We use cookies to understand how you use our site and to improve your experience.

This includes personalizing content and advertising.

By pressing "Accept All" or closing out of this banner, you consent to the use of all cookies and similar technologies and the sharing of information they collect with third parties.

You can reject marketing cookies by pressing "Deny Optional," but we still use essential, performance, and functional cookies.

In addition, whether you "Accept All," Deny Optional," click the X or otherwise continue to use the site, you accept our Privacy Policy and Terms of Service, revised from time to time.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

Mitsubishi UFJ (MUFG) Repurchases Shares Under 80M Buyback Plan

Read MoreHide Full Article

Mitsubishi UFJ Financial Group, Inc. (MUFG - Free Report) announced progress on its previously announced share repurchase plan. The company repurchased 25,639,300 shares of its common stock at an aggregate price of ¥40.2 billion between May 16, 2024 and May 31, 2024.

The repurchases were carried out under the company’s ¥100-billion share repurchase program announced on May 15, 2024. The plan allows MUFG to repurchase up to 80,000,000 shares, representing 0.68% of the total shares outstanding, excluding treasury stock.

Since May 2017, Mitsubishi UFJ has completed several share-repurchase programs, with an aim to strengthen investors’ confidence in the stock. In line with this, in February 2024, MUFG repurchased 56,418,900 shares worth ¥73 billion.

Apart from the share repurchase program, MUFG also has an impressive dividend policy. In Fiscal 2024, the company increased the forecast for dividend per common stock to ¥50 from ¥41 in fiscal 2023. Further, it targets a dividend payout ratio of 39.1% by the end of fiscal 2024. Thus, by increasing dividends and executing flexible share repurchases, Mitsubishi UFJ aims to enhance shareholders’ returns.

As of Mar 31, 2024, the company had cash and due from banks of ¥113.6 trillion, much higher than its borrowed money of ¥24.86 trillion. Given a sound balance sheet and solid liquidity position, MUFG’s capital distribution activities seem sustainable in the long run.

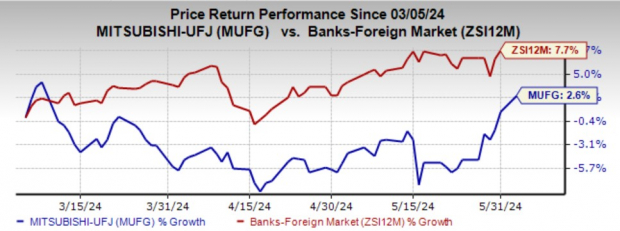

Over the past six months, shares of MUFG have gained 2.6% on the NYSE compared with the industry’s 7.7% growth.

Image Source: Zacks Investment Research

Currently, Mitsubishi UFJ carries a Zacks Rank #4 (Sell).

Last week, Cathay General Bancorp. (CATY - Free Report) announced a new share repurchase program. Under the plan, the board of directors authorized the buyback of $125 million worth of shares. There is no set expiration for the program.

Previously, CATY had announced a share repurchase program in May 2022, authorizing the buyback of up to $125 million worth of shares. The company completed this program in February 2023, with the repurchase of 2.9 million shares at an average cost of $43.14.

Similarly, Robinhood Markets, Inc. (HOOD - Free Report) announced that its board of directors approved a share repurchase program authorizing it to repurchase up to $1 billion of its outstanding common stock.

While the plan does not have an expiration date, HOOD expects to buy back shares over two to three years, starting from third-quarter 2024.

See More Zacks Research for These Tickers

Normally $25 each - click below to receive one report FREE:

Image: Bigstock

Mitsubishi UFJ (MUFG) Repurchases Shares Under 80M Buyback Plan

Mitsubishi UFJ Financial Group, Inc. (MUFG - Free Report) announced progress on its previously announced share repurchase plan. The company repurchased 25,639,300 shares of its common stock at an aggregate price of ¥40.2 billion between May 16, 2024 and May 31, 2024.

The repurchases were carried out under the company’s ¥100-billion share repurchase program announced on May 15, 2024. The plan allows MUFG to repurchase up to 80,000,000 shares, representing 0.68% of the total shares outstanding, excluding treasury stock.

Since May 2017, Mitsubishi UFJ has completed several share-repurchase programs, with an aim to strengthen investors’ confidence in the stock. In line with this, in February 2024, MUFG repurchased 56,418,900 shares worth ¥73 billion.

Apart from the share repurchase program, MUFG also has an impressive dividend policy. In Fiscal 2024, the company increased the forecast for dividend per common stock to ¥50 from ¥41 in fiscal 2023. Further, it targets a dividend payout ratio of 39.1% by the end of fiscal 2024. Thus, by increasing dividends and executing flexible share repurchases, Mitsubishi UFJ aims to enhance shareholders’ returns.

As of Mar 31, 2024, the company had cash and due from banks of ¥113.6 trillion, much higher than its borrowed money of ¥24.86 trillion. Given a sound balance sheet and solid liquidity position, MUFG’s capital distribution activities seem sustainable in the long run.

Over the past six months, shares of MUFG have gained 2.6% on the NYSE compared with the industry’s 7.7% growth.

Image Source: Zacks Investment Research

Currently, Mitsubishi UFJ carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Finance Firms Taking Similar Actions

Last week, Cathay General Bancorp. (CATY - Free Report) announced a new share repurchase program. Under the plan, the board of directors authorized the buyback of $125 million worth of shares. There is no set expiration for the program.

Previously, CATY had announced a share repurchase program in May 2022, authorizing the buyback of up to $125 million worth of shares. The company completed this program in February 2023, with the repurchase of 2.9 million shares at an average cost of $43.14.

Similarly, Robinhood Markets, Inc. (HOOD - Free Report) announced that its board of directors approved a share repurchase program authorizing it to repurchase up to $1 billion of its outstanding common stock.

While the plan does not have an expiration date, HOOD expects to buy back shares over two to three years, starting from third-quarter 2024.