We use cookies to understand how you use our site and to improve your experience.

This includes personalizing content and advertising.

By pressing "Accept All" or closing out of this banner, you consent to the use of all cookies and similar technologies and the sharing of information they collect with third parties.

You can reject marketing cookies by pressing "Deny Optional," but we still use essential, performance, and functional cookies.

In addition, whether you "Accept All," Deny Optional," click the X or otherwise continue to use the site, you accept our Privacy Policy and Terms of Service, revised from time to time.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

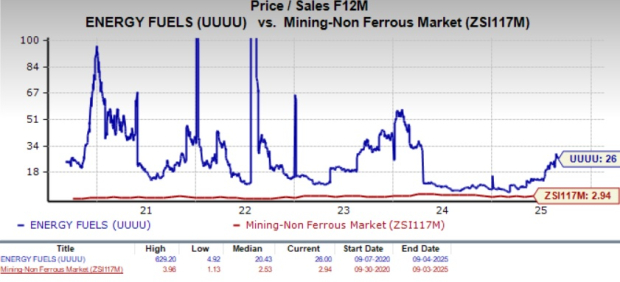

UUUU’s Value Score of F suggests that the stock is not so cheap and a stretched valuation at this moment.

Image Source: Zacks Investment Research

In comparison, uranium stocks like Cameco (CCJ - Free Report) and Centrus Energy (LEU - Free Report) are trading at much lower price-to-sales multiples of 13.09X and 7.45X, respectively.

UUUU's Valuation vs. Cameco and Centrus Energy

Image Source: Zacks Investment Research

UUUU stock has gained 119% year to date, outperforming the industry’s 11.1% growth. The broader Zacks Basic Materials sector has gained 18.3% and the S&P 500 has moved up 10.2% in the same timeframe.

UUUU’s YTD Price Performance vs. Industry, Sector & S&P 500

Image Source: Zacks Investment Research

UUUU's YTD Price Performance vs. Cameco & Centrus Energy

Image Source: Zacks Investment Research

Weak Uranium Sales, High Expenses Lead to Q2 Loss for UUUU

On Aug. 6, the company posted second-quarter 2025 results, with revenues plunging 52% year over year to $4.2 million. Energy Fuels sold 50,000 pounds of uranium on the spot market for $77 per pound, generating $3.85 million in uranium revenues. This marked a 55% decline from the year-ago quarter, due to lower sales volumes resulting from contract timing and the decision to retain inventory amid lower uranium prices. The company also recorded $0.28 million in heavy mineral sands revenues from the sale of 202 tons of rutile.

Lower revenues combined with exploration, development and processing expenses, as well as selling, general and administration expenses, led to a loss of 10 cents per share in the quarter, wider than the four cents loss reported in the year-ago quarter.

Energy Fuels Maintains Debt-Free Balance Sheet

As of June 30, 2025, Energy Fuels had $253.23 million of working capital, comprising $71.5 million of cash, $126.4 million of marketable securities and $7.8 million in trade and other receivables, as well as $76.50 million of inventory.

The company has no debt on its balance sheet. This is commendable compared with Cameco’s debt-to-capital ratio of 0.13 and Centrus Energy’s 0.55.

UUUU Provided Upbeat 2025 Production & Cost Views

Energy Fuels produced approximately 665,000 pounds of uranium from its Pinyon Plain, La Sal and Pandora mines, a sharp increase from the 115,000 pounds in the first quarter. This was attributed to exceptional performance at Pinyon Plain.

Backed by this momentum, Energy Fuels expects to produce 875,000-1,435,000 pounds of contained uranium in 2025. Processing activity will ramp up in the fourth quarter, with the company expecting to process 700,000-1,000,000 pounds of finished uranium for 2025.

Uranium sales are planned at 350,000 pounds in 2025, lower than the 450,000 pounds sold last year. The projection does not take into account any spot sales the company may make, in case prices go up. In 2026, Energy Fuels aims to sell between 620,000 and 880,000 pounds of uranium under its current portfolio of long-term uranium sales contracts.

The company expects lower uranium costs starting in the fourth quarter of 2025 as it begins processing low-cost Pinyon Plain ores. This will result in a total weighted average cost of goods sold between $23 and $30 per pound of uranium recovered, among the lowest in the world. With the integration of the company’s inventories with lower-cost Pinyon Plain output, the cost of goods sold for uranium sales is projected to fall to $50–$55 per pound through late 2025 and decline to $30–$40 per pound in early 2026.

Energy Fuels Making Efforts to Gain Share in REEs

Recently, Energy Fuels reached a significant milestone by producing the first kilogram of Dy oxide at pilot scale from its White Mesa Mill in Utah. Once it produces approximately 15 kilograms of Dy oxide, the company intends to produce high-purity terbium (Tb) oxide. It is targeting the fourth quarter of 2025 to deliver the first samples of Tb oxide.

Energy Fuels recently signed a Memorandum of Understanding with Vulcan Elements, aiming to establish a domestic supply chain for rare earth magnets that is independent of China. UUUU will supply initial quantities of high-purity "light" and "heavy" separated rare earth oxides to Vulcan, starting in the fourth quarter of 2025. Vulcan will then validate Energy Fuels' neodymium-praseodymium (NdPr) and Dy oxides for the production of rare earth magnets. Once validated, Vulcan and Energy Fuels will negotiate further long-term supply agreements.

Energy Fuels Witnesses Downward Revision Activity

The estimate for 2025 revenues is pegged at $40.80 million, indicating a 47.8% year-over-year decline. The company is expected to incur a loss of 33 cents per share in 2025.

The estimate for 2026 revenues is $122.05 million, implying a 199% year-over-year surge. The consensus estimate for earnings is pegged at one cent per share. This suggests that 2026 will be the company’s first year of profit since it started trading on the NYSE in December 2013.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Estimates for UUUU for 2025 and 2026 have undergone negative revisions over the past 60 days, as shown in the chart below.

Image Source: Zacks Investment Research

Weak Uranium Prices Remain a Challenge for UUUU

Uranium prices have been impacted this year amid an adequate supply and uncertain demand. Even though prices have moved up recently to $76.70 per pound, it remains 4% below last year’s levels.

Energy Fuels’ Long-Term Story Holds Promise

Despite lower prices currently, the long-term outlook for uranium remains strong, driven by the growing push for clean energy. Also, the push for supply chains independent of China is a growth opportunity for UUUU. Backed by its debt-free balance sheet, Energy Fuels is ramping up uranium production while developing significant REE capabilities. Taking UUUU’s current production levels and development pipeline into account, it has the potential to take its production level to 4-6 million pounds of uranium per year.

Energy Fuels’ Donald Project in Australia could start production by the end of 2027. It is one of the richest deposits of HREEs in the world and could complement UUUU’s domestic operations. Also, its Toliara Project in Madagascar and the Bahia Project in Brazil contain significant quantities of light and heavy REE oxides, which can be supplied to U.S. and European manufacturers.

Our Final Take on UUUU Stock

Backed by Energy Fuels’ debt-free balance sheet, it is advancing its growth plans to capitalize on the expected surge in uranium and REE demand. Those who already own the stock may stay invested, given UUUU’s solid long-term prospects in both these markets. However, given its premium valuation, volatility in uranium prices and the expected loss this year, new investors can wait for a better entry point.

Image: Bigstock

Energy Fuels Trades at Premium Value: How to Play the Stock?

Key Takeaways

Energy Fuels (UUUU - Free Report) is currently trading at a forward price-to-sales ratio of 26.00X, a significant premium to the non-ferrous mining industry’s 2.94X.

UUUU’s Value Score of F suggests that the stock is not so cheap and a stretched valuation at this moment.

Image Source: Zacks Investment Research

In comparison, uranium stocks like Cameco (CCJ - Free Report) and Centrus Energy (LEU - Free Report) are trading at much lower price-to-sales multiples of 13.09X and 7.45X, respectively.

UUUU's Valuation vs. Cameco and Centrus Energy

Image Source: Zacks Investment Research

UUUU stock has gained 119% year to date, outperforming the industry’s 11.1% growth. The broader Zacks Basic Materials sector has gained 18.3% and the S&P 500 has moved up 10.2% in the same timeframe.

UUUU’s YTD Price Performance vs. Industry, Sector & S&P 500

Image Source: Zacks Investment Research

UUUU's YTD Price Performance vs. Cameco & Centrus Energy

Image Source: Zacks Investment Research

Weak Uranium Sales, High Expenses Lead to Q2 Loss for UUUU

On Aug. 6, the company posted second-quarter 2025 results, with revenues plunging 52% year over year to $4.2 million. Energy Fuels sold 50,000 pounds of uranium on the spot market for $77 per pound, generating $3.85 million in uranium revenues. This marked a 55% decline from the year-ago quarter, due to lower sales volumes resulting from contract timing and the decision to retain inventory amid lower uranium prices. The company also recorded $0.28 million in heavy mineral sands revenues from the sale of 202 tons of rutile.

Lower revenues combined with exploration, development and processing expenses, as well as selling, general and administration expenses, led to a loss of 10 cents per share in the quarter, wider than the four cents loss reported in the year-ago quarter.

Energy Fuels Maintains Debt-Free Balance Sheet

As of June 30, 2025, Energy Fuels had $253.23 million of working capital, comprising $71.5 million of cash, $126.4 million of marketable securities and $7.8 million in trade and other receivables, as well as $76.50 million of inventory.

The company has no debt on its balance sheet. This is commendable compared with Cameco’s debt-to-capital ratio of 0.13 and Centrus Energy’s 0.55.

UUUU Provided Upbeat 2025 Production & Cost Views

Energy Fuels produced approximately 665,000 pounds of uranium from its Pinyon Plain, La Sal and Pandora mines, a sharp increase from the 115,000 pounds in the first quarter. This was attributed to exceptional performance at Pinyon Plain.

Backed by this momentum, Energy Fuels expects to produce 875,000-1,435,000 pounds of contained uranium in 2025. Processing activity will ramp up in the fourth quarter, with the company expecting to process 700,000-1,000,000 pounds of finished uranium for 2025.

Uranium sales are planned at 350,000 pounds in 2025, lower than the 450,000 pounds sold last year. The projection does not take into account any spot sales the company may make, in case prices go up. In 2026, Energy Fuels aims to sell between 620,000 and 880,000 pounds of uranium under its current portfolio of long-term uranium sales contracts.

The company expects lower uranium costs starting in the fourth quarter of 2025 as it begins processing low-cost Pinyon Plain ores. This will result in a total weighted average cost of goods sold between $23 and $30 per pound of uranium recovered, among the lowest in the world. With the integration of the company’s inventories with lower-cost Pinyon Plain output, the cost of goods sold for uranium sales is projected to fall to $50–$55 per pound through late 2025 and decline to $30–$40 per pound in early 2026.

Energy Fuels Making Efforts to Gain Share in REEs

Recently, Energy Fuels reached a significant milestone by producing the first kilogram of Dy oxide at pilot scale from its White Mesa Mill in Utah. Once it produces approximately 15 kilograms of Dy oxide, the company intends to produce high-purity terbium (Tb) oxide. It is targeting the fourth quarter of 2025 to deliver the first samples of Tb oxide.

Energy Fuels recently signed a Memorandum of Understanding with Vulcan Elements, aiming to establish a domestic supply chain for rare earth magnets that is independent of China. UUUU will supply initial quantities of high-purity "light" and "heavy" separated rare earth oxides to Vulcan, starting in the fourth quarter of 2025. Vulcan will then validate Energy Fuels' neodymium-praseodymium (NdPr) and Dy oxides for the production of rare earth magnets. Once validated, Vulcan and Energy Fuels will negotiate further long-term supply agreements.

Energy Fuels Witnesses Downward Revision Activity

The estimate for 2025 revenues is pegged at $40.80 million, indicating a 47.8% year-over-year decline. The company is expected to incur a loss of 33 cents per share in 2025.

The estimate for 2026 revenues is $122.05 million, implying a 199% year-over-year surge. The consensus estimate for earnings is pegged at one cent per share. This suggests that 2026 will be the company’s first year of profit since it started trading on the NYSE in December 2013.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Estimates for UUUU for 2025 and 2026 have undergone negative revisions over the past 60 days, as shown in the chart below.

Image Source: Zacks Investment Research

Weak Uranium Prices Remain a Challenge for UUUU

Uranium prices have been impacted this year amid an adequate supply and uncertain demand. Even though prices have moved up recently to $76.70 per pound, it remains 4% below last year’s levels.

Energy Fuels’ Long-Term Story Holds Promise

Despite lower prices currently, the long-term outlook for uranium remains strong, driven by the growing push for clean energy. Also, the push for supply chains independent of China is a growth opportunity for UUUU. Backed by its debt-free balance sheet, Energy Fuels is ramping up uranium production while developing significant REE capabilities. Taking UUUU’s current production levels and development pipeline into account, it has the potential to take its production level to 4-6 million pounds of uranium per year.

Energy Fuels’ Donald Project in Australia could start production by the end of 2027. It is one of the richest deposits of HREEs in the world and could complement UUUU’s domestic operations. Also, its Toliara Project in Madagascar and the Bahia Project in Brazil contain significant quantities of light and heavy REE oxides, which can be supplied to U.S. and European manufacturers.

Our Final Take on UUUU Stock

Backed by Energy Fuels’ debt-free balance sheet, it is advancing its growth plans to capitalize on the expected surge in uranium and REE demand. Those who already own the stock may stay invested, given UUUU’s solid long-term prospects in both these markets. However, given its premium valuation, volatility in uranium prices and the expected loss this year, new investors can wait for a better entry point.

UUUU currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.