We use cookies to understand how you use our site and to improve your experience.

This includes personalizing content and advertising.

By pressing "Accept All" or closing out of this banner, you consent to the use of all cookies and similar technologies and the sharing of information they collect with third parties.

You can reject marketing cookies by pressing "Deny Optional," but we still use essential, performance, and functional cookies.

In addition, whether you "Accept All," Deny Optional," click the X or otherwise continue to use the site, you accept our Privacy Policy and Terms of Service, revised from time to time.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

T. Rowe Price's (TROW) April AUM Declines 3.7% Sequentially

Read MoreHide Full Article

T. Rowe Price Group, Inc. (TROW - Free Report) announced its preliminary assets under management (AUM) of $1.48 trillion for April 2024. The figure reflected a sequential decline of 3.7%.

TROW experienced net outflows of $7.8 billion in April 2024.

At the end of April, TROW’s equity products aggregated $762 billion, which dropped 5.1% from the previous month’s level. Fixed income (including money market) declined 1.2% to $169 billion. Further, multi-asset products were $506 billion, which dipped 2.7% from the previous month.

Alternative products of $48 billion remained unchanged from the prior month’s level.

T. Rowe Price registered $432 billion in target date retirement portfolios in April 2024, which declined 2.5% from the prior month.

The company’s diversified business model and efforts to broaden its distribution reach through strategic acquisitions will likely support its top-line growth in the future. However, the company’s overdependence on investment advisory fees is concerning. This is because market fluctuations and a sudden slowdown in overall business activities are likely to hurt its revenues.

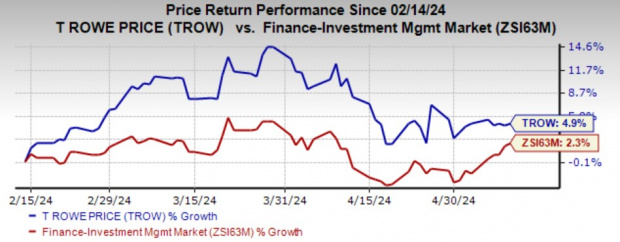

Over the past three months, shares of T. Rowe Price have risen 4.9% compared with the industry’s 2.3% growth. Image Source: Zacks Investment Research

Franklin Resources, Inc. (BEN - Free Report) reported its preliminary AUM of $1.60 trillion as of Apr 30, 2024. This reflected a decrease of 2.5% from the prior month’s level.

The decline in BEN's AUM balance was primarily due to the impact of negative markets and long-term net outflows, including $5.9 billion related to the $25 billion AUM received from the Great-West Lifeco acquisition.

Virtus Investment Partners, Inc. (VRTS - Free Report) recorded a sequential decline of nearly 5.2% in its preliminary AUM balance for April 2024. The company reported a month-end AUM of $170.06 billion, which declined from $179.31 billion as of Mar 31, 2024.

VRTS offered services to $2.6 billion of other fee-earning assets. This was excluded from the above-mentioned AUM balance.

See More Zacks Research for These Tickers

Normally $25 each - click below to receive one report FREE:

Image: Bigstock

T. Rowe Price's (TROW) April AUM Declines 3.7% Sequentially

T. Rowe Price Group, Inc. (TROW - Free Report) announced its preliminary assets under management (AUM) of $1.48 trillion for April 2024. The figure reflected a sequential decline of 3.7%.

TROW experienced net outflows of $7.8 billion in April 2024.

At the end of April, TROW’s equity products aggregated $762 billion, which dropped 5.1% from the previous month’s level. Fixed income (including money market) declined 1.2% to $169 billion. Further, multi-asset products were $506 billion, which dipped 2.7% from the previous month.

Alternative products of $48 billion remained unchanged from the prior month’s level.

T. Rowe Price registered $432 billion in target date retirement portfolios in April 2024, which declined 2.5% from the prior month.

The company’s diversified business model and efforts to broaden its distribution reach through strategic acquisitions will likely support its top-line growth in the future. However, the company’s overdependence on investment advisory fees is concerning. This is because market fluctuations and a sudden slowdown in overall business activities are likely to hurt its revenues.

Over the past three months, shares of T. Rowe Price have risen 4.9% compared with the industry’s 2.3% growth.

Image Source: Zacks Investment Research

Currently, TROW sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Performance of Other Asset Managers

Franklin Resources, Inc. (BEN - Free Report) reported its preliminary AUM of $1.60 trillion as of Apr 30, 2024. This reflected a decrease of 2.5% from the prior month’s level.

The decline in BEN's AUM balance was primarily due to the impact of negative markets and long-term net outflows, including $5.9 billion related to the $25 billion AUM received from the Great-West Lifeco acquisition.

Virtus Investment Partners, Inc. (VRTS - Free Report) recorded a sequential decline of nearly 5.2% in its preliminary AUM balance for April 2024. The company reported a month-end AUM of $170.06 billion, which declined from $179.31 billion as of Mar 31, 2024.

VRTS offered services to $2.6 billion of other fee-earning assets. This was excluded from the above-mentioned AUM balance.