“Wake me up…when September ends.” – Green Day

I listened to this band as a kid. I still hear a few throwback hits from time to time. The song referenced above popped up on Spotify earlier this week, and I couldn’t help but reminisce back to those early days.

Shortly after my trip down memory lane, my mind was directed to the intriguing seasonality patterns of the stock market. They say markets never repeat themselves exactly, but they often rhyme. August and September were volatile, but historical patterns provide plenty of reasons to be optimistic moving forward.

The pullback wasn’t entirely unexpected, as the August-September timeframe is historically the weakest two-month stretch of the year. Selling pressure tends to pick up in September, which is the worst month of the year dating back to 1950 with a -0.7% average return.

And the weak seasonality came to fruition again this year. U.S. markets were happy to turn the page past September, as a broad decline and heightened volatility marked the month. The Nasdaq dropped 5.81%, the S&P 500 lost 4.87%, while the Dow declined 3.5%.

Pullbacks and corrections in any form or fashion are never easy to deal with, but having a plan in place helps us maintain a steady hand during volatile times.

At this point, the pullback appears to be a fairly orderly decline following one of the best starts to a year in history. And as we’ll see, historical statistics point to a high probability that this recent pullback will turn out to be a great buying opportunity.

Seasonal Stats Point to Upside in Q4

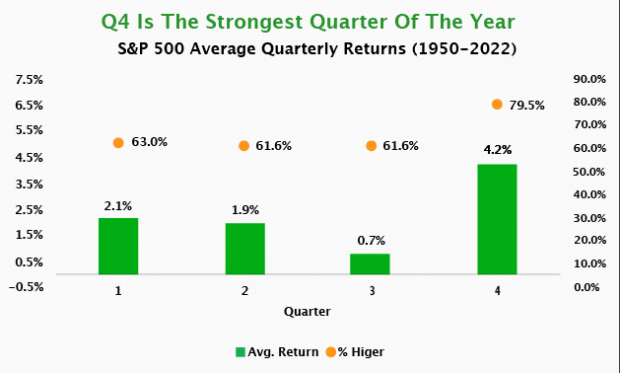

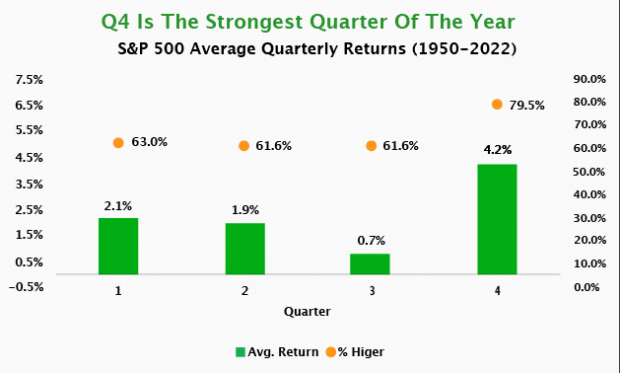

Following the weak seasonality period, things begin to shift more bullish as we enter the fourth quarter. As we can see below, the fourth quarter is historically the best quarter of the year. Dating back to 1950, Q4 is up nearly 80% of the time with an average return north of 4% (twice as much as the next best quarter).

Image Source: Zacks Investment Research

Remember, it was perfectly normal to see weakness in the third quarter. Simply put, stocks likely needed a breather after a tremendous first 7 months of the year. I view the overall price movement as healthy and constructive.

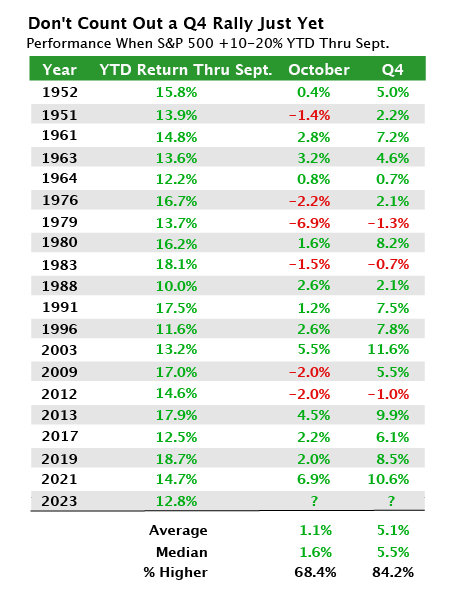

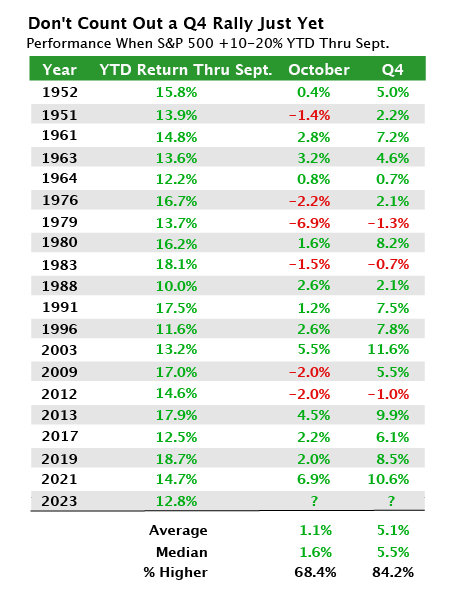

Let’s take a bit more of a detailed approach. When we zoom in on years where we’ve had similar occurrences to this year, the outlook appears just as bright, further supporting the notion that a Q4 rally is likely. The chart below shows that when the S&P 500 advanced between 10-20% year-to-date through September, the fourth quarter has been up 84% of the time and witnessed an average return north of 5%. October has also been positive over this sample size of 19 similar instances dating back to 1950.

Image Source: Zacks Investment Research

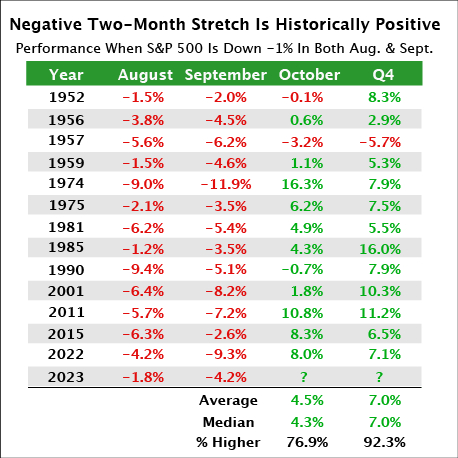

And if that wasn’t enough, there’s even more evidence that this year’s price action is aligning with a fourth-quarter surge. We mentioned earlier that the weakest two-month stretch of August and September played out in typical fashion this year. When stocks fall more than 1% in both months, the rest of the year tends to see phenomenal returns.

Continued . . .

------------------------------------------------------------------------------------------------------

Tiny Semiconductor Stock Set to Explode

(You probably haven’t heard of it)

We’ve chosen a small-cap primed for extreme growth that could rival or surpass our 900% gain in the giant NVIDIA over the past 4 years.

Today you can get aboard this under-the-radar company for under $10. But the window of opportunity could be brief as the company gains more traction. Flush with patents, it’s poised for a huge year with strong earnings growth and an expanding customer base. Download our Special Report for only $1 – One Semiconductor Stock Stands to Gain the Most. Hurry, the deadline is midnight Sunday, October 8.

See this time-sensitive stock now >>

------------------------------------------------------------------------------------------------------

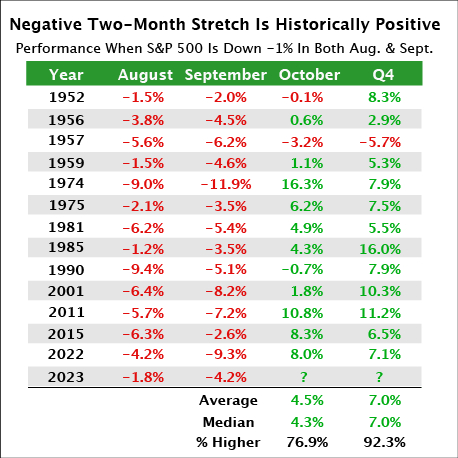

As the chart below illustrates, the month of October has experienced a 4.5% average return when the preceding two months fell by more than 1% a piece, and was higher nearly 77% of the time dating back to 1950. The last three times the S&P 500 was down at least 1% in both August and September, October returned 8% in 2022, 8.3% in 2015, and 10.8% in 2011. And the index has been higher 9 out of the past 10 times given those conditions.

Image Source: Zacks Investment Research

Similarly, the S&P 500 has been higher during Q4 12 of the past 13 times under these circumstances, boasting a 7% average return and a 92% win rate. In other words, when the weakest two-month stretch of the year turns out that way, it’s also typical for the remainder of the year to witness a formidable rally.

It’s important to state that historical statistics are not bulletproof; there’s nothing magical about them. Still, these patterns exist for a reason and serve as a reminder that eye-popping gains can follow weak periods, assuming we have the patience to participate and the data continues to improve.

Final Thoughts

It appears stocks were due for a breather after an incredible 7-month rally to begin the year. The data now points to a high likelihood that volatility will shift into positive momentum in the fourth quarter.

As it stands, so far this is a normal pullback within a new bull market. The S&P 500 is nearing a batch of major support levels that may attract buying pressure moving forward. A strong October rally is something that few are expecting, but our analysis leads us to believe that we should consider a heightened probability of exactly that. With September now behind us, I’m expecting ‘greener’ days ahead.

This May Be the Hottest Trend in Q4

The emergence of artificial intelligence (AI) has made way for some of the most exciting investments of 2023. We’re witnessing the early stages of a technology that could change the world even more than the internet. Analysts predict AI could become a trillion-dollar industry in the next 5 years and it’s forecasted to add $15 trillion to the economy by 2030.

One little-known semiconductor stock could benefit most from this trend. This innovative firm holds 23 patents with 7 pending. It’s only a fraction of the size of NVIDIA, and it’s poised for explosive growth. And today it’s priced under $10 per share. Now is the perfect time to get in.

You’ll find out the name and ticker symbol of this promising stock in our urgent special report, One Semiconductor Stock Stands to Gain the Most.

PLUS you'll be entitled to 30-day, real-time access to all of Zacks private buys and sells, all for just $1. This will help you make the most of the market’s momentum in Q4.

So there’s no reason to hesitate. And no obligation to spend a cent more.

I should mention that we are limiting the number of investors who share our #1 semiconductor pick, so I encourage you to take advantage now. This opportunity ends Sunday, October 8 at midnight.

Access our Semiconductor report PLUS 30 days of Buys and Sells >>

All the Best,

Bryan Hayes

Bryan Hayes, CFA manages our Zacks Income Investor and Headline Trader portfolios. He employs a combination of fundamental and technical analysis and has developed a unique approach to selecting stocks with the best profit potential. You can also find him covering a host of investment topics for Zacks.com.

Image: Bigstock

Fourth-Quarter Expectations: Don't Count Out a Rally Just Yet

“Wake me up…when September ends.” – Green Day

I listened to this band as a kid. I still hear a few throwback hits from time to time. The song referenced above popped up on Spotify earlier this week, and I couldn’t help but reminisce back to those early days.

Shortly after my trip down memory lane, my mind was directed to the intriguing seasonality patterns of the stock market. They say markets never repeat themselves exactly, but they often rhyme. August and September were volatile, but historical patterns provide plenty of reasons to be optimistic moving forward.

The pullback wasn’t entirely unexpected, as the August-September timeframe is historically the weakest two-month stretch of the year. Selling pressure tends to pick up in September, which is the worst month of the year dating back to 1950 with a -0.7% average return.

And the weak seasonality came to fruition again this year. U.S. markets were happy to turn the page past September, as a broad decline and heightened volatility marked the month. The Nasdaq dropped 5.81%, the S&P 500 lost 4.87%, while the Dow declined 3.5%.

Pullbacks and corrections in any form or fashion are never easy to deal with, but having a plan in place helps us maintain a steady hand during volatile times.

At this point, the pullback appears to be a fairly orderly decline following one of the best starts to a year in history. And as we’ll see, historical statistics point to a high probability that this recent pullback will turn out to be a great buying opportunity.

Seasonal Stats Point to Upside in Q4

Following the weak seasonality period, things begin to shift more bullish as we enter the fourth quarter. As we can see below, the fourth quarter is historically the best quarter of the year. Dating back to 1950, Q4 is up nearly 80% of the time with an average return north of 4% (twice as much as the next best quarter).

Image Source: Zacks Investment Research

Remember, it was perfectly normal to see weakness in the third quarter. Simply put, stocks likely needed a breather after a tremendous first 7 months of the year. I view the overall price movement as healthy and constructive.

Let’s take a bit more of a detailed approach. When we zoom in on years where we’ve had similar occurrences to this year, the outlook appears just as bright, further supporting the notion that a Q4 rally is likely. The chart below shows that when the S&P 500 advanced between 10-20% year-to-date through September, the fourth quarter has been up 84% of the time and witnessed an average return north of 5%. October has also been positive over this sample size of 19 similar instances dating back to 1950.

Image Source: Zacks Investment Research

And if that wasn’t enough, there’s even more evidence that this year’s price action is aligning with a fourth-quarter surge. We mentioned earlier that the weakest two-month stretch of August and September played out in typical fashion this year. When stocks fall more than 1% in both months, the rest of the year tends to see phenomenal returns.

Continued . . .

------------------------------------------------------------------------------------------------------

Tiny Semiconductor Stock Set to Explode

(You probably haven’t heard of it)

We’ve chosen a small-cap primed for extreme growth that could rival or surpass our 900% gain in the giant NVIDIA over the past 4 years.

Today you can get aboard this under-the-radar company for under $10. But the window of opportunity could be brief as the company gains more traction. Flush with patents, it’s poised for a huge year with strong earnings growth and an expanding customer base. Download our Special Report for only $1 – One Semiconductor Stock Stands to Gain the Most. Hurry, the deadline is midnight Sunday, October 8.

See this time-sensitive stock now >>

------------------------------------------------------------------------------------------------------

As the chart below illustrates, the month of October has experienced a 4.5% average return when the preceding two months fell by more than 1% a piece, and was higher nearly 77% of the time dating back to 1950. The last three times the S&P 500 was down at least 1% in both August and September, October returned 8% in 2022, 8.3% in 2015, and 10.8% in 2011. And the index has been higher 9 out of the past 10 times given those conditions.

Image Source: Zacks Investment Research

Similarly, the S&P 500 has been higher during Q4 12 of the past 13 times under these circumstances, boasting a 7% average return and a 92% win rate. In other words, when the weakest two-month stretch of the year turns out that way, it’s also typical for the remainder of the year to witness a formidable rally.

It’s important to state that historical statistics are not bulletproof; there’s nothing magical about them. Still, these patterns exist for a reason and serve as a reminder that eye-popping gains can follow weak periods, assuming we have the patience to participate and the data continues to improve.

Final Thoughts

It appears stocks were due for a breather after an incredible 7-month rally to begin the year. The data now points to a high likelihood that volatility will shift into positive momentum in the fourth quarter.

As it stands, so far this is a normal pullback within a new bull market. The S&P 500 is nearing a batch of major support levels that may attract buying pressure moving forward. A strong October rally is something that few are expecting, but our analysis leads us to believe that we should consider a heightened probability of exactly that. With September now behind us, I’m expecting ‘greener’ days ahead.

This May Be the Hottest Trend in Q4

The emergence of artificial intelligence (AI) has made way for some of the most exciting investments of 2023. We’re witnessing the early stages of a technology that could change the world even more than the internet. Analysts predict AI could become a trillion-dollar industry in the next 5 years and it’s forecasted to add $15 trillion to the economy by 2030.

One little-known semiconductor stock could benefit most from this trend. This innovative firm holds 23 patents with 7 pending. It’s only a fraction of the size of NVIDIA, and it’s poised for explosive growth. And today it’s priced under $10 per share. Now is the perfect time to get in.

You’ll find out the name and ticker symbol of this promising stock in our urgent special report, One Semiconductor Stock Stands to Gain the Most.

PLUS you'll be entitled to 30-day, real-time access to all of Zacks private buys and sells, all for just $1. This will help you make the most of the market’s momentum in Q4.

So there’s no reason to hesitate. And no obligation to spend a cent more.

I should mention that we are limiting the number of investors who share our #1 semiconductor pick, so I encourage you to take advantage now. This opportunity ends Sunday, October 8 at midnight.

Access our Semiconductor report PLUS 30 days of Buys and Sells >>

All the Best,

Bryan Hayes

Bryan Hayes, CFA manages our Zacks Income Investor and Headline Trader portfolios. He employs a combination of fundamental and technical analysis and has developed a unique approach to selecting stocks with the best profit potential. You can also find him covering a host of investment topics for Zacks.com.