Many of the investors I talk with are wondering what to do with tech stocks right now. Is it time to buy? Or does it make sense to wait a little longer to get a clearer sense of the sector’s direction?

On the one hand, many wonder if stocks have climbed too high, too fast.

Take Netflix and Meta (formerly Facebook) as examples. Both recently plummeted 20% following disappointing earnings announcements and cautious forward guidance… wiping $100s of billions out of the market in the blink of an eye.

That sort of price action can make even the most grizzled investing veteran flinch – especially for those who remember the Tech Wreck of the early 2000s.

On the other hand, many investors see the pullbacks and volatility as a buying opportunity. It’s been 2 years since some of these big names have been priced so low.

Believe me, I get it.

But if you've hesitated at all to invest in tech stocks, you're missing out on some of the biggest profit opportunities in the market today.

Consider the following:

It seems like only a few years ago, things like video phone calls and self-driving cars seemed like a far-off dream.

Now we see these innovations on a regular basis.

Since the pandemic started, innovation of new technologies has accelerated even more.

Not only have these shiny new products and services captivated our imaginations, but they've also been a major force powering record corporate earnings and the historic bull market run.

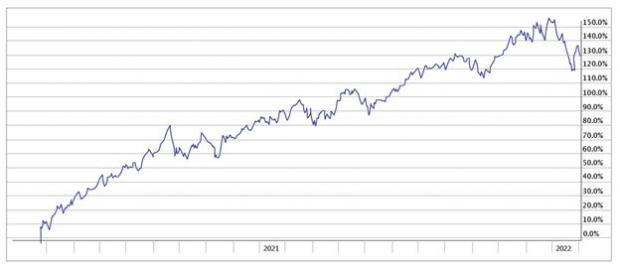

Despite the indigestion investors have experienced over the past few weeks, the tech sector has surged +130% since last March.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

In fact, the recent weakness in this space has created even more compelling opportunities to buy.

Demand That Keeps Growing and Growing

Looking at the tech landscape, there are 3 reasons for stocks to climb.

More . . .

------------------------------------------------------------------------------------------------------

Must-See Tech Stock for 2022 (Triple-Digit Profit Potential)

Fueled by the global semiconductor shortage, one semiconductor stock is poised to skyrocket in 2022 and beyond.

The company is one-fourth of 1% the size of Intel, but it’s growing FAST. The “tiny” tech stock has already climbed +663% since pandemic lows.

Its next leg higher could be equally profitable for investors who move quickly.

See this stock now >>

------------------------------------------------------------------------------------------------------

1) Industrial demand for tech-related products and services has never been greater. New technology brings in increased productivity, collaboration and safety. And with the rapid growth of blockchain technology and cryptocurrencies, the Internet of Things and the expansion of 5G networks, you can expect to see even bigger strides in the days to come.

2) Consumers are adding tech toys to more and more areas of our lives. It's not just cell phones; we have smart watches, smart home devices like the Amazon Echo or Google Home, and virtual reality devices such as Meta’s Oculus Rift, which could experience exponential growth as the “metaverse” begins to go mainstream.

3) Researchers are continuing to push further into territory previously unimaginable.

For example, scientists have technology to not only map out the human genome, but to edit it. We may be able to simply delete diseases right out of our DNA!

Countless computers and machines are being built with ability to learn independently, without being programmed by humans. This "machine learning" enables computer programs to change when exposed to new data.

Speaking of data, internet traffic has exploded over the past 2 years - and it's expected to keep growing. Data centers are investing hundreds of billions of dollars to upgrade their infrastructure to handle the load.

Where this kind of innovation meets ever-increasing consumption, there is potential for incredible growth.

Which Tech Stocks Should You Pay Attention to Right Now?

As you can see, the tech sector is already having a huge impact on almost every segment of society. The number of exciting possibilities will only increase as more companies and industries increase their use of breakthrough technology in the days to come.

As an investor, you can certainly try to target companies that are the end users of the latest developments, but why not focus on one thing each of these companies has in common?

One single component basically drives the success of the entire tech space: semiconductors.

Tech companies literally cannot function without them. That means the demand for these devices is likely to grow at least as fast as the tech sector as a whole.

And as you’ve seen in the news lately, the extreme demand for semiconductors has created a shortage of these critical components.

There is a catch. There are 38 publicly-owned companies in the electronics-semiconductor industry. Picking the right stock can be difficult.

Zacks’ Top Pick to Capitalize on This Opportunity

But not to worry. Zacks has just released One Semiconductor Stock Stands to Gain the Most, a Special Report revealing the little-known company poised to skyrocket more than any other.

This company is just a fraction of the size of the big name chipmakers like Intel and Nvidia, so most investors have never heard of it. But that may change soon, as it ramps up production for companies around the globe (including Apple). Share prices climbed 7X, and after the recent pullback, the next leg up could be just as lucrative for investors who get in early.

I encourage you to check out this report right away. Your chance to access our report ends Sunday, February 13.

Get the Report Now >>

Best,

Brian Bolan

Aggressive Growth Strategist

Brian Bolan is our aggressive growth expert and the editor of the Zacks Technology Innovators portfolio.

Image: Bigstock

Is Now the Right Time to Get Into Tech?

Many of the investors I talk with are wondering what to do with tech stocks right now. Is it time to buy? Or does it make sense to wait a little longer to get a clearer sense of the sector’s direction?

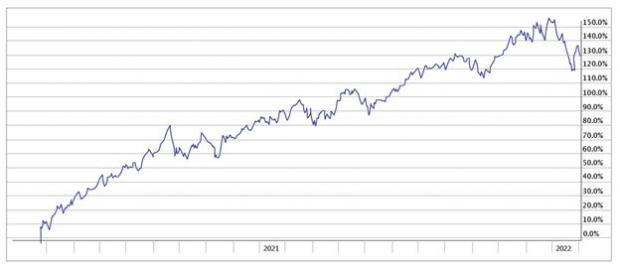

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

On the one hand, many wonder if stocks have climbed too high, too fast.

Take Netflix and Meta (formerly Facebook) as examples. Both recently plummeted 20% following disappointing earnings announcements and cautious forward guidance… wiping $100s of billions out of the market in the blink of an eye.

That sort of price action can make even the most grizzled investing veteran flinch – especially for those who remember the Tech Wreck of the early 2000s.

On the other hand, many investors see the pullbacks and volatility as a buying opportunity. It’s been 2 years since some of these big names have been priced so low.

Believe me, I get it.

But if you've hesitated at all to invest in tech stocks, you're missing out on some of the biggest profit opportunities in the market today.

Consider the following:

It seems like only a few years ago, things like video phone calls and self-driving cars seemed like a far-off dream.

Now we see these innovations on a regular basis.

Since the pandemic started, innovation of new technologies has accelerated even more.

Not only have these shiny new products and services captivated our imaginations, but they've also been a major force powering record corporate earnings and the historic bull market run.

Despite the indigestion investors have experienced over the past few weeks, the tech sector has surged +130% since last March.

In fact, the recent weakness in this space has created even more compelling opportunities to buy.

Demand That Keeps Growing and Growing

Looking at the tech landscape, there are 3 reasons for stocks to climb.

More . . .

------------------------------------------------------------------------------------------------------

Must-See Tech Stock for 2022 (Triple-Digit Profit Potential)

Fueled by the global semiconductor shortage, one semiconductor stock is poised to skyrocket in 2022 and beyond.

The company is one-fourth of 1% the size of Intel, but it’s growing FAST. The “tiny” tech stock has already climbed +663% since pandemic lows.

Its next leg higher could be equally profitable for investors who move quickly.

See this stock now >>

------------------------------------------------------------------------------------------------------

1) Industrial demand for tech-related products and services has never been greater. New technology brings in increased productivity, collaboration and safety. And with the rapid growth of blockchain technology and cryptocurrencies, the Internet of Things and the expansion of 5G networks, you can expect to see even bigger strides in the days to come.

2) Consumers are adding tech toys to more and more areas of our lives. It's not just cell phones; we have smart watches, smart home devices like the Amazon Echo or Google Home, and virtual reality devices such as Meta’s Oculus Rift, which could experience exponential growth as the “metaverse” begins to go mainstream.

3) Researchers are continuing to push further into territory previously unimaginable.

For example, scientists have technology to not only map out the human genome, but to edit it. We may be able to simply delete diseases right out of our DNA!

Countless computers and machines are being built with ability to learn independently, without being programmed by humans. This "machine learning" enables computer programs to change when exposed to new data.

Speaking of data, internet traffic has exploded over the past 2 years - and it's expected to keep growing. Data centers are investing hundreds of billions of dollars to upgrade their infrastructure to handle the load.

Where this kind of innovation meets ever-increasing consumption, there is potential for incredible growth.

Which Tech Stocks Should You Pay Attention to Right Now?

As you can see, the tech sector is already having a huge impact on almost every segment of society. The number of exciting possibilities will only increase as more companies and industries increase their use of breakthrough technology in the days to come.

As an investor, you can certainly try to target companies that are the end users of the latest developments, but why not focus on one thing each of these companies has in common?

One single component basically drives the success of the entire tech space: semiconductors.

Tech companies literally cannot function without them. That means the demand for these devices is likely to grow at least as fast as the tech sector as a whole.

And as you’ve seen in the news lately, the extreme demand for semiconductors has created a shortage of these critical components.

There is a catch. There are 38 publicly-owned companies in the electronics-semiconductor industry. Picking the right stock can be difficult.

Zacks’ Top Pick to Capitalize on This Opportunity

But not to worry. Zacks has just released One Semiconductor Stock Stands to Gain the Most, a Special Report revealing the little-known company poised to skyrocket more than any other.

This company is just a fraction of the size of the big name chipmakers like Intel and Nvidia, so most investors have never heard of it. But that may change soon, as it ramps up production for companies around the globe (including Apple). Share prices climbed 7X, and after the recent pullback, the next leg up could be just as lucrative for investors who get in early.

I encourage you to check out this report right away. Your chance to access our report ends Sunday, February 13.

Get the Report Now >>

Best,

Brian Bolan

Aggressive Growth Strategist

Brian Bolan is our aggressive growth expert and the editor of the Zacks Technology Innovators portfolio.