5 Best Quantum Computing Stocks to Buy Today

| Company (Ticker) | 12 Week Price Change | Forward PE | Price | Proj EPS Growth (1 Year) | Projected Sales Growth (1Y) |

|---|---|---|---|---|---|

| Micron Technology (MU) | 67.15% | 10.78 | $332.23 | 278.29% | 89.30% |

| MongoDB (MDB) | 26.23% | 85.92 | $388.01 | 30.76% | 21.04% |

| Analog Devices (ADI) | 20.23% | 30.26 | $297.38 | 25.67% | 16.36% |

| Onto Innovation (ONTO) | 46.99% | 33.23 | $201.82 | 19.80% | 15.08% |

| Cirrus Logic (CRUS) | -5.30% | 15.99 | $124.13 | 2.48% | -1.65% |

*Updated on January 14, 2026.

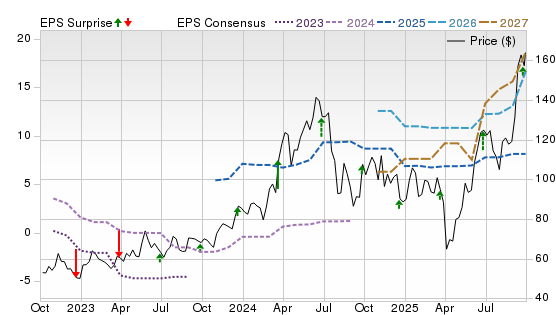

Micron Technology (MU)

$332.23 USD -5.90 (-1.75%)

3-Year Stock Price Performance

Premium Research for MU

- Zacks Rank

- Strong Buy 1

- Style Scores

C Value A Growth A Momentum A VGM

- Market Cap:$380.57 B (Mega Cap)

- Projected EPS Growth:278.29%

- Last Quarter EPS Growth:61.19%

- Last EPS Surprise22.25%

- Next EPS Report date: March 19, 2026

Our Take:

Micron makes DRAM, NAND and high-bandwidth memory that underpin accelerated computing and, over time, cryogenic and hybrid quantum systems. The company is shipping HBM3E for NVIDIA’s H200, scaling 1-gamma DRAM, and redirecting resources toward higher-margin AI/HPC memory, which also supports emerging quantum-adjacent infrastructure.

In Q1 FY26, Micron posted record revenue and guided sequential growth into Q2 as HBM ramps, while industry supply remains tight. The pivot away from lower-value consumer lines concentrates capital on advanced nodes and HBM capacity, sharpening earnings power.

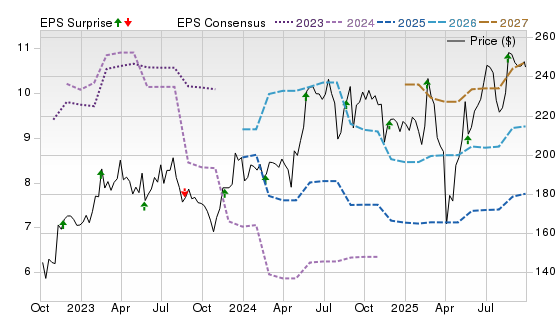

A Zacks Rank #1 (Strong Buy) reflects strong estimate revisions. Style Scores of A for Growth and Momentum underscore an early-cycle earnings recovery, while a C for Value suggests that the market has already priced in some upturn. On the Price, Consensus & EPS Surprise chart, the stock rises alongside improving FY26–FY27 EPS lines, signaling increasing confidence that the memory upcycle will persist.

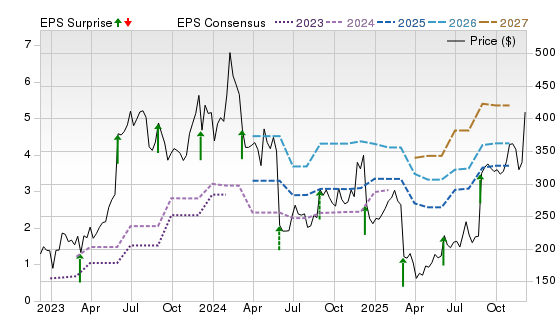

MongoDB (MDB)

$388.01 USD -23.18 (-5.64%)

3-Year Stock Price Performance

Premium Research for MDB

- Zacks Rank

Strong Buy 1

Strong Buy 1

- Style Scores

F Value A Growth B Momentum C VGM

- Market Cap:$33.47 B (Large Cap)

- Projected EPS Growth:30.87%

- Last Quarter EPS Growth:78.95%

- Last EPS Surprise:67.09%

- Next EPS Report date:March 4, 2026

Our Take:

MongoDB is a full developer data platform built around its document database, offered as self-managed software and as the Atlas service. With consistent APIs across clouds and on-prem plus integrated search, vector, time-series, triggers and streaming, it provides a portable data layer for early hybrid quantum workflows on AWS, Azure and Google Cloud.

In Q3 FY26, MongoDB highlighted continued strength in Atlas and raised guidance for the rest of the year. The company’s role in orchestrating distributed data and real-time analytics remains a relevant infrastructure bet as advanced computing stacks evolve.

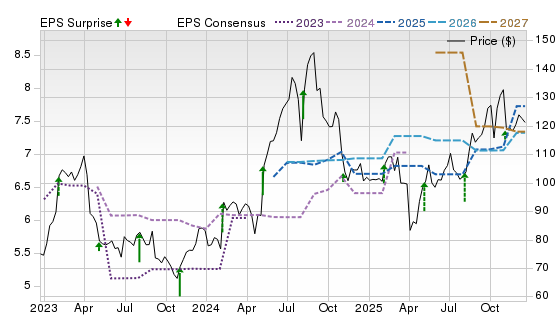

A Zacks Rank #1 signals positive estimate revisions. Style Scores of A for Growth and B for Momentum align with durable top-line expansion, while an F for Value flags a premium multiple. The chart shows volatile shares but gradually rising FY26–FY27 estimates, suggesting expectations are stabilizing after prior resets.

Analog Devices (ADI)

$297.38 USD +1.17 (0.40%)

3-Year Stock Price Performance

Premium Research for ADI

- Zacks Rank

Strong Buy 1

Strong Buy 1

- Style Scores

D Value C Growth B Momentum D VGM

- Market Cap:$145.04 B (Large Cap)

- Projected EPS Growth:25.67%

- Last Quarter EPS Growth:10.24%

- Last EPS Surprise:1.80%

- Next EPS Report date:Feb. 18, 2026

Our Take:

Analog Devices designs precision converters, RF, power and mixed-signal ICs that sit at the control and readout edge of advanced computing, including cryogenic electronics central to scaling quantum processors. ADI’s leadership in data conversion and RF signal chains positions it as an enabling supplier for quantum instrumentation and control.

The FY25 results capped a robust year, with management citing resilient demand across secular drivers. ADI’s broad portfolio and manufacturing investments support margin durability and the ability to serve niche, high-performance markets like quantum labs while benefiting from AI, industrial and automotive recoveries.

A Zacks Rank #1 reflects upward estimate revisions. The Style Scores of C for Growth and B for Momentum point to steady execution, while a D for Value suggests quality at a price. On the chart, FY26–FY27 EPS estimates edge higher as the stock recovers, indicating improving confidence in a cyclical upturn plus idiosyncratic content gain.

Onto Innovation (ONTO)

$201.82 USD +4.38 (2.22%)

3-Year Stock Price Performance

Premium Research for ONTO

- Zacks Rank

Strong Buy 1

Strong Buy 1

- Style Scores

D Value C Growth F Momentum F VGM

- Market Cap:$9.68 B (Mid Cap)

- Projected EPS Growth:-7.12%

- Last Quarter EPS Growth:-26.40%

- Last EPS Surprise:5.75%

- Next EPS Report date:Feb. 5, 2026

Our Take:

Onto Innovation supplies metrology, inspection and lithography-adjacent tools used in advanced packaging, critical for AI accelerators today and for future quantum and photonics devices. Its Dragonfly G3 with 3Di bump metrology and EchoScan void detection, target HBM and 2.5D and 3D logic stacks used in cutting-edge compute.

The Q3 2025 earnings showed cyclical pressure, but qualifications for Dragonfly 3Di at HBM customers and AI logic programs validate product-market fit as packaging complexity rises. This leverage to the AI and HBM build-out gives ONTO operating torque into the next capex cycle.

A Zacks Rank #1 signals improving revisions despite near-term lumpiness. The Style Scores of C for Growth and F for Momentum reflect mixed tape action, while a D for Value indicates limited margin of safety. The chart shows a sharp stock rebound with FY26–FY27 estimates inflecting upward, consistent with orders tied to HBM and advanced packaging ramps.

Cirrus Logic (CRUS)

$124.13 USD +0.56 (0.45%)

3-Year Stock Price Performance

Premium Research for CRUS

- Zacks Rank

Buy 2

Buy 2

- Style Scores

B Value B Growth C Momentum B VGM

- Market Cap:$6.31 B (Mid Cap)

- Projected EPS Growth:2.52%

- Last Quarter EPS Growth:114.53%

- Last EPS Surprise:17.92%

- Next EPS Report date:Feb. 3, 2026

Our Take:

Cirrus Logic develops low-power mixed-signal audio, haptics and power ICs for mobile and automotive, capabilities applicable to precision instrumentation and control in advanced and, eventually, quantum-adjacent systems. Its expertise in low-noise converters and drivers is a portable asset as next-gen interfaces proliferate.

It delivered record revenues in the second quarter of fiscal 2026 on strong demand for smartphone components. Continued momentum in the PC market is a major tailwind. Concentration risk remains, but execution, cash generation and expanding haptics portfolios support a sturdier earnings base.

A Zacks Rank #2 (Buy) reflects favorable revisions. Style Scores of B for Value and Growth balance a C for Momentum after a volatile year. On the chart, shares have rebounded as FY26–FY27 EPS estimates stabilize and begin to tick higher, suggesting investors are re-rating the earnings path thanks to customer interest across its latest general market products.

Methodology

The Zacks Rank is a proprietary stock-rating model that uses trends in earnings estimate revisions and earnings-per-share (EPS) surprises to classify stocks into five groups: #1 (Strong Buy), #2 (Buy), #3 (Hold), #4 (Sell) and #5 (Strong Sell). The Zacks Rank is calculated through four primary factors related to earnings estimates: analysts' consensus on earnings estimate revisions, the magnitude of revision change, the upside potential and estimate surprise (or the degree in which earnings per share deviated from the previous quarter).

Zacks builds the data from 3,000 analysts at over 150 different brokerage firms. The average yearly gain for Zacks Rank #1 (Strong Buy) stocks is +23.62% per year from January, 1988, through June 2, 2025.

Selections for Best Quantum Computing Stocks are based on the current top ranking stocks based on Zacks Indicator Score. For this list, only companies that have average daily trading volumes of 100,000 shares or more were considered. All information is current as of market open, Jan. 14, 2026.

Introduction to Quantum Computing Stocks

What Are Quantum Computing Stocks?

Quantum computing stocks are publicly traded companies that develop quantum hardware, quantum software, or platforms that allow customers to access quantum systems. These firms range from early-stage, pure-play quantum companies to tech giants that treat quantum computing as part of a broader innovation portfolio.

Quantum computing companies fall into several distinct categories. Understanding these groups—and which stocks belong to each—helps investors target the level of risk and exposure they want.

1. Pure-Play Quantum Hardware Companies

These companies focus almost entirely on building quantum computers and related systems. They generate most of their revenue from quantum technology rather than broader tech operations.

Examples:

- IonQ (IONQ) – Specializes in trapped-ion quantum computers with cloud access via AWS, Azure, and Google Cloud.

- Rigetti Computing (RGTI) – Builds superconducting quantum processors and hybrid quantum–classical platforms.

- D-Wave Quantum (QBTS) – Develops quantum annealing systems optimized for real-time optimization tasks.

These companies offer the highest direct exposure to quantum technology, but also carry the most risk and volatility.

2. Quantum Software & Algorithm Developers

These firms build software tools, algorithms, and operating environments that run on quantum hardware, often partnering with multiple hardware providers.

Examples:

- Quantum Computing Inc. (QUBT) – Develops photonic-based systems and reservoir computing models along with software tools for quantum applications.

- Horizon Quantum Computing (Private) – Works on compiling classical code into quantum-ready programs.

- Zapata AI (Private, formerly Zapata Computing) – Focuses on quantum-inspired optimization and machine-learning software.

Though many quantum software leaders are still private, companies like QUBT give public investors access to this segment.

3. Hybrid or Quantum-Adjacent Computing Companies

These firms don’t build full quantum computers but develop technologies that support or complement quantum computing, such as photonics, cryogenics, advanced sensors, or quantum communication systems.

Examples:

- Nvidia (NVDA) – Provides GPU platforms that power quantum simulations and hybrid quantum–classical workflows.

- Adtran (ADTN) – Develops quantum-safe networking solutions.

- Hamamatsu Photonics (HPHTF) – Manufactures detectors and lasers used in quantum research.

- Arqit Quantum (ARQQ) – Specializes in quantum encryption and quantum-safe security.

These stocks offer exposure to the broader quantum ecosystem with lower technological risk.

4. Large-Cap Technology Companies With Quantum Divisions

These tech giants invest heavily in quantum computing R&D as part of their broader innovation strategy. Their quantum operations are small relative to total revenue, but their resources make them long-term contenders.

Examples:

- Alphabet (GOOGL) – Google Quantum AI leads in superconducting qubit research and error correction breakthroughs.

- IBM (IBM) – Operates one of the world’s largest quantum ecosystems with IBM Quantum and a multi-year quantum development roadmap.

- Microsoft (MSFT) – Develops topological qubits and runs the Azure Quantum cloud platform.

- Amazon (AMZN) – Provides quantum access through AWS Braket and invests in multiple quantum hardware startups.

These companies offer the safest quantum exposure because their success does not depend solely on quantum breakthroughs.

Practical Use Cases and Near-Future Applications

Quantum computing is expected to disrupt industries that depend on immense computational power. While fully fault-tolerant systems may still be years away, several near-term applications are starting to emerge:

- Optimization problems (logistics, supply chain, routing).

- Drug discovery & materials science.

- Financial modeling, risk analysis & portfolio optimization.

- AI acceleration via quantum-enhanced machine learning.

- Cybersecurity & post-quantum cryptography.

Hybrid quantum-classical systems — already accessible via cloud platforms — are likely to be the earliest source of commercial value.

Is It Too Early to Invest in Quantum Computing Stocks Now?

Quantum computing is still in its infancy. For many investors, this raises a fair question: Is now the right time—or too soon—to buy quantum stocks?

Why It Might Be Too Early

- Many quantum companies are unprofitable and years from commercial-scale revenue.

- Stock prices tend to swing sharply on small news events.

- Quantum hardware still faces challenges like error correction and qubit stability.

Why Some Investors Are Buying Now

- Governments and corporations are investing heavily, accelerating progress.

- Several quantum companies now have real customers and recurring revenue.

- Major breakthroughs could significantly revalue early-stage players.

- Wall Street analysts are increasingly bullish on select names.

Bottom line: Quantum stocks are a high-risk, long-term bet — similar to early semiconductor or AI companies decades ago. Investors with patience and risk tolerance may see significant upside.

Pros and Cons of Investing in Quantum Computing Stocks

Benefits of Buying Quantum Computing Stocks

- Potential for exponential long-term returns

- Exposure to a transformative next-generation technology

- Early participation in a market that could rival today’s semiconductor or AI industries

- Increasing institutional interest and government funding

Risks of Buying Quantum Computing Stocks

- Many companies have uncertain business models

- High volatility and frequent price spikes/drops

- Long timelines for commercial viability

- Unproven technologies may never reach scale

- Cash burn and capital-raising risks

Are Quantum Computing Stocks a Good Long-Term Investment?

Quantum stocks can be an excellent long-term play if you:

- Can tolerate long periods of volatility

- Want exposure to frontier technologies

- Have a multi-year investment horizon

- Understand that profitability may be far off

For conservative investors, a diversified tech name like Alphabet offers safer quantum exposure.

Investing in Quantum Computing Stocks

How Do You Invest in Quantum Computing Stocks?

- Buy shares directly through a brokerage.

- Use thematic ETFs with exposure to quantum and advanced computing.

- Consider fractional shares to reduce risk in volatile names.

How to Select the Best Quantum Computing Stocks

Look for:

- Technological roadmaps — Qubit count, error rates, scalability.

- Commercial traction — Customers, recurring revenue, cloud deployments.

- Strong partnerships — Government, enterprise, and strategic alliances.

- Financial health — Cash reserves and sustainable burn rates.

- Analyst ratings and price targets — Look at what analysts covering the stock say and prediction for future share prices.

Market Timing and Future Outlook

When Will Quantum Computing Be Commercially Viable?

Most experts predict:

- Early commercial applications: Within 2–5 years.

- Broader enterprise deployment: Within 5–10 years.

- Fully fault-tolerant quantum systems: Likely 10+ years away.

Progress is accelerating, but meaningful revenue at industrial scale may take time.

Key Technological Breakthroughs to Watch

- Improvements in quantum error correction.

- Advances in qubit stability and coherence.

- Achieving quantum advantage in real-world tasks.

- Expansion of quantum cloud services.

- Launch of commercial-grade next-generation quantum processors.

- Cross-industry partnerships in AI, pharmaceuticals, and logistics.