We use cookies to understand how you use our site and to improve your experience.

This includes personalizing content and advertising.

By pressing "Accept All" or closing out of this banner, you consent to the use of all cookies and similar technologies and the sharing of information they collect with third parties.

You can reject marketing cookies by pressing "Deny Optional," but we still use essential, performance, and functional cookies.

In addition, whether you "Accept All," Deny Optional," click the X or otherwise continue to use the site, you accept our Privacy Policy and Terms of Service, revised from time to time.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

CCJ vs. UEC: Which Uranium Stock Deserves a Place in Your Portfolio?

Read MoreHide Full Article

Key Takeaways

Cameco's Q2 revenues rose 47% to $634M, with EPS surging 410% despite softer uranium prices.

Uranium Energy posted no Q3 revenues, with higher costs widening its adjusted loss to six cents per share.

CCJ offers steadier earnings via contracts and fuel services, while UEC faces losses and downward revisions.

Cameco Corporation (CCJ - Free Report) and Uranium Energy Corp. (UEC - Free Report) are prominent names in the uranium sector and are expected to play a significant role in contributing to the global nuclear energy supply chain.

Uranium prices have faced pressure earlier this year amid abundant supply and uncertain demand. Recently, uranium prices have recovered to around $73.50 per pound, supported by renewed optimism with major countries expanding their nuclear ambitions. India plans to scale its nuclear capacity 13-fold by 2047 from current levels. The United States plans to restore its global leadership in nuclear energy and expand American nuclear energy capacity from approximately 100 GW in 2024 to 400 GW by 2050.

The long-term outlook for uranium thus remains strong. Against this backdrop, investors are evaluating which uranium stock is better positioned for growth: Cameco or Uranium Energy? To make an informed decision, let us analyze their fundamentals, growth potential and key challenges.

The Case for Cameco

Canada-based Cameco accounted for 16% of global uranium production in 2024. Its operations cover the entire nuclear fuel cycle from exploration to fuel services.

Cameco reported impressive second-quarter 2025 results, with revenues climbing 47% year over year to $634 million (CAD 877 million). Uranium revenues increased 47% to $510 million (CAD 705 million) as it sold 8.7 million pounds of uranium, 40% higher than the second quarter of 2024. Despite a 17% decline in the average U.S. dollar spot price for uranium, the Canadian dollar average realized price increased 5% to CAD 81.03 per pound due to the impact of fixed price contracts. Cameco’s adjusted earnings per share surged 410% year over year to 51 cents.

Cameco expects 18 million pounds of production (100% basis) at each of McArthur River/Key Lake and Cigar Lake operations in 2025. Of this, CCJ’s share of production is expected at 22.4 million pounds of uranium.

Cameco has delivered 15.6 million pounds of uranium so far in 2025, reaching the halfway mark of its full-year target of 31–34 million pounds. In 2024, CCJ delivered 33.6 million pounds of uranium.

For 2025, uranium revenues are forecasted at CAD 2.8–3.0 billion. The company now expects the average realized price to be higher at approximately $87.00 per pound (previously $84.00 per pound). In the fuel services segment, CCJ plans to produce between 13 million and 14 million kgU in 2025. Fuel services revenues are projected at $500-$550 million for 2025. This takes the total revenue guidance for 2025 to CAD 3.3-3.550 billion. The company had reported CAD 3.136 billion in revenues in 2024.

Cameco expects its share of adjusted EBITDA from Westinghouse to be higher, at $525-$580 million, for 2025. The improvement stems from Westinghouse’s participation in the construction project for two nuclear reactors at the Dukovany power plant in the Czech Republic.

Cameco expects significant future financial benefits for Westinghouse, as a subcontractor, over the term of the construction project and related to the provision of the fuel fabrication services for both reactors. Over the next five years, Cameco’s share of adjusted EBITDA is projected to witness a compound annual growth rate of 6-10%.

At the end of the second quarter, CCJ had C$716 million ($519 million) in cash and cash equivalents, and C$996 million ($722 million) in long-term debt. CCJ had a total debt to total capital ratio of 0.13% as of June 30, 2025.

CCJ continues to invest in increasing production and capitalizing on market opportunities. Work is underway to extend the mine life at Cigar Lake to 2036. Cameco is also increasing production at McArthur River and Key Lake from 18 million pounds to its licensed annual capacity of 25 million pounds (100% basis).

The Case for Uranium Energy

Uranium Energy has a combined 12.1 million pounds of U.S.-licensed production capacity from three central processing plants. The company also boasts the largest resource portfolio in the United States and one of the largest in North America.

In the last reported third quarter of fiscal 2025 (ended April 30, 2025), Uranium Energy did not generate revenues as it did not sell uranium, considering the volatility in the market. Adjusted loss per share was six cents compared with the loss of three cents in the year-ago quarter, due to a 73% surge in total operating expenses as well as no revenues. The company's results have borne the brunt of higher operating expenses in the last few quarters.

Uranium Energy had around $271 million of liquid assets (cash, equities and inventory at market prices), and no debt as of the quarter end. UEC held 1,356,000 pounds of purchased uranium concentrate inventory valued at $96.6 million as of May 30, 2025. To build on its physical uranium program, the company will buy an additional 300,000 pounds of uranium at $37.05 per pound under existing contracts in December 2025. This will provide UEC with a low-cost stream of physical uranium at a time of heightened geopolitical uncertainty.

The company is meanwhile investing in building the next generation of low-cost uranium projects that will be competitive on a global basis and which will use the ISR (in-situ recovery) mining process, which is expected to reduce the impact on the environment compared with conventional mining. In August 2024, the company restarted uranium extraction at its fully permitted and past-producing, Christensen Ranch Mine ISR (in-situ recovery) operation in Wyoming. It is expected to ramp up while new production areas are being constructed and completed in 2025.

In the third quarter of fiscal 2025, UEC announced the startup of Header House 10-7, marking the first new production area at Christensen Ranch under the phased restart. The header house, along with past-producing wellfields 7, 8 and 10, has been delivering feed to the satellite ion exchange plant. This resulted in a solid increase in uranium head grade from the operating wellfields. Also, construction at the Burke Hollow Project continues to progress as planned, with advances made across wellfield development and processing infrastructure. The company is also advancing the Roughrider project.

Recently, UEC’s Sweetwater Uranium Complex has been designated as a transparency project by the U.S. Federal Permitting Improvement Steering Council. It is thus expected to play a key part in achieving the United States' goal of nuclear fuel independence. The Sweetwater Plant has a licensed annual capacity of 4.1 million pounds of uranium. Sweetwater is expected to be the largest dual-feed uranium facility in the United States, licensed to process both conventional ore and ISR resin. This will provide UEC unmatched flexibility to scale production across the Great Divide Basin, leveraging its leading domestic resource base.

How do Estimates Compare for Cameco & UEC?

The Zacks Consensus Estimate for Cameco’s 2025 revenues implies year-over-year growth of 12.1%. The consensus mark for earnings indicates a year-over-year upsurge of 151%.

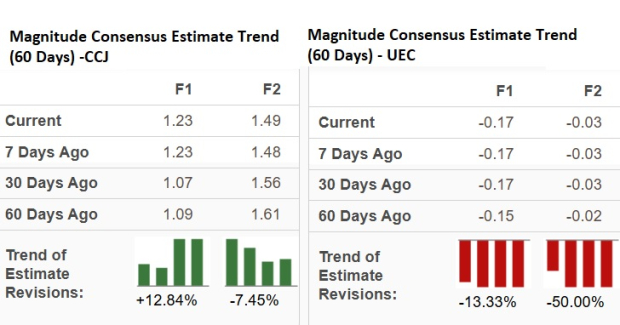

The Zacks Consensus Estimate for Cameco’s 2026 revenues indicates year-over-year dip of 1.18%, with EPS expected to climb 21.7%. The EPS estimate for Cameco’s fiscal 2025 has moved up over the past 60 days, while the same for fiscal 2026 has been revised downward in the same time frame.

The Zacks Consensus Estimate for Uranium Energy’s fiscal 2025 revenues is $79.6 million, implying a substantial improvement from the $0.22 million reported in the year-ago quarter. The company is, however, anticipated to report a loss of 17 cents per share in fiscal 2025, wider than the loss of nine cents in fiscal 2024.

The Zacks Consensus Estimate for Uranium Energy’s 2026 revenues of $77.95 million indicates a year-over-year dip of 2%. The company is expected to report a loss of three cents per share. Over the past 60 days, the estimates for both fiscal 2025 and 2026 have been revised downward.

Image Source: Zacks Investment Research

CCJ & UEC: Price Performance & Valuation

So far this year, Cameco stock has appreciated 45.9% while Uranium Energy shares have risen 55.5%.

Image Source: Zacks Investment Research

Cameco is trading at a forward price-to-sales multiple of 12.86X, above its median of 6.66X over the last five years and also above the industry average of 1.15X. Uranium Energy’s forward sales multiple sits at 52.92X, above its median of 27.64X over the last five years.

Image Source: Zacks Investment Research

Conclusion

Both companies face short-term revenue headwinds from weak uranium prices. However, Cameco fares better on this front given its fixed price contracts and support from fuel services business. Meanwhile Uranium Energy’s revenues tend to be more volatile due to its strategy to withhold sales amid low prices. Cameco benefits from its robust fuel services business and long-term contracts.

Also, considering the downward estimate revision activity, expected losses for this fiscal and next and its premium valuation, it will be wise to steer clear from UEC stock as of now. Meanwhile, Cameco, with a cheaper valuation and positive earnings growth, seems to be a better investment choice. Cameco currently carries a Zacks Rank #3 (Hold), while UEC has a Zacks Rank #4 (Sell).

Image: Bigstock

CCJ vs. UEC: Which Uranium Stock Deserves a Place in Your Portfolio?

Key Takeaways

Cameco Corporation (CCJ - Free Report) and Uranium Energy Corp. (UEC - Free Report) are prominent names in the uranium sector and are expected to play a significant role in contributing to the global nuclear energy supply chain.

Uranium prices have faced pressure earlier this year amid abundant supply and uncertain demand. Recently, uranium prices have recovered to around $73.50 per pound, supported by renewed optimism with major countries expanding their nuclear ambitions. India plans to scale its nuclear capacity 13-fold by 2047 from current levels. The United States plans to restore its global leadership in nuclear energy and expand American nuclear energy capacity from approximately 100 GW in 2024 to 400 GW by 2050.

The long-term outlook for uranium thus remains strong. Against this backdrop, investors are evaluating which uranium stock is better positioned for growth: Cameco or Uranium Energy? To make an informed decision, let us analyze their fundamentals, growth potential and key challenges.

The Case for Cameco

Canada-based Cameco accounted for 16% of global uranium production in 2024. Its operations cover the entire nuclear fuel cycle from exploration to fuel services.

Cameco reported impressive second-quarter 2025 results, with revenues climbing 47% year over year to $634 million (CAD 877 million). Uranium revenues increased 47% to $510 million (CAD 705 million) as it sold 8.7 million pounds of uranium, 40% higher than the second quarter of 2024. Despite a 17% decline in the average U.S. dollar spot price for uranium, the Canadian dollar average realized price increased 5% to CAD 81.03 per pound due to the impact of fixed price contracts. Cameco’s adjusted earnings per share surged 410% year over year to 51 cents.

Cameco expects 18 million pounds of production (100% basis) at each of McArthur River/Key Lake and Cigar Lake operations in 2025. Of this, CCJ’s share of production is expected at 22.4 million pounds of uranium.

Cameco has delivered 15.6 million pounds of uranium so far in 2025, reaching the halfway mark of its full-year target of 31–34 million pounds. In 2024, CCJ delivered 33.6 million pounds of uranium.

For 2025, uranium revenues are forecasted at CAD 2.8–3.0 billion. The company now expects the average realized price to be higher at approximately $87.00 per pound (previously $84.00 per pound). In the fuel services segment, CCJ plans to produce between 13 million and 14 million kgU in 2025. Fuel services revenues are projected at $500-$550 million for 2025. This takes the total revenue guidance for 2025 to CAD 3.3-3.550 billion. The company had reported CAD 3.136 billion in revenues in 2024.

Cameco expects its share of adjusted EBITDA from Westinghouse to be higher, at $525-$580 million, for 2025. The improvement stems from Westinghouse’s participation in the construction project for two nuclear reactors at the Dukovany power plant in the Czech Republic.

Cameco expects significant future financial benefits for Westinghouse, as a subcontractor, over the term of the construction project and related to the provision of the fuel fabrication services for both reactors. Over the next five years, Cameco’s share of adjusted EBITDA is projected to witness a compound annual growth rate of 6-10%.

At the end of the second quarter, CCJ had C$716 million ($519 million) in cash and cash equivalents, and C$996 million ($722 million) in long-term debt. CCJ had a total debt to total capital ratio of 0.13% as of June 30, 2025.

CCJ continues to invest in increasing production and capitalizing on market opportunities. Work is underway to extend the mine life at Cigar Lake to 2036. Cameco is also increasing production at McArthur River and Key Lake from 18 million pounds to its licensed annual capacity of 25 million pounds (100% basis).

The Case for Uranium Energy

Uranium Energy has a combined 12.1 million pounds of U.S.-licensed production capacity from three central processing plants. The company also boasts the largest resource portfolio in the United States and one of the largest in North America.

In the last reported third quarter of fiscal 2025 (ended April 30, 2025), Uranium Energy did not generate revenues as it did not sell uranium, considering the volatility in the market. Adjusted loss per share was six cents compared with the loss of three cents in the year-ago quarter, due to a 73% surge in total operating expenses as well as no revenues. The company's results have borne the brunt of higher operating expenses in the last few quarters.

Uranium Energy had around $271 million of liquid assets (cash, equities and inventory at market prices), and no debt as of the quarter end. UEC held 1,356,000 pounds of purchased uranium concentrate inventory valued at $96.6 million as of May 30, 2025. To build on its physical uranium program, the company will buy an additional 300,000 pounds of uranium at $37.05 per pound under existing contracts in December 2025. This will provide UEC with a low-cost stream of physical uranium at a time of heightened geopolitical uncertainty.

The company is meanwhile investing in building the next generation of low-cost uranium projects that will be competitive on a global basis and which will use the ISR (in-situ recovery) mining process, which is expected to reduce the impact on the environment compared with conventional mining.

In August 2024, the company restarted uranium extraction at its fully permitted and past-producing, Christensen Ranch Mine ISR (in-situ recovery) operation in Wyoming. It is expected to ramp up while new production areas are being constructed and completed in 2025.

In the third quarter of fiscal 2025, UEC announced the startup of Header House 10-7, marking the first new production area at Christensen Ranch under the phased restart. The header house, along with past-producing wellfields 7, 8 and 10, has been delivering feed to the satellite ion exchange plant. This resulted in a solid increase in uranium head grade from the operating wellfields. Also, construction at the Burke Hollow Project continues to progress as planned, with advances made across wellfield development and processing infrastructure. The company is also advancing the Roughrider project.

Recently, UEC’s Sweetwater Uranium Complex has been designated as a transparency project by the U.S. Federal Permitting Improvement Steering Council. It is thus expected to play a key part in achieving the United States' goal of nuclear fuel independence. The Sweetwater Plant has a licensed annual capacity of 4.1 million pounds of uranium. Sweetwater is expected to be the largest dual-feed uranium facility in the United States, licensed to process both conventional ore and ISR resin. This will provide UEC unmatched flexibility to scale production across the Great Divide Basin, leveraging its leading domestic resource base.

How do Estimates Compare for Cameco & UEC?

The Zacks Consensus Estimate for Cameco’s 2025 revenues implies year-over-year growth of 12.1%. The consensus mark for earnings indicates a year-over-year upsurge of 151%.

The Zacks Consensus Estimate for Cameco’s 2026 revenues indicates year-over-year dip of 1.18%, with EPS expected to climb 21.7%. The EPS estimate for Cameco’s fiscal 2025 has moved up over the past 60 days, while the same for fiscal 2026 has been revised downward in the same time frame.

The Zacks Consensus Estimate for Uranium Energy’s fiscal 2025 revenues is $79.6 million, implying a substantial improvement from the $0.22 million reported in the year-ago quarter. The company is, however, anticipated to report a loss of 17 cents per share in fiscal 2025, wider than the loss of nine cents in fiscal 2024.

The Zacks Consensus Estimate for Uranium Energy’s 2026 revenues of $77.95 million indicates a year-over-year dip of 2%. The company is expected to report a loss of three cents per share. Over the past 60 days, the estimates for both fiscal 2025 and 2026 have been revised downward.

Image Source: Zacks Investment Research

CCJ & UEC: Price Performance & Valuation

So far this year, Cameco stock has appreciated 45.9% while Uranium Energy shares have risen 55.5%.

Image Source: Zacks Investment Research

Cameco is trading at a forward price-to-sales multiple of 12.86X, above its median of 6.66X over the last five years and also above the industry average of 1.15X. Uranium Energy’s forward sales multiple sits at 52.92X, above its median of 27.64X over the last five years.

Image Source: Zacks Investment Research

Conclusion

Both companies face short-term revenue headwinds from weak uranium prices. However, Cameco fares better on this front given its fixed price contracts and support from fuel services business. Meanwhile Uranium Energy’s revenues tend to be more volatile due to its strategy to withhold sales amid low prices. Cameco benefits from its robust fuel services business and long-term contracts.

Also, considering the downward estimate revision activity, expected losses for this fiscal and next and its premium valuation, it will be wise to steer clear from UEC stock as of now. Meanwhile, Cameco, with a cheaper valuation and positive earnings growth, seems to be a better investment choice. Cameco currently carries a Zacks Rank #3 (Hold), while UEC has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.