We use cookies to understand how you use our site and to improve your experience.

This includes personalizing content and advertising.

By pressing "Accept All" or closing out of this banner, you consent to the use of all cookies and similar technologies and the sharing of information they collect with third parties.

You can reject marketing cookies by pressing "Deny Optional," but we still use essential, performance, and functional cookies.

In addition, whether you "Accept All," Deny Optional," click the X or otherwise continue to use the site, you accept our Privacy Policy and Terms of Service, revised from time to time.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

Footwear Demand Cools: Can NIKE Keep Its Lead in the Sneaker Game?

Read MoreHide Full Article

Key Takeaways

NIKE's classic sneaker sales are declining due to shifting trends and consumer price sensitivity.

Growth in running, training, basketball and sportswear is partially offsetting weaker classic demand.

NKE plans to reduce classic footwear mix further in FY26, with unit volumes likely down double digits.

NIKE, Inc. (NKE - Free Report) is a globally recognized American brand specializing in athletic footwear, apparel and sports equipment. The company has long been considered as a leader in the sneaker market.

However, footwear demand has been sluggish for a while, as seasonal trends have shifted consumer priorities mainly in the oversaturated segments, such as classic sneakers and bulky dad shoes. Macroeconomic factors including inflation, consumer price sensitivity and broader market headwinds are further pulling down the demand. With continued macroeconomic uncertainty, consumers are tightening their wallets and scaling back discretionary purchases, especially in non-essential items including work and dress shoes.

NKE has been witnessing declines in classic footwear franchises, which are being nearly offset by growth in the performance categories of its portfolio including running, training and basketball, as well as innovations in sportswear. Management, in its third-quarter fiscal 2025 earnings release, projected NKE’s classic footwear franchises to be down by more than 10 points as a percentage of its overall footwear mix. NIKE expects driving this mix lower in fiscal 2026, with total unit volumes likely to drop double digits, led by the aggressive measures in the Dunk franchise.

We expect footwear revenues for NIKE brand to decline 13.1% year over year in fiscal 2025 and 3.3% in fiscal 2026. Nevertheless, the company is taking swift actions to rightsize the contribution of its classic footwear franchises for sustainable growth. The team has been actively managing key footwear franchises by realigning inventory levels, supported by a steady pipeline of innovative and highly coveted products. However, the transition might take time to yield results.

adidas and lululemon Challenge NIKE’s Footwear Dominance

adidas AG (ADDYY - Free Report) and lululemon athletica inc. (LULU - Free Report) are stepping up their game in the footwear arena, posing a growing threat to NIKE’s long-held dominance through innovation, brand momentum and targeted market expansion.

adidas is another sporting goods giant vying for a larger share in the footwear market. The company offers a comprehensive selection of athletic apparel, footwear and equipment across sports, such as running, football, basketball and training. It is aggressively focused on strengthening its market dominance by launching relevant product lines and innovations alongside enhancing its brand presence through collaborations and marketing campaigns. adidas leverages high-profile collaborations with icons such as Bad Bunny, Pharrell Williams and Yohji Yamamoto (Y-3) to reinforce cultural relevance and consumer appeal, especially in the highly-competitive sneaker market.

With a strong emphasis on personalized fit, feel and biomechanics, lululemon establishes itself as a premium contender in the athletic footwear market. lululemon is methodically developing its footwear section by blending rigorous biomechanical insights, gender-specific design and versatile performance appeal. The company initially launched its footwear line with focus on women's athletic shoes, and has expanded into men's collection as part of its Spring/Summer lineup. This move is part of lululemon's strategy to grow its consumer base and leverage the demand for athletic footwear.

NKE’s Price Performance, Valuation and Estimates

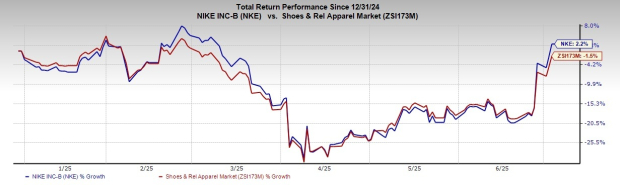

Shares of NIKE have gained 2.2% year to date against the industry’s decline of 1.5%.

i Image Source: Zacks Investment Research

From a valuation standpoint, NKE trades at a forward price-to-earnings ratio of 41.68X, higher than the industry’s average of 30.63X.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for NKE’s fiscal 2025 earnings implies a year-over-year plunge of 21.3% while that of fiscal 2026 shows growth of 54%, respectively. The company’s EPS estimate for fiscal 2025 and fiscal 2026 has moved down in the past 30 days.

Image Source: Zacks Investment Research

NIKE stock currently carries a Zacks Rank #3 (Hold).

Image: Bigstock

Footwear Demand Cools: Can NIKE Keep Its Lead in the Sneaker Game?

Key Takeaways

NIKE, Inc. (NKE - Free Report) is a globally recognized American brand specializing in athletic footwear, apparel and sports equipment. The company has long been considered as a leader in the sneaker market.

However, footwear demand has been sluggish for a while, as seasonal trends have shifted consumer priorities mainly in the oversaturated segments, such as classic sneakers and bulky dad shoes. Macroeconomic factors including inflation, consumer price sensitivity and broader market headwinds are further pulling down the demand. With continued macroeconomic uncertainty, consumers are tightening their wallets and scaling back discretionary purchases, especially in non-essential items including work and dress shoes.

NKE has been witnessing declines in classic footwear franchises, which are being nearly offset by growth in the performance categories of its portfolio including running, training and basketball, as well as innovations in sportswear. Management, in its third-quarter fiscal 2025 earnings release, projected NKE’s classic footwear franchises to be down by more than 10 points as a percentage of its overall footwear mix. NIKE expects driving this mix lower in fiscal 2026, with total unit volumes likely to drop double digits, led by the aggressive measures in the Dunk franchise.

We expect footwear revenues for NIKE brand to decline 13.1% year over year in fiscal 2025 and 3.3% in fiscal 2026. Nevertheless, the company is taking swift actions to rightsize the contribution of its classic footwear franchises for sustainable growth. The team has been actively managing key footwear franchises by realigning inventory levels, supported by a steady pipeline of innovative and highly coveted products. However, the transition might take time to yield results.

adidas and lululemon Challenge NIKE’s Footwear Dominance

adidas AG (ADDYY - Free Report) and lululemon athletica inc. (LULU - Free Report) are stepping up their game in the footwear arena, posing a growing threat to NIKE’s long-held dominance through innovation, brand momentum and targeted market expansion.

adidas is another sporting goods giant vying for a larger share in the footwear market. The company offers a comprehensive selection of athletic apparel, footwear and equipment across sports, such as running, football, basketball and training. It is aggressively focused on strengthening its market dominance by launching relevant product lines and innovations alongside enhancing its brand presence through collaborations and marketing campaigns. adidas leverages high-profile collaborations with icons such as Bad Bunny, Pharrell Williams and Yohji Yamamoto (Y-3) to reinforce cultural relevance and consumer appeal, especially in the highly-competitive sneaker market.

With a strong emphasis on personalized fit, feel and biomechanics, lululemon establishes itself as a premium contender in the athletic footwear market. lululemon is methodically developing its footwear section by blending rigorous biomechanical insights, gender-specific design and versatile performance appeal. The company initially launched its footwear line with focus on women's athletic shoes, and has expanded into men's collection as part of its Spring/Summer lineup. This move is part of lululemon's strategy to grow its consumer base and leverage the demand for athletic footwear.

NKE’s Price Performance, Valuation and Estimates

Shares of NIKE have gained 2.2% year to date against the industry’s decline of 1.5%.

i

Image Source: Zacks Investment Research

From a valuation standpoint, NKE trades at a forward price-to-earnings ratio of 41.68X, higher than the industry’s average of 30.63X.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for NKE’s fiscal 2025 earnings implies a year-over-year plunge of 21.3% while that of fiscal 2026 shows growth of 54%, respectively. The company’s EPS estimate for fiscal 2025 and fiscal 2026 has moved down in the past 30 days.

Image Source: Zacks Investment Research

NIKE stock currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.