This is an excerpt from our most recent Economic Outlook report. To access the full PDF, please click here.

Federal Reserve Governor Lisa Cook, in a speech given in March 2024, laid out specific details and historical background, about what is known as “The Dual Mandate”:

“The Fed's modern statutory mandate, as described in the 1977 amendment to the Federal Reserve Act, is to promote maximum employment and stable prices. These goals are commonly referred to as the dual mandate.”

Much has been made of the Fed’s mandate to assure the 1st mandate: For price stability in the U.S. economy.

However, this Zacks piece is about the 2nd mandate: For maximum U.S. employment.

“High levels of employment are key to a vibrant economy.”

“It means that a vital resource is being used most productively, resulting in a larger and more prosperous economy. Maximum employment promotes business investment, boosting productivity, and the economy's long-run growth potential.”

“A strong labor market also tends to increase labor force participation and makes employers more willing to recruit and upgrade the skills of workers.”

“In January 2012, monetary policymakers who make up the Federal Open Market Committee (FOMC) stated they judge that inflation of +2.0% over the longer run, as measured by the annual change in the price index for personal consumption expenditures (PCE), is most consistent with the Federal Reserve's mandate of maximum employment and price stability.”

“Employment was always mentioned as an objective of the Fed. But the 1977 amendment to the Federal Reserve Act made it part of the main U.S. law applying to monetary policy.”

“The Fed has not set a numerical target for its mandate of maximum employment. An appropriate assessment of labor market conditions requires looking at a range of indicators.”

In this piece, I will pull together the St. Louis Fed’s FRED set of Job Opening and Job Posting indicators for your review.

Let’s see how the Fed’s mandate for maximum employment is doing, with respect to this range of U.S. labor market indicators…

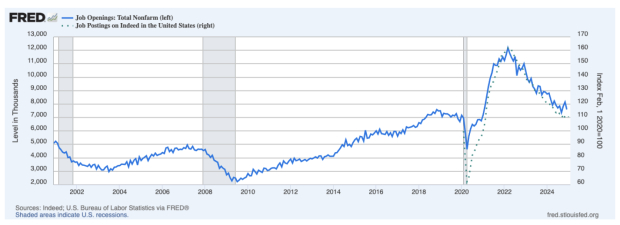

The first stop is an overlay of Total Nonfarm Job Openings against the Job Postings on Indeed in the United States.

Indeed is considered the largest and most comprehensive online job board globally.

It aggregates job listings from a vast array of sources. Thus, Indeed provides a broad and reliable picture of the overall job market, when analyzing trends through its job posting index.

Conveniently, the Indeed job posting index is set at 100 in the pre-COVID moment of Feb. 1st, 2020. On Jan. 31st, 2025? It is 110.5. That is +10% above pre-COVID levels.

As the chart below shows you, this U.S. Indeed job posting index is tracking the Total Nonfarm Job Postings quite well. There are at 7.6M Total Nonfarm Job Postings on Feb. 4th, 2025. In Feb. 2020? There were 7.0M. That is +8.6% above a pre-COVID moment.

Image Source: St Louis Federal Reserve

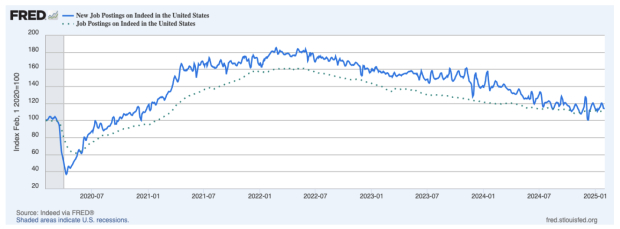

If you compare Indeed’s New Job Postings against Total Indeed Job Postings, the U.S. job postings picture does not change. Note that in the FRED chart shown below.

Image Source: St Louis Federal Reserve

Do you want a non-U.S. statistic, to corroborate the strong U.S. labor market condition identified by the U.S. Federal Reserve data systems?

The OECD is an intergovernmental organization made up of 38 member countries, but works with over 100 countries. It promotes economic growth and world trade. It was founded in 1961. The center is based in Paris, France.

The OECD is the successor organization to the Organization for European Economic Co-operation (OEEC). The OEEC was established in April 1948 among the European recipients of Marshall Plan aid, for the reconstruction of Europe after World War II.

The OECD is recognized as a highly influential publisher of mostly economic data through publications; as well as annual evaluations and rankings of member countries.

Image: Bigstock

FEB 2025 Update: On U.S. Job Openings and Job Postings

This is an excerpt from our most recent Economic Outlook report. To access the full PDF, please click here.

Federal Reserve Governor Lisa Cook, in a speech given in March 2024, laid out specific details and historical background, about what is known as “The Dual Mandate”:

“The Fed's modern statutory mandate, as described in the 1977 amendment to the Federal Reserve Act, is to promote maximum employment and stable prices. These goals are commonly referred to as the dual mandate.”

Much has been made of the Fed’s mandate to assure the 1st mandate: For price stability in the U.S. economy.

However, this Zacks piece is about the 2nd mandate: For maximum U.S. employment.

“High levels of employment are key to a vibrant economy.”

“It means that a vital resource is being used most productively, resulting in a larger and more prosperous economy. Maximum employment promotes business investment, boosting productivity, and the economy's long-run growth potential.”

“A strong labor market also tends to increase labor force participation and makes employers more willing to recruit and upgrade the skills of workers.”

“In January 2012, monetary policymakers who make up the Federal Open Market Committee (FOMC) stated they judge that inflation of +2.0% over the longer run, as measured by the annual change in the price index for personal consumption expenditures (PCE), is most consistent with the Federal Reserve's mandate of maximum employment and price stability.”

“Employment was always mentioned as an objective of the Fed. But the 1977 amendment to the Federal Reserve Act made it part of the main U.S. law applying to monetary policy.”

“The Fed has not set a numerical target for its mandate of maximum employment. An appropriate assessment of labor market conditions requires looking at a range of indicators.”

In this piece, I will pull together the St. Louis Fed’s FRED set of Job Opening and Job Posting indicators for your review.

Let’s see how the Fed’s mandate for maximum employment is doing, with respect to this range of U.S. labor market indicators…

The first stop is an overlay of Total Nonfarm Job Openings against the Job Postings on Indeed in the United States.

Indeed is considered the largest and most comprehensive online job board globally.

It aggregates job listings from a vast array of sources. Thus, Indeed provides a broad and reliable picture of the overall job market, when analyzing trends through its job posting index.

Conveniently, the Indeed job posting index is set at 100 in the pre-COVID moment of Feb. 1st, 2020. On Jan. 31st, 2025? It is 110.5. That is +10% above pre-COVID levels.

As the chart below shows you, this U.S. Indeed job posting index is tracking the Total Nonfarm Job Postings quite well. There are at 7.6M Total Nonfarm Job Postings on Feb. 4th, 2025. In Feb. 2020? There were 7.0M. That is +8.6% above a pre-COVID moment.

Image Source: St Louis Federal Reserve

If you compare Indeed’s New Job Postings against Total Indeed Job Postings, the U.S. job postings picture does not change. Note that in the FRED chart shown below.

Image Source: St Louis Federal Reserve

Do you want a non-U.S. statistic, to corroborate the strong U.S. labor market condition identified by the U.S. Federal Reserve data systems?

The OECD is an intergovernmental organization made up of 38 member countries, but works with over 100 countries. It promotes economic growth and world trade. It was founded in 1961. The center is based in Paris, France.

The OECD is the successor organization to the Organization for European Economic Co-operation (OEEC). The OEEC was established in April 1948 among the European recipients of Marshall Plan aid, for the reconstruction of Europe after World War II.

The OECD is recognized as a highly influential publisher of mostly economic data through publications; as well as annual evaluations and rankings of member countries.