We use cookies to understand how you use our site and to improve your experience.

This includes personalizing content and advertising.

By pressing "Accept All" or closing out of this banner, you consent to the use of all cookies and similar technologies and the sharing of information they collect with third parties.

You can reject marketing cookies by pressing "Deny Optional," but we still use essential, performance, and functional cookies.

In addition, whether you "Accept All," Deny Optional," click the X or otherwise continue to use the site, you accept our Privacy Policy and Terms of Service, revised from time to time.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

Top 5 Dividend-Paying Low-Beta Stocks Amid Recent Volatility

Read MoreHide Full Article

Volatility returned on Wall Street after a month-long impressive rally. Last week was a disappointing one. The three major stock indexes — the Dow, the S&P 500 and the Nasdaq Composite — fell 1.7%, 1.45 and 1.4%, respectively.

The Nasdaq Composite reversed the trend of an eight-week win. The Dow terminated a three-week winning streak. The S&P 500 ended a five-week winning run. The S&P 500 recorded its worst weekly performance since the week ended Mar 10, 2023. The Nasdaq Composite also posted the worst week since March 2023.

A higher interest rate policy adopted by several major central banks to combat inflation has created a ruckus in the global financial markets. On Jun 14, in his post-FOMC meeting statement, Fed Chairman Jerome Powell said that more interest rate hikes are likely this year despite a pause in rate hike in the June FOMC after 10 consecutive increases.

The Fed’s current “dot-plot” shows that the mean expectation of officials is for another 50-basis point raise in the benchmark interest rate. This implies, two more rate hikes of 25 basis points each within 2023. Consequently, the terminal interest rate is presently estimated at 5.6%, instead of 5.125%, anticipated after the May FOMC meeting.

At present, the CME FedWatch has assigned a probability of 72% that the Fed will raise the Fed fund rate by 25 basis points in the July FOMC meeting. On the other hand, 28% of respondents have projected that the central bank will maintain status quo.

No rate cut is expected this year. The first cut in interest rate may be delayed till 2025. Majority of market participants were expecting the first rate cut in 2024. Last week, in his testimony before the U.S. Congress, Powell reaffirmed his stand that more rate hikes are likely by this year-end.

Moreover, last week, the central banks of the UK, Switzerland, Norway and Turkey raised their respective benchmark lending rates. Market participants are concerned that higher interest rate will hinder economic activities resulting in global economic recession.

Fearing an impending recession, investors opted for safe-haven sovereign bonds instead of risky equities. As a result, on Jun 23, prices of several sovereign bonds spiked and yield declined. The yield on the benchmark 10-Year U.S. Treasury Note fell 6 basis points to 3.737%. The yields on the 10-Year UK bond and 10-Year German bond fell more than 10 basis points each.

Our Top Picks

At this stage, investment in low-beta, dividend-paying stocks with a favorable Zacks Rank may be the best option. If markets regain momentum, the favorable Zacks Rank of these stocks will capture the upside potential. However, if the downtrend continues, low-beta stocks will minimize portfolio losses and dividend payments will act as a regular income stream.

We have narrowed our search to five dividend-paying low-beta (beta >0 <1) stocks. These companies have strong growth potential for 2023 and have seen positive earnings estimate revisions in the last 60 days. Each of our picks carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

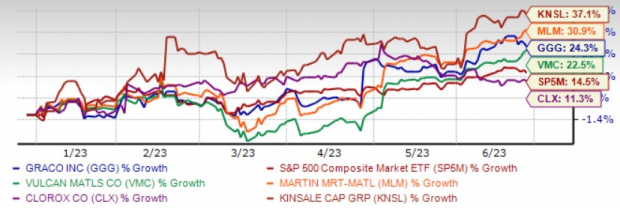

The chart below shows the price performance of our five picks year to date.

p Image Source: Zacks Investment Research

The Clorox Co. (CLX - Free Report) manufactures and markets consumer and professional products worldwide. CLX benefited from solid demand, cost-saving efforts, strong execution, and pricing actions.

CLX has been on track with its IGNITE strategy and digital investments to transition to a cloud-based platform. Also, continued strength in the international segment bodes well. Fiscal 2023 organic sales are anticipated to be flat to up 3-4%, in sync with our estimate of 1.6% growth.

Clorox has an expected revenue and earnings growth rate of 2.9% and 25.8%, respectively, for the current year (June 2024). The Zacks Consensus Estimate for current-year earnings has improved 0.5% over the last 30 days. CLX has a current dividend yield of 3.01% and a beta of 0.30.

Graco Inc. (GGG - Free Report) is benefiting from strength in its Industrial segment due to a robust product portfolio of liquid finishing and sealant and adhesive equipment. In the quarters ahead, GGG will likely benefit from strong demand trends for new and existing products. For 2023, GGG predicts organic sales growth (on a constant-currency basis) in low-single digits.

Graco has an expected revenue and earnings growth rate of 5.3% and 16.4%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 10.9% over the last 30 days. GGG has a current dividend yield of 1.11% and a beta of 0.80.

Kinsale Capital Group Inc. (KNSL - Free Report) continues to benefit from dislocation within the broader property/casualty insurance industry, rate increases and premium growth. Across the E&S market, KNSL’s products are exposed to those business lines, which have relatively lower risks.

Kinsale Capital boasts the lowest combined ratio among its specialty insurer peers while achieving the highest growth and targets the same in the mid-80s over the long term. KNSL has various reinsurance contracts to limit exposure to potential losses apart from arranging additional capacity for growth. Technological advancements have also been lowering expense ratios for quite some time.

Kinsale Capital has expected revenue and earnings growth rates of 37.8% and 36.2%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 2.4% over the last 30 days. KNSL has a current dividend yield of 0.15% and a beta of 0.86.

Vulcan Materials Co. (VMC - Free Report) is engaged in the production, distribution and sale of construction aggregates and other construction materials in the United states and Mexico. VMC has four operating segments going by the principal product lines: Aggregates, Concrete, Asphalt mix and Calcium.

VMC is benefiting from robust public sector demand. In the trailing 12-month period, highway starts were more than $100 billion and other infrastructure starts were up 23%. Also, pricing growth, fixed cost leverage and operating efficiencies added to growth.

Vulcan Materials has expected revenue and earnings growth rates of 5.6% and 27.5%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 1.1% over the last 30 days. VMC has a current dividend yield of 0.81% and a beta of 0.73.

Martin Marietta Materials Inc.’s (MLM - Free Report) earnings in the first-quarter 2023 remarkably topped the Zacks Consensus Estimate and gained year over year. Revenues also beat the Zacks Consensus Estimate and rose from the prior year. Solid pricing actions, which drove robust margin expansion despite continued inflationary pressure and modestly lower aggregate shipments, helped it generate strong results. Adjusted gross and EBITDA margins also expanded impressively from a year ago.

MLM expects solid near-term product demand backed by healthy customer backlogs across its coast-to-coast footprint. MLM has raised its revenues expectations to $6,600-$6,815 million from $6,180-$6,370 million. It anticipates delivering on the high end of its previously announced 2023 guidance range.

Martin Marietta Materials has expected revenue and earnings growth rates of 19% and 33.1%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 2.1% over the last 30 days. MLM has a current dividend yield of 0.60% and a beta of 0.85.

See More Zacks Research for These Tickers

Normally $25 each - click below to receive one report FREE:

Image: Bigstock

Top 5 Dividend-Paying Low-Beta Stocks Amid Recent Volatility

Volatility returned on Wall Street after a month-long impressive rally. Last week was a disappointing one. The three major stock indexes — the Dow, the S&P 500 and the Nasdaq Composite — fell 1.7%, 1.45 and 1.4%, respectively.

The Nasdaq Composite reversed the trend of an eight-week win. The Dow terminated a three-week winning streak. The S&P 500 ended a five-week winning run. The S&P 500 recorded its worst weekly performance since the week ended Mar 10, 2023. The Nasdaq Composite also posted the worst week since March 2023.

A higher interest rate policy adopted by several major central banks to combat inflation has created a ruckus in the global financial markets. On Jun 14, in his post-FOMC meeting statement, Fed Chairman Jerome Powell said that more interest rate hikes are likely this year despite a pause in rate hike in the June FOMC after 10 consecutive increases.

The Fed’s current “dot-plot” shows that the mean expectation of officials is for another 50-basis point raise in the benchmark interest rate. This implies, two more rate hikes of 25 basis points each within 2023. Consequently, the terminal interest rate is presently estimated at 5.6%, instead of 5.125%, anticipated after the May FOMC meeting.

At present, the CME FedWatch has assigned a probability of 72% that the Fed will raise the Fed fund rate by 25 basis points in the July FOMC meeting. On the other hand, 28% of respondents have projected that the central bank will maintain status quo.

No rate cut is expected this year. The first cut in interest rate may be delayed till 2025. Majority of market participants were expecting the first rate cut in 2024. Last week, in his testimony before the U.S. Congress, Powell reaffirmed his stand that more rate hikes are likely by this year-end.

Moreover, last week, the central banks of the UK, Switzerland, Norway and Turkey raised their respective benchmark lending rates. Market participants are concerned that higher interest rate will hinder economic activities resulting in global economic recession.

Fearing an impending recession, investors opted for safe-haven sovereign bonds instead of risky equities. As a result, on Jun 23, prices of several sovereign bonds spiked and yield declined. The yield on the benchmark 10-Year U.S. Treasury Note fell 6 basis points to 3.737%. The yields on the 10-Year UK bond and 10-Year German bond fell more than 10 basis points each.

Our Top Picks

At this stage, investment in low-beta, dividend-paying stocks with a favorable Zacks Rank may be the best option. If markets regain momentum, the favorable Zacks Rank of these stocks will capture the upside potential. However, if the downtrend continues, low-beta stocks will minimize portfolio losses and dividend payments will act as a regular income stream.

We have narrowed our search to five dividend-paying low-beta (beta >0 <1) stocks. These companies have strong growth potential for 2023 and have seen positive earnings estimate revisions in the last 60 days. Each of our picks carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The chart below shows the price performance of our five picks year to date.

p

Image Source: Zacks Investment Research

The Clorox Co. (CLX - Free Report) manufactures and markets consumer and professional products worldwide. CLX benefited from solid demand, cost-saving efforts, strong execution, and pricing actions.

CLX has been on track with its IGNITE strategy and digital investments to transition to a cloud-based platform. Also, continued strength in the international segment bodes well. Fiscal 2023 organic sales are anticipated to be flat to up 3-4%, in sync with our estimate of 1.6% growth.

Clorox has an expected revenue and earnings growth rate of 2.9% and 25.8%, respectively, for the current year (June 2024). The Zacks Consensus Estimate for current-year earnings has improved 0.5% over the last 30 days. CLX has a current dividend yield of 3.01% and a beta of 0.30.

Graco Inc. (GGG - Free Report) is benefiting from strength in its Industrial segment due to a robust product portfolio of liquid finishing and sealant and adhesive equipment. In the quarters ahead, GGG will likely benefit from strong demand trends for new and existing products. For 2023, GGG predicts organic sales growth (on a constant-currency basis) in low-single digits.

Graco has an expected revenue and earnings growth rate of 5.3% and 16.4%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 10.9% over the last 30 days. GGG has a current dividend yield of 1.11% and a beta of 0.80.

Kinsale Capital Group Inc. (KNSL - Free Report) continues to benefit from dislocation within the broader property/casualty insurance industry, rate increases and premium growth. Across the E&S market, KNSL’s products are exposed to those business lines, which have relatively lower risks.

Kinsale Capital boasts the lowest combined ratio among its specialty insurer peers while achieving the highest growth and targets the same in the mid-80s over the long term. KNSL has various reinsurance contracts to limit exposure to potential losses apart from arranging additional capacity for growth. Technological advancements have also been lowering expense ratios for quite some time.

Kinsale Capital has expected revenue and earnings growth rates of 37.8% and 36.2%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 2.4% over the last 30 days. KNSL has a current dividend yield of 0.15% and a beta of 0.86.

Vulcan Materials Co. (VMC - Free Report) is engaged in the production, distribution and sale of construction aggregates and other construction materials in the United states and Mexico. VMC has four operating segments going by the principal product lines: Aggregates, Concrete, Asphalt mix and Calcium.

VMC is benefiting from robust public sector demand. In the trailing 12-month period, highway starts were more than $100 billion and other infrastructure starts were up 23%. Also, pricing growth, fixed cost leverage and operating efficiencies added to growth.

Vulcan Materials has expected revenue and earnings growth rates of 5.6% and 27.5%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 1.1% over the last 30 days. VMC has a current dividend yield of 0.81% and a beta of 0.73.

Martin Marietta Materials Inc.’s (MLM - Free Report) earnings in the first-quarter 2023 remarkably topped the Zacks Consensus Estimate and gained year over year. Revenues also beat the Zacks Consensus Estimate and rose from the prior year. Solid pricing actions, which drove robust margin expansion despite continued inflationary pressure and modestly lower aggregate shipments, helped it generate strong results. Adjusted gross and EBITDA margins also expanded impressively from a year ago.

MLM expects solid near-term product demand backed by healthy customer backlogs across its coast-to-coast footprint. MLM has raised its revenues expectations to $6,600-$6,815 million from $6,180-$6,370 million. It anticipates delivering on the high end of its previously announced 2023 guidance range.

Martin Marietta Materials has expected revenue and earnings growth rates of 19% and 33.1%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 2.1% over the last 30 days. MLM has a current dividend yield of 0.60% and a beta of 0.85.