We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here. By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

UBS Group's (UBS) JV to Buy CS' Japanese Wealth Management Unit

Read MoreHide Full Article

UBS Group AG (UBS - Free Report) has announced that its joint venture (JV) with SuMi TRUST Wealth Management Co, (“SuMi”) is set to acquire Credit Suisse's (“CS”) wealth management business in Japan, per Reuters.

Per the deal, after the addition of CS’ client assets, UBS Group and SuMi will realign their investments to continue the initial ownership arrangement with UBS retaining 51% and SuMi maintaining 49% ownership in the venture. This JV between UBS and SuMi was launched in August 2021.

CS’ advisors and the wealth management assets in Japan will be transferred to the JV, following the completion of the merger between UBS and CS, which is expected by the end of June 2024.

In June 2023, UBS Group completed the buyout of CS (a regulatory-assisted deal). This transaction of acquiring CS was crafted with the aim of enhancing wealth and asset management capabilities as well as aid in growing its capital-light businesses. The company is on track to complete the integration process by 2026-end.

Over the past years, UBS Group has significantly strengthened its geographic footprint and expanded operations on the back of strategic partnerships and buyouts, underlining its inorganic growth strategy.

The company’s Global Wealth Management segment is its highest revenue-generating source. As of Dec 31, 2023, it had $3.8 trillion in invested assets and held the first position in Asia, Latin America, EMEA and Switzerland in terms of invested assets. Looking forward, the company has set an ambitious target to exceed $5 trillion in invested assets by 2028, indicating a strategic commitment to substantial growth and expansion in the upcoming years.

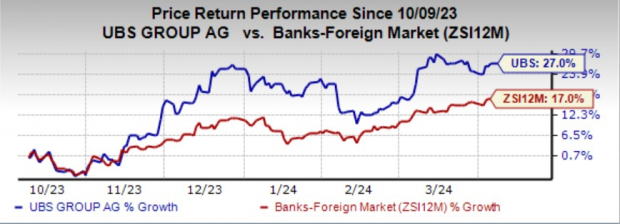

Over the past six months, shares of UBS have gained 27% on the NYSE compared with the industry’s growth of 17%. Image Source: Zacks Investment Research

AllianceBernstein Holding L.P. (AB - Free Report) and Societe Generale (SCGLY - Free Report) unveiled Bernstein, a JV poised to redefine the landscape of global cash equities and equity research. The plan to form Bernstein was announced in November 2022.

The JV combines the strengths of both AB and SCGLY. It offers institutional investors, corporates and financial institutions comprehensive insights and unparalleled access to equity markets across North America, Europe and the Asia Pacific. The JV also provides unparalleled liquidity access and leading global trading technology.

Unique Zacks Analysis of Your Chosen Ticker

Pick one free report - opportunity may be withdrawn at any time

Image: Shutterstock

UBS Group's (UBS) JV to Buy CS' Japanese Wealth Management Unit

UBS Group AG (UBS - Free Report) has announced that its joint venture (JV) with SuMi TRUST Wealth Management Co, (“SuMi”) is set to acquire Credit Suisse's (“CS”) wealth management business in Japan, per Reuters.

Per the deal, after the addition of CS’ client assets, UBS Group and SuMi will realign their investments to continue the initial ownership arrangement with UBS retaining 51% and SuMi maintaining 49% ownership in the venture. This JV between UBS and SuMi was launched in August 2021.

CS’ advisors and the wealth management assets in Japan will be transferred to the JV, following the completion of the merger between UBS and CS, which is expected by the end of June 2024.

In June 2023, UBS Group completed the buyout of CS (a regulatory-assisted deal). This transaction of acquiring CS was crafted with the aim of enhancing wealth and asset management capabilities as well as aid in growing its capital-light businesses. The company is on track to complete the integration process by 2026-end.

Over the past years, UBS Group has significantly strengthened its geographic footprint and expanded operations on the back of strategic partnerships and buyouts, underlining its inorganic growth strategy.

The company’s Global Wealth Management segment is its highest revenue-generating source. As of Dec 31, 2023, it had $3.8 trillion in invested assets and held the first position in Asia, Latin America, EMEA and Switzerland in terms of invested assets. Looking forward, the company has set an ambitious target to exceed $5 trillion in invested assets by 2028, indicating a strategic commitment to substantial growth and expansion in the upcoming years.

Over the past six months, shares of UBS have gained 27% on the NYSE compared with the industry’s growth of 17%.

Image Source: Zacks Investment Research

Currently, UBS carries a Zacks Rank #3 (Hold).

You can see tthe complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Expansion Efforts by Other Companies

AllianceBernstein Holding L.P. (AB - Free Report) and Societe Generale (SCGLY - Free Report) unveiled Bernstein, a JV poised to redefine the landscape of global cash equities and equity research. The plan to form Bernstein was announced in November 2022.

The JV combines the strengths of both AB and SCGLY. It offers institutional investors, corporates and financial institutions comprehensive insights and unparalleled access to equity markets across North America, Europe and the Asia Pacific. The JV also provides unparalleled liquidity access and leading global trading technology.