It's obvious. Some investors are going to make a killing on chips.

After all, who wouldn't want to invest in products that the world is desperate for?

Semiconductors are critical components in every tech product you can think of from toasters to jet fighters, from portable computers to flat panel TVs. The average new car has about 1,000 chips. Electric cars average 2,000.

Fact is, there's so much demand for these tiny devices that it's almost impossible to find them.

Chip manufacturers have backlogs of orders but simply can't make enough chips to keep up.

That's why there's confusion about this space. So many investors are worked up by the growth potential of semiconductor stocks, yet others are hesitating to take the plunge.

Are you among them?

I understand the concern. While the pandemic caused demand for cell phones and laptops to shoot up, a short-lived recession and a health-imperiled workforce forced factories to shut down.

Beyond Covid, the world was hit by a perfect storm including but not limited to the China trade war, a catastrophic fire in a key Japanese chip factory, a ship clogging the Suez Canal, and an historic freeze in Texas.

The accounting and consulting firm, Deloitte expects the resulting shortage to last through 2022 and into 2023.

The Wall Street Journal reports that "problems are increasing for many customers as delays are getting even longer and sales are lost."

The CEO of Intel, the world's largest semiconductor company by revenue, laments that the worst is yet to come. "We expect the shortage to persist until 2023."

He also forecasts that the big rebound won't come until 2025.

Good News: Investors Don't Have to Wait That Long

For example, while Intel is facing shrinking earnings and sales, smaller niche chip companies have surged through the crunch.

One such chip maker is David to Intel's Goliath. It's less than 1/4th of 1% the size of the $200-billion colossus.

Yet it looks to be in the early phase of a price boom that is rarely seen.

Potential Windfall of +100%, +200%, Even More.

Just imagine. What if you had bought Intel as it was just starting to grow?

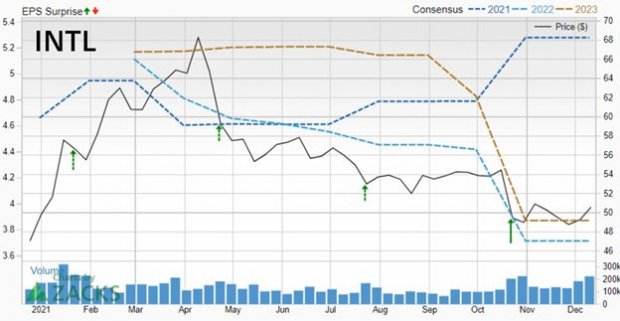

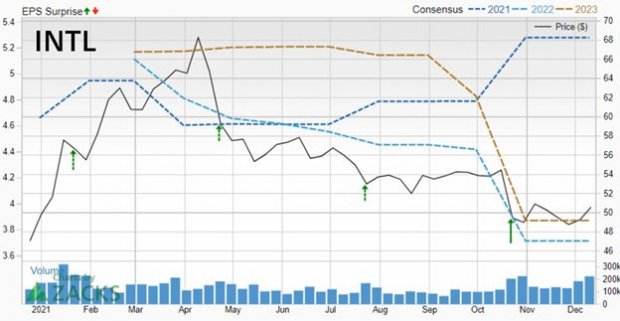

The story is in the charts. Over the past year, Intel's stock price chart has looked like a disturbing EKG.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

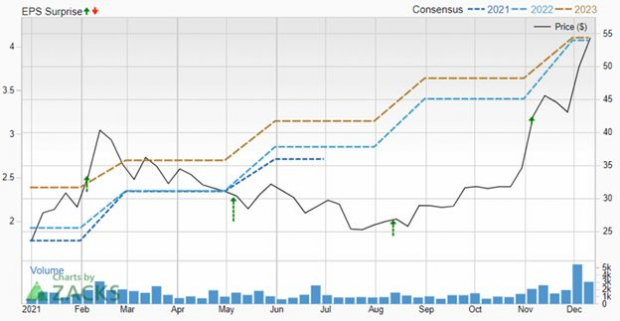

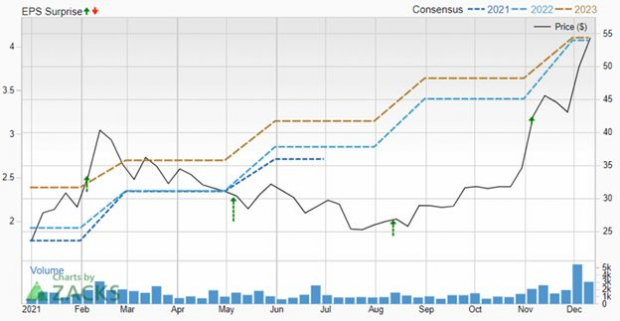

But now check the chart of a little-known semiconductor that already has a global presence.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

So where do you look for the right semiconductor stock to invest in? Let's consider four principles for guiding your search:

1) Key Signal for Explosive Growth

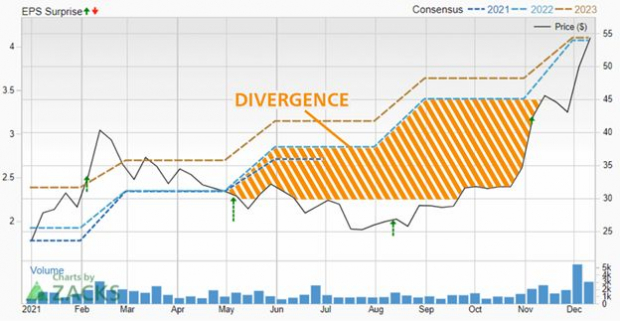

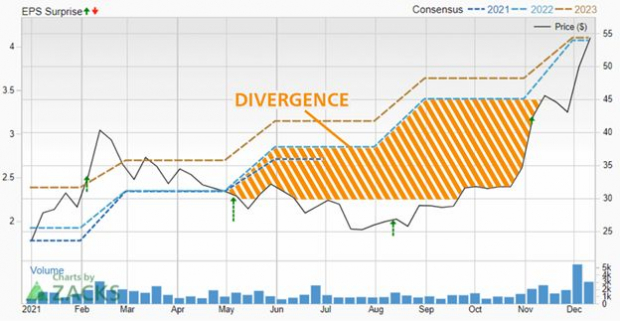

One of my favorite indicators of a stock set to double, triple, or even quadruple is DIVERGENCE.

Most investors have never been alerted to the power of this clear-cut signal of a pending price move, but it's not hard to find.

You can see it in the chart of the aforementioned little-known small-cap. Here's what it looks like with the divergence highlighted...

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The gain potential sets up beautifully. The company's earnings moved up much faster than the stock price.

Continued . . .

------------------------------------------------------------------------------------------------------

Zacks' #1 Semiconductor Stock

(You probably haven't heard of it.)

Our chosen small-cap is primed to withstand the supply crisis that’s hurting the giants. It's fresh off all-time highs but was caught in the recent market pullback.

This means that you can now get aboard at an even more stunning bargain price. But the window of maximum opportunity could be very brief as the company's surge resumes. Don't miss what looks to be a blockbuster triple-digit stock gain in the making. Download our Special Report, One Semiconductor Stock Stands to Gain the Most - hurry, the deadline is midnight Sunday, February 13.

See This Time-Sensitive Stock Now >>

------------------------------------------------------------------------------------------------------

2) Big Advantage of Small Size

How much bigger can Intel get with its $200 Billion plus market cap? I suggest that you turn to nimble small-cap semiconductor companies for a simple reason. They usually show the highest growth potential.

You can often catch them before they attract broad public interest and get noticed by Wall Street.

For example, the company showing the thrilling earnings/stock price divergence in the chart above is only ¼ of 1% of Intel's market cap. If it can become just 1% the size of Intel, that represents 4X growth from present levels.

3) Look for Potential Buy-Out Candidates

Be alert for companies with cutting-edge technology that separates them from competitors.

This could make them prime targets for acquisitions or partnerships with giants that can further enhance their access to financial resources and supplies. Such stocks are spring-coiled for a sudden leap followed by sustained growth.

4) Invest in America

U.S. semiconductor manufacturing has sharply declined from 37% of global share in 1990 to only 12% today.

This is creating a significant opportunity because reversing the trend has become an urgent bipartisan priority in Washington.

Embedded in a 2,900 page “America Competes” bill is $52 billion in aid called the CHIPS for America act: “Creating Helpful Incentives to Produce Semiconductors.” The goal is to supercharge manufacture of chips in the U.S., boosting research, competitiveness, and leadership.

Now more than ever is the time to invest in U.S.-based semiconductor companies. Would you bet against American determination, resources, and ingenuity? I wouldn't.

Zacks' Top Chip Stock to Buy Now

Even through the current shortages, forecasts call for the overall global semiconductor market to grow at a compound rate of 8.6% per year from 2021 – 2028.

But where do you start your search? For the above reasons and more, Zacks has named one manufacturer as the most promising of 38 public companies in the electronics-semiconductor industry.

Get details of this recommendation right now in Zacks' timely Special Report: One Semiconductor Stock Stands to Gain the Most.

It checks the boxes - (1) divergence of rising earnings from undervalued stock price, (2) small-cap, under Wall Street radar, with double and triple-digit gain potential, (3) prime candidate for acquisition or merger, (4) based in the U.S.A. just as semiconductor manufacturing is becoming a national priority.

Plus, our chosen company is ramping up Phase 1 of a joint manufacturing venture with China which will increase its presence in a $40 billion market.

Today, you can easily find out the name of this stock and get urgent details about its prospects for extreme gain. But the timing won't be this perfect for long.

That's why we established a deadline for downloading this Special Report: Midnight Sunday, February 13.

Click now for One Semiconductor Stock Stands to Gain the Most >>

Good Investing,

Dave

David Bartosiak is a Zacks Rank authority and is one of our foremost experts on the tech space. He invites you to download Zacks' time-sensitive Special Report, One Semiconductor Stock Stands to Gain the Most.

Image: Shutterstock

Semiconductor Shortage: Investors Could Hit It Big

It's obvious. Some investors are going to make a killing on chips.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

After all, who wouldn't want to invest in products that the world is desperate for?

Semiconductors are critical components in every tech product you can think of from toasters to jet fighters, from portable computers to flat panel TVs. The average new car has about 1,000 chips. Electric cars average 2,000.

Fact is, there's so much demand for these tiny devices that it's almost impossible to find them.

Chip manufacturers have backlogs of orders but simply can't make enough chips to keep up.

That's why there's confusion about this space. So many investors are worked up by the growth potential of semiconductor stocks, yet others are hesitating to take the plunge.

Are you among them?

I understand the concern. While the pandemic caused demand for cell phones and laptops to shoot up, a short-lived recession and a health-imperiled workforce forced factories to shut down.

Beyond Covid, the world was hit by a perfect storm including but not limited to the China trade war, a catastrophic fire in a key Japanese chip factory, a ship clogging the Suez Canal, and an historic freeze in Texas.

The accounting and consulting firm, Deloitte expects the resulting shortage to last through 2022 and into 2023.

The Wall Street Journal reports that "problems are increasing for many customers as delays are getting even longer and sales are lost."

The CEO of Intel, the world's largest semiconductor company by revenue, laments that the worst is yet to come. "We expect the shortage to persist until 2023."

He also forecasts that the big rebound won't come until 2025.

Good News: Investors Don't Have to Wait That Long

For example, while Intel is facing shrinking earnings and sales, smaller niche chip companies have surged through the crunch.

One such chip maker is David to Intel's Goliath. It's less than 1/4th of 1% the size of the $200-billion colossus.

Yet it looks to be in the early phase of a price boom that is rarely seen.

Potential Windfall of +100%, +200%, Even More.

Just imagine. What if you had bought Intel as it was just starting to grow?

The story is in the charts. Over the past year, Intel's stock price chart has looked like a disturbing EKG.

But now check the chart of a little-known semiconductor that already has a global presence.

So where do you look for the right semiconductor stock to invest in? Let's consider four principles for guiding your search:

1) Key Signal for Explosive Growth

One of my favorite indicators of a stock set to double, triple, or even quadruple is DIVERGENCE.

Most investors have never been alerted to the power of this clear-cut signal of a pending price move, but it's not hard to find.

You can see it in the chart of the aforementioned little-known small-cap. Here's what it looks like with the divergence highlighted...

The gain potential sets up beautifully. The company's earnings moved up much faster than the stock price.

Continued . . .

------------------------------------------------------------------------------------------------------

Zacks' #1 Semiconductor Stock

(You probably haven't heard of it.)

Our chosen small-cap is primed to withstand the supply crisis that’s hurting the giants. It's fresh off all-time highs but was caught in the recent market pullback.

This means that you can now get aboard at an even more stunning bargain price. But the window of maximum opportunity could be very brief as the company's surge resumes. Don't miss what looks to be a blockbuster triple-digit stock gain in the making. Download our Special Report, One Semiconductor Stock Stands to Gain the Most - hurry, the deadline is midnight Sunday, February 13.

See This Time-Sensitive Stock Now >>

------------------------------------------------------------------------------------------------------

2) Big Advantage of Small Size

How much bigger can Intel get with its $200 Billion plus market cap? I suggest that you turn to nimble small-cap semiconductor companies for a simple reason. They usually show the highest growth potential.

You can often catch them before they attract broad public interest and get noticed by Wall Street.

For example, the company showing the thrilling earnings/stock price divergence in the chart above is only ¼ of 1% of Intel's market cap. If it can become just 1% the size of Intel, that represents 4X growth from present levels.

3) Look for Potential Buy-Out Candidates

Be alert for companies with cutting-edge technology that separates them from competitors.

This could make them prime targets for acquisitions or partnerships with giants that can further enhance their access to financial resources and supplies. Such stocks are spring-coiled for a sudden leap followed by sustained growth.

4) Invest in America

U.S. semiconductor manufacturing has sharply declined from 37% of global share in 1990 to only 12% today.

This is creating a significant opportunity because reversing the trend has become an urgent bipartisan priority in Washington.

Embedded in a 2,900 page “America Competes” bill is $52 billion in aid called the CHIPS for America act: “Creating Helpful Incentives to Produce Semiconductors.” The goal is to supercharge manufacture of chips in the U.S., boosting research, competitiveness, and leadership.

Now more than ever is the time to invest in U.S.-based semiconductor companies. Would you bet against American determination, resources, and ingenuity? I wouldn't.

Zacks' Top Chip Stock to Buy Now

Even through the current shortages, forecasts call for the overall global semiconductor market to grow at a compound rate of 8.6% per year from 2021 – 2028.

But where do you start your search? For the above reasons and more, Zacks has named one manufacturer as the most promising of 38 public companies in the electronics-semiconductor industry.

Get details of this recommendation right now in Zacks' timely Special Report: One Semiconductor Stock Stands to Gain the Most.

It checks the boxes - (1) divergence of rising earnings from undervalued stock price, (2) small-cap, under Wall Street radar, with double and triple-digit gain potential, (3) prime candidate for acquisition or merger, (4) based in the U.S.A. just as semiconductor manufacturing is becoming a national priority.

Plus, our chosen company is ramping up Phase 1 of a joint manufacturing venture with China which will increase its presence in a $40 billion market.

Today, you can easily find out the name of this stock and get urgent details about its prospects for extreme gain. But the timing won't be this perfect for long.

That's why we established a deadline for downloading this Special Report: Midnight Sunday, February 13.

Click now for One Semiconductor Stock Stands to Gain the Most >>

Good Investing,

Dave

David Bartosiak is a Zacks Rank authority and is one of our foremost experts on the tech space. He invites you to download Zacks' time-sensitive Special Report, One Semiconductor Stock Stands to Gain the Most.