Want to start the week ahead of the pack? Check out Momentum Mondays, where I cover the leading breakout stocks in the market, summarize the major events of the week ahead, and prepare investors for profitable trading.

Today, we will be taking a look at the broad stock market indexes to summarize the action of the last few weeks, then we will look at the economic calendar to address any market moving data coming our way. And finally, I will share three compelling technical trade setups in stocks with top Zacks Ranks.

Busy Week of Data

There are some major economic data points on the docket this week. On Tuesday, CPI and Core CPI will give us indications on where inflation is, setting up the FOMC meeting on Wednesday. Wednesday afternoon, the Federal Reserve members meet for their regular interest rate policy decision, followed by the press conference with Fed Chair Jerome Powell.

Market expectations for rate cuts have been bouncing around over the last week. Last week the market expected the first rate cut in March 2024, but now it has moved out to May 2024 following last week’s strong employment report. Wednesday’s meeting has been firm in its expectations of no policy change though.

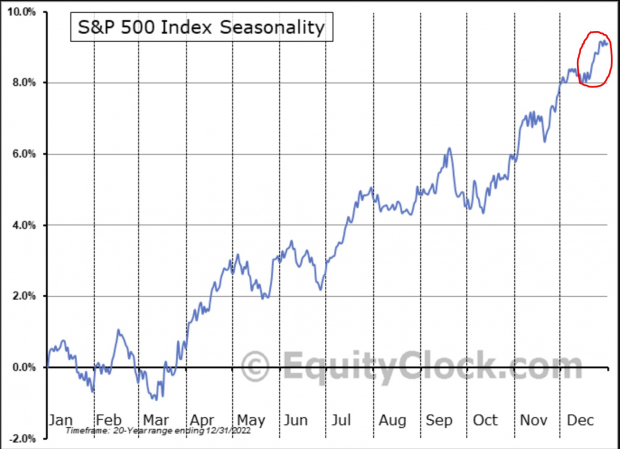

Based on the seasonality chart, I think it’s possible we will see some elevated volatility and chop this week as the market digests all the important data. However, this is setting up the final Santa Claus rally, which shows a considerable bullish bias in the last two weeks of the year.

Image Source: Equity Clock

Technical Setups

There are several compelling technical trading setups in stocks with top Zacks ranks, and here I will share three of them. In addition to this international oil stock below, there is a rapidly growing e-commerce stock and an insurance stock that refuses to go down.

Image Source: TradingView

Bottom Line

Even the best trading setups fail, so it is always important for traders to prioritize making a trading plane, following the plan, and utilizing strict risk management protocols.

Good luck this week traders!

Momentum Monday: FOMC, Inflation, and the Santa Claus Rally

Want to start the week ahead of the pack? Check out Momentum Mondays, where I cover the leading breakout stocks in the market, summarize the major events of the week ahead, and prepare investors for profitable trading.

Today, we will be taking a look at the broad stock market indexes to summarize the action of the last few weeks, then we will look at the economic calendar to address any market moving data coming our way. And finally, I will share three compelling technical trade setups in stocks with top Zacks Ranks.

Busy Week of Data

There are some major economic data points on the docket this week. On Tuesday, CPI and Core CPI will give us indications on where inflation is, setting up the FOMC meeting on Wednesday. Wednesday afternoon, the Federal Reserve members meet for their regular interest rate policy decision, followed by the press conference with Fed Chair Jerome Powell.

Market expectations for rate cuts have been bouncing around over the last week. Last week the market expected the first rate cut in March 2024, but now it has moved out to May 2024 following last week’s strong employment report. Wednesday’s meeting has been firm in its expectations of no policy change though.

Based on the seasonality chart, I think it’s possible we will see some elevated volatility and chop this week as the market digests all the important data. However, this is setting up the final Santa Claus rally, which shows a considerable bullish bias in the last two weeks of the year.

Image Source: Equity Clock

Technical Setups

There are several compelling technical trading setups in stocks with top Zacks ranks, and here I will share three of them. In addition to this international oil stock below, there is a rapidly growing e-commerce stock and an insurance stock that refuses to go down.

Image Source: TradingView

Bottom Line

Even the best trading setups fail, so it is always important for traders to prioritize making a trading plane, following the plan, and utilizing strict risk management protocols.

Good luck this week traders!