We use cookies to understand how you use our site and to improve your experience.

This includes personalizing content and advertising.

By pressing "Accept All" or closing out of this banner, you consent to the use of all cookies and similar technologies and the sharing of information they collect with third parties.

You can reject marketing cookies by pressing "Deny Optional," but we still use essential, performance, and functional cookies.

In addition, whether you "Accept All," Deny Optional," click the X or otherwise continue to use the site, you accept our Privacy Policy and Terms of Service, revised from time to time.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

FVCBankcorp (FVCB) Extends 1.3M Share Buyback Plan to March '25

Read MoreHide Full Article

FVCBankcorp, Inc. (FVCB - Free Report) has extended its current share repurchase program to Mar 31, 2025, from Mar 31, 2024.

Per the program, the company is authorized to buy back up to 1,300,000 shares, which represents approximately 7% of its outstanding shares of common stock as of Dec 31, 2023.

During 2023, FVCBankcorp bought back 115,750 shares of its common stock at a cost of $1.4 million. As of Dec 31, 2023, 1,275,202 shares remained available under the authorization.

Prior to this, the company extended its share repurchase program in March 2023 and has been regularly extending it for the past few years.

The company hasn’t paid any dividends since its inception. This strategic decision of not paying dividends shows the company’s efforts to retain earnings in order to enhance financial flexibility and fuel growth prospects.

As of Dec 31, 2023, the common equity tier 1 ratio was 12.80%, up from 12.45% year over year. As of the same date, FVCB’s total cash and due from banks, including interest-bearing deposits at other financial institutions, was $60.5 million. Total loans and deposits were $1.82 billion and $1.85 billion, respectively.

Given the company’s decent earning strength, strong balance sheet and liquidity position, FVCB will be able to sustain its current capital distributions and enhance shareholder wealth.

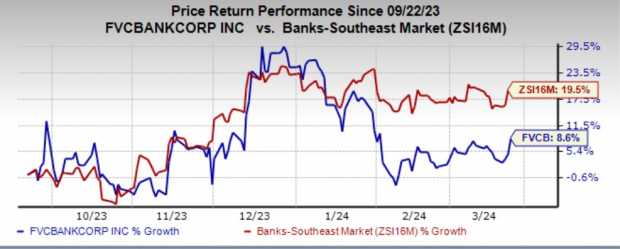

Shares of FVCB have gained 8.6% over the past six months compared with the industry’s growth of 19.5%.

Image Source: Zacks Investment Research

Currently, FVCBankcorp carries a Zacks Rank #4 (Sell).

In February, Axos Financial, Inc. (AX - Free Report) announced an additional share repurchase program. Per the plan, the company is authorized to buy back up to $100 million worth of shares. There is no specific start or end date for the newly announced plan.

AX’s new share buyback plan supplements the existing repurchase program, which was approved on Apr 26, 2023. As part of the existing plan, it has almost $20 million worth of authorization remaining. AX repurchased $83.2 million worth of shares during the first half of fiscal 2024.

Last month, Zions Bancorporation (ZION - Free Report) announced a new share repurchase plan for 2024. The plan authorizes the company to buy back up to $35 million worth of shares.

ZION has repurchased shares in each of the last three years, indicating an impressive capital distribution plan on the back of anticipated organic growth. The bank repurchased 0.9 million shares during the first nine months of 2023 but refrained from repurchasing any shares in the fourth quarter due to macroeconomic uncertainties.

See More Zacks Research for These Tickers

Normally $25 each - click below to receive one report FREE:

Image: Bigstock

FVCBankcorp (FVCB) Extends 1.3M Share Buyback Plan to March '25

FVCBankcorp, Inc. (FVCB - Free Report) has extended its current share repurchase program to Mar 31, 2025, from Mar 31, 2024.

Per the program, the company is authorized to buy back up to 1,300,000 shares, which represents approximately 7% of its outstanding shares of common stock as of Dec 31, 2023.

During 2023, FVCBankcorp bought back 115,750 shares of its common stock at a cost of $1.4 million. As of Dec 31, 2023, 1,275,202 shares remained available under the authorization.

Prior to this, the company extended its share repurchase program in March 2023 and has been regularly extending it for the past few years.

The company hasn’t paid any dividends since its inception. This strategic decision of not paying dividends shows the company’s efforts to retain earnings in order to enhance financial flexibility and fuel growth prospects.

As of Dec 31, 2023, the common equity tier 1 ratio was 12.80%, up from 12.45% year over year. As of the same date, FVCB’s total cash and due from banks, including interest-bearing deposits at other financial institutions, was $60.5 million. Total loans and deposits were $1.82 billion and $1.85 billion, respectively.

Given the company’s decent earning strength, strong balance sheet and liquidity position, FVCB will be able to sustain its current capital distributions and enhance shareholder wealth.

Shares of FVCB have gained 8.6% over the past six months compared with the industry’s growth of 19.5%.

Image Source: Zacks Investment Research

Currently, FVCBankcorp carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Share Buyback Plans of Other Banks

In February, Axos Financial, Inc. (AX - Free Report) announced an additional share repurchase program. Per the plan, the company is authorized to buy back up to $100 million worth of shares. There is no specific start or end date for the newly announced plan.

AX’s new share buyback plan supplements the existing repurchase program, which was approved on Apr 26, 2023. As part of the existing plan, it has almost $20 million worth of authorization remaining. AX repurchased $83.2 million worth of shares during the first half of fiscal 2024.

Last month, Zions Bancorporation (ZION - Free Report) announced a new share repurchase plan for 2024. The plan authorizes the company to buy back up to $35 million worth of shares.

ZION has repurchased shares in each of the last three years, indicating an impressive capital distribution plan on the back of anticipated organic growth. The bank repurchased 0.9 million shares during the first nine months of 2023 but refrained from repurchasing any shares in the fourth quarter due to macroeconomic uncertainties.