Some investors might not want to think about buying boring consumer staples stocks to start off in May, with 2023’s tech rally raging on as we get deeper into the first quarter earnings season. Yet the best investors know that diversification is crucial to long-term success. They also understand intuitively that chasing the current tech rebound might not be the most prudent play, given all of the unknowns surrounding near-term economic conditions, the Fed, earnings growth, and more.

The tech-heavy S&P 500 sectors of Communication Services and Information Technology have surged 24% and 22%, respectively, during the first four months of the year. The Consumer Discretionary sector is in third place, up nearly 15% YTD, all while being skewed by the inclusion of Amazon and Tesla.

Outside of these three sectors, Consumer Staples has posted the best performance, up nearly 4%, without the help of anything even slightly tech-related. Better yet, the Consumer Staples sector has posted the third-best performance out of the eleven S&P 500 sectors over the past five years, up 55% to lag only Health Care and Information Technology.

The performance over the last five years helps showcase that investors hardly have to sacrifice returns when they buy into the safety and stability of consumer staples. Furthermore, the last several years have also showcased some of the pitfalls of having a tech-heavy portfolio. And it is always worth taking a step back and being a contrarian at a moment when it seems the tech bulls have overtaken the stock market again.

Is the Tech Rally Set to Slow?

Big tech has reasserted its dominance on the stock market in 2023, with Meta now up nearly 100% YTD and Nvidia having surged 90%. Many other large-cap tech names have climbed well over 20% so far this year as investors price in the end of the Fed’s rate hikes and look ahead to a return to earnings growth in FY24.

The first few weeks of quarterly earnings season have also been bullish, with the market showcasing its love for Microsoft, Meta, and many other tech titans. These reports helped wake Wall Street up from the slumber it had been in for most of April. The wave of big-tech buying helped the Nasdaq bounce right back up off its 50-day just when it looked as though the bulls might have finally started to let go of the rope.

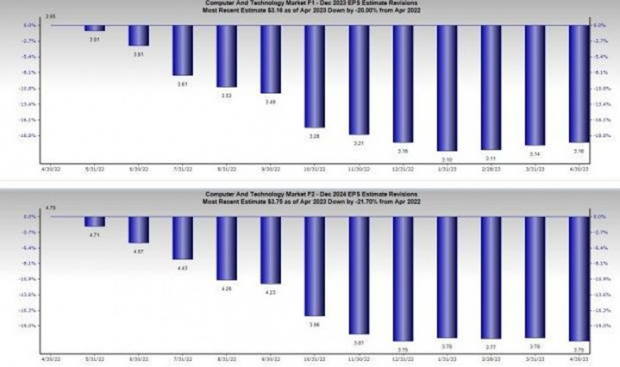

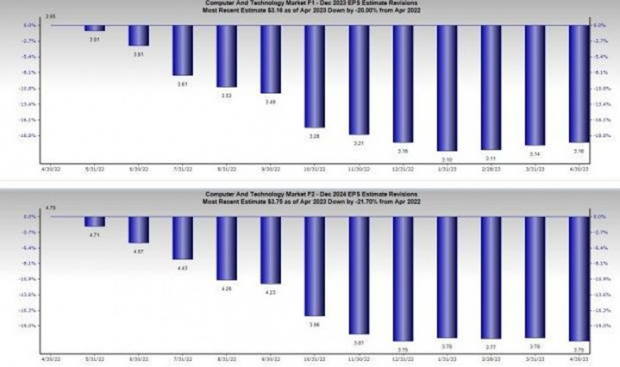

The early indications are that tech guidance, which holds huge sway over the market and accounts for 25% of total S&P 500 earnings, is resilient. That said, the nearby chart showcases how far the outlook for Tech earnings has fallen over the last year.

Image Source: Zacks Investment Research

If April’s inflation data shows prices continuing to cool it is possible that the market can keep driving higher since many have been worried for months that earnings revisions would continue to plummet, even though they are already down big compared to this time last year. And first quarter inflation-and seasonally-adjusted GDP climbed 1.1%. All of this appears to have Wall Street bulls thinking the Fed can help engineer a soft landing after all.

Yet traders have upped their bets for a 25-basis point Fed hike to 90/10 to start May, based on the CME FedWatch Tool. For a long time now Wall Street had been betting and pricing in that the Fed’s next 0.25% rate hike to take the Fed Funds rate up to between 5% and 5.25% would almost certainly be its last. But these outlooks are starting to change as the economy continues to prove too resilient for Jay Powell and the Fed’s liking.

Wall Street now places a 32% chance on another 0.25% rate hike in June, up from a 24% chance last week and 0% chance a month ago. Luckily, investors won’t have to wait long to find out more about what the Fed is thinking with its two-day FOMC meeting ending on May 3.

If the Fed ends up boosting rates above the current consensus and continues to keep them up there longer, it will have a negative impact on Tech stocks. Despite all of the positives, one must start to question just how long the current tech rally can continue before there is a significant pullback based on either profit-taking or some material change in the outlook for earnings or interest rates.

The Consumer Staples Pitch

The U.S. is a consumer-driven economy and shoppers have remained rather resilient despite an extended stretch of soaring inflation that’s still stubbornly high. There is little doubt the economy is slowing and all economic cycles come to an end at some point.

There is, of course, growing optimism that the Fed will be able to engineer that so-called soft landing for the economy. Still, many projections call for the U.S. to enter some type of recession in the next 12 months. And when recessions hit, spending slows, it is that simple. But not all spending fades equally.

Consumer staples is arguably the most indispensable area of the economy, alongside energy, utilities, and health care. And let’s remember that the oil and energy market faces near-term uncertainty and it already experienced a massive run. On top of that, the consumer staples sector is full of dividend payers given the stable nature of their businesses that are in never-ending demand from consumers across all walks of life.

For instance, consumer staples firms make up 25% of the S&P 500 Dividend Aristocrats, which is good enough for first place. Dividend Aristocrats are companies that have both paid and raised dividends for at least 25 straight years. These consumer staples standouts are able to keep raising their dividend payouts due to consistent volume growth, alongside amazing pricing power.

In fact, the last few years have showcased the immense pricing power that many consumer staples companies have as volumes remain somewhat flat while sales and profits climbed.

Not many areas of the economy can keep raising prices without seeing customers pull back or hold off on their purchases. As the name tells us, consumer staples claim rather incredible pricing power because people have to meet their most basic needs no matter what is going on in the world or the economy.

Unveiling the secrets to long-term financial success isn’t easy. But with the right resources and strategy, your portfolio can reap the rewards of your hard work and insight.

3 Overlooked Consumer Staples Stocks with Stunning Gain Potential

Though flashy tech stocks frequently capture the spotlight, some of the most impressive profits can be found in the most unassuming places. It's time to explore three under-the-radar stocks in the consumer staples sector that are brimming with potential to outperform the market.

Stock #1: This remarkable and little-known food processing powerhouse has been steadily dominating the global frozen food market. Not only does it have consistent top and bottom-line growth, but impressive pricing power as well. Experts project its revenue to climb 30% in FY23 to exceed $5.1 billion, then surge another 23% in FY24.

Stock #2: When it comes to “a household name,” few are more iconic than this company. Recently, it experienced a remarkable comeback following a brief downturn. Now, after five-straight years of revenue expansion, it boasts an extensive portfolio of well-known products used by millions all over the world.

Stock #3: Another titan in the realm of consumer goods, this company has an unparalleled legacy of trust and beat our Q3 FY23 earnings and sales estimates. With an unwavering dedication to innovation, it provides a diverse portfolio of essential household and personal care products. And thanks to its enduring brand loyalty, it’s securely poised for stability and growth.

Click the link below to uncover the tickers of these three hidden gems that could redefine your long-term portfolio success.

But that's not all.

You'll also get full 30-day, real-time access to ALL of Zacks' private buys & sells as part of our celebrated Zacks Ultimate arrangement.

Don't miss your chance to follow our real-time moves from ready-to-fly stocks under $10, to professional options trades ... from insider buys, to long-term value stocks ... and from home run investments, to income recommendations. In fact, Zacks Ultimate closed 176 double- and triple-digit gains in 2022 alone.

Your cost for all this is only $1, and there's not 1 cent of obligation to spend anything more...

Important: The number of investors who will see the consumer staple stocks and many others must be limited. Your chance to take full advantage ends at midnight Thursday, May 11.

Get Our Top 3 Consumer Staple Stocks and Your 30-Day Zacks Ultimate Trial Here >>

All the Best,

Ben Rains

Zacks Stock Strategist

Image: Bigstock

Boring Stocks, Exciting Profits: The Secret to Long-Term Portfolio Success

Some investors might not want to think about buying boring consumer staples stocks to start off in May, with 2023’s tech rally raging on as we get deeper into the first quarter earnings season. Yet the best investors know that diversification is crucial to long-term success. They also understand intuitively that chasing the current tech rebound might not be the most prudent play, given all of the unknowns surrounding near-term economic conditions, the Fed, earnings growth, and more.

The tech-heavy S&P 500 sectors of Communication Services and Information Technology have surged 24% and 22%, respectively, during the first four months of the year. The Consumer Discretionary sector is in third place, up nearly 15% YTD, all while being skewed by the inclusion of Amazon and Tesla.

Outside of these three sectors, Consumer Staples has posted the best performance, up nearly 4%, without the help of anything even slightly tech-related. Better yet, the Consumer Staples sector has posted the third-best performance out of the eleven S&P 500 sectors over the past five years, up 55% to lag only Health Care and Information Technology.

The performance over the last five years helps showcase that investors hardly have to sacrifice returns when they buy into the safety and stability of consumer staples. Furthermore, the last several years have also showcased some of the pitfalls of having a tech-heavy portfolio. And it is always worth taking a step back and being a contrarian at a moment when it seems the tech bulls have overtaken the stock market again.

Is the Tech Rally Set to Slow?

Big tech has reasserted its dominance on the stock market in 2023, with Meta now up nearly 100% YTD and Nvidia having surged 90%. Many other large-cap tech names have climbed well over 20% so far this year as investors price in the end of the Fed’s rate hikes and look ahead to a return to earnings growth in FY24.

The first few weeks of quarterly earnings season have also been bullish, with the market showcasing its love for Microsoft, Meta, and many other tech titans. These reports helped wake Wall Street up from the slumber it had been in for most of April. The wave of big-tech buying helped the Nasdaq bounce right back up off its 50-day just when it looked as though the bulls might have finally started to let go of the rope.

The early indications are that tech guidance, which holds huge sway over the market and accounts for 25% of total S&P 500 earnings, is resilient. That said, the nearby chart showcases how far the outlook for Tech earnings has fallen over the last year.

Image Source: Zacks Investment Research

If April’s inflation data shows prices continuing to cool it is possible that the market can keep driving higher since many have been worried for months that earnings revisions would continue to plummet, even though they are already down big compared to this time last year. And first quarter inflation-and seasonally-adjusted GDP climbed 1.1%. All of this appears to have Wall Street bulls thinking the Fed can help engineer a soft landing after all.

Yet traders have upped their bets for a 25-basis point Fed hike to 90/10 to start May, based on the CME FedWatch Tool. For a long time now Wall Street had been betting and pricing in that the Fed’s next 0.25% rate hike to take the Fed Funds rate up to between 5% and 5.25% would almost certainly be its last. But these outlooks are starting to change as the economy continues to prove too resilient for Jay Powell and the Fed’s liking.

Wall Street now places a 32% chance on another 0.25% rate hike in June, up from a 24% chance last week and 0% chance a month ago. Luckily, investors won’t have to wait long to find out more about what the Fed is thinking with its two-day FOMC meeting ending on May 3.

If the Fed ends up boosting rates above the current consensus and continues to keep them up there longer, it will have a negative impact on Tech stocks. Despite all of the positives, one must start to question just how long the current tech rally can continue before there is a significant pullback based on either profit-taking or some material change in the outlook for earnings or interest rates.

The Consumer Staples Pitch

The U.S. is a consumer-driven economy and shoppers have remained rather resilient despite an extended stretch of soaring inflation that’s still stubbornly high. There is little doubt the economy is slowing and all economic cycles come to an end at some point.

There is, of course, growing optimism that the Fed will be able to engineer that so-called soft landing for the economy. Still, many projections call for the U.S. to enter some type of recession in the next 12 months. And when recessions hit, spending slows, it is that simple. But not all spending fades equally.

Consumer staples is arguably the most indispensable area of the economy, alongside energy, utilities, and health care. And let’s remember that the oil and energy market faces near-term uncertainty and it already experienced a massive run. On top of that, the consumer staples sector is full of dividend payers given the stable nature of their businesses that are in never-ending demand from consumers across all walks of life.

For instance, consumer staples firms make up 25% of the S&P 500 Dividend Aristocrats, which is good enough for first place. Dividend Aristocrats are companies that have both paid and raised dividends for at least 25 straight years. These consumer staples standouts are able to keep raising their dividend payouts due to consistent volume growth, alongside amazing pricing power.

In fact, the last few years have showcased the immense pricing power that many consumer staples companies have as volumes remain somewhat flat while sales and profits climbed.

Not many areas of the economy can keep raising prices without seeing customers pull back or hold off on their purchases. As the name tells us, consumer staples claim rather incredible pricing power because people have to meet their most basic needs no matter what is going on in the world or the economy.

Unveiling the secrets to long-term financial success isn’t easy. But with the right resources and strategy, your portfolio can reap the rewards of your hard work and insight.

3 Overlooked Consumer Staples Stocks with Stunning Gain Potential

Though flashy tech stocks frequently capture the spotlight, some of the most impressive profits can be found in the most unassuming places. It's time to explore three under-the-radar stocks in the consumer staples sector that are brimming with potential to outperform the market.

Stock #1: This remarkable and little-known food processing powerhouse has been steadily dominating the global frozen food market. Not only does it have consistent top and bottom-line growth, but impressive pricing power as well. Experts project its revenue to climb 30% in FY23 to exceed $5.1 billion, then surge another 23% in FY24.

Stock #2: When it comes to “a household name,” few are more iconic than this company. Recently, it experienced a remarkable comeback following a brief downturn. Now, after five-straight years of revenue expansion, it boasts an extensive portfolio of well-known products used by millions all over the world.

Stock #3: Another titan in the realm of consumer goods, this company has an unparalleled legacy of trust and beat our Q3 FY23 earnings and sales estimates. With an unwavering dedication to innovation, it provides a diverse portfolio of essential household and personal care products. And thanks to its enduring brand loyalty, it’s securely poised for stability and growth.

Click the link below to uncover the tickers of these three hidden gems that could redefine your long-term portfolio success.

But that's not all.

You'll also get full 30-day, real-time access to ALL of Zacks' private buys & sells as part of our celebrated Zacks Ultimate arrangement.

Don't miss your chance to follow our real-time moves from ready-to-fly stocks under $10, to professional options trades ... from insider buys, to long-term value stocks ... and from home run investments, to income recommendations. In fact, Zacks Ultimate closed 176 double- and triple-digit gains in 2022 alone.

Your cost for all this is only $1, and there's not 1 cent of obligation to spend anything more...

Important: The number of investors who will see the consumer staple stocks and many others must be limited. Your chance to take full advantage ends at midnight Thursday, May 11.

Get Our Top 3 Consumer Staple Stocks and Your 30-Day Zacks Ultimate Trial Here >>

All the Best,

Ben Rains

Zacks Stock Strategist