We use cookies to understand how you use our site and to improve your experience.

This includes personalizing content and advertising.

By pressing "Accept All" or closing out of this banner, you consent to the use of all cookies and similar technologies and the sharing of information they collect with third parties.

You can reject marketing cookies by pressing "Deny Optional," but we still use essential, performance, and functional cookies.

In addition, whether you "Accept All," Deny Optional," click the X or otherwise continue to use the site, you accept our Privacy Policy and Terms of Service, revised from time to time.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

Itau Unibanco (ITUB) Announces Merger Proposal With Hipercard

Read MoreHide Full Article

Itaú Unibanco Holding S.A. (ITUB - Free Report) has announced a corporate internal restructuring plan. This will include the merger of its wholly-owned subsidiary, Hipercard Banco Múltiplo S.A. (“Hipercard”), subject to approval from the Central Bank of Brazil. The cost associated with executing and implementing the transaction is estimated to be approximately R$180,000 ($34,843).

As part of the effort, all activities currently managed by Hipercard, including the administration of bank cards, will be transferred to Itaú Unibanco. The primary purpose of this merger is to achieve greater synergy among the companies and activities of the ITUB conglomerate. This will help streamline costs and enhance efficiency.

Following the completion of the transaction, Hipercard will be dissolved as an entity and its assets will be taken over by ITUB. This will lead to a reduction in maintenance costs, rationalization in administrative and commercial activities and an improvement in the overall corporate structure.

Itaú Unibanco will take over Hipercard’s equity worth R$2.68 billion ($518 million). The merger will not result in any increase in capital or the issuance of new shares of ITUB. There will be no exchange ratio. Also, rules relating to withdrawal rights for dissenting shareholders will not apply. Overall, the transaction will not have any financial impact on Itaú Unibanco.

This strategic move highlights ITUB’s ability to adapt to the trends of the rapidly evolving market and strengthen its competitive placement. Through such efforts, the company is well-poised to improve its market leadership and drive sustainable growth in the long run.

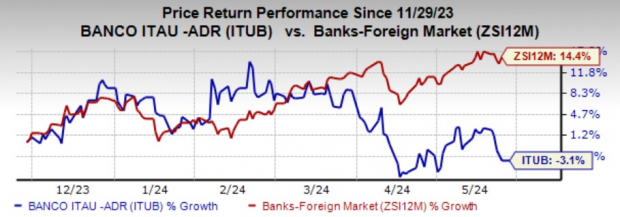

Over the past six months, the company’s shares on the NYSE have lost 3.1% against the industry’s growth of 14.4%.

Image Source: Zacks Investment Research

At present, ITUB carries a Zacks Rank #3 (Hold).

Stocks to Consider

Some better-ranked foreign finance stocks are Bancolombia S.A. (CIB - Free Report) and Banco Macro S.A. (BMA - Free Report) .

Bancolombia S.A.’s current-year earnings have been revised upward marginally over the past 30 days. Shares of CIB have gained 26.4% over the past six months. The stock currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for Banco Macro’s current-year earnings have been revised 29.6% upward over the past 30 days. Over the past three months, shares of BMA have gained 46.5%. The stock currently flaunts a Zacks Rank #1.

See More Zacks Research for These Tickers

Normally $25 each - click below to receive one report FREE:

Image: Shutterstock

Itau Unibanco (ITUB) Announces Merger Proposal With Hipercard

Itaú Unibanco Holding S.A. (ITUB - Free Report) has announced a corporate internal restructuring plan. This will include the merger of its wholly-owned subsidiary, Hipercard Banco Múltiplo S.A. (“Hipercard”), subject to approval from the Central Bank of Brazil. The cost associated with executing and implementing the transaction is estimated to be approximately R$180,000 ($34,843).

As part of the effort, all activities currently managed by Hipercard, including the administration of bank cards, will be transferred to Itaú Unibanco. The primary purpose of this merger is to achieve greater synergy among the companies and activities of the ITUB conglomerate. This will help streamline costs and enhance efficiency.

Following the completion of the transaction, Hipercard will be dissolved as an entity and its assets will be taken over by ITUB. This will lead to a reduction in maintenance costs, rationalization in administrative and commercial activities and an improvement in the overall corporate structure.

Itaú Unibanco will take over Hipercard’s equity worth R$2.68 billion ($518 million). The merger will not result in any increase in capital or the issuance of new shares of ITUB. There will be no exchange ratio. Also, rules relating to withdrawal rights for dissenting shareholders will not apply. Overall, the transaction will not have any financial impact on Itaú Unibanco.

This strategic move highlights ITUB’s ability to adapt to the trends of the rapidly evolving market and strengthen its competitive placement. Through such efforts, the company is well-poised to improve its market leadership and drive sustainable growth in the long run.

Over the past six months, the company’s shares on the NYSE have lost 3.1% against the industry’s growth of 14.4%.

Image Source: Zacks Investment Research

At present, ITUB carries a Zacks Rank #3 (Hold).

Stocks to Consider

Some better-ranked foreign finance stocks are Bancolombia S.A. (CIB - Free Report) and Banco Macro S.A. (BMA - Free Report) .

Bancolombia S.A.’s current-year earnings have been revised upward marginally over the past 30 days. Shares of CIB have gained 26.4% over the past six months. The stock currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for Banco Macro’s current-year earnings have been revised 29.6% upward over the past 30 days. Over the past three months, shares of BMA have gained 46.5%. The stock currently flaunts a Zacks Rank #1.