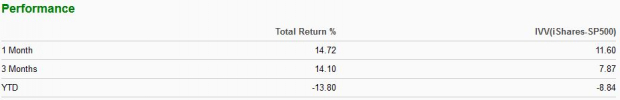

The Zacks Retail and Wholesale Sector has been scorching hot over the last month, tacking on nearly 15% in value and easily outperforming the general market. Still, the sector is down roughly 14% YTD.

Below is a chart illustrating the sector’s performance vs. the S&P 500 over several timeframes.

Image Source: Zacks Investment Research

Foot Locker , a widely-recognized company residing in the sector, is on deck to unveil Q2 results on Friday, August 19th, before the market open.

Foot Locker is a leading global retailer of athletically inspired shoes and apparel, with operations in countries in locations including North America, Africa, Europe, the Middle East, and many more.

In addition, the company carries a Zacks Rank #4 (Sell) with an overall VGM Score of an A.

Let’s take a look at how the footwear retailer stacks up heading into the print.

Share Performance & Valuation

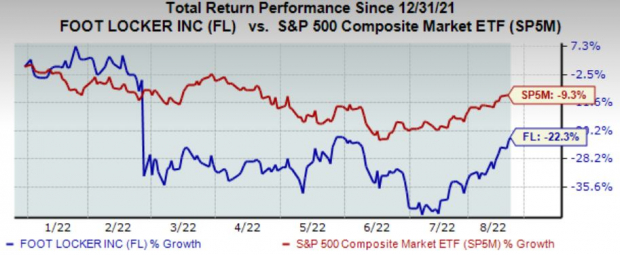

Foot Locker shares have tumbled year-to-date, losing nearly a fourth of their value and extensively underperforming the S&P 500.

Image Source: Zacks Investment Research

However, over the last month, the price action of Foot Locker shares has been remarkable – shares have tacked on a substantial 27% in value, crushing the S&P 500’s gain of 12.5%.

Image Source: Zacks Investment Research

In addition, shares trade at enticing valuation levels. The company’s 7.2X forward earnings multiple is well below its five-year median of 10.2X and represents a substantial 74% discount relative to its Zacks Sector.

Image Source: Zacks Investment Research

Quarterly Estimates

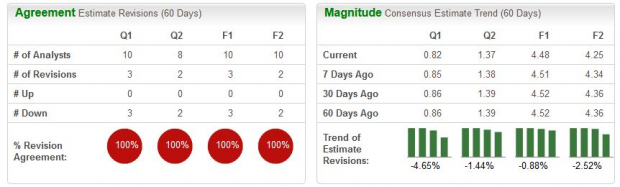

Analysts have been bearish for the quarter to be reported over the last 60 days, with three downwards estimate revisions coming in. The Zacks Consensus EPS Estimate of $0.82 reflects a steep 63% drop-off in quarterly earnings Y/Y.

Image Source: Zacks Investment Research

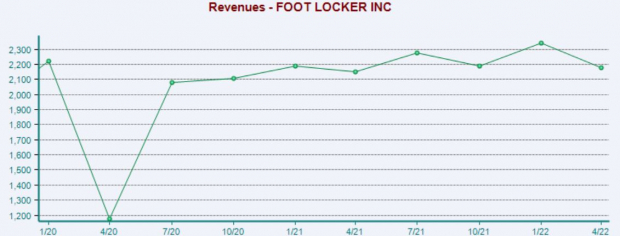

The company’s top-line projections display some softening as well – Foot Locker is projected to have generated $2.1 billion in quarterly revenue, penciling in a nearly 10% decrease from year-ago quarterly sales of $2.3 billion.

Quarterly Performance & Market Reactions

Impressively, Foot Locker has chained together eight consecutive quarters of exceeding the Zacks Consensus EPS Estimate. Just in its latest quarter, the company penciled in a 9% bottom-line beat.

Quarterly sales results have typically been reported above expectations as well, with the company recording six top-line beats over its last eight quarters. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

In addition, it’s worth noting that the market hasn’t reacted well in response to the company’s quarterly prints as of late, with shares moving down twice following its last three earnings releases.

Putting Everything Together

Foot Locker shares have tumbled year-to-date, but over the last month, they’ve soared, posting market-beating returns.

The company’s valuation levels also appear sound, with shares trading well below their five-year median and representing a steep discount relative to its Zacks Sector.

Quarterly estimates reflect a decreasing top and bottom-line, and analysts have been bearish for the quarter to be reported.

Still, Foot Locker has consistently exceeded quarterly estimates, but the market hasn’t had favorable reactions following recent quarterly prints.

Heading into the release, Foot Locker carries a Zacks Rank #4 (Sell) with an Earnings ESP Score of 2%.

Image: Bigstock

Foot Locker Q2 Preview: Another EPS Beat Inbound?

The Zacks Retail and Wholesale Sector has been scorching hot over the last month, tacking on nearly 15% in value and easily outperforming the general market. Still, the sector is down roughly 14% YTD.

Below is a chart illustrating the sector’s performance vs. the S&P 500 over several timeframes.

Image Source: Zacks Investment Research

Foot Locker , a widely-recognized company residing in the sector, is on deck to unveil Q2 results on Friday, August 19th, before the market open.

Foot Locker is a leading global retailer of athletically inspired shoes and apparel, with operations in countries in locations including North America, Africa, Europe, the Middle East, and many more.

In addition, the company carries a Zacks Rank #4 (Sell) with an overall VGM Score of an A.

Let’s take a look at how the footwear retailer stacks up heading into the print.

Share Performance & Valuation

Foot Locker shares have tumbled year-to-date, losing nearly a fourth of their value and extensively underperforming the S&P 500.

Image Source: Zacks Investment Research

However, over the last month, the price action of Foot Locker shares has been remarkable – shares have tacked on a substantial 27% in value, crushing the S&P 500’s gain of 12.5%.

Image Source: Zacks Investment Research

In addition, shares trade at enticing valuation levels. The company’s 7.2X forward earnings multiple is well below its five-year median of 10.2X and represents a substantial 74% discount relative to its Zacks Sector.

Image Source: Zacks Investment Research

Quarterly Estimates

Analysts have been bearish for the quarter to be reported over the last 60 days, with three downwards estimate revisions coming in. The Zacks Consensus EPS Estimate of $0.82 reflects a steep 63% drop-off in quarterly earnings Y/Y.

Image Source: Zacks Investment Research

The company’s top-line projections display some softening as well – Foot Locker is projected to have generated $2.1 billion in quarterly revenue, penciling in a nearly 10% decrease from year-ago quarterly sales of $2.3 billion.

Quarterly Performance & Market Reactions

Impressively, Foot Locker has chained together eight consecutive quarters of exceeding the Zacks Consensus EPS Estimate. Just in its latest quarter, the company penciled in a 9% bottom-line beat.

Quarterly sales results have typically been reported above expectations as well, with the company recording six top-line beats over its last eight quarters. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

In addition, it’s worth noting that the market hasn’t reacted well in response to the company’s quarterly prints as of late, with shares moving down twice following its last three earnings releases.

Putting Everything Together

Foot Locker shares have tumbled year-to-date, but over the last month, they’ve soared, posting market-beating returns.

The company’s valuation levels also appear sound, with shares trading well below their five-year median and representing a steep discount relative to its Zacks Sector.

Quarterly estimates reflect a decreasing top and bottom-line, and analysts have been bearish for the quarter to be reported.

Still, Foot Locker has consistently exceeded quarterly estimates, but the market hasn’t had favorable reactions following recent quarterly prints.

Heading into the release, Foot Locker carries a Zacks Rank #4 (Sell) with an Earnings ESP Score of 2%.