Playa Hotels & Resorts N.V. finally has some good news to celebrate as travelers rush to Mexico and the Caribbean this year on the reopening. This Zacks Rank #1 (Strong Buy) is expected to see triple digit earnings growth, which will be positive for the first time since the pandemic hit.

Playa Hotels & Resorts owns and/or manages 22 all-inclusive resorts in popular vacation destinations in Mexico, Jamaica and the Dominican Republic. These include brands such as Hyatt, Wyndham, Hilton, and Jewel resorts.

Another Beat in the Second Quarter of 2022

On Aug 4, Playa Hotels & Resorts reported its second quarter results and beat for the second straight quarter. Earnings were $0.15 versus the Zacks Consensus Estimate of $0.08.

Net income was $30.5 million compared to a net loss of $7.8 million in the second quarter of 2021.

Net Package RevPar rose 79.8% to $271.40 from $150.98 driven by a surge in occupancy which was 75.1% in the quarter, up 25.2% from last year which was 49.9%.

Jamaica Rebounds

Jamaica has been the laggard in reopening to outside tourist guests but it removed COVID-19 travel related restrictions in April which helped sure both leisure and MICE demand in the country.

Jamaica reported the highest occupancy rate of any segment during the second quarter as travelers surged back into the country. Flight capacity and international passenger arrivals into Montego Bay spiked in the quarter.

Jamaica has led the way in bookings for 2023 in recent months.

Playa Hotel & Resorts said that Jamaica was their best performing segment before the pandemic and they expect it to continue to improve.

Bookings pace remains strong across all three of its markets, which bodes well for the upcoming winter beach season in 2023.

Analysts Raise Full Year 2022 and 2023 Estimates

Business has improved in Playa's three key markets as COVID travel restrictions, including testing requirements, have been lifted. People want to travel and have experiences in 2022 and 2023. They are already booking for next year.

2 earnings estimates have been raised in the last week both for 2022 and 2023.

The 2022 Zacks Consensus Estimate has jumped to $0.46 from $0.37 in the last week. That's earnings growth of 195.8% compared to 2021 where the company lost $0.48.

Similarly, the 2023 Zacks Consensus Estimate has also surged higher, up to $0.63 from $0.51 in the last 7 days. This is another 37.7% earnings growth.

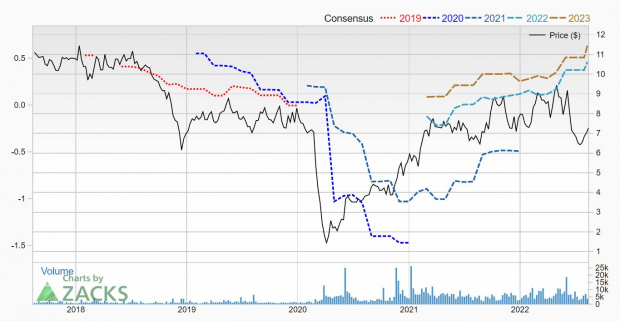

Shares Fall From Recent Highs

Shares of Playa Hotel & Resorts were big pandemic winners, up 91% over the last 2 years. But year-to-date, the shares are down 8% and they've fallen 14% in the last 3 months despite the rebound in earnings.

Image Source: Zacks Investment Research

Shares are cheap with a forward P/E of 15.8 and a price-to-book ratio of 1.7. A P/B ratio under 3.0 usually indicates a company is undervalued.

For investors looking for a play on the boom in travel, Playa Hotel & Resorts should be on your short list.

Image: Bigstock

Bull of the Day: Playa Hotels (PLYA)

Playa Hotels & Resorts N.V. finally has some good news to celebrate as travelers rush to Mexico and the Caribbean this year on the reopening. This Zacks Rank #1 (Strong Buy) is expected to see triple digit earnings growth, which will be positive for the first time since the pandemic hit.

Playa Hotels & Resorts owns and/or manages 22 all-inclusive resorts in popular vacation destinations in Mexico, Jamaica and the Dominican Republic. These include brands such as Hyatt, Wyndham, Hilton, and Jewel resorts.

Another Beat in the Second Quarter of 2022

On Aug 4, Playa Hotels & Resorts reported its second quarter results and beat for the second straight quarter. Earnings were $0.15 versus the Zacks Consensus Estimate of $0.08.

Net income was $30.5 million compared to a net loss of $7.8 million in the second quarter of 2021.

Net Package RevPar rose 79.8% to $271.40 from $150.98 driven by a surge in occupancy which was 75.1% in the quarter, up 25.2% from last year which was 49.9%.

Jamaica Rebounds

Jamaica has been the laggard in reopening to outside tourist guests but it removed COVID-19 travel related restrictions in April which helped sure both leisure and MICE demand in the country.

Jamaica reported the highest occupancy rate of any segment during the second quarter as travelers surged back into the country. Flight capacity and international passenger arrivals into Montego Bay spiked in the quarter.

Jamaica has led the way in bookings for 2023 in recent months.

Playa Hotel & Resorts said that Jamaica was their best performing segment before the pandemic and they expect it to continue to improve.

Bookings pace remains strong across all three of its markets, which bodes well for the upcoming winter beach season in 2023.

Analysts Raise Full Year 2022 and 2023 Estimates

Business has improved in Playa's three key markets as COVID travel restrictions, including testing requirements, have been lifted. People want to travel and have experiences in 2022 and 2023. They are already booking for next year.

2 earnings estimates have been raised in the last week both for 2022 and 2023.

The 2022 Zacks Consensus Estimate has jumped to $0.46 from $0.37 in the last week. That's earnings growth of 195.8% compared to 2021 where the company lost $0.48.

Similarly, the 2023 Zacks Consensus Estimate has also surged higher, up to $0.63 from $0.51 in the last 7 days. This is another 37.7% earnings growth.

Shares Fall From Recent Highs

Shares of Playa Hotel & Resorts were big pandemic winners, up 91% over the last 2 years. But year-to-date, the shares are down 8% and they've fallen 14% in the last 3 months despite the rebound in earnings.

Image Source: Zacks Investment Research

Shares are cheap with a forward P/E of 15.8 and a price-to-book ratio of 1.7. A P/B ratio under 3.0 usually indicates a company is undervalued.

For investors looking for a play on the boom in travel, Playa Hotel & Resorts should be on your short list.