We use cookies to understand how you use our site and to improve your experience.

This includes personalizing content and advertising.

By pressing "Accept All" or closing out of this banner, you consent to the use of all cookies and similar technologies and the sharing of information they collect with third parties.

You can reject marketing cookies by pressing "Deny Optional," but we still use essential, performance, and functional cookies.

In addition, whether you "Accept All," Deny Optional," click the X or otherwise continue to use the site, you accept our Privacy Policy and Terms of Service, revised from time to time.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

Here's Why First Horizon (FHN) Stock is a Must Buy Right Now

Read MoreHide Full Article

Adding First Horizon Corporation (FHN - Free Report) to your portfolio now seems to be a good idea. Supported by higher interest rates and a solid loan and deposit balance, the company is well-poised for growth.

The Zacks Consensus Estimate for FHN’s 2024 earnings has been revised upward by 4.9% over the past 60 days, indicating that analysts are optimistic regarding its earnings growth potential. FHN currently sports a Zacks Rank #1 (Strong Buy).

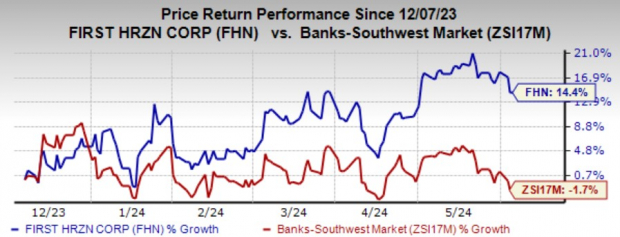

Over the past six months, the company’s shares have gained 14.4% against the industry’s 1.7% decline.

Image Source: Zacks Investment Research

Now, let’s discuss some of the important factors that make FHN stock worth a look.

Solid Loans and Deposit Base: FHN’s loans and leases witnessed a CAGR of 18.7% in the past four years ended 2023. The increase was primarily due to the strategic acquisitions, along with the diversified loan portfolio. FHN’s strong business mix of regional and specialty banking franchises across its attractive high-growth footprint keeps the company well-positioned to witness loan and deposit growth. Further, deposits witnessed a CAGR of 19.3% during the same period. The company’s footprint in higher-growth markets offers the scope for gathering lower-cost core deposits and improving loan balances.

Overall, FHN's strategic acquisitions, diversified loan portfolio and presence in high-growth markets will bolster its financial performance and witness solid loan and deposit growth in the long run.

Earnings Growth: First Horizon's earnings have witnessed growth of 3.74% over the past three to five years. Earnings are projected to increase 4.90% in 2024 and rise 9.15% in 2025.

Balance Sheet Strength: The company’s debt-to-equity ratio of 0.13 is below the industry average of 0.23. Further, as of Mar 31, 2024, debt was $1.73 billion, and cash and dues from the bank and interest-bearing deposits with banks were $2.63 billion. The company holds a decent liquidity profile and is expected to meet its debt obligations, even during the current economic slowdown. This shows First Horizon’s strong liquidity profile.

Impressive Capital Distribution: FHN has an attractive capital distribution plan. The bank authorized a new share repurchase program worth $650 million in January 2024. The plan will expire on Jan 31, 2025. Also, the bank is consistent in paying dividends to its shareholders throughout the years.

Given its strong balance sheet numbers and a decent liquidity position, along with a favorable debt-to-equity ratio, the capital-distribution activities for the company seem sustainable.

Stock Seems Undervalued: FHN has price/earnings (F1) and price/sales of 10.26 and 1.61 compared with the industry’s price/earnings (F1) and price/sales of 11.76 and 1.69, respectively. The stock has a Value Score of B. Our research suggests that stocks with a Style Score of A or B, when combined with Zacks Rank #1 or 2 (Buy), offer the highest upside potential.

Image: Shutterstock

Here's Why First Horizon (FHN) Stock is a Must Buy Right Now

Adding First Horizon Corporation (FHN - Free Report) to your portfolio now seems to be a good idea. Supported by higher interest rates and a solid loan and deposit balance, the company is well-poised for growth.

The Zacks Consensus Estimate for FHN’s 2024 earnings has been revised upward by 4.9% over the past 60 days, indicating that analysts are optimistic regarding its earnings growth potential. FHN currently sports a Zacks Rank #1 (Strong Buy).

Over the past six months, the company’s shares have gained 14.4% against the industry’s 1.7% decline.

Image Source: Zacks Investment Research

Now, let’s discuss some of the important factors that make FHN stock worth a look.

Solid Loans and Deposit Base: FHN’s loans and leases witnessed a CAGR of 18.7% in the past four years ended 2023. The increase was primarily due to the strategic acquisitions, along with the diversified loan portfolio. FHN’s strong business mix of regional and specialty banking franchises across its attractive high-growth footprint keeps the company well-positioned to witness loan and deposit growth. Further, deposits witnessed a CAGR of 19.3% during the same period. The company’s footprint in higher-growth markets offers the scope for gathering lower-cost core deposits and improving loan balances.

Overall, FHN's strategic acquisitions, diversified loan portfolio and presence in high-growth markets will bolster its financial performance and witness solid loan and deposit growth in the long run.

Earnings Growth: First Horizon's earnings have witnessed growth of 3.74% over the past three to five years. Earnings are projected to increase 4.90% in 2024 and rise 9.15% in 2025.

Balance Sheet Strength: The company’s debt-to-equity ratio of 0.13 is below the industry average of 0.23. Further, as of Mar 31, 2024, debt was $1.73 billion, and cash and dues from the bank and interest-bearing deposits with banks were $2.63 billion. The company holds a decent liquidity profile and is expected to meet its debt obligations, even during the current economic slowdown. This shows First Horizon’s strong liquidity profile.

Impressive Capital Distribution: FHN has an attractive capital distribution plan. The bank authorized a new share repurchase program worth $650 million in January 2024. The plan will expire on Jan 31, 2025. Also, the bank is consistent in paying dividends to its shareholders throughout the years.

Given its strong balance sheet numbers and a decent liquidity position, along with a favorable debt-to-equity ratio, the capital-distribution activities for the company seem sustainable.

Stock Seems Undervalued: FHN has price/earnings (F1) and price/sales of 10.26 and 1.61 compared with the industry’s price/earnings (F1) and price/sales of 11.76 and 1.69, respectively. The stock has a Value Score of B. Our research suggests that stocks with a Style Score of A or B, when combined with Zacks Rank #1 or 2 (Buy), offer the highest upside potential.

Other Stocks to Consider

Some other top-ranked stocks from the finance space are UMB Financial Corporation (UMBF - Free Report) and First Financial Bancorp. (FFBC - Free Report) , each sporting a Zacks Rank #1 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

UMBF’s 2024 earnings estimates have risen 14.4% over the past 60 days. Shares of UMBF have gained 5.9% over the past six months.

FFBC’s 2024 earnings estimates have increased 8 % over the past 60 days. Shares of FFBC have lost 3.2% in the past three months.