“Be fearful when others are greedy, and be greedy when others are fearful.” – Warren Buffett

The market rally off the April lows has been nothing short of extraordinary. In fact, it has been so swift and relentless that many investors have been caught off guard, with positioning far below where it likely should be.

What does that mean for stocks going forward?

It means that even if we have some short-term downside (which appears to be the case amid rising treasury yields along with the recent U.S. credit rating downgrade), pullbacks are likely to be relatively shallow and short-lived as underexposed investors look to quickly buy any weakness.

This has been a bullish move reminiscent of the astonishing rally off the 2020 COVID-induced plunge. I have to admit, I wasn’t expecting a ‘V’ shaped rally this time around. Still, we noted back in April that there was a large percentage of stocks in oversold territory. Combined with historically bearish sentiment along with a high level of fear, we had the recipe for a strong lockout rally to materialize – and that’s exactly what we saw transpire.

Putting This Rally in Perspective

A bit over a month ago, the S&P 500 was down over 15% on the year and narrowly avoided an official bear market (in fact, it closed down 19% from its highs and touched bear territory intraday). The Nasdaq officially entered one.

And by mid-May, the S&P 500 soared back into the green for 2025. It was the fastest recovery in over 40 years, with the index erasing its 15% YTD loss in less than six weeks. It’s a good reminder that one of the worst mistakes we can make is to panic sell during times of market stress.

We reached maximum headline fear in April as the tariff problem was covered extensively by financial media outlets. Markets have a habit of bottoming on maximum fear. What many weren’t expecting were the positive headlines that would soon follow, helping to relieve some of the volatility that plagued markets in the first quarter.

The market is now telling us two things. First, it’s to expect a quicker-than-anticipated resolution to the tariff issues and trade wars. And alongside that, the assumption is that inflation remains under control, which will allow the Fed to resume the rate-cutting process. This should provide a further tailwind to equity prices.

The evidence is now pointing to the notion that this correction in the S&P 500 has come to an abrupt end. Let’s take a look at a few reasons why the worst of the selling is likely behind us.

More . . .

------------------------------------------------------------------------------------------------------

Deadline Approaching: Zacks’ 7 Best Stocks for June

From 220 Zacks Rank #1 Strong Buy stocks, our experts hand-picked these 7 compelling companies as the most likely to spike NOW. While we can’t guarantee 100% success, they are likely to jump sooner and climb higher than any others you could buy this month.

Report distribution is limited, so don’t miss out. The deadline is midnight Sunday, June 1st.

Hurry – See Stocks Now >>

------------------------------------------------------------------------------------------------------

Three Motives to Buy on Weakness from Here

Bearish Sentiment Remains Prevalent

Despite the latest rally, the bears won’t give up. Most investors still remain bearish amid the recent volatility, so there’s certainly fuel to push markets even higher in the coming months.

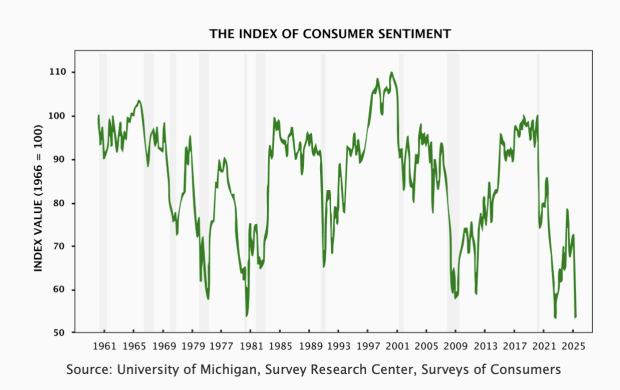

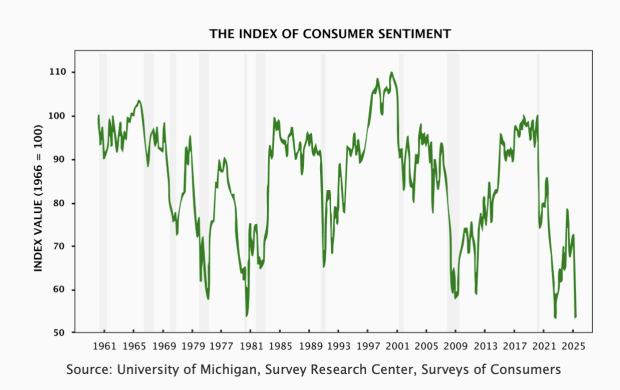

Let’s start with consumers and individual investors. Consumer sentiment plunged in May as Americans grew more pessimistic about the inflation outlook. The latest University of Michigan consumer sentiment survey showed its sentiment index registered at 50.8, its second-lowest reading on record.

Image Source: University of Michigan, Survey Research Center, Surveys of Consumers

Along the same lines, the American Association of Individual Investors (AAII) – a nonprofit organization whose purpose is to educate individual investors – also conducts sentiment surveys. As recently as early May, the percentage of AAII investors spent 11 straight weeks with more than 50% bears, which marked a new record. Clearly, pervasive bearish sentiment has dominated the minds of individual investors.

What about professional fund managers? The recently released Bank of America Global Fund Manager Survey showed the fifth-lowest level on record in terms of fund manager sentiment. Additionally, it showed a record number of participants who intend to cut U.S. equity exposure.

The survey also showed the largest two-month jump in cash since April 2020, along with the 4th highest recession expectations ever. Given this survey looks at managers who manage actual portfolios, this is a potential contrarian indicator.

Volatility Index Completes Roundtrip

In bull markets, spikes in the volatility (VIX) index typically represent great buying opportunities. Remember, it’s not imperative for us to call the exact top in the VIX or the exact bottom in the market. We’re not in the business of calling tops and bottoms, we’re in the business of making money consistently and allowing gains to compound over time.

When the VIX index closes above the 50-price level for the first time in a cycle, it has likely been preceded by poor market performance driven by panic. We took a look at past instances in which the VIX closed above 50 and subsequently plunged to close back below 30. This indicator has been known as a “bear market killer.”

Image Source: Chart Courtesy of StockCharts.com

Dating back to the early 2000s, the volatility index only experienced this exact type of movement two other times: following the Great Recession low in 2009, and after the COVID-19 bear market in 2020. Both instances marked an important bottom in the market. And looking out one year from the date the VIX closed back below 30, the S&P 500 rose +23.2% and +44.5% in those respective cases.

The average drawdown after each signal was 3.55%, while the maximum drawdown was 3.75%. This tells us that it wouldn’t be too shocking to see a bit of a retracement here, but any pullback should be relatively contained.

And since then, the VIX has actually managed to close back below 20, marking the largest 6-week volatility crash in history. Looking at the 20 other biggest monthly declines in the VIX, the 1-year forward returns for the S&P 500 averaged more than +20%, telling us to keep an open mind about better-than-expected outcomes ahead.

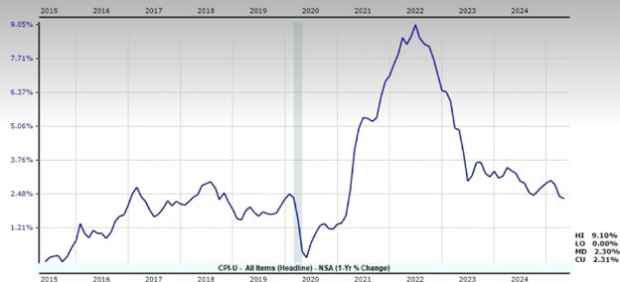

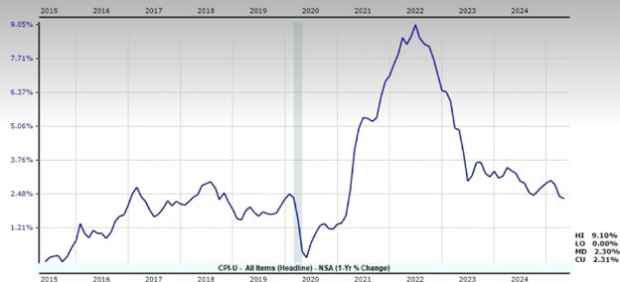

Inflation Remains on a Downward Trajectory

To top it all off, inflation has remained tame this year even in the face of President Trump’s tariffs. April’s Consumer Price Index (CPI) report showed inflation pressures actually eased, despite it being the first month that many tariffs were in effect. Data from the Bureau of Labor Statistics showed that consumer prices increased just 2.3% over the prior year, below estimates of 2.4%. It marked the lowest annual increase since February 2021.

Image Source: Zacks Research System

On a “core” basis, which strips out volatile food and energy components, prices rose 2.8% over the past year, in line with expectations.

In a more dovish signal, Federal Reserve Bank of Cleveland President Beth Hammack recently indicated that policymakers could move forward with a rate cut in June if the data comes in as expected.

“If we have clear and convincing data by June, then I think you’ll see the committee move if we know which way is the right way to move at that point in time,” Hammack said.

The downward trend in inflation should prompt the Fed to resume the rate-cutting process, which will likely serve as another boost for stocks moving forward.

Final Thoughts

These tailwinds are presenting a bullish setup for equities. Many individual stocks are now forming proper bases, another sign that this latest push higher has legs.

I’ll leave you with this. The S&P 500 has been in 11 bull markets (not including the current one) since 1949. The index hit a new high in January of 2024 following the inflation-induced bear market of 2022. Dating back to the 1950s, once those former highs were put in the rearview mirror, bull markets have lasted an average of another 4.5 years.

This overlooked fact suggests the potential for more gains ahead that could be substantial. Investors normally underestimate the length and magnitude of bull markets. It looks like this latest correction will turn out to be a great buying opportunity.

And in my opinion, it’s still early. Bearish investor sentiment, declining volatility, and a tame inflation trend suggest further gains are on the horizon.

Take Advantage Today

The time is now to get in (and not miss out) on more gains to come.

Zacks has just released a brand-new Special Report, 7 Best Stocks for the Next 30 Days, and you're invited to be one of the first to see it.

Our team of experts combed through the latest Zacks Rank #1 Strong Buys and handpicked seven exciting companies poised for significant price increases. They're likely to jump sooner and climb higher than any other stock you could buy this month.

While future success isn't guaranteed, recent winners have climbed +46.4%, +61.8% and +97.3% in just 30 days.¹

Our latest picks could soar just as high, or higher, and you can see them for only $1. You’ll also get 30-day access to all of Zacks' private portfolios for the same dollar.

I encourage you to take advantage right away. The earlier you get in, the greater profits you stand to make. But don't delay. We're limiting the number of investors who share our 7 Best Stocks, so this opportunity will end midnight Sunday, June 1.

Download 7 Best Stocks for the Next 30 Days and check out Zacks' portfolios for just $1 >>

Good Investing,

Bryan Hayes, CFA

Bryan Hayes, CFA, manages our Zacks Income Investor and Headline Trader portfolios. He employs a combination of fundamental and technical analysis and has developed a unique approach to selecting stocks with the best profit potential. You can also find him covering a host of investment topics for Zacks.com.

¹ The results listed above are not (or may not be) representative of the performance of all selections made by Zacks Investment Research's newsletter editors and may represent the partial close of a position. Access grants you a comprehensive list of all open and closed trades.

Image: Bigstock

Listen to the Market's Whispers: Buy on Upcoming Weakness

“Be fearful when others are greedy, and be greedy when others are fearful.” – Warren Buffett

The market rally off the April lows has been nothing short of extraordinary. In fact, it has been so swift and relentless that many investors have been caught off guard, with positioning far below where it likely should be.

What does that mean for stocks going forward?

It means that even if we have some short-term downside (which appears to be the case amid rising treasury yields along with the recent U.S. credit rating downgrade), pullbacks are likely to be relatively shallow and short-lived as underexposed investors look to quickly buy any weakness.

This has been a bullish move reminiscent of the astonishing rally off the 2020 COVID-induced plunge. I have to admit, I wasn’t expecting a ‘V’ shaped rally this time around. Still, we noted back in April that there was a large percentage of stocks in oversold territory. Combined with historically bearish sentiment along with a high level of fear, we had the recipe for a strong lockout rally to materialize – and that’s exactly what we saw transpire.

Putting This Rally in Perspective

A bit over a month ago, the S&P 500 was down over 15% on the year and narrowly avoided an official bear market (in fact, it closed down 19% from its highs and touched bear territory intraday). The Nasdaq officially entered one.

And by mid-May, the S&P 500 soared back into the green for 2025. It was the fastest recovery in over 40 years, with the index erasing its 15% YTD loss in less than six weeks. It’s a good reminder that one of the worst mistakes we can make is to panic sell during times of market stress.

We reached maximum headline fear in April as the tariff problem was covered extensively by financial media outlets. Markets have a habit of bottoming on maximum fear. What many weren’t expecting were the positive headlines that would soon follow, helping to relieve some of the volatility that plagued markets in the first quarter.

The market is now telling us two things. First, it’s to expect a quicker-than-anticipated resolution to the tariff issues and trade wars. And alongside that, the assumption is that inflation remains under control, which will allow the Fed to resume the rate-cutting process. This should provide a further tailwind to equity prices.

The evidence is now pointing to the notion that this correction in the S&P 500 has come to an abrupt end. Let’s take a look at a few reasons why the worst of the selling is likely behind us.

More . . .

------------------------------------------------------------------------------------------------------

Deadline Approaching: Zacks’ 7 Best Stocks for June

From 220 Zacks Rank #1 Strong Buy stocks, our experts hand-picked these 7 compelling companies as the most likely to spike NOW. While we can’t guarantee 100% success, they are likely to jump sooner and climb higher than any others you could buy this month.

Report distribution is limited, so don’t miss out. The deadline is midnight Sunday, June 1st.

Hurry – See Stocks Now >>

------------------------------------------------------------------------------------------------------

Three Motives to Buy on Weakness from Here

Bearish Sentiment Remains Prevalent

Despite the latest rally, the bears won’t give up. Most investors still remain bearish amid the recent volatility, so there’s certainly fuel to push markets even higher in the coming months.

Let’s start with consumers and individual investors. Consumer sentiment plunged in May as Americans grew more pessimistic about the inflation outlook. The latest University of Michigan consumer sentiment survey showed its sentiment index registered at 50.8, its second-lowest reading on record.

Image Source: University of Michigan, Survey Research Center, Surveys of Consumers

Along the same lines, the American Association of Individual Investors (AAII) – a nonprofit organization whose purpose is to educate individual investors – also conducts sentiment surveys. As recently as early May, the percentage of AAII investors spent 11 straight weeks with more than 50% bears, which marked a new record. Clearly, pervasive bearish sentiment has dominated the minds of individual investors.

What about professional fund managers? The recently released Bank of America Global Fund Manager Survey showed the fifth-lowest level on record in terms of fund manager sentiment. Additionally, it showed a record number of participants who intend to cut U.S. equity exposure.

The survey also showed the largest two-month jump in cash since April 2020, along with the 4th highest recession expectations ever. Given this survey looks at managers who manage actual portfolios, this is a potential contrarian indicator.

Volatility Index Completes Roundtrip

In bull markets, spikes in the volatility (VIX) index typically represent great buying opportunities. Remember, it’s not imperative for us to call the exact top in the VIX or the exact bottom in the market. We’re not in the business of calling tops and bottoms, we’re in the business of making money consistently and allowing gains to compound over time.

When the VIX index closes above the 50-price level for the first time in a cycle, it has likely been preceded by poor market performance driven by panic. We took a look at past instances in which the VIX closed above 50 and subsequently plunged to close back below 30. This indicator has been known as a “bear market killer.”

Image Source: Chart Courtesy of StockCharts.com

Dating back to the early 2000s, the volatility index only experienced this exact type of movement two other times: following the Great Recession low in 2009, and after the COVID-19 bear market in 2020. Both instances marked an important bottom in the market. And looking out one year from the date the VIX closed back below 30, the S&P 500 rose +23.2% and +44.5% in those respective cases.

The average drawdown after each signal was 3.55%, while the maximum drawdown was 3.75%. This tells us that it wouldn’t be too shocking to see a bit of a retracement here, but any pullback should be relatively contained.

And since then, the VIX has actually managed to close back below 20, marking the largest 6-week volatility crash in history. Looking at the 20 other biggest monthly declines in the VIX, the 1-year forward returns for the S&P 500 averaged more than +20%, telling us to keep an open mind about better-than-expected outcomes ahead.

Inflation Remains on a Downward Trajectory

To top it all off, inflation has remained tame this year even in the face of President Trump’s tariffs. April’s Consumer Price Index (CPI) report showed inflation pressures actually eased, despite it being the first month that many tariffs were in effect. Data from the Bureau of Labor Statistics showed that consumer prices increased just 2.3% over the prior year, below estimates of 2.4%. It marked the lowest annual increase since February 2021.

Image Source: Zacks Research System

On a “core” basis, which strips out volatile food and energy components, prices rose 2.8% over the past year, in line with expectations.

In a more dovish signal, Federal Reserve Bank of Cleveland President Beth Hammack recently indicated that policymakers could move forward with a rate cut in June if the data comes in as expected.

“If we have clear and convincing data by June, then I think you’ll see the committee move if we know which way is the right way to move at that point in time,” Hammack said.

The downward trend in inflation should prompt the Fed to resume the rate-cutting process, which will likely serve as another boost for stocks moving forward.

Final Thoughts

These tailwinds are presenting a bullish setup for equities. Many individual stocks are now forming proper bases, another sign that this latest push higher has legs.

I’ll leave you with this. The S&P 500 has been in 11 bull markets (not including the current one) since 1949. The index hit a new high in January of 2024 following the inflation-induced bear market of 2022. Dating back to the 1950s, once those former highs were put in the rearview mirror, bull markets have lasted an average of another 4.5 years.

This overlooked fact suggests the potential for more gains ahead that could be substantial. Investors normally underestimate the length and magnitude of bull markets. It looks like this latest correction will turn out to be a great buying opportunity.

And in my opinion, it’s still early. Bearish investor sentiment, declining volatility, and a tame inflation trend suggest further gains are on the horizon.

Take Advantage Today

The time is now to get in (and not miss out) on more gains to come.

Zacks has just released a brand-new Special Report, 7 Best Stocks for the Next 30 Days, and you're invited to be one of the first to see it.

Our team of experts combed through the latest Zacks Rank #1 Strong Buys and handpicked seven exciting companies poised for significant price increases. They're likely to jump sooner and climb higher than any other stock you could buy this month.

While future success isn't guaranteed, recent winners have climbed +46.4%, +61.8% and +97.3% in just 30 days.¹

Our latest picks could soar just as high, or higher, and you can see them for only $1. You’ll also get 30-day access to all of Zacks' private portfolios for the same dollar.

I encourage you to take advantage right away. The earlier you get in, the greater profits you stand to make. But don't delay. We're limiting the number of investors who share our 7 Best Stocks, so this opportunity will end midnight Sunday, June 1.

Download 7 Best Stocks for the Next 30 Days and check out Zacks' portfolios for just $1 >>

Good Investing,

Bryan Hayes, CFA

Bryan Hayes, CFA, manages our Zacks Income Investor and Headline Trader portfolios. He employs a combination of fundamental and technical analysis and has developed a unique approach to selecting stocks with the best profit potential. You can also find him covering a host of investment topics for Zacks.com.

¹ The results listed above are not (or may not be) representative of the performance of all selections made by Zacks Investment Research's newsletter editors and may represent the partial close of a position. Access grants you a comprehensive list of all open and closed trades.