We use cookies to understand how you use our site and to improve your experience.

This includes personalizing content and advertising.

By pressing "Accept All" or closing out of this banner, you consent to the use of all cookies and similar technologies and the sharing of information they collect with third parties.

You can reject marketing cookies by pressing "Deny Optional," but we still use essential, performance, and functional cookies.

In addition, whether you "Accept All," Deny Optional," click the X or otherwise continue to use the site, you accept our Privacy Policy and Terms of Service, revised from time to time.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

CALM Bets on Value-Added Foods: Will It Deliver Sustainable Growth?

Read MoreHide Full Article

Key Takeaways

CALM bought Echo Lake Foods to expand into value-added, ready-to-eat egg and breakfast products.

Echo Lake Foods had $240M in 2024 sales; the deal should add $15M in annual synergies.

CALM aims to reduce earnings volatility by diversifying beyond shell eggs into processed food offerings.

Cal-Maine Foods, Inc. (CALM - Free Report) , the largest egg producer in the United States, has acquired Echo Lake Foods to tap the growing and highly stable value-added egg products category.

Echo Lake Foods specializes in ready-to-eat egg products and breakfast foods, including waffles, pancakes, scrambled eggs, frozen cooked omelets, among others. This complements Cal-Maine Foods’ egg product offerings from the recent acquisitions of Meadowcreek Food (hard-cooked eggs) and Crepini Foods (egg wraps and protein pancakes).

Cal-Maine Foods has acquired 26 companies over the last 35 years, boosting its egg production capacity, particularly in cage-free eggs. Its recent acquisitions have been focused on diversifying its offerings beyond shell eggs to broaden retail reach. The addition of Echo Lake Foods will expand CALM’s relationships with retail, quick service restaurant and other food service customers.

Echo Lake Foods generated revenues of approximately $240 million in 2024. The deal is expected to generate about $15 million in annual synergies through egg sourcing and SG&A efficiencies, and be mid-single digit accretive to CALM’s earnings beginning in fiscal 2026.

The U.S. Prepared Breakfast Food market has witnessed a compound annual growth rate (CAGR) of 11.7% from 2021 to 2024, to around $21.7 billion, driven by consumer habits favoring convenience and nutrition. Within this segment, demand for egg-based products is rising sharply, driven by the growing popularity of high-protein, easy-to-prepare breakfasts.

With egg prices subject to volatility, the expansion into processed food provides Cal-Maine Foods with a more stable and predictable revenue stream, reduces earnings volatility and offers long-term growth potential.

However, this places Cal-Maine Foods against other established players such as Conagra Brands (CAG - Free Report) and Nestle (NSRGY - Free Report) . Conagra Brands’ Healthy Choice entered the breakfast category in 2018 with the launch of Morning Power Bowls that had egg whites and scrambled eggs, among other options. Conagra Brands continues to capitalize on its strong brand portfolio, strategic acquisitions and innovation in high-growth areas like snacks and frozen foods.

Nestlé, a global powerhouse, plays a major role in the breakfast space, particularly in cereals and granola. Beyond traditional breakfast items, Nestlé also offers egg-based meals and breakfast sandwiches through its Hot Pockets and Lean Cuisine lines. Both Nestlé and Conagra Brands are formidable opponents for Cal-Maine Foods, given their scale and brand recognition, and innovation focus.

CALM’s Price Performance, Valuation & Estimates

Cal-Maine Foods has declined 7.3% so far this year compared with the industry's 4.8% dip.

Image Source: Zacks Investment Research

CALM is currently trading at a forward 12-month price/earnings (P/E) ratio of 4.24X compared with the industry’s 11.69X.

Image Source: Zacks Investment Research

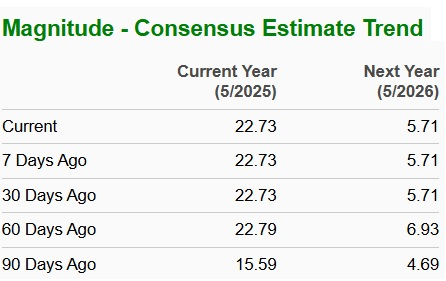

The Zacks Consensus Estimate for Cal-Maine Foods’ fiscal 2025 earnings is $22.73 per share, indicating a year-over-year upsurge of 299.5%. The estimate for fiscal 2026 of $5.71 indicates a 74.9% decline. The chart below depicts the revision activity for CALM’s earnings estimates for 2025 and 2026. Image Source: Zacks Investment Research

Image: Bigstock

CALM Bets on Value-Added Foods: Will It Deliver Sustainable Growth?

Key Takeaways

Cal-Maine Foods, Inc. (CALM - Free Report) , the largest egg producer in the United States, has acquired Echo Lake Foods to tap the growing and highly stable value-added egg products category.

Echo Lake Foods specializes in ready-to-eat egg products and breakfast foods, including waffles, pancakes, scrambled eggs, frozen cooked omelets, among others. This complements Cal-Maine Foods’ egg product offerings from the recent acquisitions of Meadowcreek Food (hard-cooked eggs) and Crepini Foods (egg wraps and protein pancakes).

Cal-Maine Foods has acquired 26 companies over the last 35 years, boosting its egg production capacity, particularly in cage-free eggs. Its recent acquisitions have been focused on diversifying its offerings beyond shell eggs to broaden retail reach. The addition of Echo Lake Foods will expand CALM’s relationships with retail, quick service restaurant and other food service customers.

Echo Lake Foods generated revenues of approximately $240 million in 2024. The deal is expected to generate about $15 million in annual synergies through egg sourcing and SG&A efficiencies, and be mid-single digit accretive to CALM’s earnings beginning in fiscal 2026.

The U.S. Prepared Breakfast Food market has witnessed a compound annual growth rate (CAGR) of 11.7% from 2021 to 2024, to around $21.7 billion, driven by consumer habits favoring convenience and nutrition. Within this segment, demand for egg-based products is rising sharply, driven by the growing popularity of high-protein, easy-to-prepare breakfasts.

With egg prices subject to volatility, the expansion into processed food provides Cal-Maine Foods with a more stable and predictable revenue stream, reduces earnings volatility and offers long-term growth potential.

However, this places Cal-Maine Foods against other established players such as Conagra Brands (CAG - Free Report) and Nestle (NSRGY - Free Report) . Conagra Brands’ Healthy Choice entered the breakfast category in 2018 with the launch of Morning Power Bowls that had egg whites and scrambled eggs, among other options. Conagra Brands continues to capitalize on its strong brand portfolio, strategic acquisitions and innovation in high-growth areas like snacks and frozen foods.

Nestlé, a global powerhouse, plays a major role in the breakfast space, particularly in cereals and granola. Beyond traditional breakfast items, Nestlé also offers egg-based meals and breakfast sandwiches through its Hot Pockets and Lean Cuisine lines. Both Nestlé and Conagra Brands are formidable opponents for Cal-Maine Foods, given their scale and brand recognition, and innovation focus.

CALM’s Price Performance, Valuation & Estimates

Cal-Maine Foods has declined 7.3% so far this year compared with the industry's 4.8% dip.

CALM is currently trading at a forward 12-month price/earnings (P/E) ratio of 4.24X compared with the industry’s 11.69X.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for Cal-Maine Foods’ fiscal 2025 earnings is $22.73 per share, indicating a year-over-year upsurge of 299.5%. The estimate for fiscal 2026 of $5.71 indicates a 74.9% decline. The chart below depicts the revision activity for CALM’s earnings estimates for 2025 and 2026.

Image Source: Zacks Investment Research

CALM currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.