We use cookies to understand how you use our site and to improve your experience.

This includes personalizing content and advertising.

By pressing "Accept All" or closing out of this banner, you consent to the use of all cookies and similar technologies and the sharing of information they collect with third parties.

You can reject marketing cookies by pressing "Deny Optional," but we still use essential, performance, and functional cookies.

In addition, whether you "Accept All," Deny Optional," click the X or otherwise continue to use the site, you accept our Privacy Policy and Terms of Service, revised from time to time.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

On Jan 12, Delta Air Lines (DAL - Free Report) initiated the fourth-quarter 2023 earnings season for the airline space. This Atlanta-based carrier reported better-than-expected earnings per share and revenues driven by the buoyant air-travel demand scenario. However, the company slashed its earnings per share guidance for the current year.

Meanwhile, the prospects of JetBlue Airways (JBLU - Free Report) acquiring Spirit Airlines appear bleak following a federal judge’s decision to block the deal. Azul reported year-over-year increases in traffic and capacity for December 2023. Another Latin American carrier, Copa Holdings (CPA - Free Report) , also reported healthy traffic numbers for December, riding on the upbeat air travel demand scenario.

Recap of the Recent Most Important Stories

1 Delta’s fourth-quarter 2023 earnings (excluding $1.88 from non-recurring items) of $1.28 per share comfortably beat the Zacks Consensus Estimate of $1.17. Earnings, however, declined 13.5% on a year-over-year basis due to high labor costs. Revenues of $14,223 million surpassed the Zacks Consensus Estimate of $14,069.5 million and increased 5.9% on a year-over-year basis, driven by strong holiday air travel demand. Adjusted operating revenues (excluding third-party refinery sales) came in at $13,661 million, up 11% year over year.

Due to supply-chain woes and economic uncertainty, DAL trimmed its earnings per share outlook for full-year 2024. It now expects 2024 adjusted earnings in the range of $6-$7 (projected to be above $7 previously).

2. A federal judge has blocked JetBlue’s impending $3.8 billion takeover of Spirit Airlines, citing competition concerns. The verdict can be seen as a victory for the Biden administration, which is in favor of blocking mergers across several industries, stating that they are anti-consumer. The judge believes that if the merger materializes then it would drive up fares. Both JBLU and SAVE disagree with the verdict and may appeal against it.

JBLU was also in the news recently following the announcement that it will have a new chief executive officer following incumbent Robin Hayes’ decision to step down next month. That story was covered in detail in the previous week’s write-up.

3. Copa Holdings’ revenue passenger miles and available seat miles increased 10.6% and 9.3%, respectively, on a year-over-year basis in December. With traffic growth outpacing capacity expansion, the load factor (percentage of seats filled by passengers) improved to 85.1% from 84.1% a year ago.

4. In December, Azul’s consolidated revenue passenger kilometers and available seat kilometers increased 5.7% and 2.9%, respectively, on a year-over-year basis. With consolidated passenger traffic growth outpacing capacity expansion, the load factor improved to 79.8% from 77.6% in December 2022.

Performance

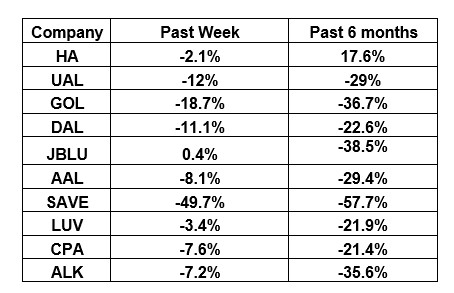

The following table shows the price movement of the major airline players over the past week and during the last six months.

Image Source: Zacks Investment Research

The table above shows that most airline stocks traded in the red over the past week, resulting in the NYSE ARCA Airline Index declining 8.8% to $59.50. Over the course of the past six months, the NYSE ARCA Airline Index depreciated 20.7%.

What’s Next in the Airline Space?

Investors await fourth-quarter 2023 earnings report of United Airlines (UAL - Free Report) , scheduled to be announced on Jan 22.

See More Zacks Research for These Tickers

Normally $25 each - click below to receive one report FREE:

Image: Shutterstock

Airline Stock Roundup: DAL's Q4 Earnings Beat, JBLU-SAVE Merger Hits a Roadblock

On Jan 12, Delta Air Lines (DAL - Free Report) initiated the fourth-quarter 2023 earnings season for the airline space. This Atlanta-based carrier reported better-than-expected earnings per share and revenues driven by the buoyant air-travel demand scenario. However, the company slashed its earnings per share guidance for the current year.

Meanwhile, the prospects of JetBlue Airways (JBLU - Free Report) acquiring Spirit Airlines appear bleak following a federal judge’s decision to block the deal. Azul reported year-over-year increases in traffic and capacity for December 2023. Another Latin American carrier, Copa Holdings (CPA - Free Report) , also reported healthy traffic numbers for December, riding on the upbeat air travel demand scenario.

Recap of the Recent Most Important Stories

1 Delta’s fourth-quarter 2023 earnings (excluding $1.88 from non-recurring items) of $1.28 per share comfortably beat the Zacks Consensus Estimate of $1.17. Earnings, however, declined 13.5% on a year-over-year basis due to high labor costs. Revenues of $14,223 million surpassed the Zacks Consensus Estimate of $14,069.5 million and increased 5.9% on a year-over-year basis, driven by strong holiday air travel demand. Adjusted operating revenues (excluding third-party refinery sales) came in at $13,661 million, up 11% year over year.

Due to supply-chain woes and economic uncertainty, DAL trimmed its earnings per share outlook for full-year 2024. It now expects 2024 adjusted earnings in the range of $6-$7 (projected to be above $7 previously).

2. A federal judge has blocked JetBlue’s impending $3.8 billion takeover of Spirit Airlines, citing competition concerns. The verdict can be seen as a victory for the Biden administration, which is in favor of blocking mergers across several industries, stating that they are anti-consumer. The judge believes that if the merger materializes then it would drive up fares. Both JBLU and SAVE disagree with the verdict and may appeal against it.

JBLU was also in the news recently following the announcement that it will have a new chief executive officer following incumbent Robin Hayes’ decision to step down next month. That story was covered in detail in the previous week’s write-up.

JBLU currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy ) stocks here.

3. Copa Holdings’ revenue passenger miles and available seat miles increased 10.6% and 9.3%, respectively, on a year-over-year basis in December. With traffic growth outpacing capacity expansion, the load factor (percentage of seats filled by passengers) improved to 85.1% from 84.1% a year ago.

4. In December, Azul’s consolidated revenue passenger kilometers and available seat kilometers increased 5.7% and 2.9%, respectively, on a year-over-year basis. With consolidated passenger traffic growth outpacing capacity expansion, the load factor improved to 79.8% from 77.6% in December 2022.

Performance

The following table shows the price movement of the major airline players over the past week and during the last six months.

Image Source: Zacks Investment Research

The table above shows that most airline stocks traded in the red over the past week, resulting in the NYSE ARCA Airline Index declining 8.8% to $59.50. Over the course of the past six months, the NYSE ARCA Airline Index depreciated 20.7%.

What’s Next in the Airline Space?

Investors await fourth-quarter 2023 earnings report of United Airlines (UAL - Free Report) , scheduled to be announced on Jan 22.