Top 5 Best Rare Earth Stocks to Buy Today

| Company (Ticker) | 12 Week Price Change | Forward PE | Price | Proj EPS Growth (1 Year) | Projected Sales Growth (1Y) |

|---|---|---|---|---|---|

| Albemarle (ALB) | 78.46% | 71.82 | $172.54 | 319.34% | 4.98% |

| Energy Fuels (UUUU) | 17.42% | NA | $23.52 | 66.02% | 83.92% |

| Idaho Strategic Resources (IDR) | 52.47% | 58.63 | $46.32 | 11.27% | 23.93% |

| SIGMA LITHIUM (SGML) | 141.83% | 22.83 | $13.47 | 268.57% | 123.49% |

| Sociedad Quimica y Minera (SQM) | 79.27% | 15.51 | $80.15 | 132.51% | 40.81% |

*Updated on January 21, 2026.

Albemarle (ALB)

$172.54 USD +9.50 (5.83%)

3-Year Stock Price Performance

Premium Research for ALB

- Zacks Rank

Strong Buy 1

Strong Buy 1

- Style Scores

D Value C Growth A Momentum C VGM

- Market Cap:$19.19 B (Large Cap)

- Projected EPS Growth:52.99%

- Last Quarter EPS Growth:-272.73%

- Last EPS Surprise:79.35%

- Next EPS Report date:Feb. 11, 2026

Our Take:

Albemarle is a leading supplier of lithium, giving investors critical minerals exposure tied to the same EV and energy-transition demand that underpins rare earths. It boasts assets in Chile, Australia and the United States.

Strategically, Albemarle has slowed spending and refocused on high-return projects while pursuing the Kings Mountain hard-rock resource in North Carolina, positioning for a cyclical upturn after lithium’s price reset. Its diversified bromine business helps cushion commodity swings, and management has reiterated a medium-term growth outlook despite market softness.

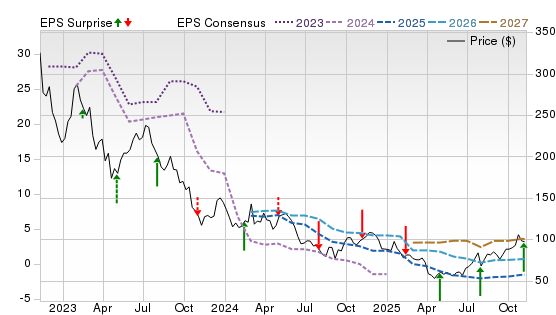

The Zacks Rank #1 (Strong Buy) flags positive estimate revisions, while Style Scores of D for Value, C for Growth and A for Momentum suggest shares are not optically cheap or high-growth on near-term metrics, but the tape has turned in ALB’s favor. On the Price, Consensus & EPS Surprise chart, shares have rebounded from previous lows as out-year EPS lines flatten and modestly firm.

See more from Zacks Research for This Ticker

Normally $25 each - click below to receive one report FREE:

Energy Fuels (UUUU)

$23.52 USD +1.58 (7.20%)

3-Year Stock Price Performance

Premium Research for UUUU

- Zacks Rank

Buy 2

Buy 2

- Style Scores

F Value F Growth F Momentum F VGM

- Market Cap:$5.21 B (Mid Cap)

- Projected EPS Growth:-21.43%

- Last Quarter EPS Growth:30.00%

- Last EPS Surprise:12.50%

- Next EPS Report date:Feb. 25, 2026

Our Take:

Energy Fuels is a U.S. producer of uranium and vanadium that is also advancing an integrated rare-earths business, including commercial production of separated NdPr at its White Mesa Mill in Utah.

White Mesa’s staged build-out aims to address Western supply gaps by processing monazite sands from feed to separated oxides domestically, a strategic position that is attractive to policymakers seeking non-China REE chains. Recent studies and company updates outline plans to expand separation capacity and improve costs as volumes scale.

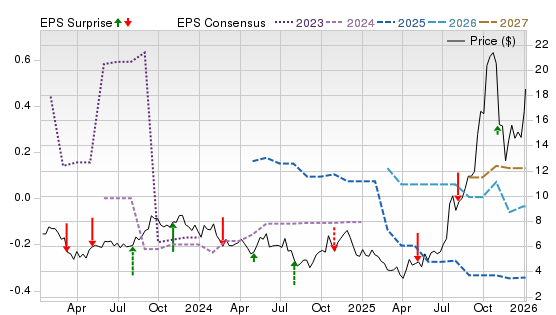

A Zacks Rank #2 (Buy) reflects favorable estimate revisions, but Style Scores of F for Value, Growth and Momentum flag premium valuation, uncertain near-term growth cadence and choppy trading, appropriate for a project-execution story. The chart shows a sharp 2024–25 price upswing followed by volatility, with consensus lines stepping up and then oscillating. That mix captures UUUU’s path forward: significant upside if separation ramps smoothly.

See more from Zacks Research for This Ticker

Normally $25 each - click below to receive one report FREE:

Idaho Strategic Resources (IDR)

$46.32 USD +1.96 (4.42%)

3-Year Stock Price Performance

Premium Research for IDR

- Zacks Rank

Buy 2

Buy 2

- Style Scores

F Value B Growth C Momentum D VGM

- Market Cap:$691.68 M (Small Cap)

- Projected EPS Growth:5.97%

- Last Quarter EPS Growth:0.00%

- Last EPS Surprise:5.26%

- Next EPS Report date:March 30, 2026

Our Take:

Idaho Strategic Resources is a small U.S. gold producer with early-stage rare-earth exploration concentrated at Lemhi Pass, where sampling has identified monazite- and xenotime-hosted mineralization with magnet-grade oxides.

The strategic angle is leveraged to a domestic rare-earth corridor: field programs continue to refine targets and characterize a mix skewed to high-value magnet and heavy REEs, a niche where Western supply remains tight. As a junior with producing gold assets, IDR retains optionality to fund work programs while seeking partners or grants as the U.S. prioritizes critical minerals supply chains.

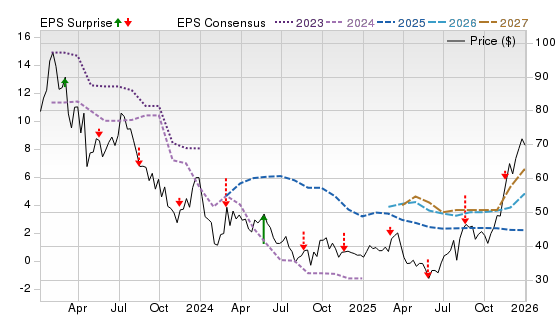

A Zacks Rank #2 indicates constructive revisions, while Style Scores of F for Value and B for Growth and Momentum point to limited near-term valuation support but improving growth expectations and trading tone. On the chart, estimates reset sharply and then flattened as the share price rose and ticked higher, a setup consistent with early-stage catalysts.

See more from Zacks Research for This Ticker

Normally $25 each - click below to receive one report FREE:

SIGMA LITHIUM (SGML)

$13.47 USD +1.20 (9.78%)

3-Year Stock Price Performance

Premium Research for SGML

- Zacks Rank

Buy 2

Buy 2

- Style Scores

D Value A Growth A Momentum A VGM

- Market Cap:$1.37 B (Small Cap)

- Projected EPS Growth:23.91%

- Last Quarter EPS Growth:41.18%

- Last EPS Surprise:0.00%

- Next EPS Report date:March 30, 2026

Our Take:

Sigma Lithium is a Brazil-based producer of high-purity lithium concentrate from Grota do Cirilo, supplying key inputs to EV supply chains. Its cash position is improving.

Operations emphasize dense-media separation and a low-waste “Greentech” flow sheet that helped lift volumes significantly and trim unit costs. With a large, scalable resource base and operating plant, Sigma offers direct exposure to any recovery in lithium prices as OEM demand normalizes.

Its Zacks Rank #2 aligns with improving estimate trends, and Style Scores of D for Value and A for Growth and Momentum highlight a growth-and-tape story more than a value one, typical for a ramping producer. The chart shows shares rebounding from the previous lows as out-year consensus curves turn up, with mixed quarterly surprises. That pattern supports the strong momentum and growth while reminding investors that execution and commodity-price risk remain central to the thesis.

See more from Zacks Research for This Ticker

Normally $25 each - click below to receive one report FREE:

Sociedad Quimica y Minera (SQM)

$80.15 USD +2.62 (3.38%)

3-Year Stock Price Performance

Premium Research for SQM

- Zacks Rank

Strong Buy 1

Strong Buy 1

- Style Scores

C Value D Growth B Momentum C VGM

- Market Cap:$22.15 B (Large Cap)

- Projected EPS Growth:-8.71%

- Last Quarter EPS Growth:100.00%

- Last EPS Surprise:-8.82%

- Next EPS Report date:March 3, 2026

Our Take:

SQM is one of the world’s largest lithium producers with brine operations in Chile’s Salar de Atacama alongside iodine and specialty fertilizers. A newly finalized public-private partnership with state miner Codelco extends Atacama operations through 2060.

The partnership clarifies the framework, lowers risks, giving SQM long-dated resource access while sharing economics and governance, key for planning expansions as prices normalize. Its diversified specialty chemicals portfolio helps stabilize earnings, while lithium remains a critical input for EV and energy storage options, often grouped with rare-earth and strategic materials stocks.

The Zacks Rank #3 (Hold) and Style Scores of C for Value and Growth and A for Momentum suggest balanced valuation and growth expectations, with strong trading momentum reflecting improved visibility after the JV. On the chart, shares spiked on JV headlines and then settled into a higher range as 2025–26 EPS estimates stabilized after prior cuts.

See more from Zacks Research for This Ticker

Normally $25 each - click below to receive one report FREE:

Methodology

The Zacks Rank is a proprietary stock-rating model that uses trends in earnings estimate revisions and earnings-per-share (EPS) surprises to classify stocks into five groups: #1 (Strong Buy), #2 (Buy), #3 (Hold), #4 (Sell) and #5 (Strong Sell). The Zacks Rank is calculated through four primary factors related to earnings estimates: analysts' consensus on earnings estimate revisions, the magnitude of revision change, the upside potential and estimate surprise (or the degree in which earnings per share deviated from the previous quarter).

Zacks builds the data from 3,000 analysts at over 150 different brokerage firms. The average yearly gain for Zacks Rank #1 (Strong Buy) stocks is +23.62% per year from January, 1988, through June 2, 2025.

Selections for Best Rare Earth Stocks are based on the current top ranking stocks based on Zacks Indicator Score and other Zacks style scores. All information is current as of market open, Jan. 20, 2026.

What are Rare Earth Stocks?

“Rare earth” stocks refer to companies involved in the extraction, processing, refining, recycling or production of rare earth elements (REEs) — a group of around 17 metallic elements (like neodymium, praseodymium, dysprosium, terbium) that play pivotal roles in modern technologies such as electric vehicles, wind turbines, high-end magnets, defense applications and electronics.

Global production of rare earth metals reached about 390,000 metric tons in 2024, up from about 132,000 in 2017, underscoring the growth of this sector.

Because of their critical nature and complex supply chains (heavily dominated by China), companies that supply or refine rare earths are often lumped into the “critical minerals” or clean-tech-materials investment theme. That means when you see “rare earth stocks,” you should also think about lithium, other battery metals, magnet supply chains and so on.

Is It a Good Time to Invest in Rare Earth Stocks?

Yes — with caveats. The timing looks favorable for several reasons:

- Geopolitical / supply-chain tailwinds: Governments (especially the U.S.) are increasingly focused on securing domestic rare earth supply chains and reducing dependence on China for minerals and refining

- Investor sentiment / deal activity: Many rare earth stocks have surged steeply. For instance, MP shares soared about 51% following a major deal, and others followed the rally. There is clear momentum.

- Increasing demand from clean tech / defense / EVs: Rare earths are critical for high-performance magnets (used in EV motors, wind turbines, defense systems). Supply constraints are real.

However, there are risk-factors:

- Many rare-earth stocks have very stretched valuations and limited current profitability, making them speculative.

- The theme is highly sensitive to commodity-price swings, export policy changes (especially China), regulatory risks, project delays and environmental issues.

- Timing matters: If much of the “good news” is already baked into prices, returns may be muted or risk a pull-back higher.

In short: Yes — it appears to be a timely set-up for rare earth and critical minerals investing, especially if you’re willing to accept higher risk and long-term payoff. But it’s not a guaranteed “easy” win.

Types of Rare Earth Stocks

- Primary rare-earth companies: Firms directly mining, refining, separating or producing rare-earth elements, such as, MP Materials.

- Junior/exploration companies: Smaller, earlier-stage firms exploring rare-earth deposits — higher risk/higher upside.

- Diversified mining/critical-minerals companies: Firms where rare earth is one part of a broader portfolio (e.g., lithium, cobalt, base metals). These offer exposure to the theme with different risk/return profiles.

Benefits of Investing in Rare Earth Stocks

- High strategic importance: Rare earths are critical to defense, clean energy, EVs — giving structural demand.

- Supply-chain shift: With efforts to decouple from China, Western production/refinement is gaining focus — creating investment opportunities.

- Potential for outsized gains: Given bottlenecks and scarcity, companies that successfully scale may see large value appreciation.

- Diversification: Rare earths offer exposure to a different kind of commodity/tech-supply chain than traditional stocks.

Risks of Investing in Rare Earth Stocks

- Commodity price risk: When prices of rare earth oxides fall (or oversupply emerges), companies suffer.

- Execution risk: Mines and processing facilities can face delays, cost overruns, regulatory/environmental hurdles.

- Valuation risk: Given hype, many stocks may have inflated expectations baked in, limiting upside or increasing downside.

- Global trade/regulation risk: China still dominates refining and can influence prices/export controls.

- Sensitivity to subsidies/policy: Much of the upside may depend on continued supportive policy (e.g., U.S. government investing). If that pullsback, companies suffer.

How Sensitive Are These Companies to Global Trade Dynamics?

Very sensitive. For example:

- A major U.S. rare-earth producer’s share price surged after a U.S. Department of defense deal and Apple partnership, demonstrating how policy/trade events drive value.

- On the flip side, increased Chinese export volumes made investors cautious about future pricing and led to share-price pull-backs.

Hence, when you evaluate rare-earth stocks you must account for not just the company fundamentals, but global trade flows, export restrictions, government incentives, and commodity-price dynamics.

How to Select Rare Earth Stocks

What Metrics Should I Use to Evaluate a Rare Earth Company?

- Production volume / growth rate: How much rare earth oxide (or separated elements) is the company producing or projecting?

- Cost structure / margin: What are mining and refining costs? A low cost producer has an edge in a volatile commodity environment.

- Vertical integration: Does the company only mine, or also refine/separate/process into usable materials? Companies with downstream capability may command higher margins (e.g., magnets).

- Off-take agreements / contracts: Does the company have binding agreements with large OEMs, governments or defense-related customers? That provides visibility and de-risking.

- Valuation metrics: Traditional P/E may not apply for early stage companies; metrics like EBITDA multiples, resource value, cash flow forecasts, asset-to-market cap ratio are especially relevant.

- Balance sheet strength: Mining/refining is capital intensive — debt levels, capital-expenditure commitments and cash runway matter.

- Jurisdiction & ESG / permitting risk: Mining regulations, permitting environment, environmental footprint and community risks can delay projects significantly.

What is the Total Addressable Market (TAM) for These Rare Earth-Theme Segments?

- The global rare earth element market is driven by EVs, wind turbines, consumer electronics, defense systems and emerging technologies like quantum or 5G/6G.

- Given the expansion of these sectors, the TAM is growing: e.g., neodymium-praseodymium (NdPr) oxide demand is expected to grow strongly as magnets go into EV motors and wind-turbine generators.

- A useful way to think about TAM: Estimate future demand growth for key end-markets (EVs, wind), look at the rare-earth elements required per unit, then estimate the volume of elements and the price per unit.

- Many analysts believe that new supply (especially outside of China) must ramp significantly to meet future demand, which gives upside potential for rare Earth producers. (See e.g., the production jump globally).

Should I Pick Individual Stocks or Use Rare Earth ETFs / Funds?

- Individual stocks: Offer highest upside potential but also highest risk (company-specific execution risk, mining risk, financing risk). Example: MP Materials, USA Rare Earth, etc.

- ETFs / funds: Provide broader diversification across multiple companies, reducing idiosyncratic risk. For example, REMX (VanEck Vectors Rare Earth/Strategic Metals ETF) holds a portfolio of ~27 global names.

- If you are bullish about the theme but less comfortable picking winners, an ETF may be a better choice. If you have conviction and are willing to do detailed company-analysis (and accept risk), then individual stocks may give more reward.

Portfolio Fit and Impact for Rare Earth Stocks

How Do Rare Earth-Theme Stocks Fit Into My Overall Portfolio?

- They can serve as a thematic/strategic allocation — e.g., a small portion of your portfolio (5-10%) dedicated to “critical minerals / supply-chain transformation”.

- They often act as a growth / high-volatility sleeve rather than core stable income stocks.

- When included, they should complement your broader holdings (e.g., tech, defense, commodities, clean energy) rather than dominate them.

- Because of the high risk/high reward nature, it’s prudent to treat them as part of the “satellite” portfolio rather than the “core”.

Can I Invest for Both Financial Return and Environmental Impact (ESG or Sustainability Goals)?

Yes — rare earth stocks can offer that dual exposure:

- Financial return: through growth in demand for EVs, wind, electronics, defense supply chains.

- Environmental / sustainability impact: supporting the clean-tech transition (e.g., wind turbines, EV motors rely on rare earth magnets), domestic supply chain de-risking, recycling of materials.

- However, you must still evaluate the ESG risks (mining footprint, tailings, community impact). A sustainable theme doesn’t guarantee sustainable business practices.

What Is the Exit Strategy for These Stocks If the Theme Fades or the Company Fails to Execute?

- Set target metrics: e.g., share price target, resource milestones, contract wins.

- Use stop-loss or position size limits: because execution risks are high, you may want to cap exposure or set alerts if certain milestones aren’t met.

- Consider time-horizon: rare-earth infrastructure build-out may take years; if your investment horizon is short, you risk being early without returns.

- Diversify: don’t depend on a single rare-earth stock.

- Be willing to exit if fundamentals deteriorate (e.g., contracts drop, production delays, commodity price crash, policy reversals).

Alternative Investment Options for Rare Earth Stocks

- ETFs / thematic funds: e.g., REMX (VanEck Rare Earth/Strategic Metals) for diversified exposure.

- Battery / critical-minerals funds: Some funds combine lithium, cobalt, nickel and rare earths, offering broader critical-minerals exposure. For example, some articles group “critical minerals stocks such as lithium” alongside rare earth stocks.

- Junior exploration companies: Very high risk/high reward. For investors comfortable with volatility, early-stage explorers may deliver outsized gains — but many fail.

- Mining commodity funds: Broader commodity/mining ETFs or funds that include rare earths as part of a basket.

- Corporate bonds / private placements: Some rare-earth projects may issue debt or private-equity funding; less liquid but potentially interesting for sophisticated investors.

- Recycling and downstream stocks: Think about companies that refine, separate, recycle rare-earth magnets rather than just mine. Sometimes less risky and higher margin potential.