We use cookies to understand how you use our site and to improve your experience.

This includes personalizing content and advertising.

By pressing "Accept All" or closing out of this banner, you consent to the use of all cookies and similar technologies and the sharing of information they collect with third parties.

You can reject marketing cookies by pressing "Deny Optional," but we still use essential, performance, and functional cookies.

In addition, whether you "Accept All," Deny Optional," click the X or otherwise continue to use the site, you accept our Privacy Policy and Terms of Service, revised from time to time.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

Flotek's Premium Valuation: Should Investors Buy the Stock?

Read MoreHide Full Article

Key Takeaways

FTK trades at a 16.63X forward P/E, above its industry average and rival ChampionX's valuation.

A ProFrac lease deal may add $27.4M in recurring analytics revenue by 2026, boosting FTK's margins.

Flotek posted 10 straight quarters of EBITDA growth,with Q1 2025 profits rising 93% year over year.

Flotek Industries (FTK - Free Report) is currently considered relatively overvalued, trading at a forward 12-month price-to-earnings ratio of 16.63. This figure surpasses the Zacks Oil and Gas - Field Services industry average of 12.78. It is also higher than rival ChampionX (CHX - Free Report) .

FTK's P/E F12M vs. Industry & CHX

Image Source: Zacks Investment Research

The question that naturally arises is whether it is worth overpaying for the energy services provider? Let us delve deeper and analyze Flotek’s fundamentals and overall business environment.

The ProFrac Deal

In April 2025, FTK purchased 30 mobile gas monitoring and dual-fuel optimization units from ProFrac Holding Corp. (ACDC - Free Report) . More than buying equipment, the transaction is seen as a strategic bet on building recurring, high-margin revenues from real-time gas analytics and remote power solutions. These units help generate electricity on-site, especially in remote areas, by optimizing fuel quality and reducing emissions.

Twenty-two of the acquired assets are already deployed under a six-year lease with ProFrac, projected to generate $14 million in EBITDA in 2025. Once all 30 units are up and running, FTK estimates that annual lease revenues could reach $27.4 million in 2026 — almost double the Data Analytics segment’s revenues in 2024. Importantly, the ProFrac deal was structured to preserve cash by using a combination of equity, promissory notes, and shortfall penalty offsets.

While ChampionX has expanded its digital offerings through production optimization tools, it is yet to adopt a lease-based model for its analytics technology. ChampionX’s digital revenues remain modest, and its greater reliance on short-cycle markets adds volatility.

Digitizing Custody Transfer

Flotek is starting to make a name for itself in custody transfer — part of the oil business that is often ignored but significant. It is the process that decides how oil and gas revenues get split among producers, royalty owners and midstream companies. This process has typically been done manually, but Flotek’s JP3 XSPCT Analyzer brings automation and real-time data into the mix.

In early testing at eight sites in the Permian Basin, the system found big problems — up to $3.5 million a year in underpayments when compared to the old manual method. That’s not just a small error; it’s money that should be flowing to the right parties but isn’t. Naturally, the industry is starting to get noticed.

Starting in Q2 2025, Flotek is turning those pilot tests into monthly contracts, which means steady, recurring revenues for its Data Analytics division. What was once a test expense is now becoming a high-margin service. With its digital platform Viper, Flotek also offers tools for continuous monitoring, reporting and compliance — all in one place.

10 Straight Quarters of EBITDA Gains

Flotek has quietly achieved a significant milestone: 10 straight quarters of improved adjusted EBITDA. This kind of consistent performance is rare for a smaller energy company. From losing $5.1 million in late 2022 to gaining $7.8 million in the first quarter of 2025, Flotek has truly turned its financial health around. This shows smart management and solid execution in both its chemical and data analytics businesses. This steady progress is primarily the direct result of winning new contracts consistently and improving its profit margins.

What's really impressive is how fast these improvements are occurring. During the January-March period of this year, FTK's adjusted EBITDA soared by 93% from the first quarter of 2024. At the same time, their overall profit margins grew, and their selling, general, and administrative (SG&A) costs, when compared to their revenues, shrank to just 11%. These gains reflect fundamental improvements in how Flotek runs its business. Even in a challenging market for oilfield services, Flotek has managed to grow both its sales and profits without taking on too much risk.

Northward Earnings Estimates for FTK Stock

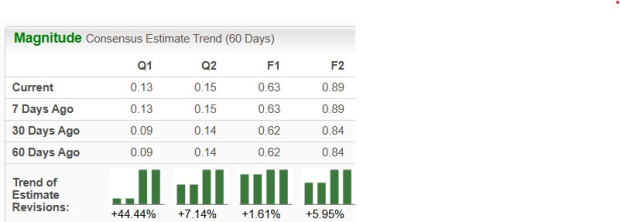

Over the past 60 days, the Zacks Consensus Estimate for Flotek’s second- and third-quarter 2025 earnings, as well as its 2025 and 2026 earnings, has moved north.Image Source: Zacks Investment Researc

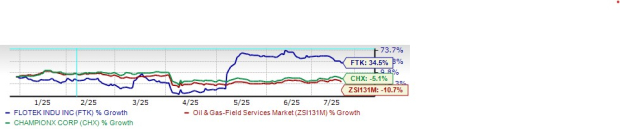

YTD Price Comparison

FTK shares have gained 34.5% so far this year compared to the industry’s 11% fall. ChampionX has slid more than 5% during this timeframe.Image Source: Zacks Investment Research

Assessing FTK’s High Valuation

The positive developments have likely led to Flotek’s premium valuations, as investors have high expectations for the company’s prospects and profitability. Consequently, they are willing to pay a premium for the stock, anticipating that it will outperform its peers and the broader market in the coming months.

However, there are several uncertainties regarding the stock. While Q2 schedules remain solid, management flagged uncertainty around activity levels in the second half of 2025. Lower oil prices and potential tariff impacts on pipe and tubular costs have prompted some E&P operators to reduce capital spending. This could directly impact Flotek’s Chemistry segment, which is tied to upstream activity.

Then, the company’s dependence on a few large contracts introduces concentration risk. The ProFrac deal, with a multi-year lease providing $160 million revenue backlog, is a major positive. However, it also introduces a degree of concentration risk if customer performance or demand falters. While the long-term nature of the deal helps stabilize revenues, any operational disruption or contract renegotiation could have a significant financial impact. Similarly, the eight of the 30 acquired PowerTech assets are not yet revenue-generating. If deployment timelines slip or utilization rates underwhelm, the expected boost to recurring revenues in H2 2025 and 2026 could be delayed.

FTK is expanding aggressively across upstream applications like custody transfer, flare monitoring, and smart filtration skids. While the total addressable market is large, these applications require education, longer sales cycles, and infrastructure rollout. For instance, while FTK has eight custody transfer pilot locations converting to revenues, real adoption across legacy wells remains limited due to operator concerns around historical underpayments. The ability to convert pilot sites into broader deployment at scale remains an open question and a potential drag on execution.

How to Play Flotek Stock Now?

Based on the write-up, we can safely conclude that the company’s long-term outlook is strong and some investors may be willing to accept the premium. However, its current stock price already reflects a lot of this optimism. With the company facing certain risks, like reliance on key contracts and challenges in scaling new technology, jumping in now might mean overpaying. Therefore, while Flotek is a stock to watch, it might be smart for investors to wait for a more attractive entry point before buying shares. FTK currently carries a Zacks Rank #3 (Hold).

Image: Bigstock

Flotek's Premium Valuation: Should Investors Buy the Stock?

Key Takeaways

Flotek Industries (FTK - Free Report) is currently considered relatively overvalued, trading at a forward 12-month price-to-earnings ratio of 16.63. This figure surpasses the Zacks Oil and Gas - Field Services industry average of 12.78. It is also higher than rival ChampionX (CHX - Free Report) .

FTK's P/E F12M vs. Industry & CHX

The question that naturally arises is whether it is worth overpaying for the energy services provider? Let us delve deeper and analyze Flotek’s fundamentals and overall business environment.

The ProFrac Deal

In April 2025, FTK purchased 30 mobile gas monitoring and dual-fuel optimization units from ProFrac Holding Corp. (ACDC - Free Report) . More than buying equipment, the transaction is seen as a strategic bet on building recurring, high-margin revenues from real-time gas analytics and remote power solutions. These units help generate electricity on-site, especially in remote areas, by optimizing fuel quality and reducing emissions.

Twenty-two of the acquired assets are already deployed under a six-year lease with ProFrac, projected to generate $14 million in EBITDA in 2025. Once all 30 units are up and running, FTK estimates that annual lease revenues could reach $27.4 million in 2026 — almost double the Data Analytics segment’s revenues in 2024. Importantly, the ProFrac deal was structured to preserve cash by using a combination of equity, promissory notes, and shortfall penalty offsets.

While ChampionX has expanded its digital offerings through production optimization tools, it is yet to adopt a lease-based model for its analytics technology. ChampionX’s digital revenues remain modest, and its greater reliance on short-cycle markets adds volatility.

Digitizing Custody Transfer

Flotek is starting to make a name for itself in custody transfer — part of the oil business that is often ignored but significant. It is the process that decides how oil and gas revenues get split among producers, royalty owners and midstream companies. This process has typically been done manually, but Flotek’s JP3 XSPCT Analyzer brings automation and real-time data into the mix.

In early testing at eight sites in the Permian Basin, the system found big problems — up to $3.5 million a year in underpayments when compared to the old manual method. That’s not just a small error; it’s money that should be flowing to the right parties but isn’t. Naturally, the industry is starting to get noticed.

Starting in Q2 2025, Flotek is turning those pilot tests into monthly contracts, which means steady, recurring revenues for its Data Analytics division. What was once a test expense is now becoming a high-margin service. With its digital platform Viper, Flotek also offers tools for continuous monitoring, reporting and compliance — all in one place.

10 Straight Quarters of EBITDA Gains

Flotek has quietly achieved a significant milestone: 10 straight quarters of improved adjusted EBITDA. This kind of consistent performance is rare for a smaller energy company. From losing $5.1 million in late 2022 to gaining $7.8 million in the first quarter of 2025, Flotek has truly turned its financial health around. This shows smart management and solid execution in both its chemical and data analytics businesses. This steady progress is primarily the direct result of winning new contracts consistently and improving its profit margins.

What's really impressive is how fast these improvements are occurring. During the January-March period of this year, FTK's adjusted EBITDA soared by 93% from the first quarter of 2024. At the same time, their overall profit margins grew, and their selling, general, and administrative (SG&A) costs, when compared to their revenues, shrank to just 11%. These gains reflect fundamental improvements in how Flotek runs its business. Even in a challenging market for oilfield services, Flotek has managed to grow both its sales and profits without taking on too much risk.

Northward Earnings Estimates for FTK Stock

Over the past 60 days, the Zacks Consensus Estimate for Flotek’s second- and third-quarter 2025 earnings, as well as its 2025 and 2026 earnings, has moved north. Image Source: Zacks Investment Researc

Image Source: Zacks Investment Researc

YTD Price Comparison

FTK shares have gained 34.5% so far this year compared to the industry’s 11% fall. ChampionX has slid more than 5% during this timeframe. Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Assessing FTK’s High Valuation

The positive developments have likely led to Flotek’s premium valuations, as investors have high expectations for the company’s prospects and profitability. Consequently, they are willing to pay a premium for the stock, anticipating that it will outperform its peers and the broader market in the coming months.

However, there are several uncertainties regarding the stock. While Q2 schedules remain solid, management flagged uncertainty around activity levels in the second half of 2025. Lower oil prices and potential tariff impacts on pipe and tubular costs have prompted some E&P operators to reduce capital spending. This could directly impact Flotek’s Chemistry segment, which is tied to upstream activity.

Then, the company’s dependence on a few large contracts introduces concentration risk. The ProFrac deal, with a multi-year lease providing $160 million revenue backlog, is a major positive. However, it also introduces a degree of concentration risk if customer performance or demand falters. While the long-term nature of the deal helps stabilize revenues, any operational disruption or contract renegotiation could have a significant financial impact. Similarly, the eight of the 30 acquired PowerTech assets are not yet revenue-generating. If deployment timelines slip or utilization rates underwhelm, the expected boost to recurring revenues in H2 2025 and 2026 could be delayed.

FTK is expanding aggressively across upstream applications like custody transfer, flare monitoring, and smart filtration skids. While the total addressable market is large, these applications require education, longer sales cycles, and infrastructure rollout. For instance, while FTK has eight custody transfer pilot locations converting to revenues, real adoption across legacy wells remains limited due to operator concerns around historical underpayments. The ability to convert pilot sites into broader deployment at scale remains an open question and a potential drag on execution.

How to Play Flotek Stock Now?

Based on the write-up, we can safely conclude that the company’s long-term outlook is strong and some investors may be willing to accept the premium. However, its current stock price already reflects a lot of this optimism. With the company facing certain risks, like reliance on key contracts and challenges in scaling new technology, jumping in now might mean overpaying. Therefore, while Flotek is a stock to watch, it might be smart for investors to wait for a more attractive entry point before buying shares. FTK currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.