We use cookies to understand how you use our site and to improve your experience.

This includes personalizing content and advertising.

By pressing "Accept All" or closing out of this banner, you consent to the use of all cookies and similar technologies and the sharing of information they collect with third parties.

You can reject marketing cookies by pressing "Deny Optional," but we still use essential, performance, and functional cookies.

In addition, whether you "Accept All," Deny Optional," click the X or otherwise continue to use the site, you accept our Privacy Policy and Terms of Service, revised from time to time.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

T. Rowe Price (TROW) Introduces 5-D Framework for DC Plan

Read MoreHide Full Article

T. Rowe Price Group, Inc. (TROW - Free Report) introduced a new patent-pending framework designed to assist defined contributions (DC) plan sponsors in evaluating and selecting the best-suited retirement income solutions considering the needs and preferences of their plan participants.

Presently, the majority of DC plan sponsors characterize their member base as aging and expect to keep retired members enrolled in the plan well throughout retirement. Both of these considerations encourage to modify the DC plan in order to better meet the interests of pre-retirees and retired participants.

TROW’s global retirement strategy and multi-asset research teams identified that the industry lacks a common and unbiased method to assist the sponsors in evaluating and expanding the range of retirement income products. As a result, the teams collaborated to develop a five-dimensional (5-D) framework that will provide a standardized language that DC plan sponsors, advisors and consultants can utilize to understand the trade-offs required by different retirement income products to meet specific participant objectives.

At the time of savings, investment solutions are primarily evaluated using a two-dimensional framework that is aimed at achieving a desired return while effectively managing risk. The latest 5-D framework for the decumulation phase of investments focuses on a wider range of objectives, including longevity risk hedge, payment level, volatility, liquidity of balance and unexpected balance depletion, addressing the need for a more comprehensive approach to retirement savings management.

Management’s Comments

Sebastien Page, head of global multi-asset and chief investment officer at TROW, stated, "It is our hope that the 5-D framework and supporting research will become a standard for how in-plan retirement income solutions are evaluated. Our team has created an unbiased and uniform model that allows plan sponsors to visualize, compare, and contrast retirement income products."

Jessica Sclafani, global retirement strategist at T. Rowe Price, mentioned, "The interconnected nature of the 5-D framework examines and quantifies the trade-offs that are uniquely inherent to retirement income needs. It offers a common method to compare and evaluate retirement income solutions."

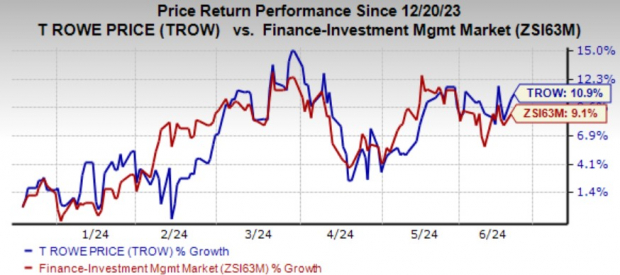

Over the past six months, shares of T. Rowe Price have risen 10.9% compared with the industry’s 9.1% growth.

Some better-ranked finance stocks worth mentioning are Origin Bancorp, Inc. (OBK - Free Report) and BrightSphere Investment Group Inc. .

Origin Bancorp’s 2024 earnings estimates have moved north by 9.1% in the past 60 days. The stock has lost 1% over the past six months. Currently, OBK sports a Zacks Rank #1.

BrightSphere Investment Group’s 2024 earnings estimates have been revised 1.8% upward in the past 60 days. The company’s shares have gained 13.1% over the past six months. At present, BSIG carries Zacks Rank of 2 (Buy).

See More Zacks Research for These Tickers

Normally $25 each - click below to receive one report FREE:

Image: Shutterstock

T. Rowe Price (TROW) Introduces 5-D Framework for DC Plan

T. Rowe Price Group, Inc. (TROW - Free Report) introduced a new patent-pending framework designed to assist defined contributions (DC) plan sponsors in evaluating and selecting the best-suited retirement income solutions considering the needs and preferences of their plan participants.

Presently, the majority of DC plan sponsors characterize their member base as aging and expect to keep retired members enrolled in the plan well throughout retirement. Both of these considerations encourage to modify the DC plan in order to better meet the interests of pre-retirees and retired participants.

TROW’s global retirement strategy and multi-asset research teams identified that the industry lacks a common and unbiased method to assist the sponsors in evaluating and expanding the range of retirement income products. As a result, the teams collaborated to develop a five-dimensional (5-D) framework that will provide a standardized language that DC plan sponsors, advisors and consultants can utilize to understand the trade-offs required by different retirement income products to meet specific participant objectives.

At the time of savings, investment solutions are primarily evaluated using a two-dimensional framework that is aimed at achieving a desired return while effectively managing risk. The latest 5-D framework for the decumulation phase of investments focuses on a wider range of objectives, including longevity risk hedge, payment level, volatility, liquidity of balance and unexpected balance depletion, addressing the need for a more comprehensive approach to retirement savings management.

Management’s Comments

Sebastien Page, head of global multi-asset and chief investment officer at TROW, stated, "It is our hope that the 5-D framework and supporting research will become a standard for how in-plan retirement income solutions are evaluated. Our team has created an unbiased and uniform model that allows plan sponsors to visualize, compare, and contrast retirement income products."

Jessica Sclafani, global retirement strategist at T. Rowe Price, mentioned, "The interconnected nature of the 5-D framework examines and quantifies the trade-offs that are uniquely inherent to retirement income needs. It offers a common method to compare and evaluate retirement income solutions."

Over the past six months, shares of T. Rowe Price have risen 10.9% compared with the industry’s 9.1% growth.

Image Source: Zacks Investment Research

Currently, TROW carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stocks to Consider

Some better-ranked finance stocks worth mentioning are Origin Bancorp, Inc. (OBK - Free Report) and BrightSphere Investment Group Inc. .

Origin Bancorp’s 2024 earnings estimates have moved north by 9.1% in the past 60 days. The stock has lost 1% over the past six months. Currently, OBK sports a Zacks Rank #1.

BrightSphere Investment Group’s 2024 earnings estimates have been revised 1.8% upward in the past 60 days. The company’s shares have gained 13.1% over the past six months. At present, BSIG carries Zacks Rank of 2 (Buy).