January CPI came in above the 0.5% threshold illustrating an inflation acceleration (7.5% annualized), sending growth-focused equities into a bit of a tailspin.

However, I see opportunity here to pick up pre-earnings innovation-driven winners before they report what should result in a springboard price action over the next few weeks on the predication that this is indeed peak inflation (with many of the most notable inflation drivers being transient in nature).

Is The Worst Case-Scenario Priced In?

Public equity markets tend to overreact to both the up and downside with any economic shift. This type of exaggerated market moves is what we're seeing in high-growth names due to the recently initiated period of monetary tightening (the process of the central bank raising rates). When something unexpected occurs, knee-jerk reactions can easily overshoot underlying fundamentals (which we've seen a lot of as of late).

The worst-case scenario that looks to have been priced in (predominantly by high-growth innovators) is an economic backdrop of decelerating demand while inflation soars. In this event, the Federal Reserve would be forced to rapidly tighten its monetary approach in order to save our economy from an unwanted period of stagflation (stagnant economic growth coupled with outsized inflation).

Rate-sensitive growth stocks have naturally been hit the hardest by the fears of an increasingly hawkish Federal Reserve, as their projected earnings far in the future (where most of its market value is derived) get discounted back at a higher rate. However, it would appear that this sell-off overshot fundamentals for the best-positioned market disruptors.

The US 10-Year yield skyrocketed materially above 2% for the first time since the July 2019 trade began, and growth stocks rallied in relief. The 50% or more capitulations from many innovation-fueled stocks' 52-week highs appear to have been driven by nothing more than uncertainty & fear surrounding monetary expectations.

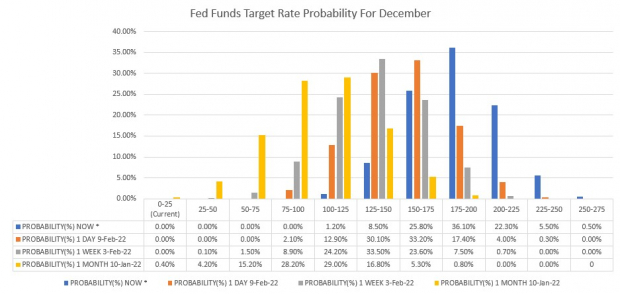

Today, those expectations were driven higher, but the range of predictions have soared to around 6 to 8 rate hikes by year end after St. Louis Fed President, Bullard called for a 50-basis point March hike (two 25-basis point increments in one meeting). According to CME's Fed Funds futures data, there is now a 0% probability of 3 or less 25-basis point hikes before the year is up and a 64.4% chance that we will see 7 or more rate increases (indicating an average of 1-hike per meeting). A stark contrast to the 48% and 0.8% respective probabilities this futures market had priced for 1 month prior.

My chart below shows this sentiment shift, comparing Friday's 2022 Fed Funds probabilities with 1-day, 1-week, and 1-month prior.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The increased confidence in rates allows analysts and investors to better quantify their valuation models and provided the overly discounted growth sector with a nice relief rally today as the aggressive short-sellers begin unwinding their innovation-focused positions.

The January CPI reading this morning was above expectations, but I believe that this could have been the peak for inflation as the Omicron’s pandemic prolonging bottleneck effect subsides, allowing supply and demand imbalances to revert towards a stable free-market equilibrium (price stabilization).

The New Trader

Many old-school money managers have been unable to adjust their investment approaches to adapt to this novel trading environment, where momentum, self-fulfilling prophecies, technical analysis, and the tidal wave of freshman participants with a penchant for innovation have taken precedence over traditional value investing.

In fact, value investing doesn't even hold the same meaning that it did 20 years ago. With interest rates near 0% for almost 2 years now, valuation multiples like P/E, P/S, P/B, and EV/EBITDA have become convoluted measures of intrinsic value. These seemingly antiquated standards of relative value are missing the critical component of long-term growth outlooks as the post-pandemic digital renaissance commences.

We are entering an advanced phase of economic development, which can be characterized by digitally fueled secular growth from hundreds (if not thousands) of young innovators looking to change the world.

Record low-interest rates coupled with the pandemic's rapid digitalization (accelerating adaptation) has allowed market-disrupting start-ups years away from profitability to attain valuations in the $10s of billions. Investors aren't modeling for the notion that rates will be systemically lower in the post-pandemic economy (exemplified by the Fed's reduction of its long-term target Fed Funds rate) and further fuel the boundless profitable growth potential that many newly public innovators possess.

Markets Already Priced For The Worst Case Scenario: Time To Buy Future Economy Stocks

January CPI came in above the 0.5% threshold illustrating an inflation acceleration (7.5% annualized), sending growth-focused equities into a bit of a tailspin.

However, I see opportunity here to pick up pre-earnings innovation-driven winners before they report what should result in a springboard price action over the next few weeks on the predication that this is indeed peak inflation (with many of the most notable inflation drivers being transient in nature).

Is The Worst Case-Scenario Priced In?

Public equity markets tend to overreact to both the up and downside with any economic shift. This type of exaggerated market moves is what we're seeing in high-growth names due to the recently initiated period of monetary tightening (the process of the central bank raising rates). When something unexpected occurs, knee-jerk reactions can easily overshoot underlying fundamentals (which we've seen a lot of as of late).

The worst-case scenario that looks to have been priced in (predominantly by high-growth innovators) is an economic backdrop of decelerating demand while inflation soars. In this event, the Federal Reserve would be forced to rapidly tighten its monetary approach in order to save our economy from an unwanted period of stagflation (stagnant economic growth coupled with outsized inflation).

Rate-sensitive growth stocks have naturally been hit the hardest by the fears of an increasingly hawkish Federal Reserve, as their projected earnings far in the future (where most of its market value is derived) get discounted back at a higher rate. However, it would appear that this sell-off overshot fundamentals for the best-positioned market disruptors.

The US 10-Year yield skyrocketed materially above 2% for the first time since the July 2019 trade began, and growth stocks rallied in relief. The 50% or more capitulations from many innovation-fueled stocks' 52-week highs appear to have been driven by nothing more than uncertainty & fear surrounding monetary expectations.

Today, those expectations were driven higher, but the range of predictions have soared to around 6 to 8 rate hikes by year end after St. Louis Fed President, Bullard called for a 50-basis point March hike (two 25-basis point increments in one meeting). According to CME's Fed Funds futures data, there is now a 0% probability of 3 or less 25-basis point hikes before the year is up and a 64.4% chance that we will see 7 or more rate increases (indicating an average of 1-hike per meeting). A stark contrast to the 48% and 0.8% respective probabilities this futures market had priced for 1 month prior.

My chart below shows this sentiment shift, comparing Friday's 2022 Fed Funds probabilities with 1-day, 1-week, and 1-month prior.

The increased confidence in rates allows analysts and investors to better quantify their valuation models and provided the overly discounted growth sector with a nice relief rally today as the aggressive short-sellers begin unwinding their innovation-focused positions.

The January CPI reading this morning was above expectations, but I believe that this could have been the peak for inflation as the Omicron’s pandemic prolonging bottleneck effect subsides, allowing supply and demand imbalances to revert towards a stable free-market equilibrium (price stabilization).

The New Trader

Many old-school money managers have been unable to adjust their investment approaches to adapt to this novel trading environment, where momentum, self-fulfilling prophecies, technical analysis, and the tidal wave of freshman participants with a penchant for innovation have taken precedence over traditional value investing.

In fact, value investing doesn't even hold the same meaning that it did 20 years ago. With interest rates near 0% for almost 2 years now, valuation multiples like P/E, P/S, P/B, and EV/EBITDA have become convoluted measures of intrinsic value. These seemingly antiquated standards of relative value are missing the critical component of long-term growth outlooks as the post-pandemic digital renaissance commences.

We are entering an advanced phase of economic development, which can be characterized by digitally fueled secular growth from hundreds (if not thousands) of young innovators looking to change the world.

Record low-interest rates coupled with the pandemic's rapid digitalization (accelerating adaptation) has allowed market-disrupting start-ups years away from profitability to attain valuations in the $10s of billions. Investors aren't modeling for the notion that rates will be systemically lower in the post-pandemic economy (exemplified by the Fed's reduction of its long-term target Fed Funds rate) and further fuel the boundless profitable growth potential that many newly public innovators possess.