We use cookies to understand how you use our site and to improve your experience.

This includes personalizing content and advertising.

By pressing "Accept All" or closing out of this banner, you consent to the use of all cookies and similar technologies and the sharing of information they collect with third parties.

You can reject marketing cookies by pressing "Deny Optional," but we still use essential, performance, and functional cookies.

In addition, whether you "Accept All," Deny Optional," click the X or otherwise continue to use the site, you accept our Privacy Policy and Terms of Service, revised from time to time.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

UUUU vs. CCJ: Which Uranium Stock is the Better Buy Now?

Read MoreHide Full Article

Key Takeaways

Energy Fuels aims to quadruple uranium output to 1M pounds in 2025, led by the Pinyon Plain mine.

Cameco targets 2025 uranium deliveries of 31-34M pounds, including 22.4M pounds from its share of production.

UUUU stock has gained 84.8% YTD, topping CCJ's 54.1%, and trades below its five-year median valuation.

Energy Fuels Inc. (UUUU - Free Report) and Cameco Corporation (CCJ - Free Report) are major players in the uranium production industry and are expected to play a significant role in contributing to the global nuclear energy supply chain.

Uranium prices have been under pressure recently, declining to $71 per pound as a pause in fresh buying by holding funds allowed utilities to set lower bids. Prices are down 14.3% in a year. Prices had briefly surged to a seven-month high of $79 in late June, following a major purchase announcement from the Sprott Physical Uranium Trust, but the rally was short-lived.

The long-term outlook for uranium remains strong, driven by the growing push for clean energy. The U.S. government’s initiative to quadruple domestic nuclear energy capacity by 2050, along with rising energy needs from AI data centers, has boosted long-term demand expectations. Against this backdrop, investors are evaluating which uranium stock is better positioned, Energy Fuels or Cameco? To make an informed decision, let us analyze their fundamentals, growth potential and key challenges.

The Case for Energy Fuels

The company has been the leading U.S. producer of natural uranium concentrate for the past several years. It has produced two-thirds of all uranium in the United States since 2017.

UUUU’s White Mesa Mill in Utah remains the only fully licensed and operating conventional uranium processing facility in the United States. Its Pinyon Plain mine in Arizona is a standout asset, delivering 230,661 pounds of uranium in June and 638,700 pounds during the second quarter. It is set to be the highest-grade uranium deposit mined in U.S. history. Pinyon has considerable exploration upside, with Energy Fuels currently extracting ore from only about 25% of the vertical extent of the target zone.

Energy Fuels currently expects to mine 55,000-80,000 tons of ore containing approximately 875,000-1,435,000 pounds of contained uranium from the Pinyon Plain, Pandora and La Sal mines during 2025. This is an increase from the previously reported guidance of approximately 22%. Total finished uranium production for the year could reach up to 1,000,000 pounds – four times its previous expectation of 200,000 pounds.

During the second quarter, Energy Fuels sold 50,000 pounds of uranium on the spot market for $77.00 per pound. The company expects to sell 140,000 pounds of uranium in the third quarter and 160,000 pounds in the fourth quarter under its existing portfolio of long-term utility contracts. In 2026, the company expects to sell between 620,000 and 880,000 pounds of U3O8 under its existing long-term contracts.

Energy Fuels recently initiated the pilot-scale production of heavy rare earth element (HREE) oxides at the mill. It is the only facility in the United States producing HREEs from mined ores at a commercial site. This makes Energy Fuels a pioneer in domestic HREE production, crucial for the permanent magnet industry and national supply-chain security.

Energy Fuels’ Donald Project in Australia is one of the richest deposits of HREEs in the world and is expected to start production by the end of 2027. The Toliara Project in Madagascar and the Bahia Project in Brazil contain significant quantities of light and heavy REE oxides.

Backed by a debt-free balance sheet, Energy Fuels is ramping up uranium production while developing significant REE capabilities. Taking current production levels and its development pipeline into account, the company has the potential to produce 6 million pounds of uranium per year.

The Case for Cameco

Canada-based Cameco accounted for 16% of global uranium production in 2024. Its operations cover the entire nuclear fuel cycle from exploration to fuel services.

Cameco plans to ramp up its tier-one assets and continue to optimize performance and reliability. The company intends to produce 18 million pounds of uranium (100% basis) at each of McArthur River/Key Lake and Cigar Lake in 2025. Cameco’s share of production is expected at 22.4 million pounds of uranium.

CCJ plans to produce between 13 million and 14 million kgU in its fuel services segment in 2025. Uranium deliveries are projected at 31-34 million pounds for 2025.

At joint venture Inkai, production activity was suspended by the majority owner and controlling partner, Kazatomprom, from Jan. 1, 2025. Production resumed on Jan. 23, 2025. Despite the interruption, the 2025 guidance has been unchanged. JV Inkai has revised its mine plan and budget to reflect the temporary suspension and now aims to produce 8.3 million pounds this year (100% basis), with Cameco’s purchase allocation set at 3.7 million pounds.

Also, Kazakhstan changed the Mineral Extraction Tax (MET) for uranium from 6% to 9% for 2025. From 2026 onward, the tax will be based on production and spot prices.

The company’s total debt to total capital was 0.15 as of March 31, 2025. Cameco plans to maintain the financial strength and flexibility necessary to boost production and capitalize on market opportunities. Work is underway to extend the mine life at Cigar Lake to 2036. CCJ is also increasing production at McArthur River and Key Lake to its licensed annual capacity of 25 million pounds (100% basis).

Cameco, in June, announced that it expects an increase of $170 million in its 49% equity share of Westinghouse Electric Company’s (Westinghouse) 2025 second-quarter and annual adjusted EBITDA. This is tied to Westinghouse’s participation in the construction project for two nuclear reactors at the Dukovany power plant in the Czech Republic.

Cameco also expects significant financial benefits for Westinghouse, as a subcontractor, over the term of the construction project and related to the provision of the fuel fabrication services required for both reactors for a specified period. The outlook for Westinghouse’s compound annual growth rate for adjusted EBITDA remains 6-10% over the next five years.

How Do Estimates Compare for Energy Fuels & Cameco?

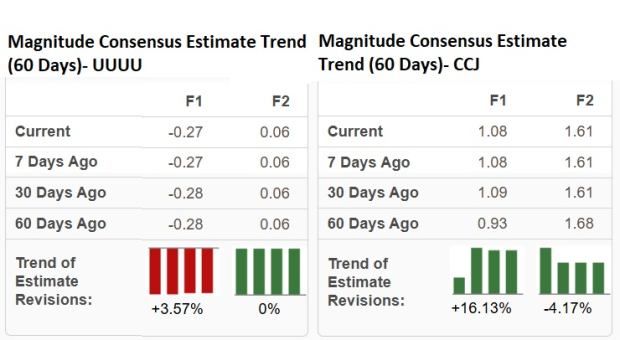

The Zacks Consensus Estimate for Energy Fuel’s 2025 revenues indicates a year-over-year drop of 41.24%. The company is expected to incur a loss of 27 cents per share in 2025, narrower than the loss of 28 cents reported in 2024. While the earnings per share (EPS) estimate for fiscal 2025 has moved up over the past 60 days, the same for 2026 has remained unchanged in the same time frame.

Estimates for 2026, however, depict a better picture. The Zacks Consensus Estimate for UUUU’s revenues indicates a year-over-year surge of 199.8%, with EPS pegged at six cents, marking the first year of expected profits for the company.

The Zacks Consensus Estimate for Cameco’s 2025 revenues implies year-over-year growth of 10.2%. The consensus mark for earnings indicates a year-over-year upsurge of 120.4%. The Zacks Consensus Estimate for Cameco’s 2026 revenues implies year-over-year growth of 6.8%, with EPS expected to soar 49%. The EPS estimate for fiscal 2025 has moved up over the past 60 days, while the same for fiscal 2026 has been revised downward in the same time frame. Image Source: Zacks Investment Research

UUUU & CCJ: Price Performance & Valuation

So far this year, Energy Fuels stock has appreciated 84.8% outperforming Cameco, which has gained 54.1%.

Image Source: Zacks Investment Research

Energy Fuels is trading at a forward price-to-sales multiple of 19.34X, below its median of 20.48X over the last five years. CCJ’s forward sales multiple sits at 13.21X, above its median of 6.59X over the last five years.

Image Source: Zacks Investment Research

Conclusion

Both companies face short-term revenue headwinds from weak uranium prices. While Cameco benefits from its robust fuel services business and long-term contracts, Energy Fuels offers diversification through heavy mineral sands and rare earths. For Cameco, the increased MET for uranium in Kazakhstan remains a concern.

UUUU boasts a stronger balance sheet and greater stock momentum. Its premium valuation appears justified given its robust growth prospects. Energy Fuels, which currently carries a Zacks Rank #2 (Buy), is a more compelling investment choice than Cameco, which has a Zacks Rank #4 (Sell).

Image: Bigstock

UUUU vs. CCJ: Which Uranium Stock is the Better Buy Now?

Key Takeaways

Energy Fuels Inc. (UUUU - Free Report) and Cameco Corporation (CCJ - Free Report) are major players in the uranium production industry and are expected to play a significant role in contributing to the global nuclear energy supply chain.

Uranium prices have been under pressure recently, declining to $71 per pound as a pause in fresh buying by holding funds allowed utilities to set lower bids. Prices are down 14.3% in a year. Prices had briefly surged to a seven-month high of $79 in late June, following a major purchase announcement from the Sprott Physical Uranium Trust, but the rally was short-lived.

The long-term outlook for uranium remains strong, driven by the growing push for clean energy. The U.S. government’s initiative to quadruple domestic nuclear energy capacity by 2050, along with rising energy needs from AI data centers, has boosted long-term demand expectations. Against this backdrop, investors are evaluating which uranium stock is better positioned, Energy Fuels or Cameco? To make an informed decision, let us analyze their fundamentals, growth potential and key challenges.

The Case for Energy Fuels

The company has been the leading U.S. producer of natural uranium concentrate for the past several years. It has produced two-thirds of all uranium in the United States since 2017.

UUUU’s White Mesa Mill in Utah remains the only fully licensed and operating conventional uranium processing facility in the United States. Its Pinyon Plain mine in Arizona is a standout asset, delivering 230,661 pounds of uranium in June and 638,700 pounds during the second quarter. It is set to be the highest-grade uranium deposit mined in U.S. history. Pinyon has considerable exploration upside, with Energy Fuels currently extracting ore from only about 25% of the vertical extent of the target zone.

Energy Fuels currently expects to mine 55,000-80,000 tons of ore containing approximately 875,000-1,435,000 pounds of contained uranium from the Pinyon Plain, Pandora and La Sal mines during 2025. This is an increase from the previously reported guidance of approximately 22%. Total finished uranium production for the year could reach up to 1,000,000 pounds – four times its previous expectation of 200,000 pounds.

During the second quarter, Energy Fuels sold 50,000 pounds of uranium on the spot market for $77.00 per pound. The company expects to sell 140,000 pounds of uranium in the third quarter and 160,000 pounds in the fourth quarter under its existing portfolio of long-term utility contracts. In 2026, the company expects to sell between 620,000 and 880,000 pounds of U3O8 under its existing long-term contracts.

Energy Fuels recently initiated the pilot-scale production of heavy rare earth element (HREE) oxides at the mill. It is the only facility in the United States producing HREEs from mined ores at a commercial site. This makes Energy Fuels a pioneer in domestic HREE production, crucial for the permanent magnet industry and national supply-chain security.

Energy Fuels’ Donald Project in Australia is one of the richest deposits of HREEs in the world and is expected to start production by the end of 2027. The Toliara Project in Madagascar and the Bahia Project in Brazil contain significant quantities of light and heavy REE oxides.

Backed by a debt-free balance sheet, Energy Fuels is ramping up uranium production while developing significant REE capabilities. Taking current production levels and its development pipeline into account, the company has the potential to produce 6 million pounds of uranium per year.

The Case for Cameco

Canada-based Cameco accounted for 16% of global uranium production in 2024. Its operations cover the entire nuclear fuel cycle from exploration to fuel services.

Cameco plans to ramp up its tier-one assets and continue to optimize performance and reliability. The company intends to produce 18 million pounds of uranium (100% basis) at each of McArthur River/Key Lake and Cigar Lake in 2025. Cameco’s share of production is expected at 22.4 million pounds of uranium.

CCJ plans to produce between 13 million and 14 million kgU in its fuel services segment in 2025. Uranium deliveries are projected at 31-34 million pounds for 2025.

At joint venture Inkai, production activity was suspended by the majority owner and controlling partner, Kazatomprom, from Jan. 1, 2025. Production resumed on Jan. 23, 2025. Despite the interruption, the 2025 guidance has been unchanged. JV Inkai has revised its mine plan and budget to reflect the temporary suspension and now aims to produce 8.3 million pounds this year (100% basis), with Cameco’s purchase allocation set at 3.7 million pounds.

Also, Kazakhstan changed the Mineral Extraction Tax (MET) for uranium from 6% to 9% for 2025. From 2026 onward, the tax will be based on production and spot prices.

The company’s total debt to total capital was 0.15 as of March 31, 2025. Cameco plans to maintain the financial strength and flexibility necessary to boost production and capitalize on market opportunities. Work is underway to extend the mine life at Cigar Lake to 2036. CCJ is also increasing production at McArthur River and Key Lake to its licensed annual capacity of 25 million pounds (100% basis).

Cameco, in June, announced that it expects an increase of $170 million in its 49% equity share of Westinghouse Electric Company’s (Westinghouse) 2025 second-quarter and annual adjusted EBITDA. This is tied to Westinghouse’s participation in the construction project for two nuclear reactors at the Dukovany power plant in the Czech Republic.

Cameco also expects significant financial benefits for Westinghouse, as a subcontractor, over the term of the construction project and related to the provision of the fuel fabrication services required for both reactors for a specified period. The outlook for Westinghouse’s compound annual growth rate for adjusted EBITDA remains 6-10% over the next five years.

How Do Estimates Compare for Energy Fuels & Cameco?

The Zacks Consensus Estimate for Energy Fuel’s 2025 revenues indicates a year-over-year drop of 41.24%. The company is expected to incur a loss of 27 cents per share in 2025, narrower than the loss of 28 cents reported in 2024. While the earnings per share (EPS) estimate for fiscal 2025 has moved up over the past 60 days, the same for 2026 has remained unchanged in the same time frame.

Estimates for 2026, however, depict a better picture. The Zacks Consensus Estimate for UUUU’s revenues indicates a year-over-year surge of 199.8%, with EPS pegged at six cents, marking the first year of expected profits for the company.

The Zacks Consensus Estimate for Cameco’s 2025 revenues implies year-over-year growth of 10.2%. The consensus mark for earnings indicates a year-over-year upsurge of 120.4%. The Zacks Consensus Estimate for Cameco’s 2026 revenues implies year-over-year growth of 6.8%, with EPS expected to soar 49%. The EPS estimate for fiscal 2025 has moved up over the past 60 days, while the same for fiscal 2026 has been revised downward in the same time frame.

Image Source: Zacks Investment Research

UUUU & CCJ: Price Performance & Valuation

So far this year, Energy Fuels stock has appreciated 84.8% outperforming Cameco, which has gained 54.1%.

Image Source: Zacks Investment Research

Energy Fuels is trading at a forward price-to-sales multiple of 19.34X, below its median of 20.48X over the last five years. CCJ’s forward sales multiple sits at 13.21X, above its median of 6.59X over the last five years.

Image Source: Zacks Investment Research

Conclusion

Both companies face short-term revenue headwinds from weak uranium prices. While Cameco benefits from its robust fuel services business and long-term contracts, Energy Fuels offers diversification through heavy mineral sands and rare earths. For Cameco, the increased MET for uranium in Kazakhstan remains a concern.

UUUU boasts a stronger balance sheet and greater stock momentum. Its premium valuation appears justified given its robust growth prospects. Energy Fuels, which currently carries a Zacks Rank #2 (Buy), is a more compelling investment choice than Cameco, which has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.