This is an excerpt from our most recent Economic Outlook report. To access the full PDF, please click here.

Four times a year, Zacks does a survey of Chief Investment Officers (CIOs).

CIOs get asked 14 questions. All questions tap into their 12-month look-ahead views: On numerous stock ETFs, broad bond classes, and key macro fundamentals.

For this Zacks Economics Report, I share the latest results. Since the calendar year of 2023 and that 12-month look ahead match up, it amounts to a credible “Year Ahead” forecast.

Keep in mind: CIOs manage money. They think conservative, and apply long-term investing tactics.

I. Zacks FEB 2023 CIO Survey at a Glance

A. First off, we tap into their careers. 50% are CIOs for large buy-side firms.

Q1 – Types of Organization

There are 50% large buy side firms, 25% major banks, 25% academics, 0% midsize brokerages and 0% consultancies.

B. Then, we ask them for their 12M returns outlook for each major style class (Large, Mid, and Small Cap). And their preference for Value or Growth stocks.

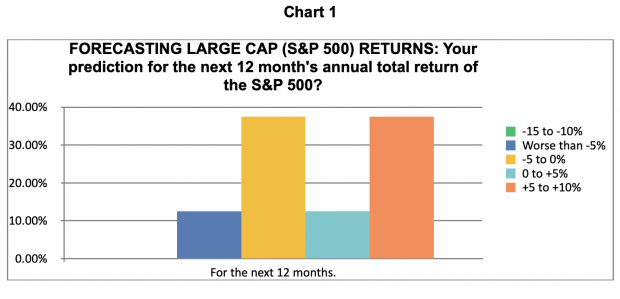

In the latest results, CIOs are very sober about the outlook for returns in 2023.

The Large Caps are going to toggle around. An equal number of CIOs see small losses for the S&P500 (-5% to 0%) as see modest gains (+5% to 10%). Confirm that next.

Image Source: Zacks Investment Research

This shows the same weak outlook.

Q2 – Large Caps and Q5 Large Cap Value or Growth, 12 months

The likeliest Large Cap return is (-5% to 0%) or (+5% to +10%) in 12 months.

Value indexes Out Perform. Growth indexes Market or Under Perform.

Q3 – Mid Caps and Q6 Mid Cap Value or Growth, 12 months

The likeliest Mid Cap return is (+0 to +5%) or (+5% to +10%) in 12 months.

Value indexes Market Perform. Growth indexes Under Perform.

Q4 – Small Caps and Q7 Small Cap Value or Growth, 12 months

The likeliest Small Cap return is (-5% to 0%), (0 to +5%) or (+5% to +10%) in 12 months. Value indexes Out Perform. Growth indexes Market or Under Perform.

CIOs are sober about the 2023 outlook, largely due to their concern about slow U.S. real GDP growth morphing into a U.S. recession.

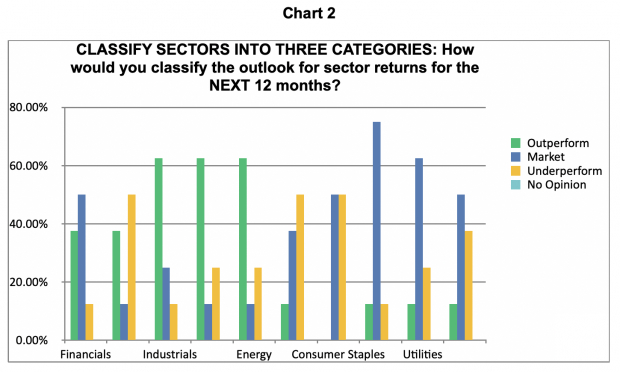

Now, we skip to Question 8, which is about the outlook for S&P500 sectors.

Image Source: Zacks Investment Research

You can see in both the chart above, and the Q8 questions results, below.

CIOs are more bullish.

They like cyclical S&P500 sector areas like Industrials, Materials, and Energy. Maybe Financials too.

Q8 – S&P500 Sectors, 12 months

Outperforms are: Industrials, Materials, Energy, maybe Financials

Market performs are: Health Care, Utilities, Telcos

Underperforms are: Info Tech, Consumer Discretionary, Consumer Staples

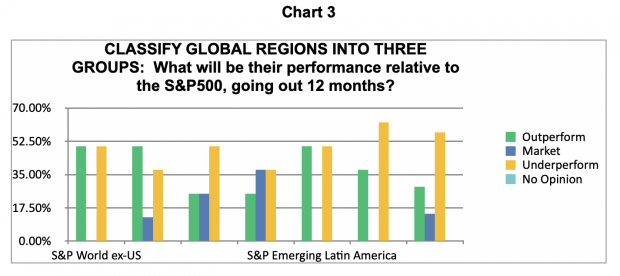

D. What about global stock ETF regions and countries?

CIOs are bullish again.

This is the first time in a long time, I have seen the CIOs bullish on the World Ex-U.S.

Q9 – Global Regions, 12 months

Outperforms: World ex-U.S., Euro Stoxx 50, S&P Emerging Latin America

Market performs: Emerging Asia Pacific

Underperforms: ME & Africa, Vanguard Developed Asia Pacific, Emerging Europe

Image Source: Zacks Investment Research

If you want to play country ETFs, Q10 below provides you the list of the ETFs with the best 12-month look ahead.

Q10 – Countries, 12 months

Outperform: S. Korea, Brazil, France, Australia, Canada, India

Market Perform: Mexico, Hong Kong, Japan, Taiwan, U.K., Malaysia,

Underperform: Russia, South Africa, Turkey, China, Singapore, Germany, Italy, Spain

South Korea is their best country ETF idea in 2023.

Materials countries like Brazil, Australia, and Canada make the outperform list too.

To no surprise, stay away from Russia.

Image: Shutterstock

Zacks 2023 CIO Survey

This is an excerpt from our most recent Economic Outlook report. To access the full PDF, please click here.

Four times a year, Zacks does a survey of Chief Investment Officers (CIOs).

CIOs get asked 14 questions. All questions tap into their 12-month look-ahead views: On numerous stock ETFs, broad bond classes, and key macro fundamentals.

For this Zacks Economics Report, I share the latest results. Since the calendar year of 2023 and that 12-month look ahead match up, it amounts to a credible “Year Ahead” forecast.

Keep in mind: CIOs manage money. They think conservative, and apply long-term investing tactics.

I. Zacks FEB 2023 CIO Survey at a Glance

A. First off, we tap into their careers. 50% are CIOs for large buy-side firms.

Q1 – Types of Organization

There are 50% large buy side firms, 25% major banks, 25% academics, 0% midsize brokerages and 0% consultancies.

B. Then, we ask them for their 12M returns outlook for each major style class (Large, Mid, and Small Cap). And their preference for Value or Growth stocks.

In the latest results, CIOs are very sober about the outlook for returns in 2023.

The Large Caps are going to toggle around. An equal number of CIOs see small losses for the S&P500 (-5% to 0%) as see modest gains (+5% to 10%). Confirm that next.

Image Source: Zacks Investment Research

This shows the same weak outlook.

Q2 – Large Caps and Q5 Large Cap Value or Growth, 12 months

The likeliest Large Cap return is (-5% to 0%) or (+5% to +10%) in 12 months.

Value indexes Out Perform. Growth indexes Market or Under Perform.

Q3 – Mid Caps and Q6 Mid Cap Value or Growth, 12 months

The likeliest Mid Cap return is (+0 to +5%) or (+5% to +10%) in 12 months.

Value indexes Market Perform. Growth indexes Under Perform.

Q4 – Small Caps and Q7 Small Cap Value or Growth, 12 months

The likeliest Small Cap return is (-5% to 0%), (0 to +5%) or (+5% to +10%) in 12 months. Value indexes Out Perform. Growth indexes Market or Under Perform.

CIOs are sober about the 2023 outlook, largely due to their concern about slow U.S. real GDP growth morphing into a U.S. recession.

Now, we skip to Question 8, which is about the outlook for S&P500 sectors.

Image Source: Zacks Investment Research

You can see in both the chart above, and the Q8 questions results, below.

CIOs are more bullish.

They like cyclical S&P500 sector areas like Industrials, Materials, and Energy. Maybe Financials too.

Q8 – S&P500 Sectors, 12 months

Outperforms are: Industrials, Materials, Energy, maybe Financials

Market performs are: Health Care, Utilities, Telcos

Underperforms are: Info Tech, Consumer Discretionary, Consumer Staples

D. What about global stock ETF regions and countries?

CIOs are bullish again.

This is the first time in a long time, I have seen the CIOs bullish on the World Ex-U.S.

Q9 – Global Regions, 12 months

Outperforms: World ex-U.S., Euro Stoxx 50, S&P Emerging Latin America

Market performs: Emerging Asia Pacific

Underperforms: ME & Africa, Vanguard Developed Asia Pacific, Emerging Europe

Image Source: Zacks Investment Research

If you want to play country ETFs, Q10 below provides you the list of the ETFs with the best 12-month look ahead.

Q10 – Countries, 12 months

Outperform: S. Korea, Brazil, France, Australia, Canada, India

Market Perform: Mexico, Hong Kong, Japan, Taiwan, U.K., Malaysia,

Underperform: Russia, South Africa, Turkey, China, Singapore, Germany, Italy, Spain

South Korea is their best country ETF idea in 2023.

Materials countries like Brazil, Australia, and Canada make the outperform list too.

To no surprise, stay away from Russia.