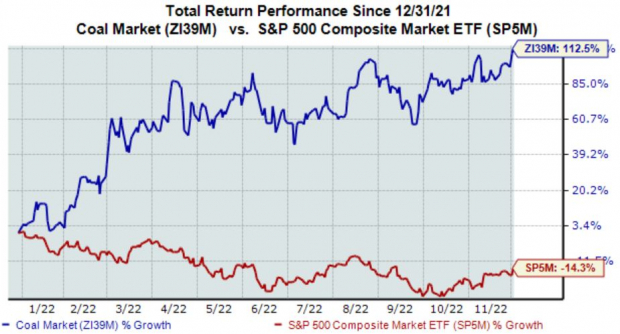

The Zacks Coal Industry has been scorching hot in 2022, up more than a triple-digit 110% and crushing the S&P 500’s performance.

Image Source: Zacks Investment Research

Further, the Industry is currently ranked in the top 14% of all Zacks Industries (36 out of 250).

Studies have shown that 50% of a stock's price movement can be attributed to the group it’s in, making it crucial to ensure that investors target stocks in a thriving industry.

In fact, the top 50% of Zacks Ranked Industries outperform the bottom 50% by a factor of more than two to one.

A company residing in the realm that’s witnessed positive earnings estimate revisions over the last several months is CONSOL Energy .

Image Source: Zacks Investment Research

CONSOL Energy is a publicly owned producer and exporter of high-BTU bituminous thermal coal and is one of the leading energy companies in the United States.

Let’s take a closer look at how the company currently stands.

Share Performance & Valuation

Year-to-date, CEIX shares have been unbelievably strong, up more than 230% and leaving the S&P 500’s performance in the dust.

Image Source: Zacks Investment Research

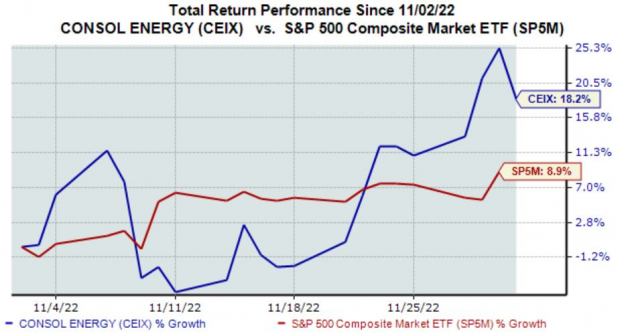

Over the last month, CEIX shares have continued on their market-beating trajectory, up nearly 20%.

Image Source: Zacks Investment Research

Clearly, bulls have had complete control of this stock in 2022.

Currently, shares trade at a 1.4X forward price-to-sales ratio, above the 0.6X five-year margin and its Zacks Coal Industry average of 0.8X.

Image Source: Zacks Investment Research

CEIX carries a Value Style Score of “B.”

Growth Outlook

It’s hard to ignore CEIX’s growth profile, further bolstered by its Style Score of “A” for Growth.

The Zacks Consensus EPS Estimate of $11.05 for its current fiscal year (FY22) suggests a Y/Y improvement of more than 430%. And in FY23, estimates suggest a further 150% of bottom-line growth.

The earnings growth comes on top of forecasted Y/Y revenue upticks of 57% in FY22 and 35% in FY23.

Dividends

Let’s face it – we all love to get paid.

Fortunately for those with an appetite for income, CEIX’s 5.4% annual dividend yield provides precisely that. As we can see in the chart below, the current annual yield is well above its Zacks Industry average.

Image Source: Zacks Investment Research

Bottom Line

One of the best ways investors can find expected winners is by utilizing the Zacks Rank – one of the most potent market tools out there that gives investors a massive advantage.

The top 5% of all stocks receive the highly coveted Zacks Rank #1 (Strong Buy). These stocks should outperform the market more than any other rank.

CONSOL Energy would be an excellent stock for investors to keep on their watchlists, as displayed by its Zack Rank #1 (Strong Buy).

Bull of the Day: CONSOL Energy, Inc. (CEIX)

The Zacks Coal Industry has been scorching hot in 2022, up more than a triple-digit 110% and crushing the S&P 500’s performance.

Image Source: Zacks Investment Research

Further, the Industry is currently ranked in the top 14% of all Zacks Industries (36 out of 250).

Studies have shown that 50% of a stock's price movement can be attributed to the group it’s in, making it crucial to ensure that investors target stocks in a thriving industry.

In fact, the top 50% of Zacks Ranked Industries outperform the bottom 50% by a factor of more than two to one.

A company residing in the realm that’s witnessed positive earnings estimate revisions over the last several months is CONSOL Energy .

Image Source: Zacks Investment Research

CONSOL Energy is a publicly owned producer and exporter of high-BTU bituminous thermal coal and is one of the leading energy companies in the United States.

Let’s take a closer look at how the company currently stands.

Share Performance & Valuation

Year-to-date, CEIX shares have been unbelievably strong, up more than 230% and leaving the S&P 500’s performance in the dust.

Image Source: Zacks Investment Research

Over the last month, CEIX shares have continued on their market-beating trajectory, up nearly 20%.

Image Source: Zacks Investment Research

Clearly, bulls have had complete control of this stock in 2022.

Currently, shares trade at a 1.4X forward price-to-sales ratio, above the 0.6X five-year margin and its Zacks Coal Industry average of 0.8X.

Image Source: Zacks Investment Research

CEIX carries a Value Style Score of “B.”

Growth Outlook

It’s hard to ignore CEIX’s growth profile, further bolstered by its Style Score of “A” for Growth.

The Zacks Consensus EPS Estimate of $11.05 for its current fiscal year (FY22) suggests a Y/Y improvement of more than 430%. And in FY23, estimates suggest a further 150% of bottom-line growth.

The earnings growth comes on top of forecasted Y/Y revenue upticks of 57% in FY22 and 35% in FY23.

Dividends

Let’s face it – we all love to get paid.

Fortunately for those with an appetite for income, CEIX’s 5.4% annual dividend yield provides precisely that. As we can see in the chart below, the current annual yield is well above its Zacks Industry average.

Image Source: Zacks Investment Research

Bottom Line

One of the best ways investors can find expected winners is by utilizing the Zacks Rank – one of the most potent market tools out there that gives investors a massive advantage.

The top 5% of all stocks receive the highly coveted Zacks Rank #1 (Strong Buy). These stocks should outperform the market more than any other rank.

CONSOL Energy would be an excellent stock for investors to keep on their watchlists, as displayed by its Zack Rank #1 (Strong Buy).