We use cookies to understand how you use our site and to improve your experience.

This includes personalizing content and advertising.

By pressing "Accept All" or closing out of this banner, you consent to the use of all cookies and similar technologies and the sharing of information they collect with third parties.

You can reject marketing cookies by pressing "Deny Optional," but we still use essential, performance, and functional cookies.

In addition, whether you "Accept All," Deny Optional," click the X or otherwise continue to use the site, you accept our Privacy Policy and Terms of Service, revised from time to time.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

BMNR's Shares Down 46.1% in a Month: Should You Buy the Dip?

Read MoreHide Full Article

Key Takeaways

BMNR shares have dropped 46.1% in a month while trading far below their 52-week high.

BitMine has rapidly expanded its ETH treasury to 3.63M tokens and aims for 5% of total supply.

BMNR faces valuation concerns, crypto-linked volatility and regulatory and liquidity pressures.

Shares of Las Vegas, NV-based Ethereum treasury company BitMine Immersion Technologies (BMNR - Free Report) have not had a good time on the bourses of late, declining 46.1% over the past 30 days. Shares of some other players in the Zacks Technology Services industry, like Bitfarms Limited (BITF - Free Report) and AppLovin Corporation (APP - Free Report) , too, have also dropped in double digits in the same time frame. That said, Bitfarms and AppLovin have performed better than BitMine Immersion Technologies.

1-Month Price Comparison

Image Source: Zacks Investment Research

BMNR, a Bitcoin and Ethereum Network company, is currently trading at a huge discount to its 52-week high of $161, reached earlier in the year. Ethereum is the world’s second-largest cryptocurrency. BitMine focuses on the accumulation of crypto for long-term investment.

Given the significant pullback in BMNR’s shares currently, investors might be tempted to snap up the stock. But is this the right time to buy BMNR? Let us find out.

Factors Supporting BMNR

BitMine is benefiting significantly from the rapid rise of stablecoins in the digital asset ecosystem. Stablecoins — cryptocurrencies pegged to assets like the U.S. dollar — offer key advantages including lower transaction costs, faster settlement speeds, 24/7 availability and global utility. Their relative price stability makes them an essential bridge between traditional finance and decentralized markets, helping facilitate broader adoption of digital assets. Growth of the overall stablecoin market contributes to the usage of various blockchains, including Ethereum.

Earlier this year, BitMine completed an initial $250 million PIPE private placement to support its strategic transition. The capital, alongside additional funding efforts, has been used to substantially increase the company’s Ethereum holdings. BitMine has aggressively expanded its ETH treasury to roughly 3.63 million tokens, giving it combined cash and crypto assets exceeding $11 billion, according to a recent BMNR release. Chairman Lee noted that the company ultimately aims to accumulate 5% of the total ETH supply — a bold ambition that underscores its confidence in the long-term value of Ethereum and the broader digital asset economy.

BitMine currently owns 3% of the ETH token supply, reflecting that it is two-thirds of the way to securing the objective.By securing an expanding share of the ETH supply, the company aims to help institutionalize capital and real-world assets on-chain, positioning itself to create long-term value as the digital asset revolution accelerates.

Recently, BMNR has acquired 69,822 ETH tokens to boost its Ethereum holdings. As of Nov. 23, BMNR’s crypto holdings included 3,629,701 ETH at $2,840 per ETH, 192 Bitcoin, $38 million stake in Eightco Holdings, apart from unencumbered cash of $800 million.

Reflecting its shareholder-friendly approach, BitMine recently became the first large-cap crypto company to declare an annual dividend. Earlier in the month, BitMine declared an annual dividend of $0.01 per share. The dividend is payable on Dec. 29, 2025, to its shareholders of record on Dec. 8.

Factors Working Against BMNR

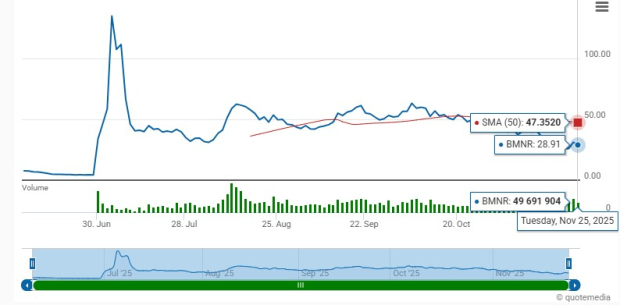

This tech company’s stock has slipped below its 50-day moving average, which is an important indicator for gauging market trends and momentum. Falling below this average suggests a bearish trend, often prompting caution in investors.

50-Day Moving Average

Image Source: Zacks Investment Research

Moreover, valuation remains a sticking point for BMNR, with shares being overvalued. The company currently has a Value Score of F, suggesting stretched valuation. AppLovin and Bitfarms currently have a Value Score of D and F, respectively.

Per a recent statement by BMNR’s chairman Lee, “The continued decline in crypto prices in the past week reflects the impaired liquidity since October 10th, as well as price technicals, which remain weak”. With BMNR correlating greatly with the price of Ethereum, no doubt the fall in price of the second-largest cryptocurrency behind Bitcoin has led to the southward movement of the stock. The recent market volatility, apart from liquidity issues, has also hurt BMNR stock.

How Should Investors Play BMNR Stock?

Agreed that BMNR is being well-served by its efforts to boost Ethereum holdings. The rise of stablecoins in the digital asset ecosystem is also aiding the company. BitMine’s pro-shareholder stance is commendable as well. The Wall Street average target price of $53.5 for BMNR stock suggests an upside of 72% from current levels.

Image Source: Zacks Investment Research

However, some headwinds are hard to ignore. The stock price is highly correlated with the volatile crypto market. Overvaluation concerns also remain a hindrance. Moreover, the constantly evolving regulatory landscape for cryptocurrencies poses a significant risk to BitMine’s financial stability and strategic planning. Rapid technological changes and competition from alternative blockchain networks may also hurt the stock, pushing it on the back foot.

Given the abovementioned headwinds, we believe that it is not at all advisable to buy the dip in this Zacks Rank #3 (Hold) stock currently. Instead, investors should monitor the company’s developments closely for an appropriate entry point.

Image: Bigstock

BMNR's Shares Down 46.1% in a Month: Should You Buy the Dip?

Key Takeaways

Shares of Las Vegas, NV-based Ethereum treasury company BitMine Immersion Technologies (BMNR - Free Report) have not had a good time on the bourses of late, declining 46.1% over the past 30 days. Shares of some other players in the Zacks Technology Services industry, like Bitfarms Limited (BITF - Free Report) and AppLovin Corporation (APP - Free Report) , too, have also dropped in double digits in the same time frame. That said, Bitfarms and AppLovin have performed better than BitMine Immersion Technologies.

1-Month Price Comparison

BMNR, a Bitcoin and Ethereum Network company, is currently trading at a huge discount to its 52-week high of $161, reached earlier in the year. Ethereum is the world’s second-largest cryptocurrency. BitMine focuses on the accumulation of crypto for long-term investment.

Given the significant pullback in BMNR’s shares currently, investors might be tempted to snap up the stock. But is this the right time to buy BMNR? Let us find out.

Factors Supporting BMNR

BitMine is benefiting significantly from the rapid rise of stablecoins in the digital asset ecosystem. Stablecoins — cryptocurrencies pegged to assets like the U.S. dollar — offer key advantages including lower transaction costs, faster settlement speeds, 24/7 availability and global utility. Their relative price stability makes them an essential bridge between traditional finance and decentralized markets, helping facilitate broader adoption of digital assets. Growth of the overall stablecoin market contributes to the usage of various blockchains, including Ethereum.

Earlier this year, BitMine completed an initial $250 million PIPE private placement to support its strategic transition. The capital, alongside additional funding efforts, has been used to substantially increase the company’s Ethereum holdings. BitMine has aggressively expanded its ETH treasury to roughly 3.63 million tokens, giving it combined cash and crypto assets exceeding $11 billion, according to a recent BMNR release. Chairman Lee noted that the company ultimately aims to accumulate 5% of the total ETH supply — a bold ambition that underscores its confidence in the long-term value of Ethereum and the broader digital asset economy.

BitMine currently owns 3% of the ETH token supply, reflecting that it is two-thirds of the way to securing the objective.By securing an expanding share of the ETH supply, the company aims to help institutionalize capital and real-world assets on-chain, positioning itself to create long-term value as the digital asset revolution accelerates.

Recently, BMNR has acquired 69,822 ETH tokens to boost its Ethereum holdings. As of Nov. 23, BMNR’s crypto holdings included 3,629,701 ETH at $2,840 per ETH, 192 Bitcoin, $38 million stake in Eightco Holdings, apart from unencumbered cash of $800 million.

Reflecting its shareholder-friendly approach, BitMine recently became the first large-cap crypto company to declare an annual dividend. Earlier in the month, BitMine declared an annual dividend of $0.01 per share. The dividend is payable on Dec. 29, 2025, to its shareholders of record on Dec. 8.

Factors Working Against BMNR

This tech company’s stock has slipped below its 50-day moving average, which is an important indicator for gauging market trends and momentum. Falling below this average suggests a bearish trend, often prompting caution in investors.

50-Day Moving Average

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Moreover, valuation remains a sticking point for BMNR, with shares being overvalued. The company currently has a Value Score of F, suggesting stretched valuation. AppLovin and Bitfarms currently have a Value Score of D and F, respectively.

Per a recent statement by BMNR’s chairman Lee, “The continued decline in crypto prices in the past week reflects the impaired liquidity since October 10th, as well as price technicals, which remain weak”. With BMNR correlating greatly with the price of Ethereum, no doubt the fall in price of the second-largest cryptocurrency behind Bitcoin has led to the southward movement of the stock. The recent market volatility, apart from liquidity issues, has also hurt BMNR stock.

How Should Investors Play BMNR Stock?

Agreed that BMNR is being well-served by its efforts to boost Ethereum holdings. The rise of stablecoins in the digital asset ecosystem is also aiding the company. BitMine’s pro-shareholder stance is commendable as well. The Wall Street average target price of $53.5 for BMNR stock suggests an upside of 72% from current levels.

However, some headwinds are hard to ignore. The stock price is highly correlated with the volatile crypto market. Overvaluation concerns also remain a hindrance. Moreover, the constantly evolving regulatory landscape for cryptocurrencies poses a significant risk to BitMine’s financial stability and strategic planning. Rapid technological changes and competition from alternative blockchain networks may also hurt the stock, pushing it on the back foot.

Given the abovementioned headwinds, we believe that it is not at all advisable to buy the dip in this Zacks Rank #3 (Hold) stock currently. Instead, investors should monitor the company’s developments closely for an appropriate entry point.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.