Starting a new business can be a daunting task. An online presence is an absolute must for any business these days, regardless of the industry. While there are a host of difference services that provide the tools to create that presence, one company has attempted to simplify the process by offering an all-in-one solution where entrepreneurs can build a website as well as sell products and services directly through their platform.

Squarespace operates a web-based platform for businesses and independent creators to build an online presence, growth their brands, and manage their businesses. Its suite of integrated products enables users to manage their projects through websites, domains, e-commerce, marketing tools, scheduling, and social media.

Squarespace, a Zacks Rank #2 (Buy) stock, is ranked favorably by our Zacks Style Scores, with a top-rated ‘A’ mark in our Growth category. This indicates the stock is likely to move higher on favorable sales and earnings growth metrics.

Squarespace has delivered a trailing four-quarter average earnings surprise of 105.55%. Earlier in March, SQSP stock jumped nearly 14% after the company reported revenues that came in above analysts’ expectations. The web-hosting service reported fourth-quarter revenues of $228.8 million, a 2.91% surprise versus the $222.3 consensus estimate.

The stock has steadily outperformed the market this year, rising nearly 24% year-to-date. Notice how SQSP has been steadily making a series of higher highs, while trading above upward-sloping 50 (blue) and 200-day (red) moving averages. Shares continue to hover near a 52-week high – a sign of strength.

Image Source: StockCharts

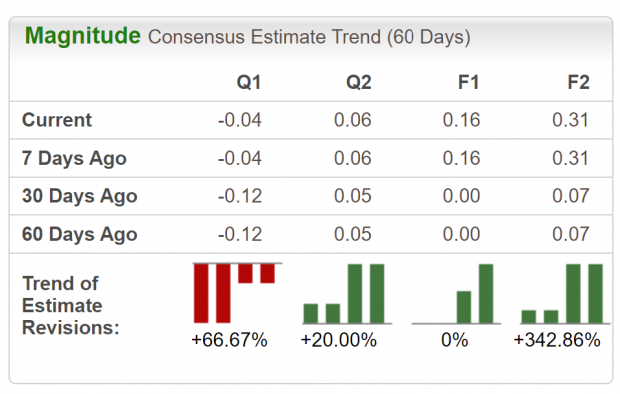

Analysts are in agreement in terms of earnings revisions and have been raising estimates recently. Squarespace is approaching a major achievement in its business, as the company is set to turn a profit in 2023. For the full year, analysts expect SQSP to deliver earnings of $0.16/share, which translates to growth of 184.21% relative to last year. Sales are projected to rise 11.26% to $964.6 million.

Image Source: Zacks Investment Research

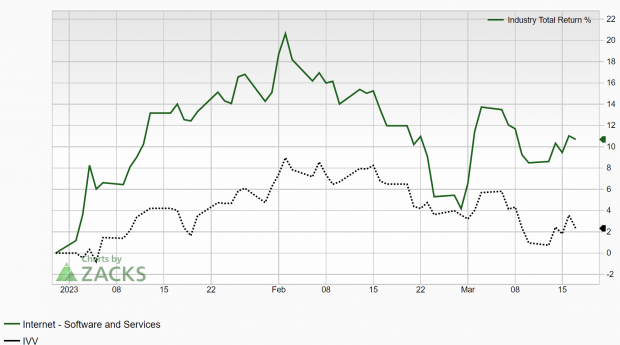

The company is part of the Zacks Internet – Software and Services industry group, which currently ranks in the top 29% out of approximately 250 Zacks Ranked Industries. This group has widely outperformed the market to kick off the new year, up nearly 11% versus a less than 3% gain for the S&P:

Image Source: Zacks Investment Research

Also note the favorable earnings metrics for this group below:

Image Source: Zacks Investment Research

Historical research studies suggest that approximately half of a stock’s price appreciation is due to its industry grouping. In fact, the top 50% of Zacks Ranked Industries outperforms the bottom 50% by a factor of more than 2 to 1. It’s no secret that investing in stocks that are part of leading industry groups can give us a leg up relative to the market. By focusing on leading stocks within the top 50% of Zacks Ranked Industries, we can dramatically improve our stock-picking success.

As Squarespace enters a new profitable phase, make sure to keep an eye on the stock as it appears primed for a period of outperformance.

Image: Bigstock

This Popular Website Builder and E-Commerce Provider Is Soaring

Starting a new business can be a daunting task. An online presence is an absolute must for any business these days, regardless of the industry. While there are a host of difference services that provide the tools to create that presence, one company has attempted to simplify the process by offering an all-in-one solution where entrepreneurs can build a website as well as sell products and services directly through their platform.

Squarespace operates a web-based platform for businesses and independent creators to build an online presence, growth their brands, and manage their businesses. Its suite of integrated products enables users to manage their projects through websites, domains, e-commerce, marketing tools, scheduling, and social media.

Squarespace, a Zacks Rank #2 (Buy) stock, is ranked favorably by our Zacks Style Scores, with a top-rated ‘A’ mark in our Growth category. This indicates the stock is likely to move higher on favorable sales and earnings growth metrics.

Squarespace has delivered a trailing four-quarter average earnings surprise of 105.55%. Earlier in March, SQSP stock jumped nearly 14% after the company reported revenues that came in above analysts’ expectations. The web-hosting service reported fourth-quarter revenues of $228.8 million, a 2.91% surprise versus the $222.3 consensus estimate.

The stock has steadily outperformed the market this year, rising nearly 24% year-to-date. Notice how SQSP has been steadily making a series of higher highs, while trading above upward-sloping 50 (blue) and 200-day (red) moving averages. Shares continue to hover near a 52-week high – a sign of strength.

Image Source: StockCharts

Analysts are in agreement in terms of earnings revisions and have been raising estimates recently. Squarespace is approaching a major achievement in its business, as the company is set to turn a profit in 2023. For the full year, analysts expect SQSP to deliver earnings of $0.16/share, which translates to growth of 184.21% relative to last year. Sales are projected to rise 11.26% to $964.6 million.

Image Source: Zacks Investment Research

The company is part of the Zacks Internet – Software and Services industry group, which currently ranks in the top 29% out of approximately 250 Zacks Ranked Industries. This group has widely outperformed the market to kick off the new year, up nearly 11% versus a less than 3% gain for the S&P:

Image Source: Zacks Investment Research

Also note the favorable earnings metrics for this group below:

Image Source: Zacks Investment Research

Historical research studies suggest that approximately half of a stock’s price appreciation is due to its industry grouping. In fact, the top 50% of Zacks Ranked Industries outperforms the bottom 50% by a factor of more than 2 to 1. It’s no secret that investing in stocks that are part of leading industry groups can give us a leg up relative to the market. By focusing on leading stocks within the top 50% of Zacks Ranked Industries, we can dramatically improve our stock-picking success.

As Squarespace enters a new profitable phase, make sure to keep an eye on the stock as it appears primed for a period of outperformance.