We use cookies to understand how you use our site and to improve your experience.

This includes personalizing content and advertising.

By pressing "Accept All" or closing out of this banner, you consent to the use of all cookies and similar technologies and the sharing of information they collect with third parties.

You can reject marketing cookies by pressing "Deny Optional," but we still use essential, performance, and functional cookies.

In addition, whether you "Accept All," Deny Optional," click the X or otherwise continue to use the site, you accept our Privacy Policy and Terms of Service, revised from time to time.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

With thousands of companies about to report their quarterly results as a new earnings season begins, let’s take a look at the Sales & Earnings Growth Winners screen. It starts with Zacks Rank #1s (Strong Buys) and Zacks Rank #2s (Buys), but also seeks out companies with effective management through ROE and good liquidity.

The companies that pass this screen have a history of earnings and sales growth, which makes them likely to continue such success as they go to the plate in the next few weeks. Here are three names on the list right now:

FedEx Corp. (FDX - Free Report) and the holiday season is a combination that goes together like peanut butter & jelly; buy & hold; Hall & Oates, etc. It’s a match made in market heaven, which was on display in its fiscal second quarter report from mid-December.

You know what FDX does. Every time you hear a beeping sound, its either an Amazon or FedEx truck. The company provides customers and businesses worldwide with a broad portfolio of transportation, e-commerce and business services.

It operates through the following segments: FedEx Express, TNT Express, FedEx Ground and FedEx Freight. As part of the Transportation – Air Freight and Cargo space, FDX is in the top 4% of the Zacks Industry Rank.

Shares surged more than 12.5% in December as it took advantage of the holiday shopping season despite supply chain disruptions and a challenging labor market.

Fiscal second-quarter earnings per share of $4.83 beat the Zacks Consensus Estimate by more than 14%. Revenue of nearly $23.5 billion jumped 14.2% year over year while also exceeding our expectations by nearly 4.2%.

The company thinks the fiscal second half is looking pretty good, so FDX raised its outlook. Analysts followed suit and increased their estimates over the past 30 days.

The Zacks Consensus Estimate for this fiscal year (ending May 2022) is now up to $20.82, which marks a 7% advance over the past 60 days. Expectations for next fiscal year (ending May 2023) is now $23.22, which advanced 2.9% in the same time and suggests year-over-year improvement of approximately 11.5%.

Another sign of second-half optimism was FDX authorizing a new $5 billion share repurchase program. FDX repurchased about $750 million of its common stock fiscal year to date and ended the fiscal second quarter with $6.8 billion in cash.

Home is a good place to be during this pandemic, both literally (for safety) and financially (for big bucks in your portfolio). Robust housing market conditions have been a boon for the space, including major players like D.R. Horton (DHI - Free Report) .

This Zacks Rank #2 (Buy) homebuilder builds and sells single-family houses for entry level and move-up markets. It operates through three segments… and you’d probably never guess that Homebuilding is the biggest piece with nearly 97% of total revenues in fiscal 2020. The other segments are Forestar and Financial Services. Shares are up more than 45% over the past 12 months.

DHI reports again on Feb 2, when it will be going for a 12th straight quarter with a positive earnings surprise. In its fiscal fourth quarter report, earnings per share of $3.70 beat the Zacks Consensus Estimate by 8.8%. Total revenues of $8.1 billion improved 27% year over year and beat our expectation by more than 4%. Homebuilding revenues accounted for $7.63 billion and were up 23.9% year over year.

As for all of fiscal 2022, DHI expects consolidated revenue between $32.5 billion and $33.5 billion. Homes closed is expected at 90K to 92K.

DHI has been successfully dealing with severe disruptions in its supply chain, including restricting the pace of its sales orders. Analysts believe that the company’s upward trajectory should continue, given its industry-leading market share; solid acquisition strategy; well-stocked supply of land, lots and homes; and affordable product offerings across multiple brands.

Over the past 60 days, the Zacks Consensus Estimate for this year (ending September 2022) advanced 2.3% to $14.50. Next year increased in that time by 2.2% to $15.50. Therefore, the year-over-year improvement is currently expected at nearly 7%.

Our dependence on semiconductors and electronics accelerated dramatically during this pandemic… and it won’t be slowing down anytime soon. In fact, the demand will continue growing exponentially into the future, so we better make sure this stuff works!

That’s what Keysight Technologies (KEYS - Free Report) is all about. This provider of electronic design and test instrumentation systems is part of the electronics – measuring equipment space, which is in the top 5% of the Zacks Industry Rank.

It’s two segments are the Communications Solutions Group (accounting for 74% of non-GAAP revenues in fiscal 2020) and the Electronic Industrial Solutions Group (26%). Shares of KEYS are up approximately 28% over the past year.

The company topped the Zacks Consensus Estimate for six straight quarters now. Most recently, it reported fiscal fourth quarter earnings per share of $1.82, which beat expectations by 10.3%. Revenues of $1.29 billion improved 6% year over year.

Furthermore, orders increased 21% to $1.49 billion. Revenues at CSG rose 2% year over year to $919 million due to strength in 5G and aerospace, defense and government end-markets. EISG revenues jumped 18% to $375 million thanks to demand for semiconductor measurement solutions and next-generation automotive and energy technologies.

The company attributed the momentum to its software-centric solutions strategy that allows it to capitalize on long-term secular growth trends in its markets. KEYS expects to continue delivering above-market growth moving forward.

Analysts obviously agree as they have raised earnings estimates over the past 60 days. The Zacks Consensus Estimate for this year (ending October 2022) are up 3.1% to $6.91, while the advance for next year (ending September 2023) is 4.3% to $7.54. The expected year-over-year improvement is more than 9% at the moment.

KEYS is in a good position to continue capitalizing on the investment in next generation process technologies by semiconductor companies. The acceleration of 5G deployments and the defense technology modernization are also avenues for growth moving throughout 2022 and beyond.

For its fiscal first quarter, KEYS expects revenues of $1.225 billion to $1.245 billion with non-GAAP earnings between $1.50 and $1.56.

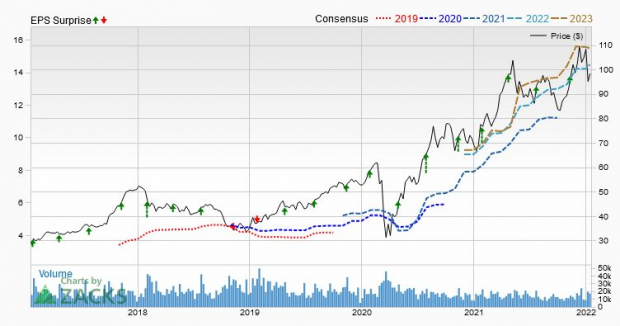

Image Source: Zacks Investment Research

See More Zacks Research for These Tickers

Normally $25 each - click below to receive one report FREE:

Image: Bigstock

3 Sales & Earnings Growth Winners

With thousands of companies about to report their quarterly results as a new earnings season begins, let’s take a look at the Sales & Earnings Growth Winners screen. It starts with Zacks Rank #1s (Strong Buys) and Zacks Rank #2s (Buys), but also seeks out companies with effective management through ROE and good liquidity.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The companies that pass this screen have a history of earnings and sales growth, which makes them likely to continue such success as they go to the plate in the next few weeks. Here are three names on the list right now:

FedEx Corp. (FDX - Free Report)

FedEx Corp. (FDX - Free Report) and the holiday season is a combination that goes together like peanut butter & jelly; buy & hold; Hall & Oates, etc. It’s a match made in market heaven, which was on display in its fiscal second quarter report from mid-December.

You know what FDX does. Every time you hear a beeping sound, its either an Amazon or FedEx truck. The company provides customers and businesses worldwide with a broad portfolio of transportation, e-commerce and business services.

It operates through the following segments: FedEx Express, TNT Express, FedEx Ground and FedEx Freight. As part of the Transportation – Air Freight and Cargo space, FDX is in the top 4% of the Zacks Industry Rank.

Shares surged more than 12.5% in December as it took advantage of the holiday shopping season despite supply chain disruptions and a challenging labor market.

Fiscal second-quarter earnings per share of $4.83 beat the Zacks Consensus Estimate by more than 14%. Revenue of nearly $23.5 billion jumped 14.2% year over year while also exceeding our expectations by nearly 4.2%.

The company thinks the fiscal second half is looking pretty good, so FDX raised its outlook. Analysts followed suit and increased their estimates over the past 30 days.

The Zacks Consensus Estimate for this fiscal year (ending May 2022) is now up to $20.82, which marks a 7% advance over the past 60 days. Expectations for next fiscal year (ending May 2023) is now $23.22, which advanced 2.9% in the same time and suggests year-over-year improvement of approximately 11.5%.

Another sign of second-half optimism was FDX authorizing a new $5 billion share repurchase program. FDX repurchased about $750 million of its common stock fiscal year to date and ended the fiscal second quarter with $6.8 billion in cash.

D.R. Horton (DHI - Free Report)

Home is a good place to be during this pandemic, both literally (for safety) and financially (for big bucks in your portfolio). Robust housing market conditions have been a boon for the space, including major players like D.R. Horton (DHI - Free Report) .

This Zacks Rank #2 (Buy) homebuilder builds and sells single-family houses for entry level and move-up markets. It operates through three segments… and you’d probably never guess that Homebuilding is the biggest piece with nearly 97% of total revenues in fiscal 2020. The other segments are Forestar and Financial Services. Shares are up more than 45% over the past 12 months.

DHI reports again on Feb 2, when it will be going for a 12th straight quarter with a positive earnings surprise. In its fiscal fourth quarter report, earnings per share of $3.70 beat the Zacks Consensus Estimate by 8.8%. Total revenues of $8.1 billion improved 27% year over year and beat our expectation by more than 4%. Homebuilding revenues accounted for $7.63 billion and were up 23.9% year over year.

As for all of fiscal 2022, DHI expects consolidated revenue between $32.5 billion and $33.5 billion. Homes closed is expected at 90K to 92K.

DHI has been successfully dealing with severe disruptions in its supply chain, including restricting the pace of its sales orders. Analysts believe that the company’s upward trajectory should continue, given its industry-leading market share; solid acquisition strategy; well-stocked supply of land, lots and homes; and affordable product offerings across multiple brands.

Over the past 60 days, the Zacks Consensus Estimate for this year (ending September 2022) advanced 2.3% to $14.50. Next year increased in that time by 2.2% to $15.50. Therefore, the year-over-year improvement is currently expected at nearly 7%.

Keysight Technologies (KEYS - Free Report)

Our dependence on semiconductors and electronics accelerated dramatically during this pandemic… and it won’t be slowing down anytime soon. In fact, the demand will continue growing exponentially into the future, so we better make sure this stuff works!

That’s what Keysight Technologies (KEYS - Free Report) is all about. This provider of electronic design and test instrumentation systems is part of the electronics – measuring equipment space, which is in the top 5% of the Zacks Industry Rank.

It’s two segments are the Communications Solutions Group (accounting for 74% of non-GAAP revenues in fiscal 2020) and the Electronic Industrial Solutions Group (26%). Shares of KEYS are up approximately 28% over the past year.

The company topped the Zacks Consensus Estimate for six straight quarters now. Most recently, it reported fiscal fourth quarter earnings per share of $1.82, which beat expectations by 10.3%. Revenues of $1.29 billion improved 6% year over year.

Furthermore, orders increased 21% to $1.49 billion. Revenues at CSG rose 2% year over year to $919 million due to strength in 5G and aerospace, defense and government end-markets. EISG revenues jumped 18% to $375 million thanks to demand for semiconductor measurement solutions and next-generation automotive and energy technologies.

The company attributed the momentum to its software-centric solutions strategy that allows it to capitalize on long-term secular growth trends in its markets. KEYS expects to continue delivering above-market growth moving forward.

Analysts obviously agree as they have raised earnings estimates over the past 60 days. The Zacks Consensus Estimate for this year (ending October 2022) are up 3.1% to $6.91, while the advance for next year (ending September 2023) is 4.3% to $7.54. The expected year-over-year improvement is more than 9% at the moment.

KEYS is in a good position to continue capitalizing on the investment in next generation process technologies by semiconductor companies. The acceleration of 5G deployments and the defense technology modernization are also avenues for growth moving throughout 2022 and beyond.

For its fiscal first quarter, KEYS expects revenues of $1.225 billion to $1.245 billion with non-GAAP earnings between $1.50 and $1.56.