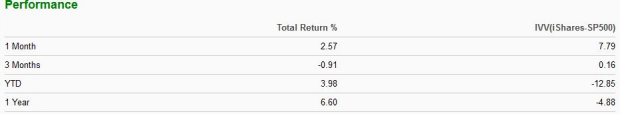

The Zacks Consumer Staples Sector has held up remarkably year-to-date, increasing nearly 4% in value vs. the S&P 500’s decline of almost 13%. However, over the last month, the sector has lagged the general market, posting a return of 2.6% vs. the S&P 500’s climb of 7.8%.

The chart below illustrates the sector’s performance vs. the S&P 500 in several timeframes.

Image Source: Zacks Investment Research

Companies within the sector generate reliable revenues in the face of good and bad economic environments, helping explain why the sector has been a solid place to park cash in 2022.

One company residing in the sector is the widely-recognized Kellogg’s . Kellogg’s is a manufacturer and marketer of ready-to-eat convenience foods, with a nice balance between cereal and snack products. Simply put, we see their products on shelves all the time.

In addition, the company is on deck to release 2022 Q2 earnings before the market opens on Thursday, August 4th. Let’s take a look at how the snack giant shapes up heading into the print.

Share Performance & Valuation

Kellogg shares have been blistering hot year-to-date, increasing nearly 17% in value and crushing the S&P 500’s performance.

Image Source: Zacks Investment Research

Over the last month, K shares have lagged the general market but have still posted a solid 3% return. With a somewhat clearer economic outlook, investors have been buying riskier stocks as of late, and K doesn’t fit that definition.

Image Source: Zacks Investment Research

Shares are elevated relative to where they’ve traded in the past – Kellogg’s forward earnings multiple of 18.3X is notably above its five-year median of 15.7X. Still, it represents a solid 13% discount relative to its Zacks Sector.

Kellogg’s has a Style Score of a B for Value.

Image Source: Zacks Investment Research

Quarterly Estimates

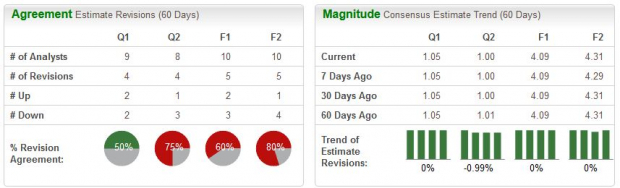

Analysts have had mixed reactions for the quarter to be reported over the last 60 days, with a pair of downwards and upwards estimate revisions. The Zacks Consensus EPS Estimate resides at $1.05, reflecting an 8% decrease in earnings year-over-year.

Image Source: Zacks Investment Research

However, the top-line looks to expand modestly – K is forecasted to generate $3.7 billion in quarterly revenue, a 2.6% uptick compared to year-ago quarterly sales of $3.6 billion.

Quarterly Performance & Market Reactions

Kellogg’s has recently been on a strong earnings streak, chaining together five consecutive bottom-line beats. Just in its latest quarter, the company recorded a solid 21% double-digit EPS beat.

In addition, quarterly revenue results have been remarkable as well, with Kellogg’s recording nine top-line beats over its last ten quarters. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Day-traders who play the long side will enjoy this – over the company’s previous five EPS beats, shares have moved upwards four times, all by at least 1.2%.

Putting Everything Together

Investors who parked their cash in K shares at the beginning of the year have been handsomely rewarded, although shares have lagged the S&P 500 as of late.

In addition, shares trade at historically elevated values but still reflect a solid double-digit discount relative to its Zacks Consumer Staples Sector.

The bottom-line is forecasted to register a decline, but the top-line looks to grow marginally – a reflection of the margin compression negatively impacting the company.

Kellogg’s has repeatedly posted quarterly results above top and bottom-line estimates, and the market has reacted well to EPS beats as of late.

Heading into the quarterly report, Kellogg’s carries a Zacks Rank #3 (Hold) with an Earnings ESP Score of 1.7%.

Image: Shutterstock

Kellogg's Q2 Preview: 6th Consecutive EPS Beat Inbound?

The Zacks Consumer Staples Sector has held up remarkably year-to-date, increasing nearly 4% in value vs. the S&P 500’s decline of almost 13%. However, over the last month, the sector has lagged the general market, posting a return of 2.6% vs. the S&P 500’s climb of 7.8%.

The chart below illustrates the sector’s performance vs. the S&P 500 in several timeframes.

Image Source: Zacks Investment Research

Companies within the sector generate reliable revenues in the face of good and bad economic environments, helping explain why the sector has been a solid place to park cash in 2022.

One company residing in the sector is the widely-recognized Kellogg’s . Kellogg’s is a manufacturer and marketer of ready-to-eat convenience foods, with a nice balance between cereal and snack products. Simply put, we see their products on shelves all the time.

In addition, the company is on deck to release 2022 Q2 earnings before the market opens on Thursday, August 4th. Let’s take a look at how the snack giant shapes up heading into the print.

Share Performance & Valuation

Kellogg shares have been blistering hot year-to-date, increasing nearly 17% in value and crushing the S&P 500’s performance.

Image Source: Zacks Investment Research

Over the last month, K shares have lagged the general market but have still posted a solid 3% return. With a somewhat clearer economic outlook, investors have been buying riskier stocks as of late, and K doesn’t fit that definition.

Image Source: Zacks Investment Research

Shares are elevated relative to where they’ve traded in the past – Kellogg’s forward earnings multiple of 18.3X is notably above its five-year median of 15.7X. Still, it represents a solid 13% discount relative to its Zacks Sector.

Kellogg’s has a Style Score of a B for Value.

Image Source: Zacks Investment Research

Quarterly Estimates

Analysts have had mixed reactions for the quarter to be reported over the last 60 days, with a pair of downwards and upwards estimate revisions. The Zacks Consensus EPS Estimate resides at $1.05, reflecting an 8% decrease in earnings year-over-year.

Image Source: Zacks Investment Research

However, the top-line looks to expand modestly – K is forecasted to generate $3.7 billion in quarterly revenue, a 2.6% uptick compared to year-ago quarterly sales of $3.6 billion.

Quarterly Performance & Market Reactions

Kellogg’s has recently been on a strong earnings streak, chaining together five consecutive bottom-line beats. Just in its latest quarter, the company recorded a solid 21% double-digit EPS beat.

In addition, quarterly revenue results have been remarkable as well, with Kellogg’s recording nine top-line beats over its last ten quarters. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Day-traders who play the long side will enjoy this – over the company’s previous five EPS beats, shares have moved upwards four times, all by at least 1.2%.

Putting Everything Together

Investors who parked their cash in K shares at the beginning of the year have been handsomely rewarded, although shares have lagged the S&P 500 as of late.

In addition, shares trade at historically elevated values but still reflect a solid double-digit discount relative to its Zacks Consumer Staples Sector.

The bottom-line is forecasted to register a decline, but the top-line looks to grow marginally – a reflection of the margin compression negatively impacting the company.

Kellogg’s has repeatedly posted quarterly results above top and bottom-line estimates, and the market has reacted well to EPS beats as of late.

Heading into the quarterly report, Kellogg’s carries a Zacks Rank #3 (Hold) with an Earnings ESP Score of 1.7%.