITDA (EV/EBITDA), the industry is currently trading at 53.06X compared with the S&P 500’s 18.63X and the sector’s 25.8X. Over the past five years, the industry has traded as high as 69.52X, as low as 10.25X and at a median of 29.25X, as the chart below shows.

EV/EBITDA Ratio (Past Five Years)

Image Source: Zacks Investment Research

3 Stocks to Consider

General Motors: It is one of the world’s largest automakers and held the largest share of the U.S. auto market at 16.5% in 2024. Strong demand for its leading brands continues to fuel sales growth, driven by popular pickups and SUVs. GM expects ICE volumes to stay robust while strengthening its production base with onshoring initiatives. Upcoming launches like the next-generation Cadillac CT5, redesigned XT5, and the Orion Assembly plant’s relaunch in early 2027, set to produce the Cadillac Escalade and new full-size pickups, underscore GM’s commitment to meet customer demand in the U.S. market. It is gaining strong momentum in its software and services business, which is becoming a key growth driver.

GM currently sports a Zacks Rank #1 (Strong Buy). The Zacks Consensus Estimate for GM’s 2025 and 2026 EPS has moved north by 6 cents and 41 cents, respectively, over the past seven days. It has surpassed earnings estimates in each of the trailing four quarters, the average earnings surprise being 8.95%.

Polaris: It develops, engineers, and produces both off-road and on-road vehicles. Polaris posted a solid third quarter with $1.8 billion in revenues. Along with its On Road and Marine segments outperforming their industries, the company also secured notable Off Road market share gains during the quarter. Polaris introduced its updated 2025 full-year outlook and expects adjusted sales in the range of $6.9 billion to $7.1 billion. The company reported sales of $7.17 billion in 2024.

PII currently sports a Zacks Rank #1. The Zacks Consensus Estimate for PII’s 2025 loss per share has narrowed by $1.15 over the past 60 days. The Zacks Consensus Estimate for PII’s 2026 EPS has moved up 40 cents over the past 60 days. It has surpassed earnings estimates in each of the trailing four quarters, the average earnings surprise being 179.12%.

Price & Consensus: PII

Image Source: Zacks Investment Research

Blue Bird: The company is engaged in the designing, engineering, manufacturing and sale of school buses and related parts. It also offers alternative fuel applications with its propane-powered and compressed natural gas-powered school buses. It reiterated its fiscal 2026 financial outlook based on solid performance in 2025. It expects fiscal 2026 revenues of $1.5 billion and adjusted EBITDA of $220 million. The company expects 2026 to mirror the record results delivered in 2025 and anticipates continued profitable growth in the years ahead as it works toward reaching approximately $2 billion in revenues and an adjusted EBITDA margin exceeding 16%.

BLBD currently carries a Zacks Rank #2 (Buy). The Zacks Consensus Estimate for fiscal 2026 sales implies year-over-year growth of 5.74%. The consensus mark for BLBD’s 2026 EPS has moved up 6 cents over the past 30 days. It has surpassed earnings estimates in three of the trailing four quarters and matched once, the average earnings surprise being 19.79%.

Price & Consensus: BLBD

Image Source: Zacks Investment Research

See More Zacks Research for These Tickers

Normally $25 each - click below to receive one report FREE:

Image: Bigstock

3 Domestic Auto Stocks to Consider Amid Upbeat Demand Outlook

The Zacks Domestic Auto industry is set for renewed momentum as affordable EVs and proposed tax incentives encourage buyers despite economic uncertainty and rising tariffs. More budget-friendly EVs are expected to expand adoption, while tariffs may limit foreign rivals, supporting domestic manufacturers. The Trump administration’s proposed tax deduction of up to $10,000 on interest for U.S.-assembled vehicles could further boost demand, with 2025 sales projected to reach 16.1-16.2 million units.Domestic automakers like General Motors Company (GM - Free Report) , Polaris Inc. (PII - Free Report) and Blue Bird Corporation (BLBD - Free Report) are likely to gain from acquired momentum.

Industry Overview

The Zacks Domestic Auto industry includes companies that are engaged in designing, manufacturing and retailing vehicles across the globe. These include passenger cars, crossover vehicles, sport utility vehicles, trucks, vans, motorcycles and electric vehicles. The industry, which is highly consumer cyclic and provides employment to a large number of people, is at the forefront of innovation, courtesy of its nature and the transformation that it is going through. The widespread use of technology and rapid digitization are resulting in a fundamental restructuring of the automotive market. Several companies in the industry have engine and transmission plants, and conduct research and development, and testing of electric and autonomous vehicles.

Factors Shaping the Industry's Prospects

Affordable EVs to Attract Buyers:Even with higher tariffs and economic uncertainty clouding the outlook for the auto sector, the growing availability of lower-priced electric vehicles is expected to draw in more buyers. Until now, most EVs sold in the United States have been positioned at premium price points, putting them beyond the reach of many shoppers. That is starting to change as carmakers shift their attention to more economical models, with multiple EVs priced at $35,000 or below slated to launch in the next few years. Additionally, stricter tariffs are likely to limit foreign automakers, especially dominant Chinese players, from entering the domestic market, potentially boosting the share of American manufacturers.

Tax Incentives Aimed at Boosting Vehicle Demand:Per Forbes, the Trump administration’s proposed “One Big Beautiful Bill Act” would allow eligible buyers of newly purchased, U.S.-assembled vehicles to deduct up to $10,000 in interest paid on auto loans. The benefit excludes leases and commercial vehicles and begins phasing out for individuals earning more than $100,000 or couples making above $200,000. With the average new car priced at $48,000 and loan rates near 8.64%, someone paying $2,000 in annual interest could save roughly $400 each year or about $2,000 across a five-year loan. These savings could help counteract price increases linked to Trump’s import tariffs. The measure is expected to stimulate demand for new vehicles. Per S&P Global, U.S. auto sales in 2025 will climb to 16.1-16.2 million units, up from 15.98 million in 2024.

Losing Ground in European & Chinese Markets: Chinese automakers boosted their collective share of Europe’s total vehicle sales to around 5.1% in the first half of 2025, nearly double their share from a year earlier, per data from JATO Dynamics. In China, domestic EV companies have also tightened their hold on the market, with their share jumping from 65% in the first half of 2020 to nearly 90% in the first half of 2025, per Counterpoint. Against this backdrop, American automakers are finding it increasingly difficult to defend their global market positions, which is constraining their sales growth outside the domestic market. The global share loss limits U.S. automakers’ scale, margins, and investment capacity, ultimately influencing pricing and competitiveness in their home market as well.

Zacks Industry Rank Indicates Bright Near-Term Prospects

The Zacks Automotive – Domestic industry is part of the broader Zacks Auto-Tires-Trucks sector. The industry currently carries a Zacks Industry Rank #65, which places it in the top 27% of 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates bright near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the top 50% of the Zacks-ranked industries is a result of a positive earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are optimistic about this group’s earnings growth potential.

Amid an upbeat industry outlook, we will present a few stocks that you might consider adding to your watchlist. Before that, let us discuss the industry’s recent stock market performance and valuation picture.

Industry Lags Sector And S&P 500

The Domestic Auto industry has underperformed the auto sector and the Zacks S&P 500 composite over the past year. The industry has returned 6.3% compared with the sector and S&P 500’s growth of 7.1% and 14.5%, respectively.

One-Year Price Performance

Image Source: Zacks Investment Research

Industry's Current Valuation

Since automotive companies are debt-laden, it makes sense to value them based on the EV/EBITDA (Enterprise Value/Earnings before Interest Tax Depreciation and Amortization) ratio. On the basis of the trailing 12-month enterprise value to EBITDA (EV/EBITDA), the industry is currently trading at 53.06X compared with the S&P 500’s 18.63X and the sector’s 25.8X. Over the past five years, the industry has traded as high as 69.52X, as low as 10.25X and at a median of 29.25X, as the chart below shows.

EV/EBITDA Ratio (Past Five Years)

Image Source: Zacks Investment Research

3 Stocks to Consider

General Motors: It is one of the world’s largest automakers and held the largest share of the U.S. auto market at 16.5% in 2024. Strong demand for its leading brands continues to fuel sales growth, driven by popular pickups and SUVs. GM expects ICE volumes to stay robust while strengthening its production base with onshoring initiatives. Upcoming launches like the next-generation Cadillac CT5, redesigned XT5, and the Orion Assembly plant’s relaunch in early 2027, set to produce the Cadillac Escalade and new full-size pickups, underscore GM’s commitment to meet customer demand in the U.S. market. It is gaining strong momentum in its software and services business, which is becoming a key growth driver.

GM currently sports a Zacks Rank #1 (Strong Buy). The Zacks Consensus Estimate for GM’s 2025 and 2026 EPS has moved north by 6 cents and 41 cents, respectively, over the past seven days. It has surpassed earnings estimates in each of the trailing four quarters, the average earnings surprise being 8.95%.

Price & Consensus: GM

Image Source: Zacks Investment Research

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Polaris: It develops, engineers, and produces both off-road and on-road vehicles. Polaris posted a solid third quarter with $1.8 billion in revenues. Along with its On Road and Marine segments outperforming their industries, the company also secured notable Off Road market share gains during the quarter. Polaris introduced its updated 2025 full-year outlook and expects adjusted sales in the range of $6.9 billion to $7.1 billion. The company reported sales of $7.17 billion in 2024.

PII currently sports a Zacks Rank #1. The Zacks Consensus Estimate for PII’s 2025 loss per share has narrowed by $1.15 over the past 60 days. The Zacks Consensus Estimate for PII’s 2026 EPS has moved up 40 cents over the past 60 days. It has surpassed earnings estimates in each of the trailing four quarters, the average earnings surprise being 179.12%.

Price & Consensus: PII

Image Source: Zacks Investment Research

Blue Bird: The company is engaged in the designing, engineering, manufacturing and sale of school buses and related parts. It also offers alternative fuel applications with its propane-powered and compressed natural gas-powered school buses. It reiterated its fiscal 2026 financial outlook based on solid performance in 2025. It expects fiscal 2026 revenues of $1.5 billion and adjusted EBITDA of $220 million. The company expects 2026 to mirror the record results delivered in 2025 and anticipates continued profitable growth in the years ahead as it works toward reaching approximately $2 billion in revenues and an adjusted EBITDA margin exceeding 16%.

BLBD currently carries a Zacks Rank #2 (Buy). The Zacks Consensus Estimate for fiscal 2026 sales implies year-over-year growth of 5.74%. The consensus mark for BLBD’s 2026 EPS has moved up 6 cents over the past 30 days. It has surpassed earnings estimates in three of the trailing four quarters and matched once, the average earnings surprise being 19.79%.

Price & Consensus: BLBD

Image Source: Zacks Investment Research