We use cookies to understand how you use our site and to improve your experience.

This includes personalizing content and advertising.

By pressing "Accept All" or closing out of this banner, you consent to the use of all cookies and similar technologies and the sharing of information they collect with third parties.

You can reject marketing cookies by pressing "Deny Optional," but we still use essential, performance, and functional cookies.

In addition, whether you "Accept All," Deny Optional," click the X or otherwise continue to use the site, you accept our Privacy Policy and Terms of Service, revised from time to time.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

Last week, the Republican Party’s Donald Trump victory in the U.S. presidential election ignited a new so-called "Trump trade”.

• The U.S. dollar • Crypto, and • U.S. stocks all surged

In the Global Week Ahead?

Investors will continue to assess the global implications of his return to the presidency.

In Europe?

• Germany is grappling with a political coalition crisis, and • Britain's finance minister delivers a key speech.

Finally, climate change policymakers head to Baku for a U.N. climate summit (COP29).

Next are Reuters' five world market themes, reordered for equity traders—

(1) On Wednesday, the U.S. Consumer Price Inflation (CPI) data for OCT lands

Focus turns to U.S. inflation data on Nov 13th, as markets wait to see if president-elect Trump will push ahead with economic policies that could be inflationary.

Economists expect the consumer price index to have climbed +0.2% for October.

September's +2.4% annual increase was the smallest in more than 3-1/2 years, reinforcing Federal Reserve rate-cut bets.

But the central bank may have been thrown a curveball with Trump's election, since the Republican's plans to raise tariffs could fuel price rises.

Following the Fed's 25-bps rate cut last Thursday, Chair Jerome Powell gave little guidance on how fast and far rates will now fall.

Markets are also watching whether "Trump trades" - including a stronger U.S. dollar and buying shares of banks and small-cap companies - will continue as investors assess the impact of the election result.

(2) A Mainland China Stimulus Package Takes a Firmer Shape

A closely watched gathering of China's top legislative body wrapped up on Friday with the announcement of a 6 trillion yuan ($837.17 billion) spending package aimed at cleaning up off-the-book debt at local governments.

That is sure to disappoint investors who pumped mainland blue chips to a +5.5% gain this week, amid some speculation there would be extra spending, to counter the potential impact from a Donald Trump-led trade war.

Some analysts had warned it would be too early for Beijing to formalize a strategy only days after Trump's election victory, but investors have repeatedly pushed up Chinese stocks only for policymakers to disappoint expectations.

With Trump's threatened 60% tariffs dwarfing those from eight years ago, meeting the annual economic growth goal of around +5% may be the least of Beijing concerns.

(3) Germany’s Federal Governing Coalition is in Turmoil

A collapse in Germany's ruling coalition puts a crisis in Europe's biggest economy in the spotlight just after Trump's win.

Chancellor Olaf Scholz's decision to fire his finance minister, from coalition partner the Free Democrats, points to a vote of no confidence in January and possible snap elections in March.

Scholz's Social Democrats now rule with remaining coalition ally the Greens in a minority government but face pressure to hold a no-confidence vote sooner. A contentious draft budget also needs to be finalized.

The timing is unfortunate. Germany has just dodged recession after a series of setbacks, while higher tariffs may loom under Trump.

Uncertainty could hurt business investment and slow M&A. As an election-packed year globally winds down, Germany could be gearing up to hold a poll of its own.

(4) A Big United Nations (UN) Climate Change Conference (COP29) Kicks Off

Policymakers and climate activists head to Azerbaijan's capital Baku from Nov. 11th for the 29th annual United Nations Climate Summit, known as COP29.

The summit has been dubbed the "climate finance COP" for its central goal: to agree on how much money should go each year to helping developing countries cope with climate-related costs.

Governments are also eager to resolve rules for trading carbon credits earned through the preservation of forests and other natural carbon sinks.

But coming just days after the U.S. elections and amid rising geopolitical tensions, the meeting is expected to be a subdued affair.

Trump, a climate denier, wants to ramp up fossil fuel production and pull out of the Paris Climate Accords, a framework for reducing global greenhouse gas emissions.

(5) More U.K. Plans Come Out for Review

U.K. finance minister Rachel Reeves will serve up her latest plans to reinvigorate Britain's sluggish capital markets in her first Mansion House speech on Thursday, with a slew of pension fund reforms topping industry wish-lists.

U.K. defined benefit retirement schemes, most of which are closed to new members, are collectively sitting on an estimated 300 billion pounds of cash that could be funneled into housing, infrastructure, unlisted company investments and unloved stocks for the greater good of the U.K. economy, industry sources say.

But while change is broadly welcome, the idea of mandating pension fund investment in so-called U.K. productive finance has been criticized because of the risk that good intentions may not always lead to good outcomes for retirement savers, particularly as U.K. equities continue to perform poorly against global peers.

Zacks #1 Rank (STRONG BUY) Stocks

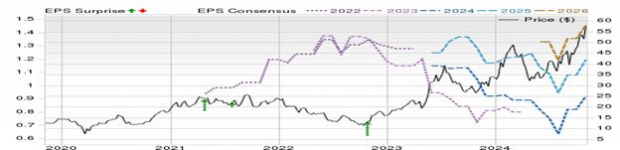

(1) Carvana (CVNA - Free Report) ): This is a $241 a share stock in the Internet-Commerce industry. I see a Zacks Value score of F, a Zacks Growth score of A, and a Zacks Momentum score of A.

Image Source: Zacks Investment Research

Carvana Co. is a leading e-commerce platform for buying and selling used cars.

Carvana's end-to-end online business model that covers every aspect of used-car retailing - including sales, financing, logistics, inspection and repair centers, as well as software development - has transformed traditional used-car sales in several ways.

With a mission of changing the way people buy cars, Carvana is harnessing the power of digitization and applying it to the auto industry. It is changing customers' shopping experience by letting them find the perfect car from the comfort of homes without having to haggle with sales people.

Thanks to advanced technology, customers can browse through its broad inventory of high-quality used cars and get a clear and complete view of the interior and exterior of each car.

Once the customers make their selection, the vehicle is either delivered to their home as soon as the next day or available for pick up at a car vending machine.

(2) Advantest (ATEYY - Free Report) ): This is a $65 a share stock in the Electronics-Measuring Instrument industry. I see a Zacks Value score of F, a Zacks Growth score of B, and a Zacks Momentum score of A.

Image Source: Zacks Investment Research

Advantest Corporation is one of the world's leading automatic test equipment suppliers to the semiconductor industry, and is also a producer of electronic and optoelectronic instruments and systems.

A global company, Advantest has long offered total ATE solutions, and serves the industry in every component of semiconductor test: tester, handler, mechanical and electrical interfaces, and software.

Its logic, memory, mixed-signal and RF testers, and device handlers, are integrated into the most advanced semiconductor fabrication lines in the world.

(3) Vertiv (VRT - Free Report) ): This is a $122 a share stock in the Computers-IT industry. I see a Zacks Value score of D, a Zacks Growth score of A, and a Zacks Momentum score of F.

Image Source: Zacks Investment Research

Vertiv Holdings Co. provides digital infrastructure and continuity solutions.

It offers hardware, software, analytics and ongoing services.

Vertiv Holdings Co., formerly known as GS Acquisition Holdings Corp, is headquartered in Columbus, Ohio.

Key Global Macro

The Wednesday U.S. CPI data for OCT is the big macro data print this week.

On Monday, it is Veteran’s Day in the USA.

Mainland China’s Foreign Direct Investment (FDI) for OCT comes out. In y/y terms, it has been down -30.4% y/y.

On Tuesday, the Fed’s Waller and Harker give speeches.

On Wednesday, the U.S. Consumer Price Index (CPI) for OCT comes out. I see a +2.4% y/y print is the prior broad reading. Ex food & energy? I see a +3.3% y/y print is the prior.

On Thursday, the U.S. Producer Price Index (PPI) for OCT comes out. I see a +1.8% y/y prior print. Ex-food & energy? The core PPI should be up +2.8% y/y.

On Friday, U.K. GDP for Q3 is out. The prior reading was up +0.7% y/y.

U.S. retail sales for OCT is out. The prior month showed up a solid +0.4% m/m print.

Conclusion

On November 6th, 2024, Zacks Research Director Sheraz Mian provided the latest Q3 earning season update.

Here are his key points:

(1) Total Q3-24 earnings for the 399 S&P500 members that have reported results through Wednesday, November 6th, are up +6.9%, on +5.2% higher revenues.

(2) Earnings growth is expected to accelerate after the modest growth pace in Q3, with double-digit earnings growth projected in three of the next four quarters.

(3) For Q4-24, total S&P500 earnings are currently expected to be up +8.1% from the same period last year, on +4.9% higher revenues.

Had it not been for the Energy sector drag, Q4 earnings for the rest of the index would be up +10.0%.

(4) Earnings estimates for Q4-24 have come down since the quarter got underway, with the +8.1% growth today down from +9.8% at the start of October.

This magnitude of decline to estimates compares favorably to what we had seen in the comparable period of Q3-24 and other recent periods.

That’s it for me.

Have an excellent trading week!

John Blank, PhD.

Zacks Chief Equity Strategist and Economist

See More Zacks Research for These Tickers

Normally $25 each - click below to receive one report FREE:

Image: Bigstock

Global Week Ahead: OCT Consumer Price Inflation

Last week, the Republican Party’s Donald Trump victory in the U.S. presidential election ignited a new so-called "Trump trade”.

• The U.S. dollar

• Crypto, and

• U.S. stocks all surged

In the Global Week Ahead?

Investors will continue to assess the global implications of his return to the presidency.

In Europe?

• Germany is grappling with a political coalition crisis, and

• Britain's finance minister delivers a key speech.

Finally, climate change policymakers head to Baku for a U.N. climate summit (COP29).

Next are Reuters' five world market themes, reordered for equity traders—

(1) On Wednesday, the U.S. Consumer Price Inflation (CPI) data for OCT lands

Focus turns to U.S. inflation data on Nov 13th, as markets wait to see if president-elect Trump will push ahead with economic policies that could be inflationary.

Economists expect the consumer price index to have climbed +0.2% for October.

September's +2.4% annual increase was the smallest in more than 3-1/2 years, reinforcing Federal Reserve rate-cut bets.

But the central bank may have been thrown a curveball with Trump's election, since the Republican's plans to raise tariffs could fuel price rises.

Following the Fed's 25-bps rate cut last Thursday, Chair Jerome Powell gave little guidance on how fast and far rates will now fall.

Markets are also watching whether "Trump trades" - including a stronger U.S. dollar and buying shares of banks and small-cap companies - will continue as investors assess the impact of the election result.

(2) A Mainland China Stimulus Package Takes a Firmer Shape

A closely watched gathering of China's top legislative body wrapped up on Friday with the announcement of a 6 trillion yuan ($837.17 billion) spending package aimed at cleaning up off-the-book debt at local governments.

That is sure to disappoint investors who pumped mainland blue chips to a +5.5% gain this week, amid some speculation there would be extra spending, to counter the potential impact from a Donald Trump-led trade war.

Some analysts had warned it would be too early for Beijing to formalize a strategy only days after Trump's election victory, but investors have repeatedly pushed up Chinese stocks only for policymakers to disappoint expectations.

With Trump's threatened 60% tariffs dwarfing those from eight years ago, meeting the annual economic growth goal of around +5% may be the least of Beijing concerns.

(3) Germany’s Federal Governing Coalition is in Turmoil

A collapse in Germany's ruling coalition puts a crisis in Europe's biggest economy in the spotlight just after Trump's win.

Chancellor Olaf Scholz's decision to fire his finance minister, from coalition partner the Free Democrats, points to a vote of no confidence in January and possible snap elections in March.

Scholz's Social Democrats now rule with remaining coalition ally the Greens in a minority government but face pressure to hold a no-confidence vote sooner. A contentious draft budget also needs to be finalized.

The timing is unfortunate. Germany has just dodged recession after a series of setbacks, while higher tariffs may loom under Trump.

Uncertainty could hurt business investment and slow M&A. As an election-packed year globally winds down, Germany could be gearing up to hold a poll of its own.

(4) A Big United Nations (UN) Climate Change Conference (COP29) Kicks Off

Policymakers and climate activists head to Azerbaijan's capital Baku from Nov. 11th for the 29th annual United Nations Climate Summit, known as COP29.

The summit has been dubbed the "climate finance COP" for its central goal: to agree on how much money should go each year to helping developing countries cope with climate-related costs.

Governments are also eager to resolve rules for trading carbon credits earned through the preservation of forests and other natural carbon sinks.

But coming just days after the U.S. elections and amid rising geopolitical tensions, the meeting is expected to be a subdued affair.

Trump, a climate denier, wants to ramp up fossil fuel production and pull out of the Paris Climate Accords, a framework for reducing global greenhouse gas emissions.

(5) More U.K. Plans Come Out for Review

U.K. finance minister Rachel Reeves will serve up her latest plans to reinvigorate Britain's sluggish capital markets in her first Mansion House speech on Thursday, with a slew of pension fund reforms topping industry wish-lists.

U.K. defined benefit retirement schemes, most of which are closed to new members, are collectively sitting on an estimated 300 billion pounds of cash that could be funneled into housing, infrastructure, unlisted company investments and unloved stocks for the greater good of the U.K. economy, industry sources say.

But while change is broadly welcome, the idea of mandating pension fund investment in so-called U.K. productive finance has been criticized because of the risk that good intentions may not always lead to good outcomes for retirement savers, particularly as U.K. equities continue to perform poorly against global peers.

Zacks #1 Rank (STRONG BUY) Stocks

(1) Carvana (CVNA - Free Report) ): This is a $241 a share stock in the Internet-Commerce industry. I see a Zacks Value score of F, a Zacks Growth score of A, and a Zacks Momentum score of A.

Image Source: Zacks Investment Research

Carvana Co. is a leading e-commerce platform for buying and selling used cars.

Carvana's end-to-end online business model that covers every aspect of used-car retailing - including sales, financing, logistics, inspection and repair centers, as well as software development - has transformed traditional used-car sales in several ways.

With a mission of changing the way people buy cars, Carvana is harnessing the power of digitization and applying it to the auto industry. It is changing customers' shopping experience by letting them find the perfect car from the comfort of homes without having to haggle with sales people.

Thanks to advanced technology, customers can browse through its broad inventory of high-quality used cars and get a clear and complete view of the interior and exterior of each car.

Once the customers make their selection, the vehicle is either delivered to their home as soon as the next day or available for pick up at a car vending machine.

(2) Advantest (ATEYY - Free Report) ): This is a $65 a share stock in the Electronics-Measuring Instrument industry. I see a Zacks Value score of F, a Zacks Growth score of B, and a Zacks Momentum score of A.

Image Source: Zacks Investment Research

Advantest Corporation is one of the world's leading automatic test equipment suppliers to the semiconductor industry, and is also a producer of electronic and optoelectronic instruments and systems.

A global company, Advantest has long offered total ATE solutions, and serves the industry in every component of semiconductor test: tester, handler, mechanical and electrical interfaces, and software.

Its logic, memory, mixed-signal and RF testers, and device handlers, are integrated into the most advanced semiconductor fabrication lines in the world.

(3) Vertiv (VRT - Free Report) ): This is a $122 a share stock in the Computers-IT industry. I see a Zacks Value score of D, a Zacks Growth score of A, and a Zacks Momentum score of F.

Image Source: Zacks Investment Research

Vertiv Holdings Co. provides digital infrastructure and continuity solutions.

It offers hardware, software, analytics and ongoing services.

Vertiv Holdings Co., formerly known as GS Acquisition Holdings Corp, is headquartered in Columbus, Ohio.

Key Global Macro

The Wednesday U.S. CPI data for OCT is the big macro data print this week.

On Monday, it is Veteran’s Day in the USA.

Mainland China’s Foreign Direct Investment (FDI) for OCT comes out. In y/y terms, it has been down -30.4% y/y.

On Tuesday, the Fed’s Waller and Harker give speeches.

On Wednesday, the U.S. Consumer Price Index (CPI) for OCT comes out. I see a +2.4% y/y print is the prior broad reading. Ex food & energy? I see a +3.3% y/y print is the prior.

On Thursday, the U.S. Producer Price Index (PPI) for OCT comes out. I see a +1.8% y/y prior print. Ex-food & energy? The core PPI should be up +2.8% y/y.

On Friday, U.K. GDP for Q3 is out. The prior reading was up +0.7% y/y.

U.S. retail sales for OCT is out. The prior month showed up a solid +0.4% m/m print.

Conclusion

On November 6th, 2024, Zacks Research Director Sheraz Mian provided the latest Q3 earning season update.

Here are his key points:

(1) Total Q3-24 earnings for the 399 S&P500 members that have reported results through Wednesday, November 6th, are up +6.9%, on +5.2% higher revenues.

73.9% beat EPS estimates. 61.4% beat revenue estimates.

(2) Earnings growth is expected to accelerate after the modest growth pace in Q3, with double-digit earnings growth projected in three of the next four quarters.

(3) For Q4-24, total S&P500 earnings are currently expected to be up +8.1% from the same period last year, on +4.9% higher revenues.

Had it not been for the Energy sector drag, Q4 earnings for the rest of the index would be up +10.0%.

(4) Earnings estimates for Q4-24 have come down since the quarter got underway, with the +8.1% growth today down from +9.8% at the start of October.

This magnitude of decline to estimates compares favorably to what we had seen in the comparable period of Q3-24 and other recent periods.

That’s it for me.

Have an excellent trading week!

John Blank, PhD.

Zacks Chief Equity Strategist and Economist