We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here. By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

J&J (JNJ - Free Report) kicked off the fourth-quarter earnings season for the pharma sector with a beat. Sanofi (SNY - Free Report) announced a deal to acquire Inhibrx’s (INBX - Free Report) pipeline candidate, INBRX-101, for an aggregate transaction value of nearly $2.2 billion. Ionis (IONS - Free Report) announced positive top-line data from a phase III study evaluating its pipeline candidate, donidalorsen, for treating hereditary angioedema (HAE), a rare and life-threatening genetic disease.

Recap of the Week’s Most Important Stories

J&J Begins Q4 Earnings Season: J&J reported strong fourth-quarter results, beating estimates for earnings as well as sales. Its Innovative Medicines unit outperformed expectations, with sales of several key drugs like Darzalex, Stelara, Tremfya and Imbruvica beating estimates. The MedTech segment also beat the Zacks Consensus Estimate. Sales of J&J’s Innovative Medicines segment rose 4% on an operational basis, while that of the MedTech segment rose 13.4%.

J&J re-confirmed its full-year adjusted earnings and sales growth guidance that it had issued in December. For 2024, J&J expects total revenues in the range of $87.8 billion-$88.6 billion, which implies growth in the range of 4.5%-5.5%, driven by its Innovative Medicine and MedTech segments. The company maintained its operational sales growth guidance in the range of 5-6% and also its adjusted earnings per share guidance in the range of $10.55-$10.75. The earnings range implies growth in the range of 6.4%-8.4%.

Sanofi to Buy Inhibrx: Sanofi announced a definitive agreement to acquire INBRX-101, a rare disease pipeline candidate, from Inhibrx following the spin-off of non-INBRX-101 assets into a new publicly traded company called New Inhibrx. INBRX-101 is being developed in a phase II study to treat alpha-1 antitrypsin deficiency, an inherited rare disease characterized by low levels of AAT protein, which mainly affects lung function.

For the merger agreement, shareholders of Inhibrx will receive a consideration of $30 per share in cash plus a contingent value right equal to $5 per share plus 0.25 shares in New Inhibrx. In addition, Sanofi has agreed to pay off Inhibrx's outstanding debt balance and will also capitalize New Inhibrx with $200 million in cash. Sanofi will have an equity stake of 8% in New Inhibrx. All these add up to an aggregate transaction value of $2.2 billion. The transaction has been approved by the board of directors of both companies and is expected to be closed in the second quarter of 2024.

Ionis’ Donidalorsen Meets Goal in HAE Study: Ionis’ phase III study evaluating its pipeline candidate donidalorsen for treating HAE achieved its primary endpoint. The OASIS-HAE study showed a statistically significant reduction in the rate of angioedema attacks in patients treated with donidalorsen every four weeks or patients treated every eight weeks, compared to placebo. In addition, donidalorsen achieved statistical significance on all secondary endpoints in the 4-week arm and key secondary endpoints in the 8-week arm. Based on these results, Ionis plans to file a new drug application for donidalorsen with the FDA. Ionis’ partner, Otsuka, is also looking to file a marketing authorization application in Europe.

The NYSE ARCA Pharmaceutical Index declined 0.19% in the last five trading sessions.

Image: Bigstock

Pharma Stock Roundup: JNJ Reports Q4 Earnings, SNY Inks M&A Deal With INBX

J&J (JNJ - Free Report) kicked off the fourth-quarter earnings season for the pharma sector with a beat. Sanofi (SNY - Free Report) announced a deal to acquire Inhibrx’s (INBX - Free Report) pipeline candidate, INBRX-101, for an aggregate transaction value of nearly $2.2 billion. Ionis (IONS - Free Report) announced positive top-line data from a phase III study evaluating its pipeline candidate, donidalorsen, for treating hereditary angioedema (HAE), a rare and life-threatening genetic disease.

Recap of the Week’s Most Important Stories

J&J Begins Q4 Earnings Season: J&J reported strong fourth-quarter results, beating estimates for earnings as well as sales. Its Innovative Medicines unit outperformed expectations, with sales of several key drugs like Darzalex, Stelara, Tremfya and Imbruvica beating estimates. The MedTech segment also beat the Zacks Consensus Estimate. Sales of J&J’s Innovative Medicines segment rose 4% on an operational basis, while that of the MedTech segment rose 13.4%.

J&J re-confirmed its full-year adjusted earnings and sales growth guidance that it had issued in December. For 2024, J&J expects total revenues in the range of $87.8 billion-$88.6 billion, which implies growth in the range of 4.5%-5.5%, driven by its Innovative Medicine and MedTech segments. The company maintained its operational sales growth guidance in the range of 5-6% and also its adjusted earnings per share guidance in the range of $10.55-$10.75. The earnings range implies growth in the range of 6.4%-8.4%.

Sanofi to Buy Inhibrx: Sanofi announced a definitive agreement to acquire INBRX-101, a rare disease pipeline candidate, from Inhibrx following the spin-off of non-INBRX-101 assets into a new publicly traded company called New Inhibrx. INBRX-101 is being developed in a phase II study to treat alpha-1 antitrypsin deficiency, an inherited rare disease characterized by low levels of AAT protein, which mainly affects lung function.

For the merger agreement, shareholders of Inhibrx will receive a consideration of $30 per share in cash plus a contingent value right equal to $5 per share plus 0.25 shares in New Inhibrx. In addition, Sanofi has agreed to pay off Inhibrx's outstanding debt balance and will also capitalize New Inhibrx with $200 million in cash. Sanofi will have an equity stake of 8% in New Inhibrx. All these add up to an aggregate transaction value of $2.2 billion. The transaction has been approved by the board of directors of both companies and is expected to be closed in the second quarter of 2024.

Ionis’ Donidalorsen Meets Goal in HAE Study: Ionis’ phase III study evaluating its pipeline candidate donidalorsen for treating HAE achieved its primary endpoint. The OASIS-HAE study showed a statistically significant reduction in the rate of angioedema attacks in patients treated with donidalorsen every four weeks or patients treated every eight weeks, compared to placebo. In addition, donidalorsen achieved statistical significance on all secondary endpoints in the 4-week arm and key secondary endpoints in the 8-week arm. Based on these results, Ionis plans to file a new drug application for donidalorsen with the FDA. Ionis’ partner, Otsuka, is also looking to file a marketing authorization application in Europe.

The NYSE ARCA Pharmaceutical Index declined 0.19% in the last five trading sessions.

Large Cap Pharmaceuticals Industry 5YR % Return

Large Cap Pharmaceuticals Industry 5YR % Return

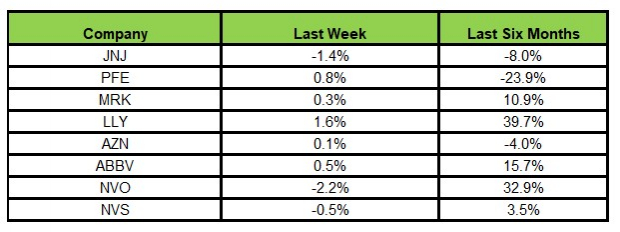

Here’s how the eight major stocks performed in the last five trading sessions.

In the last five trading sessions, Lilly rose the most (1.6%), while Novo Nordisk declined the most (2.2%).Image Source: Zacks Investment Research

In the past six months, Lilly has risen the most (39.7%), while Pfizer has declined the most (23.9%).

(See the last pharma stock roundup here: MRK to Buy Harpoon, JNJ to Acquire Ambrx Biopharma & More)

What's Next in the Pharma World?

Watch for fourth-quarter earnings of Pfizer, Sanofi, Merck, AbbVie and Novo Nordisk and regular pipeline and regulatory updates next week.