Panasonic is a historic technology firm that has seen its earnings revisions trend in the wrong direction recently. The stock has also fallen around 20% since February and PCRFY shares have yet to mount a real recovery, while lagging its industry over the past several years.

The Short Story

Panasonic is a tech titan that operates multiple units: appliances, life solutions, connected solutions, automotive, and industrial solutions. The company is currently working to expand its battery business far beyond Tesla as the electric vehicle age begins.

Panasonic also made a splash when it announced in April its plans to buy U.S. supply-chain software provider Blue Yonder Holding Inc. The deal is valued at roughly $7 billion and is projected to help bolster the firm’s software business in the SaaS age. Wall Street has, however, not reacted too kindly to the deal, with PCRFY down around 8% since the end of April.

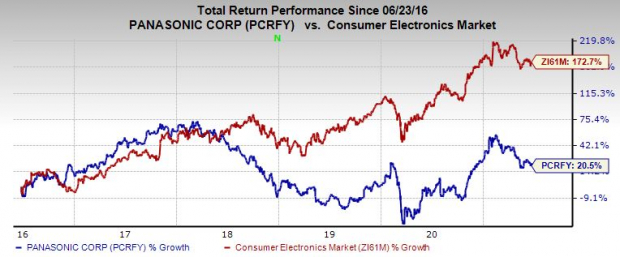

The recent pullback is part of a larger downturn since February for a stock that has struggled to keep up with the booming tech sector. The nearby chart shows PCRFY shares are up just roughly 20% in the last five years. When it comes to the technical side, Panasonic is currently trading below both its 50-day and 200-day moving averages. The rough stretch in 2021 comes as the Nasdaq has rebounded to reach new highs.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Bottom Line

Panasonic has seen some downward earnings revisions activity recently to help it land a Zacks Rank #5 (Strong Sell) at the moment. And its Audio Video Production industry sits in the bottom third of over 250 Zacks industries.

All that said, investors might want to hold off on Panasonic stock until it flashes signs of a possible comeback before considering the consumer electronics standout.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Bear of the Day: Panasonic Corp. (PCRFY)

Panasonic is a historic technology firm that has seen its earnings revisions trend in the wrong direction recently. The stock has also fallen around 20% since February and PCRFY shares have yet to mount a real recovery, while lagging its industry over the past several years.

The Short Story

Panasonic is a tech titan that operates multiple units: appliances, life solutions, connected solutions, automotive, and industrial solutions. The company is currently working to expand its battery business far beyond Tesla as the electric vehicle age begins.

Panasonic also made a splash when it announced in April its plans to buy U.S. supply-chain software provider Blue Yonder Holding Inc. The deal is valued at roughly $7 billion and is projected to help bolster the firm’s software business in the SaaS age. Wall Street has, however, not reacted too kindly to the deal, with PCRFY down around 8% since the end of April.

The recent pullback is part of a larger downturn since February for a stock that has struggled to keep up with the booming tech sector. The nearby chart shows PCRFY shares are up just roughly 20% in the last five years. When it comes to the technical side, Panasonic is currently trading below both its 50-day and 200-day moving averages. The rough stretch in 2021 comes as the Nasdaq has rebounded to reach new highs.

Bottom Line

Panasonic has seen some downward earnings revisions activity recently to help it land a Zacks Rank #5 (Strong Sell) at the moment. And its Audio Video Production industry sits in the bottom third of over 250 Zacks industries.

All that said, investors might want to hold off on Panasonic stock until it flashes signs of a possible comeback before considering the consumer electronics standout.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>