We use cookies to understand how you use our site and to improve your experience.

This includes personalizing content and advertising.

By pressing "Accept All" or closing out of this banner, you consent to the use of all cookies and similar technologies and the sharing of information they collect with third parties.

You can reject marketing cookies by pressing "Deny Optional," but we still use essential, performance, and functional cookies.

In addition, whether you "Accept All," Deny Optional," click the X or otherwise continue to use the site, you accept our Privacy Policy and Terms of Service, revised from time to time.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

Boeing or Lockheed: Which Defense Stock Offers More Lift?

Read MoreHide Full Article

Key Takeaways

Global tensions are boosting defense budgets, fueling growth for BA and LMT programs.

BA shows stronger liquidity, while LMT faces weaker cash flow and higher debt pressures.

BA shares surged 39.3% in a year, while LMT declined 15.8%, despite its steadier profile.

Geopolitical instability worldwide has been driving the growth of defense giants like Boeing ((BA - Free Report) ) and Lockheed Martin ((LMT - Free Report) ). The heightened tension, particularly the hostilities witnessed in parts of Europe and the Middle East lately, is being directly translated into expanded U.S. and allied defense budgets, which fund crucial military modernization efforts and procurement programs.

Consequently, the increased demand for the combat-proven F-35 Joint Strike Fighter program, military helicopters like the Blackhawk, and missile systems like JASSM, Javelin, and LRASM is driving a stable defense-focused revenue stream for Lockheed. On the other hand, while Boeing relies on its notable defense programs like AH-64 Apache Helicopter, F/A-18 Super Hornet aircraft and Strategic Deterrence system, this jet giant’s exposure to the commercial aerospace market bolsters its overall backlog count. In addition, both these companies enjoy a prominent presence in next-generation space technologies, which offer them strong growth opportunities from the rapidly evolving space economy.

Rising global defense spending and steady gains in commercial aviation have driven investor interest in aerospace leaders with defense exposure to new highs. Against this backdrop, investors may struggle to choose between Boeing and Lockheed. Before making this difficult choice, let us delve into each of these companies’ strengths, weaknesses, growth opportunities, and risks (if any).

Financial Strength and Growth Catalysts: How Do Boeing and Lockheed Stack Up?

Boeing, which has struggled with its financial position in recent years, has recently recovered and demonstrated a solid liquidity position by the end of June 2025, with cash and cash equivalents of $22.97 billion exceeding its current debt of $8.72 billion. Moreover, BA’s current ratio was 1.23 at the end of the second quarter of 2025, which being more than 1, indicates that it has sufficient capital to pay off its short-term debt obligations.

On the other hand, Lockheed’s balance sheet reflected weakness, unlike the trend typically observed in other quarters. Its cash and cash equivalents of $1.29 billion at the end of the second quarter of 2025 were significantly lower than its long and short-term debt values. Furthermore, its cash flow from operations declined year over year to $1.61 billion at the end of June 2025, raising further concerns about its liquidity.

As far as growth catalysts are concerned, the proposed $1.01 trillion U.S. defense budget for fiscal 2026 should bolster both Boeing and Lockheed Martin. Boeing benefits directly from $3.1 billion for its F-15EX Eagle II fighter and $3.5 billion for the new F-47 Next Generation Air Dominance platform.

Lockheed also stands to gain significantly from a large proposed increase of 30% in Space Force funding to $40 billion, $25 billion funding allocation for the 'Golden Dome' next-generation missile defense shield, and $2.5 billion for missile and munitions production expansion, on the virtue of its involvement in similar defense products.

Apart from the defense budget, a diverse growth catalyst benefiting Boeing is its involvement in the global aerospace OEM and aftermarket service market, particularly in the commercial aviation segment. To this end, the company forecasts that global demand will require 43,600 new commercial planes by 2044, driven by an annual passenger traffic growth rate of 4.2%. This, in turn, should bode well for its commercial and services business units over the long run.

On the other hand, Lockheed continues to strengthen its position as America’s largest defense contractor through several innovative programs that are now entering their growth stages. Key drivers include sustained activity for the F-35 and Trident II D5 missile modernization. Furthermore, increased production rates for the PAC-3 missile, high demand for HIMARS and GMLRS systems, and the ramp-up of the CH-53K King Stallion helicopter are expected to significantly boost revenues.

Risks of Investing in Boeing vs. Lockheed

Both Boeing and Lockheed face universal industry headwinds, including a pervasive global labor shortage and ongoing aerospace supply-chain constraints. These issues, exacerbated by heightened U.S. import tariffs, threaten delivery timelines and operational performance for both giants.

Boeing, however, faces significant, company-specific risks rooted in its commercial aerospace exposure. The 737 product line continues to pose major execution and reputational challenges. Despite safety improvements and increased deliveries, the production rate remains low, hampered by FAA-mandated enhanced inspections on all 737-9 aircraft. These delays and quality concerns have impacted customer sentiment, contributing to significant order cancellations, primarily for the 737, totaling over $2.6 billion in the first half of 2025.

In contrast, Lockheed’s primary internal challenge is financial. It is grappling with performance issues on a classified fixed-price contract within its Aeronautics segment, resulting in cumulative pre-tax reach-forward losses of approximately $1.4 billion as of mid-2025.

How Do Zacks Estimates Compare for BA & LMT?

The Zacks Consensus Estimate for Boeing’s 2025 sales implies a year-over-year rise of 28.8%, and the same for its loss also suggests an improvement. The stock’s bottom-line estimates (except for third-quarter 2025) have moved south over the past 60 days.

Image Source: Zacks Investment Research

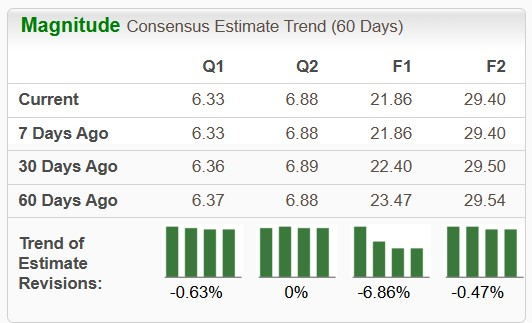

The Zacks Consensus Estimate for Lockheed’s 2025 sales implies a year-over-year rise of 4.5%, while that for its earnings suggests a decline of 23.2%. Furthermore, its near-term bottom-line estimates (except for fourth-quarter 2025) moved south over the past 60 days. Image Source: Zacks Investment Research

Stock Price Performance: BA vs LMT

BA (up 8.3%) has outperformed LMT (up 6.1%) over the past three months and has done the same in the past year. Shares of BA have surged 39.1%, while those of LMT have lost 15.8% in the past year.

Image Source: Zacks Investment Research

Valuation of LMT More Attractive Than That of BA

LMT is trading at a forward sales multiple of 1.48, below BA’s 1.73.

Image Source: Zacks Investment Research

ROIC: BA vs LMT

The image below shows that BA’s Return on Invested Capital (ROIC) came in below EADSY’s. Its negative figure suggests that the American jet giant is not generating enough profit from its investments to cover the cost of its capital.

Image Source: Zacks Investment Research

Conclusion

Both Boeing and Lockheed present distinct investment cases.

Boeing, while showing signs of financial recovery and possessing significant long-term growth potential in both commercial and defense markets, remains a high-risk investment. It continues to be weighed down by operational challenges and reputational issues, particularly within its commercial division.

Lockheed, on the other hand, stands out as the more dependable choice for investors prioritizing stability and consistent returns. With a more attractive valuation and stronger return metrics, its resilient defense portfolio provides reliable cash flow and shareholder returns, supported by a diverse and expanding range of military programs.

Ultimately, Lockheed appears better suited to remain on one’s watchlist amid a volatile geopolitical environment due to its dependable, defense-focused business model.

Image: Bigstock

Boeing or Lockheed: Which Defense Stock Offers More Lift?

Key Takeaways

Geopolitical instability worldwide has been driving the growth of defense giants like Boeing ((BA - Free Report) ) and Lockheed Martin ((LMT - Free Report) ). The heightened tension, particularly the hostilities witnessed in parts of Europe and the Middle East lately, is being directly translated into expanded U.S. and allied defense budgets, which fund crucial military modernization efforts and procurement programs.

Consequently, the increased demand for the combat-proven F-35 Joint Strike Fighter program, military helicopters like the Blackhawk, and missile systems like JASSM, Javelin, and LRASM is driving a stable defense-focused revenue stream for Lockheed. On the other hand, while Boeing relies on its notable defense programs like AH-64 Apache Helicopter, F/A-18 Super Hornet aircraft and Strategic Deterrence system, this jet giant’s exposure to the commercial aerospace market bolsters its overall backlog count. In addition, both these companies enjoy a prominent presence in next-generation space technologies, which offer them strong growth opportunities from the rapidly evolving space economy.

Rising global defense spending and steady gains in commercial aviation have driven investor interest in aerospace leaders with defense exposure to new highs. Against this backdrop, investors may struggle to choose between Boeing and Lockheed. Before making this difficult choice, let us delve into each of these companies’ strengths, weaknesses, growth opportunities, and risks (if any).

Financial Strength and Growth Catalysts: How Do Boeing and Lockheed Stack Up?

Boeing, which has struggled with its financial position in recent years, has recently recovered and demonstrated a solid liquidity position by the end of June 2025, with cash and cash equivalents of $22.97 billion exceeding its current debt of $8.72 billion. Moreover, BA’s current ratio was 1.23 at the end of the second quarter of 2025, which being more than 1, indicates that it has sufficient capital to pay off its short-term debt obligations.

On the other hand, Lockheed’s balance sheet reflected weakness, unlike the trend typically observed in other quarters. Its cash and cash equivalents of $1.29 billion at the end of the second quarter of 2025 were significantly lower than its long and short-term debt values. Furthermore, its cash flow from operations declined year over year to $1.61 billion at the end of June 2025, raising further concerns about its liquidity.

As far as growth catalysts are concerned, the proposed $1.01 trillion U.S. defense budget for fiscal 2026 should bolster both Boeing and Lockheed Martin. Boeing benefits directly from $3.1 billion for its F-15EX Eagle II fighter and $3.5 billion for the new F-47 Next Generation Air Dominance platform.

Lockheed also stands to gain significantly from a large proposed increase of 30% in Space Force funding to $40 billion, $25 billion funding allocation for the 'Golden Dome' next-generation missile defense shield, and $2.5 billion for missile and munitions production expansion, on the virtue of its involvement in similar defense products.

Apart from the defense budget, a diverse growth catalyst benefiting Boeing is its involvement in the global aerospace OEM and aftermarket service market, particularly in the commercial aviation segment. To this end, the company forecasts that global demand will require 43,600 new commercial planes by 2044, driven by an annual passenger traffic growth rate of 4.2%. This, in turn, should bode well for its commercial and services business units over the long run.

On the other hand, Lockheed continues to strengthen its position as America’s largest defense contractor through several innovative programs that are now entering their growth stages. Key drivers include sustained activity for the F-35 and Trident II D5 missile modernization. Furthermore, increased production rates for the PAC-3 missile, high demand for HIMARS and GMLRS systems, and the ramp-up of the CH-53K King Stallion helicopter are expected to significantly boost revenues.

Risks of Investing in Boeing vs. Lockheed

Both Boeing and Lockheed face universal industry headwinds, including a pervasive global labor shortage and ongoing aerospace supply-chain constraints. These issues, exacerbated by heightened U.S. import tariffs, threaten delivery timelines and operational performance for both giants.

Boeing, however, faces significant, company-specific risks rooted in its commercial aerospace exposure. The 737 product line continues to pose major execution and reputational challenges. Despite safety improvements and increased deliveries, the production rate remains low, hampered by FAA-mandated enhanced inspections on all 737-9 aircraft. These delays and quality concerns have impacted customer sentiment, contributing to significant order cancellations, primarily for the 737, totaling over $2.6 billion in the first half of 2025.

In contrast, Lockheed’s primary internal challenge is financial. It is grappling with performance issues on a classified fixed-price contract within its Aeronautics segment, resulting in cumulative pre-tax reach-forward losses of approximately $1.4 billion as of mid-2025.

How Do Zacks Estimates Compare for BA & LMT?

The Zacks Consensus Estimate for Boeing’s 2025 sales implies a year-over-year rise of 28.8%, and the same for its loss also suggests an improvement. The stock’s bottom-line estimates (except for third-quarter 2025) have moved south over the past 60 days.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for Lockheed’s 2025 sales implies a year-over-year rise of 4.5%, while that for its earnings suggests a decline of 23.2%. Furthermore, its near-term bottom-line estimates (except for fourth-quarter 2025) moved south over the past 60 days.

Image Source: Zacks Investment Research

Stock Price Performance: BA vs LMT

BA (up 8.3%) has outperformed LMT (up 6.1%) over the past three months and has done the same in the past year. Shares of BA have surged 39.1%, while those of LMT have lost 15.8% in the past year.

Image Source: Zacks Investment Research

Valuation of LMT More Attractive Than That of BA

LMT is trading at a forward sales multiple of 1.48, below BA’s 1.73.

Image Source: Zacks Investment Research

ROIC: BA vs LMT

The image below shows that BA’s Return on Invested Capital (ROIC) came in below EADSY’s. Its negative figure suggests that the American jet giant is not generating enough profit from its investments to cover the cost of its capital.

Image Source: Zacks Investment Research

Conclusion

Both Boeing and Lockheed present distinct investment cases.

Boeing, while showing signs of financial recovery and possessing significant long-term growth potential in both commercial and defense markets, remains a high-risk investment. It continues to be weighed down by operational challenges and reputational issues, particularly within its commercial division.

Lockheed, on the other hand, stands out as the more dependable choice for investors prioritizing stability and consistent returns. With a more attractive valuation and stronger return metrics, its resilient defense portfolio provides reliable cash flow and shareholder returns, supported by a diverse and expanding range of military programs.

Ultimately, Lockheed appears better suited to remain on one’s watchlist amid a volatile geopolitical environment due to its dependable, defense-focused business model.

Both Boeing and Lockheed carry a Zacks Rank #3 (Hold) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.