We use cookies to understand how you use our site and to improve your experience.

This includes personalizing content and advertising.

By pressing "Accept All" or closing out of this banner, you consent to the use of all cookies and similar technologies and the sharing of information they collect with third parties.

You can reject marketing cookies by pressing "Deny Optional," but we still use essential, performance, and functional cookies.

In addition, whether you "Accept All," Deny Optional," click the X or otherwise continue to use the site, you accept our Privacy Policy and Terms of Service, revised from time to time.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

3 Earnings All-Stars With Positive Revisions & Surprises

With our first positive month of 2022 out of the way and a new earnings season about to begin, this is a good time to revisit the EPS Growth, Revisions and Positive Surprises. Below are three names that recently passed this screen by securing a high Zacks Rank with upward earnings estimate revisions and positive surprises.

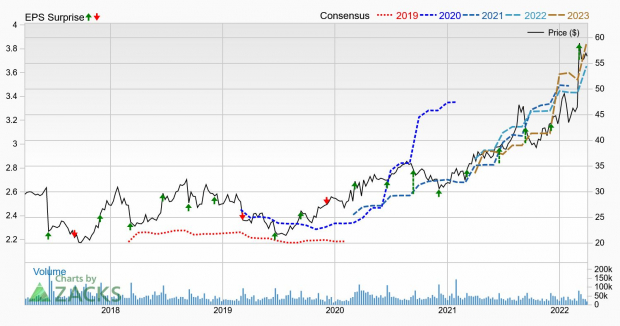

Kroger (KR - Free Report) was a real “go-to” destination during the pandemic with restaurants closed and people stuck in their homes, except for trips to the grocery store of course. The environment will change now that covid’s days are numbered, but this grocery giant sees plenty of money left on the shelves For example, KR’s focus on enhancing its product freshness and expanding its digital sales led to a strong fourth quarter report in early March and a solid guidance for 2022.

This supermarket powerhouse operates under many banners, including Kroger (of course), Food 4 Less, Mariano’s, Pick ‘n Save and several others. It’s four formats are combo stores (food + drugs), multi-department store, marketplace stores and price impact warehouses. As part of the retail-supermarkets space, KR is in the top 10% of the Zacks Industry Rank. Shares are up more than 62% over the past year.

KR reported fourth-quarter earnings per share of 91 cents a few weeks ago, which marked a positive surprise of nearly 25% and eclipsed the Zacks Consensus Estimate for the ninth straight quarter.

Total sales were $33 billion, which topped the Zacks Consensus Estimate by approximately 1.3%. Excluding fuel, sales were up 3.7% year over year. Identical sales, without fuel, rose 4%, while digital sales soared 105% on a two-year stack.

For full year 2022, KR expects to keep its momentum despite a rapidly-changing operating environment. The company sees adjusted earnings per share between $3.75 and $3.85 with identical sales growth (excluding fuel) of 2% to 3%. Despite all the challenges out there, the company still expects to generate total shareholder returns of 8% to 11% over time.

Earnings estimates have increased since the strong quarter and positive guidance. The Zacks Consensus Estimate for this fiscal year (ending January 2023) is $3.66 and next year’s (ending January 2024) is at $3.85, marking gains of 6.7% and 6.9%, respectively, over the past 30 days. But those estimates also suggest year-over-year improvement of 5.2%, which is pretty good for a boring old grocery chain.

Image Source: Zacks Investment Research

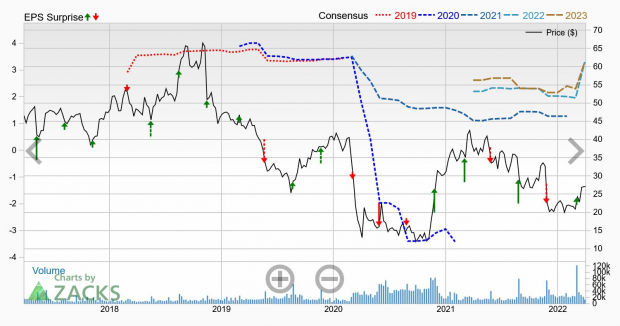

Nordstrom, Inc.

The market might have gotten off to a rough start in 2022, but Nordstrom, Inc. saw shares rise approximately 20% year to date. It’s fourth quarter report from earlier this month showed a company that’s able to increase earnings and sales, while growing its digital footprint.

JWN is a fashion specialty retailer positioned in the upscale segment of the industry. We’re talking about serious shoppers here. Some of its main channels include the Nordstrom full-line stores; Nordstrom Rack; and Trunk Club clubhouses.

However, a little luxury is just what’s needed at the end of an unprecedented pandemic that had people wearing sweatpants and shorts to online business meetings. JWN is enjoying solid demand for its apparel and footwear, robust digital growth, lower markdowns and higher merchandise margins.

JWN kicked off this month with a strong fiscal fourth quarter performance, which included earnings per share of $1.23 that beat the Zacks Consensus Estimate by 18.3%. Furthermore, revenues of $4.5 billion surged 23% from last year and topped our expectation by more than 1.5%.

However, the company seemed most proud that sales were down only 1% from the same period in fiscal 2019, which suggests it has almost fully recovered from the pandemic. Moving forward, the company’s primary focus is on improving the performance of Nordstrom Rack; further increasing profitability; and optimizing its supply chain and inventory flow.

The company expects revenue growth between 5% and 7% for fiscal 2022, as well as adjusted earnings per share of $3.15 to $3.30. The range was above the Zacks Consensus Estimate at the time, but analysts have been hiking expectations to make up the difference.

We now expect earnings of $3.30 for both this fiscal year (ending January 2023) and next fiscal year (ending January 2024). Those estimates have jumped 68% and 43.5%, respectively, over the past 30 days with plenty of time for more improvement moving forward.

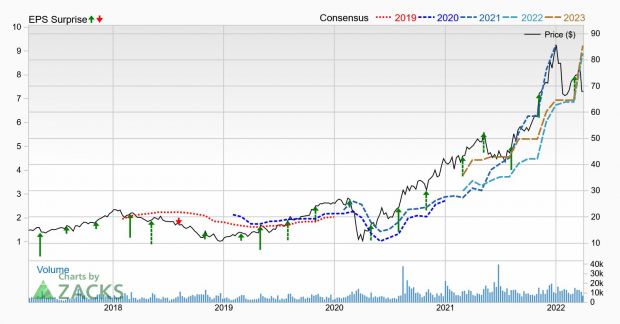

The first rate hike in over three years (with as many as six more coming in future months) makes people a bit more wary about big purchases like new homes. So it’s no surprise that shares of Builders FirstSource, Inc. (BLDR - Free Report) are lower so far in 2022.

However, it still expects strong demand this year… and analysts seem to agree. Earnings estimates have moved higher over the past month, allowing BLDR to retain its enviable Zacks Rank #1 (Strong Buy) status. Plus, shares are still higher by more than 42% over the past year.

BLDR is the largest supplier of building materials, manufactured components and construction services. As part of the building products – retail space, it's in the top 7% of the Zacks Industry Rank. One of the big moves of late was the merger with BMC Stock Holdings, which played a part in its fourth-quarter report from early this month.

The company earned $2.78 per share in the quarter, beating the Zacks Consensus Estimate by more than 47% and bringing the four-quarter average surprise to 74%. BLDR has now surpassed our earnings expectations for 14 consecutive reports.

Net sales came to $4.6 billion, surpassing the Zacks Consensus Estimate by more than 6%. The result also improved 23.7% from last year on a pro forma basis. Core organic sales advanced 11.7% on robust demand for single-family housing, R&R and other activities.

For full year 2021, adjusted earnings soared to $10.32 versus $2.79 in 2020. Net sales were $19.9 billion, up 55.8% from the 2020 pro-forma level.

The Zacks Consensus Estimate for this year jumped 30% in the past 30 days to $8.90, while next year increased 33% to $9.23. Therefore, analysts currently see 3.7% year-over-year growth with plenty of time for further improvement.

Image Source: Zacks Investment Research

See More Zacks Research for These Tickers

Normally $25 each - click below to receive one report FREE:

Image: Bigstock

3 Earnings All-Stars With Positive Revisions & Surprises

With our first positive month of 2022 out of the way and a new earnings season about to begin, this is a good time to revisit the EPS Growth, Revisions and Positive Surprises. Below are three names that recently passed this screen by securing a high Zacks Rank with upward earnings estimate revisions and positive surprises.

Kroger (KR - Free Report)

Kroger (KR - Free Report) was a real “go-to” destination during the pandemic with restaurants closed and people stuck in their homes, except for trips to the grocery store of course. The environment will change now that covid’s days are numbered, but this grocery giant sees plenty of money left on the shelves For example, KR’s focus on enhancing its product freshness and expanding its digital sales led to a strong fourth quarter report in early March and a solid guidance for 2022.

This supermarket powerhouse operates under many banners, including Kroger (of course), Food 4 Less, Mariano’s, Pick ‘n Save and several others. It’s four formats are combo stores (food + drugs), multi-department store, marketplace stores and price impact warehouses. As part of the retail-supermarkets space, KR is in the top 10% of the Zacks Industry Rank. Shares are up more than 62% over the past year.

KR reported fourth-quarter earnings per share of 91 cents a few weeks ago, which marked a positive surprise of nearly 25% and eclipsed the Zacks Consensus Estimate for the ninth straight quarter.

Total sales were $33 billion, which topped the Zacks Consensus Estimate by approximately 1.3%. Excluding fuel, sales were up 3.7% year over year. Identical sales, without fuel, rose 4%, while digital sales soared 105% on a two-year stack.

For full year 2022, KR expects to keep its momentum despite a rapidly-changing operating environment. The company sees adjusted earnings per share between $3.75 and $3.85 with identical sales growth (excluding fuel) of 2% to 3%. Despite all the challenges out there, the company still expects to generate total shareholder returns of 8% to 11% over time.

Earnings estimates have increased since the strong quarter and positive guidance. The Zacks Consensus Estimate for this fiscal year (ending January 2023) is $3.66 and next year’s (ending January 2024) is at $3.85, marking gains of 6.7% and 6.9%, respectively, over the past 30 days. But those estimates also suggest year-over-year improvement of 5.2%, which is pretty good for a boring old grocery chain.

Image Source: Zacks Investment Research

Nordstrom, Inc.

The market might have gotten off to a rough start in 2022, but Nordstrom, Inc. saw shares rise approximately 20% year to date. It’s fourth quarter report from earlier this month showed a company that’s able to increase earnings and sales, while growing its digital footprint.

JWN is a fashion specialty retailer positioned in the upscale segment of the industry. We’re talking about serious shoppers here. Some of its main channels include the Nordstrom full-line stores; Nordstrom Rack; and Trunk Club clubhouses.

However, a little luxury is just what’s needed at the end of an unprecedented pandemic that had people wearing sweatpants and shorts to online business meetings. JWN is enjoying solid demand for its apparel and footwear, robust digital growth, lower markdowns and higher merchandise margins.

JWN kicked off this month with a strong fiscal fourth quarter performance, which included earnings per share of $1.23 that beat the Zacks Consensus Estimate by 18.3%. Furthermore, revenues of $4.5 billion surged 23% from last year and topped our expectation by more than 1.5%.

However, the company seemed most proud that sales were down only 1% from the same period in fiscal 2019, which suggests it has almost fully recovered from the pandemic. Moving forward, the company’s primary focus is on improving the performance of Nordstrom Rack; further increasing profitability; and optimizing its supply chain and inventory flow.

The company expects revenue growth between 5% and 7% for fiscal 2022, as well as adjusted earnings per share of $3.15 to $3.30. The range was above the Zacks Consensus Estimate at the time, but analysts have been hiking expectations to make up the difference.

We now expect earnings of $3.30 for both this fiscal year (ending January 2023) and next fiscal year (ending January 2024). Those estimates have jumped 68% and 43.5%, respectively, over the past 30 days with plenty of time for more improvement moving forward.

Image Source: Zacks Investment Research

Builders FirstSource, Inc. (BLDR - Free Report)

The first rate hike in over three years (with as many as six more coming in future months) makes people a bit more wary about big purchases like new homes. So it’s no surprise that shares of Builders FirstSource, Inc. (BLDR - Free Report) are lower so far in 2022.

However, it still expects strong demand this year… and analysts seem to agree. Earnings estimates have moved higher over the past month, allowing BLDR to retain its enviable Zacks Rank #1 (Strong Buy) status. Plus, shares are still higher by more than 42% over the past year.

BLDR is the largest supplier of building materials, manufactured components and construction services. As part of the building products – retail space, it's in the top 7% of the Zacks Industry Rank. One of the big moves of late was the merger with BMC Stock Holdings, which played a part in its fourth-quarter report from early this month.

The company earned $2.78 per share in the quarter, beating the Zacks Consensus Estimate by more than 47% and bringing the four-quarter average surprise to 74%. BLDR has now surpassed our earnings expectations for 14 consecutive reports.

Net sales came to $4.6 billion, surpassing the Zacks Consensus Estimate by more than 6%. The result also improved 23.7% from last year on a pro forma basis. Core organic sales advanced 11.7% on robust demand for single-family housing, R&R and other activities.

For full year 2021, adjusted earnings soared to $10.32 versus $2.79 in 2020. Net sales were $19.9 billion, up 55.8% from the 2020 pro-forma level.

The Zacks Consensus Estimate for this year jumped 30% in the past 30 days to $8.90, while next year increased 33% to $9.23. Therefore, analysts currently see 3.7% year-over-year growth with plenty of time for further improvement.

Image Source: Zacks Investment Research