Note: The following is an excerpt from this week’s Earnings Trends report. You can access the full report that contains detailed historical actual and estimates for the current and following periods, please click here>>>

Here are a Few of the key points:

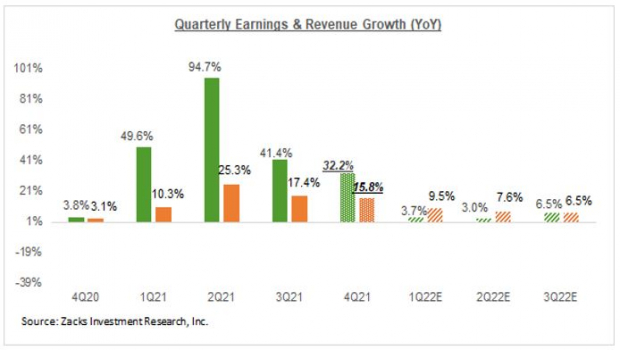

- Earnings growth is expected to decelerate in the current and coming periods on account of tough comparisons.

- The revisions trend has lately been negative, with estimates for the current period coming down modestly. This follows the consistently positive revisions trend over the preceding six quarters.

- Total S&P 500 earnings for the first quarter of 2022 are expected to be up +3.7% from the same period last year on +9.5% higher revenues. This would follow the +32.2% growth in earnings on +15.8% growth in revenues in 2021 Q4.

- Estimates for full-year 2022 have stabilized in recent weeks, after starting to weaken towards the end of 2021 Q4. Current 2022 earnings estimates are up +2.6% since the start of October 2021, but up only +0.7% on an ex-Energy basis.

The overall earnings picture has been very strong lately, with the growth rates as well as the absolute dollar totals at very high levels. The growth pace decelerates significantly in the following periods, as you can see in the chart below that provides a big-picture view of earnings on a quarterly basis.

Image Source: Zacks Investment Research

The chart below shows the overall earnings picture on an annual basis, with the growth momentum expected to continue.

Image Source: Zacks Investment Research

We remain positive in our earnings outlook, as we see the recent negative shift in the revisions trend as transitory Omicron-related factors.

Image: Bigstock

Looking Ahead to the 2022 Q1 Earnings Season

Note: The following is an excerpt from this week’s Earnings Trends report. You can access the full report that contains detailed historical actual and estimates for the current and following periods, please click here>>>

Here are a Few of the key points:

The overall earnings picture has been very strong lately, with the growth rates as well as the absolute dollar totals at very high levels. The growth pace decelerates significantly in the following periods, as you can see in the chart below that provides a big-picture view of earnings on a quarterly basis.

Image Source: Zacks Investment Research

The chart below shows the overall earnings picture on an annual basis, with the growth momentum expected to continue.

Image Source: Zacks Investment Research

We remain positive in our earnings outlook, as we see the recent negative shift in the revisions trend as transitory Omicron-related factors.