We use cookies to understand how you use our site and to improve your experience.

This includes personalizing content and advertising.

By pressing "Accept All" or closing out of this banner, you consent to the use of all cookies and similar technologies and the sharing of information they collect with third parties.

You can reject marketing cookies by pressing "Deny Optional," but we still use essential, performance, and functional cookies.

In addition, whether you "Accept All," Deny Optional," click the X or otherwise continue to use the site, you accept our Privacy Policy and Terms of Service, revised from time to time.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

TSM vs. LRCX: Which Chip Supplier Stock Is the Smarter Pick?

Read MoreHide Full Article

Key Takeaways

LRCX benefits from AI trends, reporting 24.5% revenue growth and 33.3% EPS growth in fiscal Q3 2025.

TSM posted 35% revenue growth in Q1 2025, with AI-related revenues expected to double in 2025.

LRCX shipments for advanced nodes topped $1B in 2024, projected to exceed $3B in 2025.

Taiwan Semiconductor Manufacturing Company (TSM - Free Report) and Lam Research Corporation (LRCX - Free Report) are two of the most important companies in the semiconductor industry. Taiwan Semiconductor Manufacturing, also known as TSMC, makes the actual chips that power everything from smartphones to AI servers. Lam Research makes the equipment that chipmakers like TSMC use to produce those chips. Both companies are crucial to the tech supply chain and have seen strong demand in recent years.

However, with rising demand for artificial intelligence (AI), 5G and advanced chips, the question is: Which is the smarter pick for investors today?

TSMC: Foundry Leader With Big Opportunities and Risks

TSM manufactures chips for the world’s top tech companies, including NVIDIA, Advanced Micro Devices and Broadcom. Taiwan Semiconductor Manufacturing is known for its advanced production capabilities and has already moved into 3nm production, with 2nm coming soon. Its large scale allows it to handle rising AI chip demand better than most competitors.

In the first quarter of 2025, Taiwan Semiconductor Manufacturing reported a 35% increase in revenues and a 53% jump in profit. Its 3nm and 5nm chips accounted for nearly 58% of wafer sales. AI-related revenues tripled in 2024 and are expected to double again in 2025. With AI likely to be a long-term driver, TSMC’s future growth potential looks strong.

Taiwan Semiconductor Manufacturing is also investing heavily to stay ahead. It plans to spend up to $42 billion in 2025, mostly on advanced manufacturing. This is up from $29.8 billion in 2024 and shows its commitment to keeping its lead in cutting-edge chip production.

However, challenges do linger. Taiwan Semiconductor Manufacturing’s heavy presence in Taiwan leaves it exposed to geopolitical tensions between China and the United States. While the company is building new fabs in the United States, Japan and Europe, these projects are costly and take time. Rising energy prices in Taiwan and weakness in the smartphone and PC markets could also pressure profits in the short term.

Lam Research: A Strong Player With Steady Gains

Lam Research is also capitalizing on the same AI trends but from the equipment side. It builds the tools chipmakers need to manufacture next-generation semiconductors, including high-bandwidth memory (HBM) and chips used in advanced packaging. These technologies are vital for powering AI and cloud data centers.

Lam Research’s products are not only critical but also innovative. For example, its ALTUS ALD tool uses molybdenum to improve speed and efficiency in chip production. Another product, the Aether platform, helps chipmakers achieve higher performance and density. These are essential capabilities as demand for advanced AI chips increases.

In 2024, Lam Research’s shipments for gate-all-around nodes and advanced packaging exceeded $1 billion, and management expects this figure to triple to more than $3 billion in 2025. Additionally, the industry’s migration to backside power distribution and dry-resist processing presents further growth opportunities for LRCX’s cutting-edge fabrication solutions.

These trends are aiding Lam Research’s financial performance. In the third quarter of fiscal 2025, the company reported revenues of $4.72 billion, up 24.5% year over year, and non-GAAP EPS of $1.04, highlighting a 33.3% increase (adjusting for stock split).

TSM vs. LRCX: Earnings Outlook and Valuation

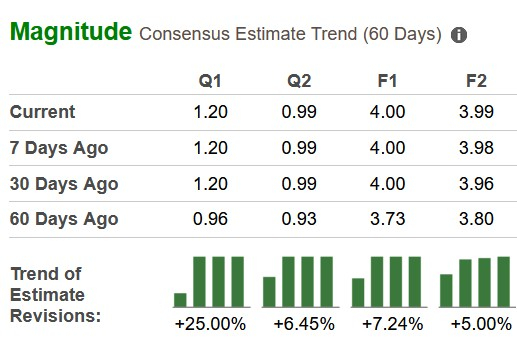

The Zacks Consensus Estimate for Taiwan Semiconductor Manufacturing’s 2025 EPS implies year-over-year growth of 31.8%, slightly lower than Lam Research’s 33.8% for fiscal 2025. Moreover, the earnings estimate revision trend for the two companies reflects that analysts are turning more bullish toward LRCX.

LRCX Earnings Estimate Revision Trend Image Source: Zacks Investment Research

TSM Earnings Estimate Revision Trend

Image Source: Zacks Investment Research

On the valuation front, Lam Research trades at 23.16 times forward earnings compared to 21.43 times for Taiwan Semiconductor Manufacturing. While LRCX looks more expensive, its positive earnings momentum justifies the premium. TSMC’s lower valuation reflects its risks, including higher capital spending and geopolitical concerns.

Image Source: Zacks Investment Research

Year to date, LRCX stock has soared 27.7%, while TSM shares have risen 8.1%. This difference shows how investors are weighing the risks and rewards of each company.

Image Source: Zacks Investment Research

Conclusion: LRCX Is the Smarter Pick Right Now

Taiwan Semiconductor Manufacturing and Lam Research are both strong companies in an industry that should keep growing. But today, Lam Research seems like the better investment. It is benefiting from the same AI trends as TSMC but with fewer risks from political tensions and spending. Its steady growth, strong demand and solid profits make Lam Research a smarter choice for investors right now.

Image: Bigstock

TSM vs. LRCX: Which Chip Supplier Stock Is the Smarter Pick?

Key Takeaways

Taiwan Semiconductor Manufacturing Company (TSM - Free Report) and Lam Research Corporation (LRCX - Free Report) are two of the most important companies in the semiconductor industry. Taiwan Semiconductor Manufacturing, also known as TSMC, makes the actual chips that power everything from smartphones to AI servers. Lam Research makes the equipment that chipmakers like TSMC use to produce those chips. Both companies are crucial to the tech supply chain and have seen strong demand in recent years.

However, with rising demand for artificial intelligence (AI), 5G and advanced chips, the question is: Which is the smarter pick for investors today?

TSMC: Foundry Leader With Big Opportunities and Risks

TSM manufactures chips for the world’s top tech companies, including NVIDIA, Advanced Micro Devices and Broadcom. Taiwan Semiconductor Manufacturing is known for its advanced production capabilities and has already moved into 3nm production, with 2nm coming soon. Its large scale allows it to handle rising AI chip demand better than most competitors.

In the first quarter of 2025, Taiwan Semiconductor Manufacturing reported a 35% increase in revenues and a 53% jump in profit. Its 3nm and 5nm chips accounted for nearly 58% of wafer sales. AI-related revenues tripled in 2024 and are expected to double again in 2025. With AI likely to be a long-term driver, TSMC’s future growth potential looks strong.

Taiwan Semiconductor Manufacturing is also investing heavily to stay ahead. It plans to spend up to $42 billion in 2025, mostly on advanced manufacturing. This is up from $29.8 billion in 2024 and shows its commitment to keeping its lead in cutting-edge chip production.

However, challenges do linger. Taiwan Semiconductor Manufacturing’s heavy presence in Taiwan leaves it exposed to geopolitical tensions between China and the United States. While the company is building new fabs in the United States, Japan and Europe, these projects are costly and take time. Rising energy prices in Taiwan and weakness in the smartphone and PC markets could also pressure profits in the short term.

Lam Research: A Strong Player With Steady Gains

Lam Research is also capitalizing on the same AI trends but from the equipment side. It builds the tools chipmakers need to manufacture next-generation semiconductors, including high-bandwidth memory (HBM) and chips used in advanced packaging. These technologies are vital for powering AI and cloud data centers.

Lam Research’s products are not only critical but also innovative. For example, its ALTUS ALD tool uses molybdenum to improve speed and efficiency in chip production. Another product, the Aether platform, helps chipmakers achieve higher performance and density. These are essential capabilities as demand for advanced AI chips increases.

In 2024, Lam Research’s shipments for gate-all-around nodes and advanced packaging exceeded $1 billion, and management expects this figure to triple to more than $3 billion in 2025. Additionally, the industry’s migration to backside power distribution and dry-resist processing presents further growth opportunities for LRCX’s cutting-edge fabrication solutions.

These trends are aiding Lam Research’s financial performance. In the third quarter of fiscal 2025, the company reported revenues of $4.72 billion, up 24.5% year over year, and non-GAAP EPS of $1.04, highlighting a 33.3% increase (adjusting for stock split).

TSM vs. LRCX: Earnings Outlook and Valuation

The Zacks Consensus Estimate for Taiwan Semiconductor Manufacturing’s 2025 EPS implies year-over-year growth of 31.8%, slightly lower than Lam Research’s 33.8% for fiscal 2025. Moreover, the earnings estimate revision trend for the two companies reflects that analysts are turning more bullish toward LRCX.

LRCX Earnings Estimate Revision Trend

Image Source: Zacks Investment Research

TSM Earnings Estimate Revision Trend

Image Source: Zacks Investment Research

On the valuation front, Lam Research trades at 23.16 times forward earnings compared to 21.43 times for Taiwan Semiconductor Manufacturing. While LRCX looks more expensive, its positive earnings momentum justifies the premium. TSMC’s lower valuation reflects its risks, including higher capital spending and geopolitical concerns.

Image Source: Zacks Investment Research

Year to date, LRCX stock has soared 27.7%, while TSM shares have risen 8.1%. This difference shows how investors are weighing the risks and rewards of each company.

Image Source: Zacks Investment Research

Conclusion: LRCX Is the Smarter Pick Right Now

Taiwan Semiconductor Manufacturing and Lam Research are both strong companies in an industry that should keep growing. But today, Lam Research seems like the better investment. It is benefiting from the same AI trends as TSMC but with fewer risks from political tensions and spending. Its steady growth, strong demand and solid profits make Lam Research a smarter choice for investors right now.

Currently, Lam Research has a Zacks Rank #2 (Buy), making the stock a must-pick compared to Taiwan Semiconductor Manufacturing, which has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.