Company Overview

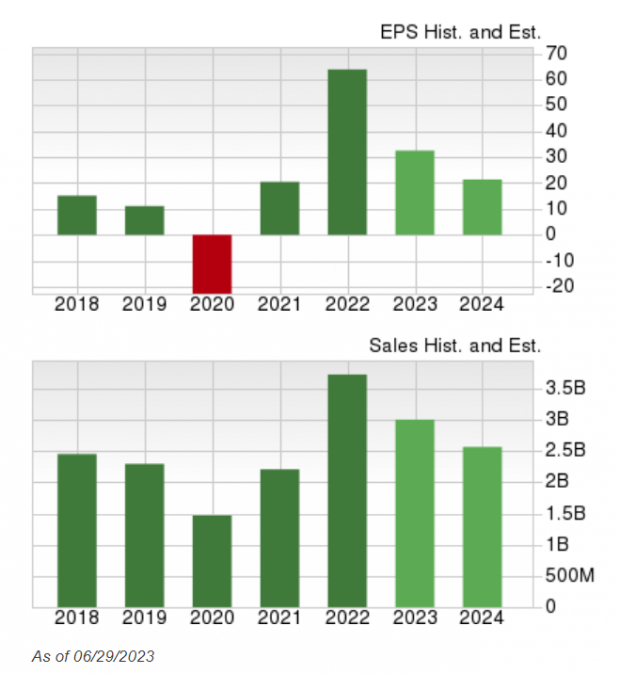

Missouri-based Zacks Rank #5 stock (Strong Sell) Arch Resources Inc. () is one of the leading coal producers in the world and operates nine mines across the major coal basins of the United States. While Arch’s mining facilities are located in the United States, it exports coal worldwide. In 2016 the company filed for bankruptcy but emerged stronger and grew its earnings as coal prices roared back. However, in 2023 and 2024, earnings are expected to trend lower.

Image Source: Zacks Investment Research

Emissions Concerns to Suck the Energy Out of ARCH

Though Arch Resources is a well-run coal company, its earnings will likely be negatively impacted by climate change concerns and the world’s meteoric shift to clean fuel sources from traditional sources. Unfortunately for Arch, major macro-shifts in the energy economy are out of the company’s control. Presently, natural gas and renewable energy are the choices over coal for energy needs. Furthermore, cheap shale gas, technological advancements in clean energy, and government incentives make matters worse for ARCH.

Coal Industry

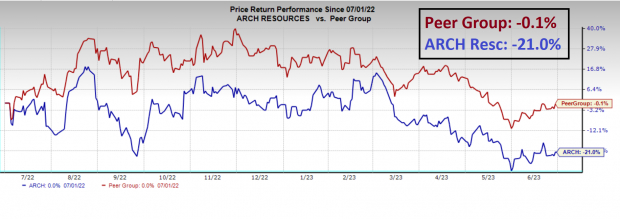

Currently, the Coal Industry is ranked 245 out of 251 – putting it in the bottom 2% of all industries tracked by Zacks. Studies by Zacks indicate that lowly ranked industry groups like the coal industry tend to underperform dramatically. Beyond the industry concerns, the coal industry is intensely competitive, with several bids for each new coal contract. Finally, investors can learn a lot about a company’s position in an industry by using a comparison chart. Over the past year, ARCH is lower by 21% while its peer group is flat – a sign of dramatic underperformance.

Image Source: Zacks Investment Research

Patchy Earnings Surprise History

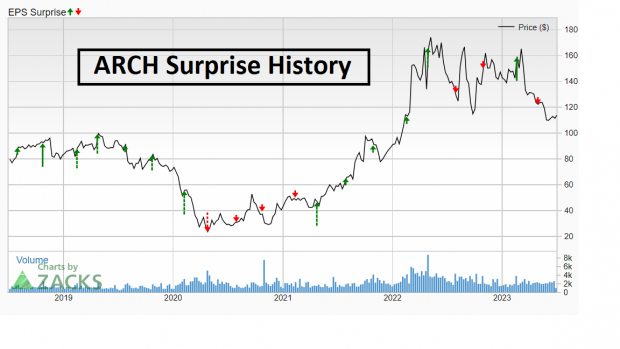

Arch has produced earnings well below Zacks Consensus Estimates in seven of the past thirteen quarters.

Image Source: Zacks Investment Research

Bear Flag

While the broader U.S. equities market has soared in recent months, ARCH has down-trended. Shares are now carving out a bear flag pattern after a short relief rally. If shares find resistance at the declining 50-day moving average, it could spell more downside.

Image Source: Zacks Investment Research

Conclusion

Arch Resources faces a weak industry, high-competitive environment, and fundamental challenges. To make matters worse for ARCH, the stock shows relative weakness versus the broader equity market and is carving out a bear flag pattern. Avoid ARCH for now.

Bear of the Day: Arch Resources (ARCH)

Company Overview

Missouri-based Zacks Rank #5 stock (Strong Sell) Arch Resources Inc. () is one of the leading coal producers in the world and operates nine mines across the major coal basins of the United States. While Arch’s mining facilities are located in the United States, it exports coal worldwide. In 2016 the company filed for bankruptcy but emerged stronger and grew its earnings as coal prices roared back. However, in 2023 and 2024, earnings are expected to trend lower.

Image Source: Zacks Investment Research

Emissions Concerns to Suck the Energy Out of ARCH

Though Arch Resources is a well-run coal company, its earnings will likely be negatively impacted by climate change concerns and the world’s meteoric shift to clean fuel sources from traditional sources. Unfortunately for Arch, major macro-shifts in the energy economy are out of the company’s control. Presently, natural gas and renewable energy are the choices over coal for energy needs. Furthermore, cheap shale gas, technological advancements in clean energy, and government incentives make matters worse for ARCH.

Coal Industry

Currently, the Coal Industry is ranked 245 out of 251 – putting it in the bottom 2% of all industries tracked by Zacks. Studies by Zacks indicate that lowly ranked industry groups like the coal industry tend to underperform dramatically. Beyond the industry concerns, the coal industry is intensely competitive, with several bids for each new coal contract. Finally, investors can learn a lot about a company’s position in an industry by using a comparison chart. Over the past year, ARCH is lower by 21% while its peer group is flat – a sign of dramatic underperformance.

Image Source: Zacks Investment Research

Patchy Earnings Surprise History

Arch has produced earnings well below Zacks Consensus Estimates in seven of the past thirteen quarters.

Image Source: Zacks Investment Research

Bear Flag

While the broader U.S. equities market has soared in recent months, ARCH has down-trended. Shares are now carving out a bear flag pattern after a short relief rally. If shares find resistance at the declining 50-day moving average, it could spell more downside.

Image Source: Zacks Investment Research

Conclusion

Arch Resources faces a weak industry, high-competitive environment, and fundamental challenges. To make matters worse for ARCH, the stock shows relative weakness versus the broader equity market and is carving out a bear flag pattern. Avoid ARCH for now.