This is an excerpt from our most recent Economic Outlook report. To access the full PDF, please click here.

FRED has added 20 data series about Work-from-Home (WFH) practices in the U.S.

This information is collected through the U.S. Survey of Working Arrangements and Attitudes (SWAA).

This survey gathers monthly data from 2,500 to 10,000 U.S. residents — aged between 20 and 64 — about the number of full-pay working days worked from home.

Data are organized by industry and worker characteristics too.

Let’s take a thorough look, through this new data this month, and see what we can learn.

Work-from-Home: The Broad Trends

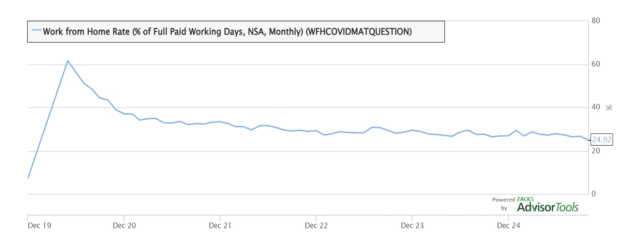

On Nov. 5th, 2025, the broad U.S. WFH Rate was at 24.9%.

Since the start of COVID, roughly May 2020, that rate has fallen from 61.6%.

Image Source: Zacks Investment Research

Consistent with the latest Work from Home (WFH) percentages, the National Office Vacancy Rate was 18.6% in September 2025 (Source is Commercial Café).

WFH also increases U.S. Office Conversion Potential.

Increased interest in converting empty or underutilized commercial office space into residential units can revitalize downtown areas and address housing shortages -- though this process is complex and costly.

This stabilized U.S. Work from Home Rate of 24.9% represents a new, permanent structural change in the U.S. economy — rather than a full reversion to pre-COVID norms.

In brief, the U.S. labor market is settling into a new equilibrium — where flexibility is a key competitive differentiator — for employers.

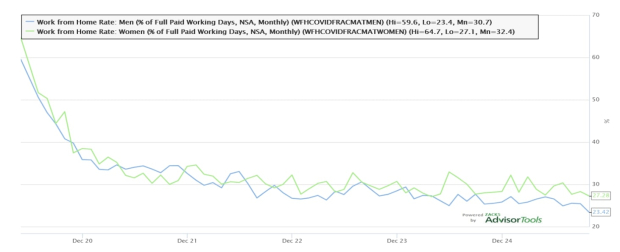

A part of that flexibility concerns its family-centered appeal.

The next FRED chart shows Work from Home for Women is higher at 27.8% on Nov. 5th, 2025, compared to a Work from Home for Men at 23.4%.

Image Source: Zacks Investment Research

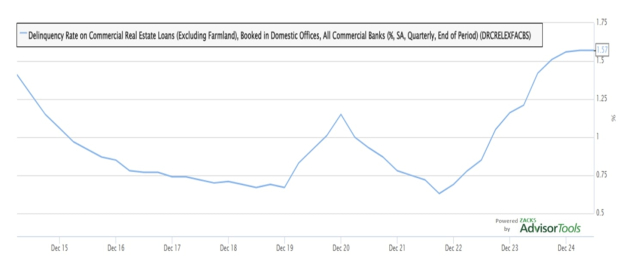

Finally, a FRED Delinquency Rate on Commercial Real Estate Loans (Excluding Farmland), that is booked in domestic offices, for All Commercial Banks shows rising 2025 financial stress, from this U.S. WFH structural change.

Consult that below:

Image Source: Zacks Investment Research

Image: Bigstock

Trends in U.S. Work-from-Home Data

This is an excerpt from our most recent Economic Outlook report. To access the full PDF, please click here.

FRED has added 20 data series about Work-from-Home (WFH) practices in the U.S.

This information is collected through the U.S. Survey of Working Arrangements and Attitudes (SWAA).

This survey gathers monthly data from 2,500 to 10,000 U.S. residents — aged between 20 and 64 — about the number of full-pay working days worked from home.

Data are organized by industry and worker characteristics too.

Let’s take a thorough look, through this new data this month, and see what we can learn.

Work-from-Home: The Broad Trends

On Nov. 5th, 2025, the broad U.S. WFH Rate was at 24.9%.

Since the start of COVID, roughly May 2020, that rate has fallen from 61.6%.

Image Source: Zacks Investment Research

Consistent with the latest Work from Home (WFH) percentages, the National Office Vacancy Rate was 18.6% in September 2025 (Source is Commercial Café).

WFH also increases U.S. Office Conversion Potential.

Increased interest in converting empty or underutilized commercial office space into residential units can revitalize downtown areas and address housing shortages -- though this process is complex and costly.

This stabilized U.S. Work from Home Rate of 24.9% represents a new, permanent structural change in the U.S. economy — rather than a full reversion to pre-COVID norms.

In brief, the U.S. labor market is settling into a new equilibrium — where flexibility is a key competitive differentiator — for employers.

A part of that flexibility concerns its family-centered appeal.

The next FRED chart shows Work from Home for Women is higher at 27.8% on Nov. 5th, 2025, compared to a Work from Home for Men at 23.4%.

Image Source: Zacks Investment Research

Finally, a FRED Delinquency Rate on Commercial Real Estate Loans (Excluding Farmland), that is booked in domestic offices, for All Commercial Banks shows rising 2025 financial stress, from this U.S. WFH structural change.

Consult that below:

Image Source: Zacks Investment Research