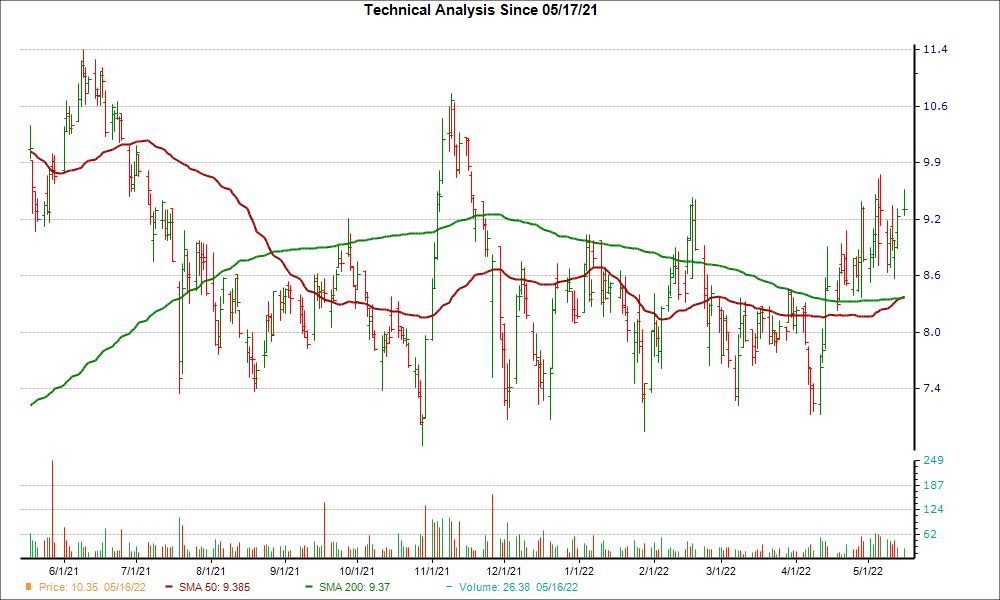

Hersha Hospitality Trust is looking like an interesting pick from a technical perspective, as the company reached a key level of support. Recently, HT's 50-day simple moving average crossed above its 200-day simple moving average, known as a "golden cross."

Considered an important signifier for a bullish breakout, a golden cross is a technical chart pattern that's formed when a stock's short-term moving average breaks above a longer-term moving average; the most common crossover involves the 50-day and the 200-day, since bigger time periods tend to form stronger breakouts.

There are three stages to a golden cross. First, there must be a downtrend in a stock's price that eventually bottoms out. Then, the stock's shorter moving average crosses over its longer moving average, triggering a positive trend reversal. The third stage is when a stock continues the upward momentum to higher prices.

This kind of chart pattern is the opposite of a death cross, which is a technical event that suggests future bearish price movement.

HT could be on the verge of a breakout after moving 11.3% higher over the last four weeks. Plus, the company is currently a #1 (Strong Buy) on the Zacks Rank.

Looking at HT's earnings expectations, investors will be even more convinced of the bullish uptrend. For the current quarter, there have been 2 changes higher compared to none lower over the past 60 days, and the Zacks Consensus Estimate has moved up as well.

Given this move in earnings estimates and the positive technical factor, investors may want to keep their eye on HT for more gains in the near future.

Image: Bigstock

Hersha Hospitality (HT) Now Trades Above Golden Cross: Time to Buy?

Hersha Hospitality Trust is looking like an interesting pick from a technical perspective, as the company reached a key level of support. Recently, HT's 50-day simple moving average crossed above its 200-day simple moving average, known as a "golden cross."

Considered an important signifier for a bullish breakout, a golden cross is a technical chart pattern that's formed when a stock's short-term moving average breaks above a longer-term moving average; the most common crossover involves the 50-day and the 200-day, since bigger time periods tend to form stronger breakouts.

There are three stages to a golden cross. First, there must be a downtrend in a stock's price that eventually bottoms out. Then, the stock's shorter moving average crosses over its longer moving average, triggering a positive trend reversal. The third stage is when a stock continues the upward momentum to higher prices.

This kind of chart pattern is the opposite of a death cross, which is a technical event that suggests future bearish price movement.

HT could be on the verge of a breakout after moving 11.3% higher over the last four weeks. Plus, the company is currently a #1 (Strong Buy) on the Zacks Rank.

Looking at HT's earnings expectations, investors will be even more convinced of the bullish uptrend. For the current quarter, there have been 2 changes higher compared to none lower over the past 60 days, and the Zacks Consensus Estimate has moved up as well.

Given this move in earnings estimates and the positive technical factor, investors may want to keep their eye on HT for more gains in the near future.