We all know that the overall earnings picture is very strong, with broad-based growth momentum across all major sectors and the overall earnings tally reaching a new all-time quarterly record in the preceding reporting cycle (for 2021 Q1).

The year-over-year growth numbers were very strong in Q1, partly reflecting the easy comparisons to the year-earlier period. The easy comparisons issue will be even more pronounced in Q2 as the corresponding 2020 period represented the pandemic’s severest impact.

We should keep in mind, however, that the strong earnings growth we saw in Q1 and the even stronger growth expected in Q2 is also reflective of genuine growth in the absolute sense, not just a result of easy comparisons. Take a look at the chart below to get a better sense of this reality.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

These are quarterly earnings totals, with aggregate earnings estimates for 2021 Q2, and actually reported earnings for 2020 Q2 and 2019 Q2 highlighted.

You can see that 2021 Q2 earnings for the S&P 500 index are expected to be up +59.4% from the Covid-hit 2020 Q2 period. But even relative to the pre-Covid 2019 Q2 period, 2021 Q2 earnings are expected to be up +7.9%.

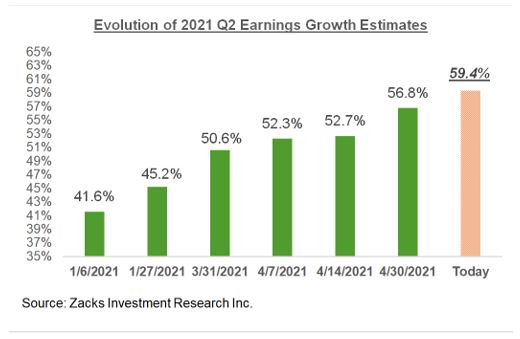

Estimates have been steadily going up, as we have been consistently pointing out in our earnings commentary, though the favorable revisions trend has eased off in recent weeks. The chart below shows earnings growth expectations for 2021 Q2 have changed since early January.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The chart below takes a big-picture view of the quarterly earnings and revenue growth pace.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The chart below presents the big-picture view on an annual basis. As you can see below, 2021 earnings and revenues are expected to be up +34.3% and +10.3%, respectively, which follows the Covid-driven decline of -13.1% in 2020.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

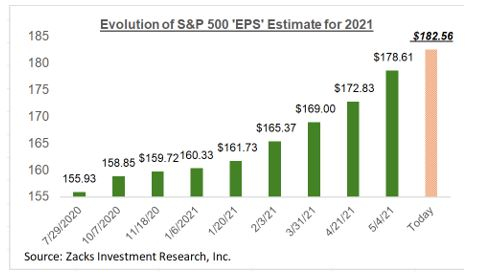

On an index ‘EPS’ basis, the 2021 expectation works out to $182.56, up from $135.98 per ‘Index share’ in 2020. These full-year estimates have been going up as well, as the chart below shows.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

For a detailed look at the overall earnings picture, including expectations for the coming periods, please check out our weekly Earnings Trends report >>>>Handicapping the Q2 Earnings Season

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Image: Shutterstock

Q2 2021 Earnings Season Preview

We all know that the overall earnings picture is very strong, with broad-based growth momentum across all major sectors and the overall earnings tally reaching a new all-time quarterly record in the preceding reporting cycle (for 2021 Q1).

The year-over-year growth numbers were very strong in Q1, partly reflecting the easy comparisons to the year-earlier period. The easy comparisons issue will be even more pronounced in Q2 as the corresponding 2020 period represented the pandemic’s severest impact.

We should keep in mind, however, that the strong earnings growth we saw in Q1 and the even stronger growth expected in Q2 is also reflective of genuine growth in the absolute sense, not just a result of easy comparisons. Take a look at the chart below to get a better sense of this reality.

These are quarterly earnings totals, with aggregate earnings estimates for 2021 Q2, and actually reported earnings for 2020 Q2 and 2019 Q2 highlighted.

You can see that 2021 Q2 earnings for the S&P 500 index are expected to be up +59.4% from the Covid-hit 2020 Q2 period. But even relative to the pre-Covid 2019 Q2 period, 2021 Q2 earnings are expected to be up +7.9%.

Estimates have been steadily going up, as we have been consistently pointing out in our earnings commentary, though the favorable revisions trend has eased off in recent weeks. The chart below shows earnings growth expectations for 2021 Q2 have changed since early January.

The chart below takes a big-picture view of the quarterly earnings and revenue growth pace.

The chart below presents the big-picture view on an annual basis. As you can see below, 2021 earnings and revenues are expected to be up +34.3% and +10.3%, respectively, which follows the Covid-driven decline of -13.1% in 2020.

On an index ‘EPS’ basis, the 2021 expectation works out to $182.56, up from $135.98 per ‘Index share’ in 2020. These full-year estimates have been going up as well, as the chart below shows.

For a detailed look at the overall earnings picture, including expectations for the coming periods, please check out our weekly Earnings Trends report >>>>Handicapping the Q2 Earnings Season

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>