Seagate Technology Holdings (STX), a Zacks Rank #5 (Strong Sell) stock, is a global provider of data storage technology and solutions. The company provides mass capacity storage products including hard disk drives (HDDs), solid state drives (SSDs), and network-attached drives. Based in Dublin, Ireland, STX sells its products primarily to original equipment manufacturers, distributors, and retailers.

STX faces stiff competition in an evolving industry. The merger between Western Digital and SanDisk has made it more challenging for Seagate to capture market share in the important SSD market. Ongoing global macroeconomic headwinds, high inflation, as well as lingering component shortages are likely to continue to exert pressure on revenues in the short-term.

Furthermore, Seagate derives a significant portion of its revenues from outside the United States, subjecting the company to exchange rate volatility. Unfavorable movement in exchange rates can adversely impact results and undermine growth potential.

The Zacks Rundown

STX has been severely underperforming the market over the past year. This poorly-rated stock experienced a climax top in December of last year and has been in a price downtrend ever since. Shares are hitting a series of 52-week lows and represent a compelling short opportunity. When a stock can’t even muster a rally when the general market is moving higher, it’s telling us “I’m very weak”.

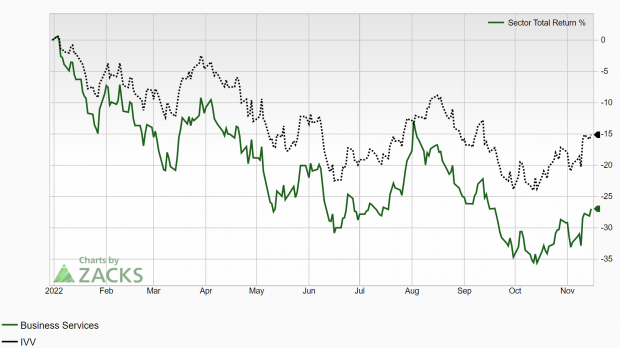

Seagate Technology is part of the Zacks Business Services sector, which currently ranks in the bottom 44% out of all 16 Zacks Ranked Sectors. As such, we expect this sector as a whole to underperform the market over the next 3 to 6 months. The Business Services sector has underperformed the market this year at nearly every turn:

Image Source: Zacks Investment Research

Candidates in the bottom tiers of sectors can often represent solid potential short candidates. While individual stocks have the ability to outperform even when included in a poor-performing sector, the inclusion in a weaker group serves as a headwind for any potential rallies. The odds are stacked against STX and the stock is agreeing with this notion after making a series of lower lows.

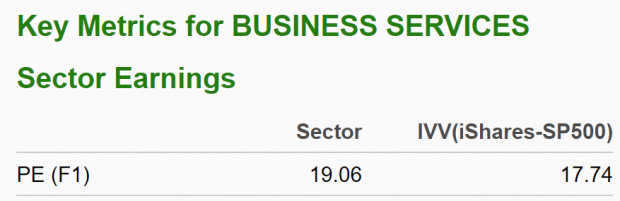

Despite the subpar performance, the sector is still relatively overvalued:

Image Source: Zacks Investment Research

Weak Foundation: Falling Short on Earnings and Deteriorating Forecasts

Earnings misses have been a sore spot for STX during the past year. The data storage provider has fallen short of estimates in three of the past four quarters. STX most recently reported fiscal Q1 EPS last month of $0.48/share, missing the $0.68 consensus estimate by -29.41%. Revenues of $2.03 billion also missed the mark by -1.95%. These are the types of negative trends that the bears like to see.

STX has posted an average earnings miss of -11.59% over the past four quarters. Consistently missing earnings estimates by that a wide of a margin is a recipe for stock price underperformance.

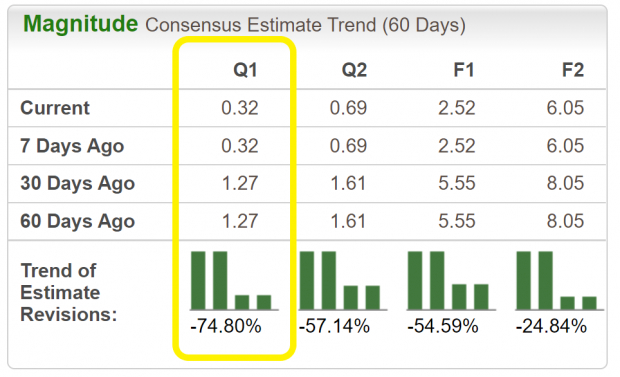

Analysts have been revising earnings estimates downward as of late. For the current quarter, estimates have been slashed -74.8% over the past 30 days. The fiscal Q2 Zacks Consensus EPS Estimate now stands at $0.32/share, translating to a -86.72% earnings regression relative to the same quarter last year.

Image Source: Zacks Investment Research

Technical Outlook

STX stock has been steadily falling since late last year and has now established a well-defined downtrend. Notice how both the 50-day (blue line) and 200-day (red line) moving averages are sloping down. Shares have declined more than 45% in the past year. The stock continues to trade below both averages – another bearish sign.

Image Source: StockCharts

While not the most accurate indicator, STX has also experienced what is known as a ‘death cross’, wherein the stock’s 50-day moving average crosses below its 200-day moving average. STX would have to make a serious move to the upside and show increasing earnings estimate revisions to warrant taking any long positions in the stock.

Final Thoughts

The recent earnings misses in addition to deteriorating estimates are both huge red flags and need to be respected. These will likely serve as a ceiling to any potential rallies, nurturing the stock’s downtrend.

STX’s characteristics have resulted in a Zacks Momentum Style Score of ‘C’, indicating further downside is likely. The fact that STX is included in a bottom-performing sector simply adds to the growing list of concerns. Investors will want to steer clear of STX until the situation shows major signs of improvement, or possibly include it as part of a hedge or short strategy.

Bear of the Day: Seagate Technology Holdings (STX)

Seagate Technology Holdings (STX), a Zacks Rank #5 (Strong Sell) stock, is a global provider of data storage technology and solutions. The company provides mass capacity storage products including hard disk drives (HDDs), solid state drives (SSDs), and network-attached drives. Based in Dublin, Ireland, STX sells its products primarily to original equipment manufacturers, distributors, and retailers.

STX faces stiff competition in an evolving industry. The merger between Western Digital and SanDisk has made it more challenging for Seagate to capture market share in the important SSD market. Ongoing global macroeconomic headwinds, high inflation, as well as lingering component shortages are likely to continue to exert pressure on revenues in the short-term.

Furthermore, Seagate derives a significant portion of its revenues from outside the United States, subjecting the company to exchange rate volatility. Unfavorable movement in exchange rates can adversely impact results and undermine growth potential.

The Zacks Rundown

STX has been severely underperforming the market over the past year. This poorly-rated stock experienced a climax top in December of last year and has been in a price downtrend ever since. Shares are hitting a series of 52-week lows and represent a compelling short opportunity. When a stock can’t even muster a rally when the general market is moving higher, it’s telling us “I’m very weak”.

Seagate Technology is part of the Zacks Business Services sector, which currently ranks in the bottom 44% out of all 16 Zacks Ranked Sectors. As such, we expect this sector as a whole to underperform the market over the next 3 to 6 months. The Business Services sector has underperformed the market this year at nearly every turn:

Image Source: Zacks Investment Research

Candidates in the bottom tiers of sectors can often represent solid potential short candidates. While individual stocks have the ability to outperform even when included in a poor-performing sector, the inclusion in a weaker group serves as a headwind for any potential rallies. The odds are stacked against STX and the stock is agreeing with this notion after making a series of lower lows.

Despite the subpar performance, the sector is still relatively overvalued:

Image Source: Zacks Investment Research

Weak Foundation: Falling Short on Earnings and Deteriorating Forecasts

Earnings misses have been a sore spot for STX during the past year. The data storage provider has fallen short of estimates in three of the past four quarters. STX most recently reported fiscal Q1 EPS last month of $0.48/share, missing the $0.68 consensus estimate by -29.41%. Revenues of $2.03 billion also missed the mark by -1.95%. These are the types of negative trends that the bears like to see.

STX has posted an average earnings miss of -11.59% over the past four quarters. Consistently missing earnings estimates by that a wide of a margin is a recipe for stock price underperformance.

Analysts have been revising earnings estimates downward as of late. For the current quarter, estimates have been slashed -74.8% over the past 30 days. The fiscal Q2 Zacks Consensus EPS Estimate now stands at $0.32/share, translating to a -86.72% earnings regression relative to the same quarter last year.

Image Source: Zacks Investment Research

Technical Outlook

STX stock has been steadily falling since late last year and has now established a well-defined downtrend. Notice how both the 50-day (blue line) and 200-day (red line) moving averages are sloping down. Shares have declined more than 45% in the past year. The stock continues to trade below both averages – another bearish sign.

Image Source: StockCharts

While not the most accurate indicator, STX has also experienced what is known as a ‘death cross’, wherein the stock’s 50-day moving average crosses below its 200-day moving average. STX would have to make a serious move to the upside and show increasing earnings estimate revisions to warrant taking any long positions in the stock.

Final Thoughts

The recent earnings misses in addition to deteriorating estimates are both huge red flags and need to be respected. These will likely serve as a ceiling to any potential rallies, nurturing the stock’s downtrend.

STX’s characteristics have resulted in a Zacks Momentum Style Score of ‘C’, indicating further downside is likely. The fact that STX is included in a bottom-performing sector simply adds to the growing list of concerns. Investors will want to steer clear of STX until the situation shows major signs of improvement, or possibly include it as part of a hedge or short strategy.